Fra Zerohedge:

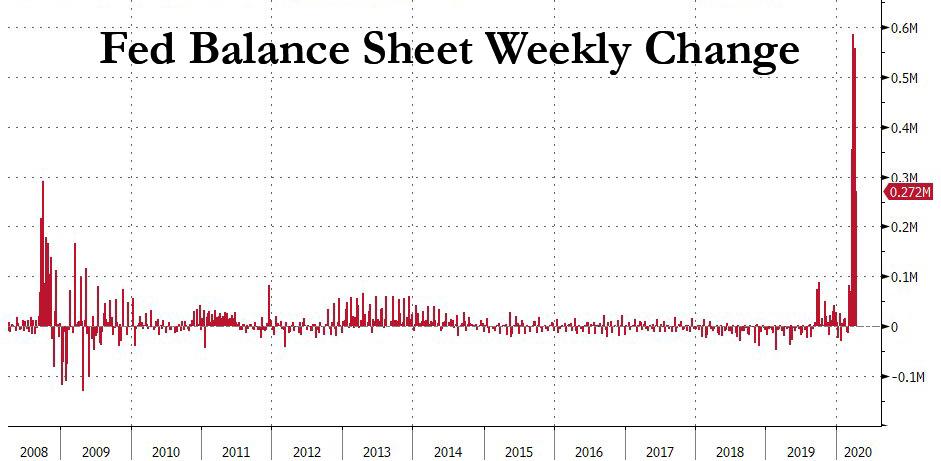

In remarks delivered before the Foreign Exchange Committee of the NY Fed, Lorie Logan, who is the head of the Fed’s open markets, i.e., the head trader of the world’s biggest hedge fund, commented on the Fed’s unprecedented intervention, and takeover, of capital markets, saying that “the scale of these purchases has been unparalleled, totaling about $1.6 trillion in the past four weeks“, something we showed last week when laid out the hundreds of billions in weekly purchases in the past 4 weeks, eclipsing the intervention during the financial crisis by orders of magnitude, as follows:

- April 8: $$272BN

- April 1: $557BN

- March 25: $586BN

- March 17:$356BN

Then again, hearing it from the person who made it all possible is so much more fulfilling.

That’s the spin, the reality is that liquidity is collapsing in the Treasury market because of the Fed’s purchases, which is soaking up so many bonds it now owns up to 50% and in some cases more, of any given Cusip, especially those with longer maturities.

Logan then had some disappointing words for those who are hoping the Fed will push the VIX back to 10: “supporting smooth market functioning” does not “mean eliminating all volatility. In well-functioning markets, prices will respond rapidly and efficiently to new information.”

Except, of course, when the information is negative and the Fed has to buy everything that is being sold as it just did in the past 3 weeks. But then again, this is the same Fed which thinks the US population is too dumb to understand what is going on.

Some words of advice for Ms. Logan: the people are no longer dumb and they understand precisely what the Fed is doing. Perhaps to preempt the populist anger that will soon target the Fed itself, Logan then elaborated by saying that “during the unprecedented disruption caused by the coronavirus pandemic, a great deal of new information arrives every day about the outlook for specific markets, such as housing, and for the economy as a whole. These changes in the outlook should move the Treasury and agency MBS markets irrespective of the Federal Reserve’s purchases.”

Right, they “should”, which is probably why the Fed had has been the buyer of first, last and only resort, and why even the $7 trillion BlackRock is no longer even shy to admit that the only trade in this farce of a market (as Howard Marks discussed) is to front- or back-run the Fed: “We’ll Just Buy Whatever Central Banks Are Buying“‘

Finally, in one desperate attempt to deflect the coming shitstorm that will – we hope – finally end the Fed, Logan tried to deflect blame stating that “today’s crisis is different, having originated outside the financial system, in an enormous challenge to public health.”

Which is, of course, also a lie, because had companies not spent $4 trillion on buybacks in the past 4 years and instead had allocated the money to a “fat tail” fund, none of the insanity observed in the past month would have happened.

As if a whole new level of pandering to the unwashed peasants, the NY Fed head trader then went so far as to lie that the Fed had learned some lesson in all of this:

Yet the lesson of the previous crisis still applies, and the Federal Reserve has taken it to heart in responding to the recent stresses in funding markets, Treasury and MBS markets, and credit markets.

Translation: last time we bailed out just the banks and people were angry. This time we “learned our lesson”, and in addition to bailing out the banks and the mega corporations that are now swallowing all of America’s small and medium businesses whole, we will pretend to be bailing out main street by handing out taxpayers a check for $1,200 per month. Enough to pay about a third of the rent thanks to the latest massive housing bubble that the Fed has inflated.

But in the end none of this matters. What does matter? Why getting stocks to new all time highs of course:

By acting quickly and forcefully to support all of these markets at once, we have been able to stabilize market conditions.

Well that’s just wonderful, because who cares about a second depression and the total collapse in cash flow if bonds are trading at par in a complete disconnect with fundamentals, and TSLA is up 100% in the past week because the company can no longer pay its rent.

Lorie’s conclusion:

Many challenges surely lie ahead for the economy and financial markets. But the past month demonstrates that the Federal Reserve will use its tools aggressively to keep markets working so that credit can flow to households, businesses, and state and local governments throughout our economy.

Translation: the Fed will buy as many trillions more as it needs to completely disconnect all prices from fundamentals and create a Potemkin Village economy so vast, the USSR will be spinning in its grave.

One last point: to keep track of just how “well” the Fed is doing in its true endgame mission – to crush the dollar and hyperinflate away the debt – just keep an eye on gold. It will tell you all you need to know.

Logan’s full speech can be found here.