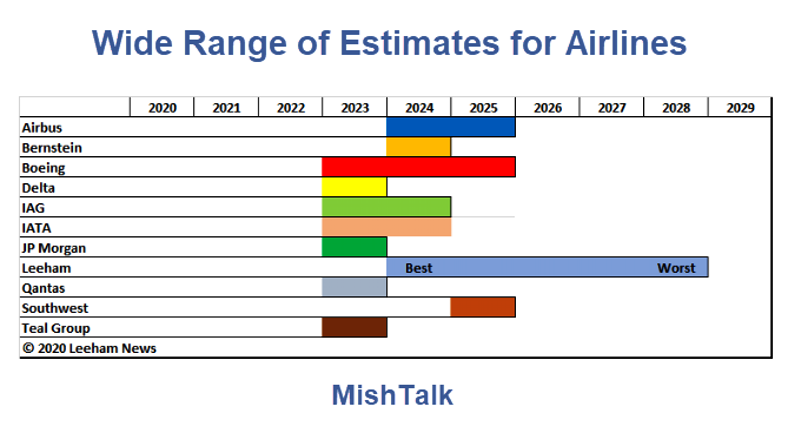

Estimates vary widely from 4 to 9 years depending on the source.

Why Airline Traffic Won’t Fully Recover Soon

Many journalists and industry observers have been obsessively searching for “green shoots” indicating the beginning of a recovery, but much of this commentary misses the mark.

Last month, investment research firm Bernstein published an analysis calling for narrowbody traffic to recover by 2023 and widebody traffic by 2025.

Lehman Offers This Assessment

- Bureaucratic caution will lead most countries to take an additional 6-12 months after herd immunity is achieved before reopening to most inbound non-resident passengers.

- Even for domestic or regional travel, passengers must feel safe from infection before they’ll fly again.

- Countries with greater internal consumption of domestic production should recover sooner than trade-dependent countries. Accordingly, domestic travel in the US, EU, and China is likely to return sooner than in most other regions.

- Getting business travelers back on airplanes will require renewed economic activity, in addition to the obvious safety requirements.

- Improved video conferencing technologies like Zoom, Skype, and Google Meet make a similar structural shift all but inevitable as businesses learn how to operate in a COVID-impaired world where air travel is challenging and inconvenient.

- As long as travel demand remains depressed, supply will fall in other parts of the travel ecosystem, especially hotels.

- Airlines that restore capacity too quickly will see their profitability dented as too many seats chase too few passengers.Bottom line: Global air travel won’t be back to pre-COVID volume for several years

I selected the above bullet points from a long article. Here is Leeham’s Bottom line:

“Global air travel won’t be back to pre-COVID volume for several years”

That assessment was from July and it did not change on September 7 in an article that discussed Twin-Aisle Leasing Market Challenges.

The timeline for a passenger traffic recovery remains uncertain. The IATA does not expect passenger traffic to return to pre-COVID-19 levels until 2024. Leeham Co. predicts that it will take four to eight years before traffic returns to pre-COVID-19 levels.

Long-haul markets, where airlines almost exclusively operate twin-aisle aircraft, witnessed the sharpest drop in passenger traffic. As outlined in a previous article, airlines already retired significant numbers of older aircraft. Due to lingering travel restrictions, those markets should be the slowest to recover to pre-pandemic levels.

There are virtually no takers for second-hand widebody passenger aircraft now. Separately, Airbus and Boeing decreased their passenger twin-aisle production rates from a combined 28 to 15 per month from next year: 787 at six, A350 at five, 777 and A330 at two each.