Fra BNP Paribas:

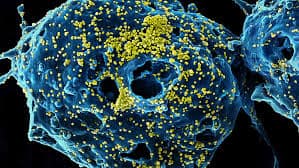

Global growth downgrade on Covid-19 shock

KEY MESSAGES

We continue to think the short-term impact of Covid-19 will be greater than many assume and will have a material effect on global growth. We estimate the impact of the virus on global GDP growth at 0.4pp. For China, we see a 1.2pp hit, EM exChina 0.3pp, the US 0.2pp and the eurozone 0.3pp. Embedding these changes nudges our 2020 global growth forecast down from 3.0% to 2.6%.

Our working assumption is still that the contagion abates relatively soon and remains limited outside China. With this in mind, the bulk of the impact is likely to be seen in Q1 in China and at the end of Q2 elsewhere, followed by a V-shaped recovery.

However, there is considerable uncertainty and we now see the risks to the global economy as tilted to the downside. Our risk scenarios include a longer period of disruption for China, and contagion spreading to developed markets, hitting consumption.

In our central case, we do not expect much in the way of policy action outside China and EM Asia. However, under our risk scenarios we see intervention as likely, including from the European Central Bank and the US Federal Reserve

Another shock: Just as the prospects for the global economy were beginning to brighten, Covid-19 looks to be a significant setback, with echoes of the headwinds facing the economy in 2019. Indeed, the key story last year was persistent weakness in the manufacturing sector, global trade and capex, driven largely by heightened uncertainty and slowing economic growth in China.

The onset of Covid-19 and subsequent forceful action by authorities in China and elsewhere mean that the impact on the Chinese and global economies will be more frontloaded and pronounced (and generally larger than many assume), in our view, than the impact of the trade uncertainty that dominated the story last year. The trade tensions saw plants continue to operate, but with less demand.

With Covid-19, China is in lockdown mode, with production halted and only now tentatively re-starting. Resuming normal activity levels is likely to take time.

Moreover, the economic ramifications are likely to be felt by countries already in a fragile position. Many are the same countries as those that suffered in 2019, ie those

with higher exposure to China in terms of exports, where manufacturing is a larger share of the economy, and where exports of capital goods are particularly significant.

Risks now tilted to the downside: In Global Outlook: Q1 2020 – Positioning for the tide, 3 December, we shifted our perception of the balance of risks – in terms of probabilities – from the downside to being more balanced, on account of the prompt action from central banks, the relative resilience of the services sector and more clarity on a number of political fronts (such as the US-China trade dispute and Brexit).

However, as well as causing us to lower our economic forecasts, the Covid-19 outbreak has made us re-evaluate the risks as again being tilted to the downside. Our working assumption: We do not know how the virus will evolve over the coming weeks and months, but our working assumption is that the virus peaks in China before the end of Q1 and begins to dissipate thereafter, with limited contagion outside of China.

That said, we would stress the uncertainty around this assumption. Methodological changes to data collection saw a big jump in the number of new cases on 13 February (Figure 4). Moreover, there have been more reported cases in countries outside of China, though we would note that 99% of confirmed cases are in mainland China, of which over 80% are in the province of Hubei.