Fra Zerohedge om dagens rentemøde:

So what did they say…

Pretty obvious and expected: Fed says it will do all it can to help economy still facing considerable risk

The Federal Reserve on Wednesday committed itself to use its full range of tools to help the economy facing considerable risk from the coronavirus pandemic.

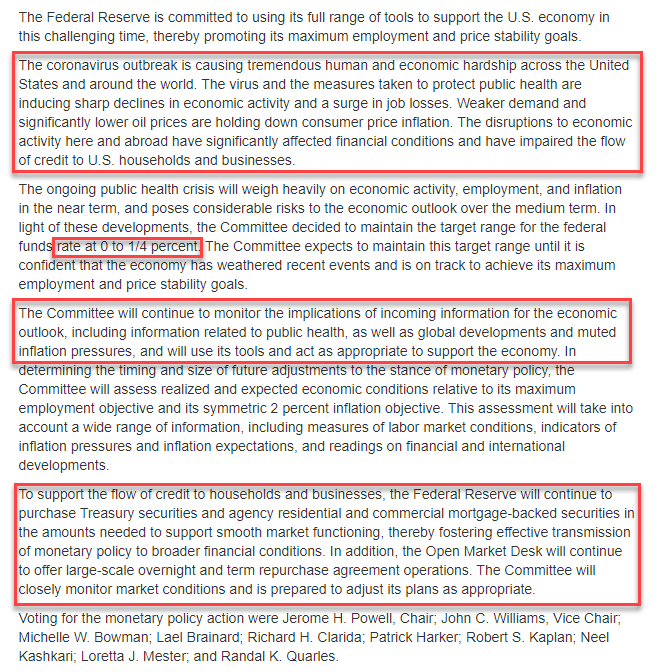

“The ongoing public health crisis will weigh heavily on economic activity, employment and inflation in the near term, and poses considerable risks to the economic outlook over the medium term,” the Fed said in a statement after two-day meeting.

The Fed kept its benchmark rate close to zero and repeated it would hold policy steady until the economy has weathered recent events and “is on track” to achieve full employment and price stability.

“In determining the timing and size of future adjustments to the stance of monetary policy, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. “

That is unchanged from the March’s broad-based forward guidance.

In a novel twist, the Fed went so far as single out oil prices as a reason for low CPI:

Weaker demand and significantly lower oil prices are holding down consumer price inflation

This should be sufficient to answer any questions if the Fed plans on hiking rates in the medium or long-term.

Also notable, in addition to inflation the Fed will now be monitoring incoming health data:

“The Committee will continue to monitor the implications of incoming information for the economic outlook, including information related to public health, as well as global developments and muted inflation pressures, and will use its tools and act as appropriate to support the economy”

To support the flow of credit to households and businesses, the Federal Reserve will continue to purchase Treasury securities and agency residential and commercial mortgage-backed securities in the amounts needed to support smooth market functioning, thereby fostering effective transmission of monetary policy to broader financial conditions

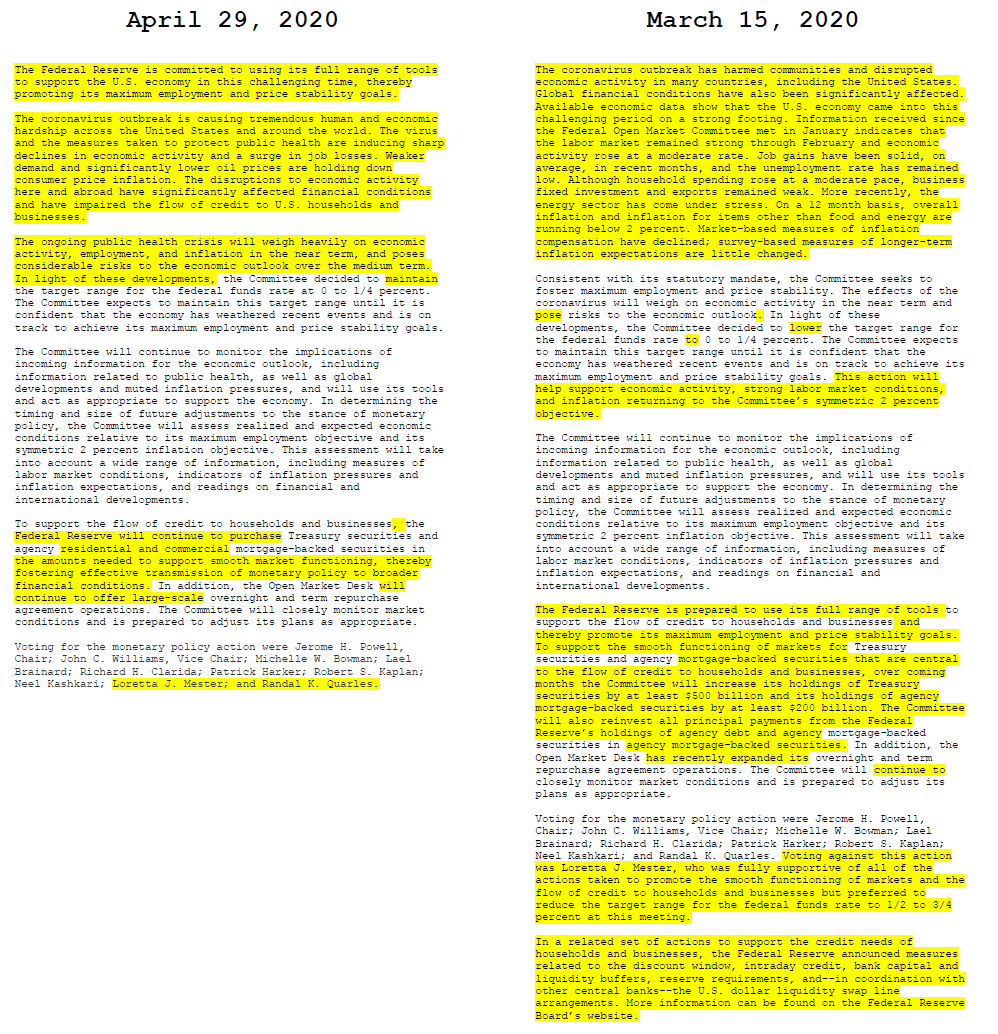

In the past statement the Fed was explicit, indicating it would buy “at least” $500BN in TSYs and at least $200BN in MBS, instead it merely said it would purchase in amounts needed to support smooth market functioning, which has been seen as another pledge for unlimited QE. This disappointed some, such as Neil Dutta, head of economics at Renaissance Macro Research in New York, was quick to criticize the Fed’s existing forward guidance, calling it confusing:

“The economy will weather recent events much sooner than it will be on track to achieve the Fed’s dual mandate goals. In the meetings ahead, the Fed should make it more obvious that it is keeping rates at zero long after the crisis has been put behind us.”

There was also no mention of Yield Curve Control, although that will surely be brought up during the press conference.

Oh, and as we cautioned shortly before the FOMC, the Fed indeed punted on IOER, keeping it unchanged at 0.10%. Here is Ian Lyngen’s take:

“The Fed announcement included a stable IOER level at 0.10% – demonstrating little willingness on the part of the Committee to risk any further disruption in the front end of the market. The forward guidance also confirmed a willingness to purchase Treasuries and MBS ‘in the amounts needed to support smooth market functioning, thereby fostering effective transmission of monetary policy to broader financial conditions.’ The absence of numeric caps confirms that QE remains of the limitless variety – which allows for inter meeting flexibility.”

Full Statement below:

Quite a cutdown from its ‘war and peace’ statement in March…