Fra Bank of America / Zerohedge:

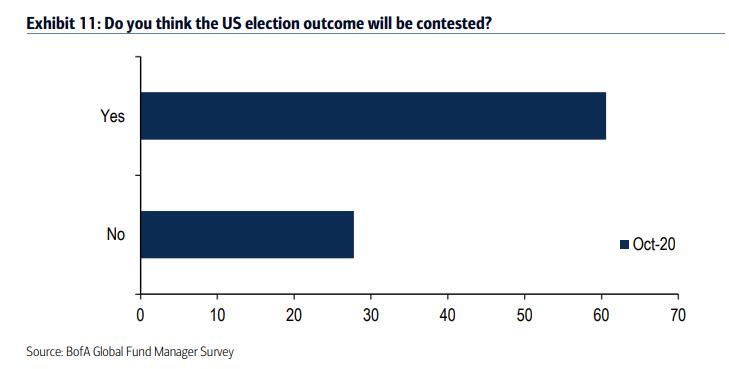

While the latest Fund Manager Survey from BofA revealed that a vast majority of investors are concerned about a contested election, and the resulting volatility this may entail especially if (when) the Supreme Court is called in to decide the next president…

… no matter the ultimate outcome, investors are curious how to trade – and hedge – the various possible outcomes, so much so that BofA’s Jared Woodard writes that the impact of various election scenarios is the “top question investors are posing.”

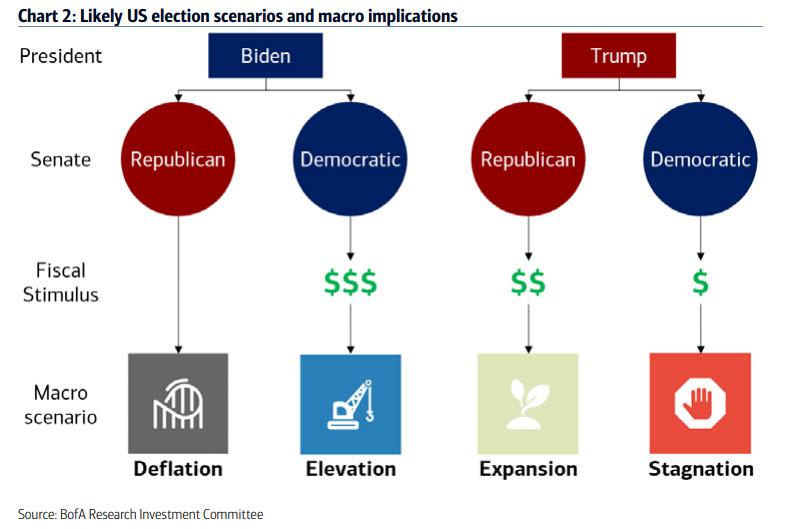

So, in the latest note from BofA’s Research Investment Committee, Woodard and team proceed to give an answer, highlighting that the most important consequence of the US election “will be the amount and composition of fiscal stimulus” and noting that since Congress controls the budget and the House majority is likely to stay Democratic, the Senate outcome is the most important one to watch. The 4 key scenarios are laid out in the chart below, whose investment implications BofA dissects next:

Before going into the details, Woodard gives some “general tips for investing around elections”:

- For a trade, buy political dips;

- For an investment, watch the first 200 days;

- Don’t touch the core portfolio.

With that in mind let’s dig in starting with…

1. President Biden + Democratic Senate = Bullish Elevation

While many investors say they fear the impact of a “Democratic sweep” because of higher expected taxes and greater regulation, BofA counters that a unified government would be bullish:

- The desire to maintain majorities through midterm elections in two years incentivizes a pro-growth, pro-employment agenda now (fiscal stimulus, industrial policy) & redistribution only later (if ever). This is particularly urgent for Democrats, who have struggled historically to motivate voters in midterms;

- Even if progressives impose new taxes & regulations, the bank expects that the planned consumption and investment incentives would more than offset the drag.

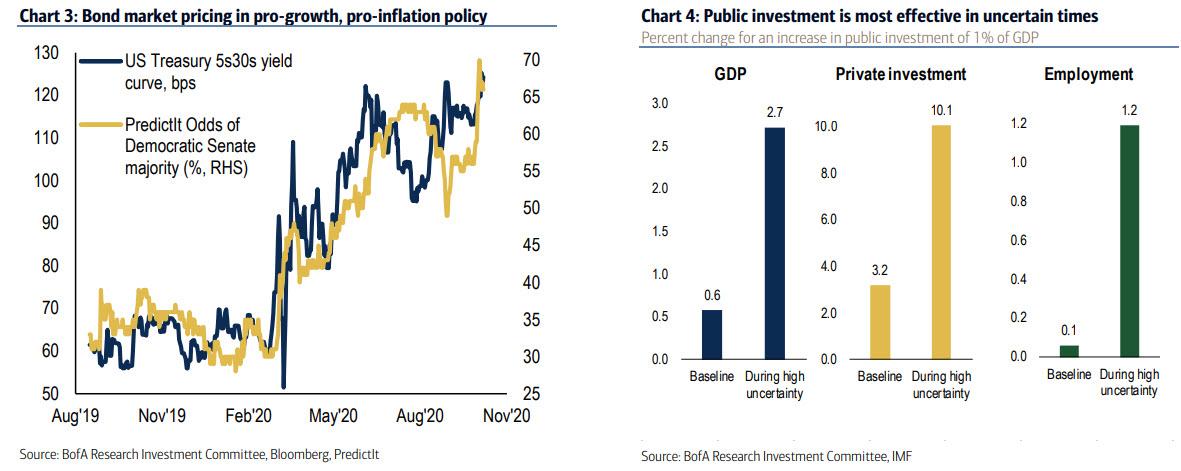

As an aside, Woodard notes that voters are tired of gridlock citing a recent Gallup Governance survey, where only 23% said they favor a Congress and Presidency controlled by different parties, the 2nd-lowest reading in history. Markets also seem prepared to accept a “blue wave”, with equities rising and the yield curve steepening in tandem with odds of a Democratic Senate majority (Chart 3).

Unified governance (by either party) is also the key condition for BofA’s bullish macro Elevation scenario, as continued CARES Act-style economic support can, at best, return the US economy to the levels achieved at the end of 2019. That was still lead to an environment of stagnant growth and scarce profits.

As such, a step-change to 3%+ GDP & higher productivity requires major new investments in R&D, capex, and a broader base of household demand; such policy shifts “require bold leadership and a governing majority, not tepid incrementalism.”

Next, Woodard claims that the timing is certainly right, citing a new IMF study which found that public investment is most effective in periods of high uncertainty, like this one. Using data across 107 countries over the last 30 years, the study found that, on average, new public investment worth 1% of GDP raised economic growth over the subsequent two years by 2.7%, private sector investment by 10%, and employment by 1.2% (Chart 4).

Trades: as has already been widely priced in by the market, expect a continued 2016-style “rowdy rotation” away from crowded secular stagnation beneficiaries (large caps, defensives, tech, bonds) and toward inflation assets (small caps, cyclicals, financials, commodities).

- Likely winners: renewable energy, advanced industrials, electric vehicles, telecommunications, banks and silver;

- Likely losers: health insurers, mega-cap tech, for-profit education, and media (NY Times +326% since Trump win vs. +4% in the 4 years prior).

2. President Biden + Republican Senate = Bearish Gridlock

Hardly “rocket surgery”, if Republicans retains the Senate they are very likely to block further stimulus under a Democratic President, which BofA says would be bearish for economic growth, corporate profits and financial markets (but it would be bullish for more stimulus from the Fed). In any case, as BofA sarcastically puts it, “after $21tn of monetary & fiscal stimulus in 2020, $0 of follow-on support would be deflationary.”

Indeed, political parties historically have used obstructionist tactics when out of power to thwart key legislation, most often through the “rediscovery” of commitments to “fiscal discipline”. As an example, BofA cites the budget austerity during 2012-2015 as a major reason for the slow economic recovery.

Trades: “in this scenario investors should prepare for lower returns and higher volatility. Raise cash and buy Treasuries, munis, and high-quality corporate bonds.”

3. President Trump + Any Senate = Uncertain Stagnation

This is the “status quo” scenario: after the election, basic support packages may be easier to pass, but BofA doubts whether President Trump and a Democratic House would find enough common ground to pass transformative, pro-growth legislation. The case of infrastructure is instructive: both parties agree on the need for more resources for transportation, energy security, etc., but talks have always broken down over “red line” issues like immigration. That said, with a GOP Senate, investment may come more easily for R&D and industries relevant to national security.

However, the risk of volatile stagflation also rises with a divided government. Policies that have increasingly bipartisan appeal, such as regulating Silicon Valley or countering the threat from China, would require massive (and in this case, unlikely) domestic public investment to offset related frictions.

Trades: long stagnation winners e.g. tech, consumer discretionary, large caps, IG bonds…but with less leverage and lower market beta.

4. Contested election = Buying Opportunity

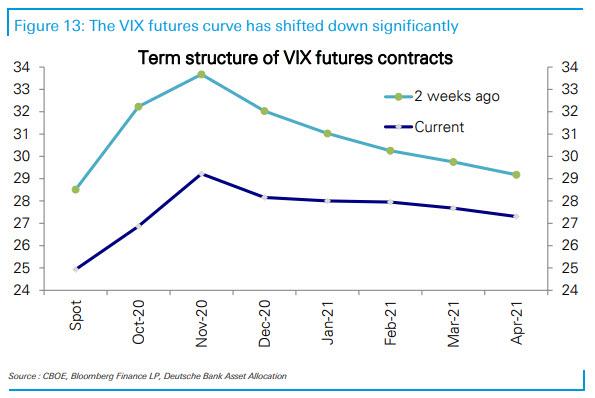

Contrary to various doomsday predictions for what happens on Nov 4, BofA’s Nitin Saksena points out that options markets imply a move of 3.6% in the S&P 500 the day after November 3rd, only modestly above the recent historical average of 2.9%. However, instead of focusing on the day after, markets are pricing in greater odds of a contested election than ever before, with more volatility possible through December (although forward vol has certainly declined substantially in recent weeks).

According to BofA, “there are several unusual but plausible scenarios and no real historical precedent.” The bank does note that in 2000 the Supreme Court decided the election, but it suggests returns from that period are hardly analogous “since the set of possible outcomes now is wider and more politically fraught.”

That said, according to Woodard, the most important thing to know is that “the same features of the US economy that made every investor in the world desperate to buy US assets in 2020 will still exist in 2021, no matter the election outcome: the deepest and most liquid financial markets, strong institutions, the rule of law, and the most productive, creative workforce”.

BofA’s recommended trades for a contested election: treat any market decline on a contested election as an opportunity to buy risky assets and sell volatility (and if the worst case scenario happens, investors can just hope that they get a bailout… just like America’s banks.)