Fra Natixis:

Selling your investments when markets appear to be in crisis mode may feel like the right thing to do. However, decades’ worth of market data show that staying invested through volatile times has been a smart route to take to pursue long-term financial goals. For Millennial investors who may not have experienced the sharp market declines of the Financial Crisis of 2008–2009, today’s extremes may be even more unsettling. But if you’re investing for goals 5, 10 or 30 years away, here are three reasons why you should avoid emotion-based investment decisions.

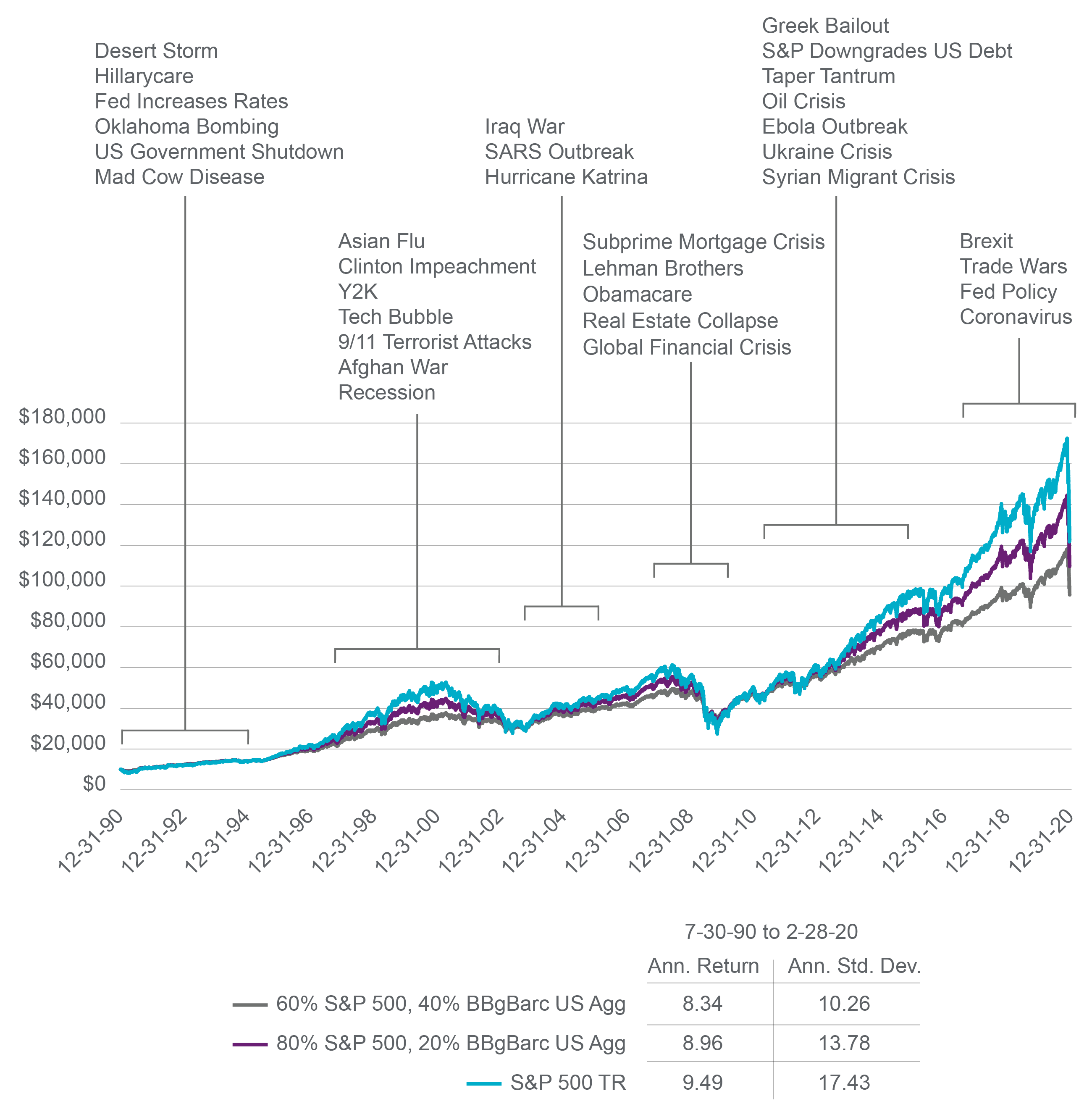

1. Markets Have Historically Been Resilient: Despite facing decade after decade of wars, virus outbreaks, natural disasters, recessions, and financial crisis, markets continued to climb higher over the past 30 years. Consider how these hypothetical $10,000 investments allocated to stocks and bonds grew over 30 years, ending 2/28/2020.

Cumulative Growth of $10,000

For illustrative purposes only. Periods chosen are based on start of drawdown to maximum drawdown and recovery period. Indexes are not investments, do not incur fees and expenses, and are not professionally managed. It is not possible to invest directly in an index. Past performance is no guarantee of, and not necessarily indicative of, future results.

Source: Natixis Portfolio Research & Consulting Group (PRCG), FactSet

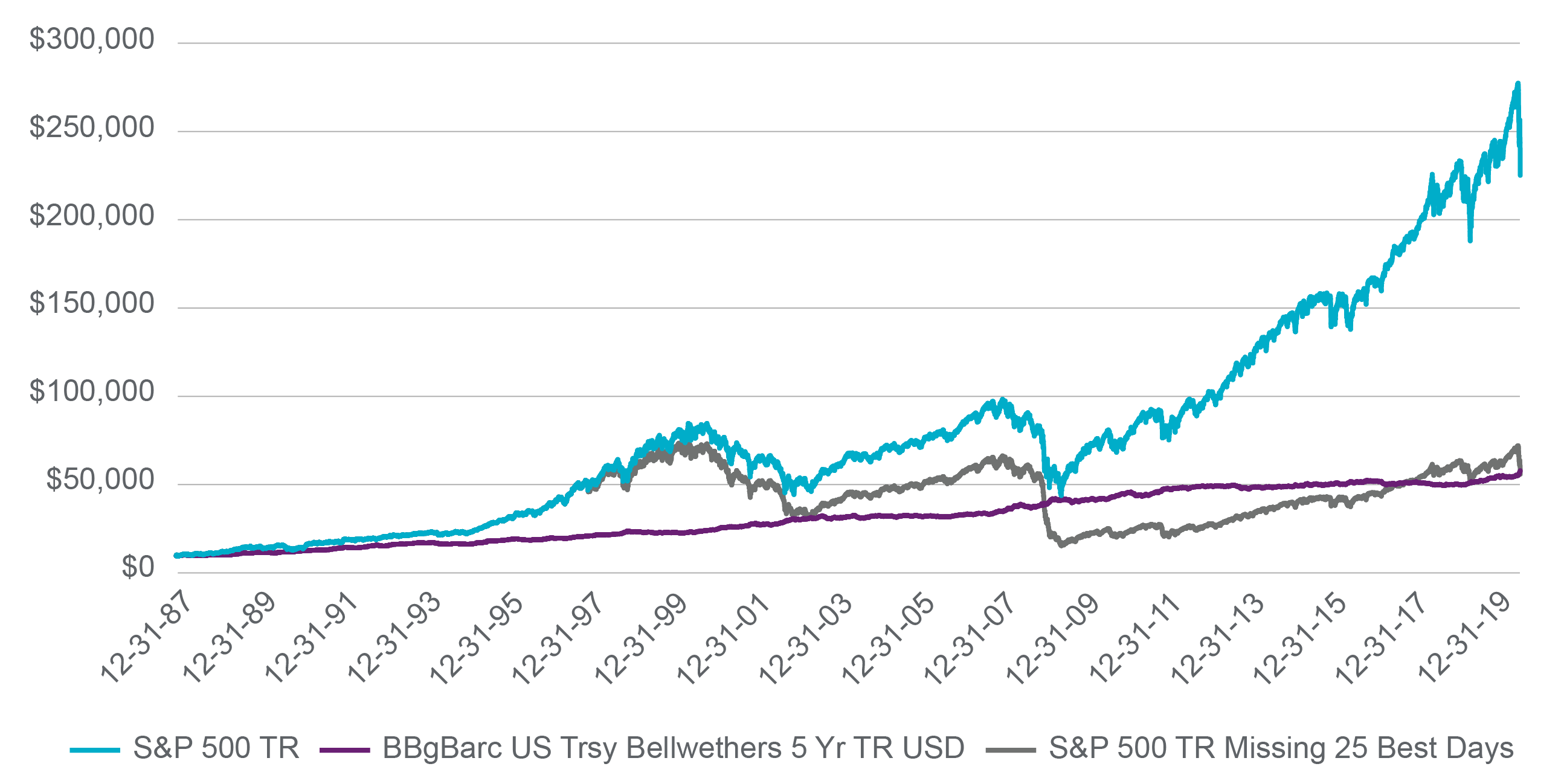

2. Cashing Out Has Historically Meant Missing Out: Investors who panic and sell often miss the upside if markets rebound. Consider what missing out on the 25 best days in the US stock market over the past three decades would have meant to the growth of a hypothetical $10,000 investment in the S&P 500® index.

25 Best Days for S&P 500 TR USD between 12/31/1987 and 12/31/2019. For illustrative purposes only. Indexes are not investments, do not incur fees and expenses, and are not professionally managed. It is not possible to invest directly in an index. Past performance is no guarantee of, and not necessarily indicative of, future results.Source: Natixis Portfolio Research & Consulting Group (PRCG), Morningstar MPI.

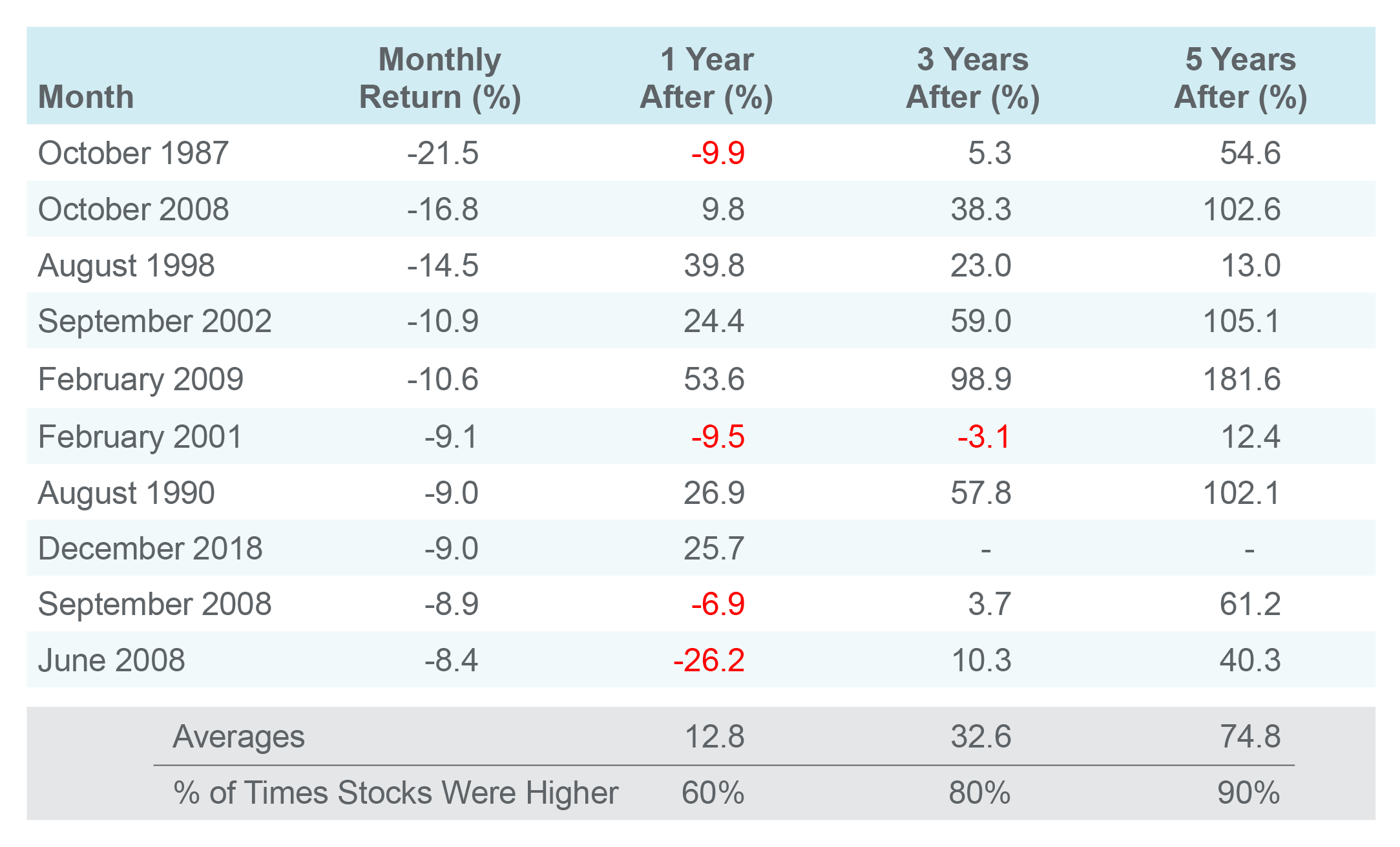

Now look at the returns of the US stock market after the 10 worst months from 12/31/1985 to 12/31/2019. Investors who sold during these turbulent months would have missed out on market recoveries in the following months or years.

Displays the 10 most negative performances of monthly returns from the S&P 500 TR USD between 12/31/1985 and 12/31/2019. Past performance is no guarantee of, and not necessarily indicative of, future results.

Source: Natixis Portfolio Research & Consulting Group (PRCG), Morningstar MPI.

3. Time Is on Your Side: As a long-term investor, it’s wise to remember that it’s not a “timing” issue, it’s just an issue of time. Consider how staying invested over the long term has historically added up. These hypothetical $100,000 investments in the S&P 500® Index over 20 and 30 years, ending 12/31/2019, grew significantly – despite several volatile short-term market events.

$100,000 Hypothetical Investment in the S&P 500 Index over 30 Years

For illustrative purposes only. Indexes are not investments, do not incur fees and expenses, and are not professionally managed. It is not possible to invest directly in an index. Data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results.

Source: Natixis Portfolio Research & Consulting Group (PRCG), FactSet

Bloomberg Barclays U.S. Aggregate Index is an unmanaged index that covers the US-dollar denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The index includes bonds from the Treasury, government-related, corporate, mortgage-backed securities, asset-backed securities, and collateralized mortgage-backed securities sectors.

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.