After listening to Fed Chair Powell’s press conference and reviewing today’s news release and supporting documents, we have 3 takeaways from today’s FOMC meeting:

#1: Chalk up another win for the Fed Drift on quarterly releases of the central bank’s economic projections, although it is slim victory for US stocks and results are still incomplete:

- In its latest iteration, the Fed Drift is the propensity for the S&P 500 to rally from the open on the day before a monetary policy announcement through the close of the day after a meeting where the Fed releases a new SEP (Summary of Economic Projections).

- As we outlined yesterday, the “Drift” has worked well in 2019. The March, June and September meetings all saw the S&P 500 rally across the timeframe noted in the previous point.

- The S&P 500 opened yesterday at 3135.36 and closed today at 3141.63, up 0.2%. That’s well less than the average 3-day “Drift” this year of 0.8%, but we still have tomorrow’s action to evaluate.

Conclusion: there was very little “new” in today’s release and press conference, but the revised SEP still helped lift stocks, so let’s see why…

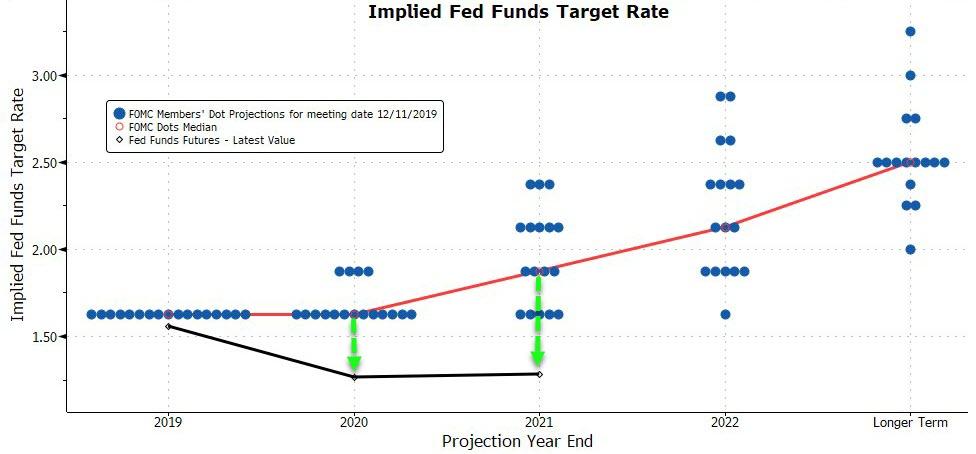

#2: The most eye-catching line of the SEP was the projected path of Fed Funds policy rates created by the “Dot Plot” estimates supplied by committee members:

- The current consensus calls for Fed Funds to remain stable through 2020 at 1.6%.

- Even in 2021 committee members in aggregate only see 1 rate increase, taking Fed Funds to 1.9%.

- Worth noting: a statistical analysis of the “Dots” shows the committee is largely of one mind on keeping rates steady in 2020. The standard deviation of their guesses is just 0.11, less than half the year-ago levels of certainty about rates in 2019 (0.26). In fact, the Fed has never been more certain about December’s forward-year rate policy since they started releasing the “Dots”.

- Chair Powell’s press conference mirrored this institutional conviction at almost every turn, albeit with a dovish tilt. He sees wage growth constrained by slack productivity growth, only a “faint” relationship between labor market utilization and inflation, and little need to take back 2019’s rate cuts in 2020 (unlike 1998). Moreover, he believes there is still substantial slack in the US labor market and worries more about the Fed losing credibility regarding its 2% inflation target than overshooting it.

Conclusion: the Fed wants to portray itself as 1) solidly in lockstep that rates are appropriately set for the year ahead and 2) biased to ease if measured inflation remains below their goal, which explains why markets are betting their next move is a cut, but not soon…

#3: Fed Funds Futures slanted their bets about a 2020 rate only modestly after the Fed’s announcement, and mostly for the back half of 2020:

- Odds that the Fed keep rates unchanged in Q1: 83.1% today, 81.1% yesterday.

- Odds that rates will be unchanged through Q2: 62.3% today, 63.1% yesterday.

- Futures currently think the odds are strongest that the Fed will end 2020 with rates either where they are now (37%, but down from 41% yesterday) or 25 basis points lower (39% today, 38% yesterday).

Conclusion: yes, markets agree with the Fed that rates are by and large set correctly, but also think easing is the “real” base case. Let’s face it: just one rate cut next year (the modal guess in December 2020) is unlikely if only because the Fed won’t think it has the credibility to fine-tune policy that way. Markets know that, so pricing in one cut just means that they think the Fed will have to respond to slowing economic growth in 2020.

Summing up: the Fed says they’re done for now, but markets say there’s still more work to do.

Given that Fed Funds Futures have had a better call than the policymakers, we’re going with the market’s prediction for 2020.

* * *

New readers can get a 2-week (no credit-card) free trial at datatrekresearch.com.