Fra Zerohedge

The global/US economy is in trouble, and more specifically, S&P500 earnings deterioration will likely end up in a recession in the next several quarters.

US major equity indexes are hitting new highs, as Treasury yields have soared this weak on the idea that a 2016-style rebound in the global economy is imminent.

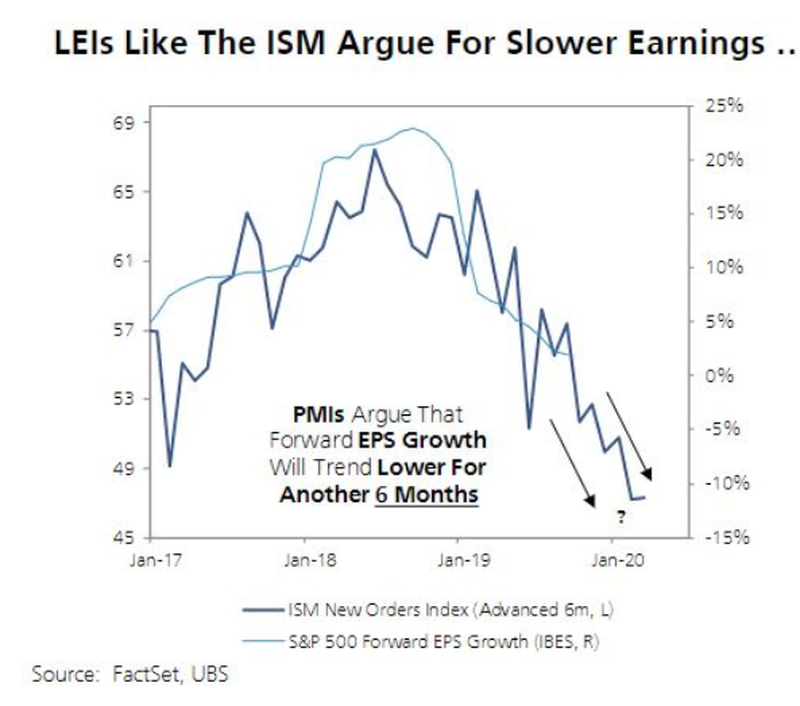

Earlier in the week, UBS strategist Francois Trahan blew apart the imminent global/US rebound narrative and said: “The earnings landscape has already deteriorated and will likely get worse:

The consensus year-over-year growth rate in S&P500 forward earnings is down to a mere 1% from a peak of 23% in September of 2018. Forward earnings are already contracting in the Midcap and Smallcap indices…If history were a perfect guide, the S&P500 would trough in Q2 of 2020 and rebound after that. Should the economy bottom in Q4 of 2020, as interest rates suggest, then history argues, the S&P500 would begin to price in a sustainable recovery sometime between April and August of 2020…PMIs Argue That Forward EPS Growth Will Trend Lower For Another 6 Months.”

President Trump’s non-stop fake trade news tweeting has indeed decoupled the market from focusing on worsening macro and fundamentals.

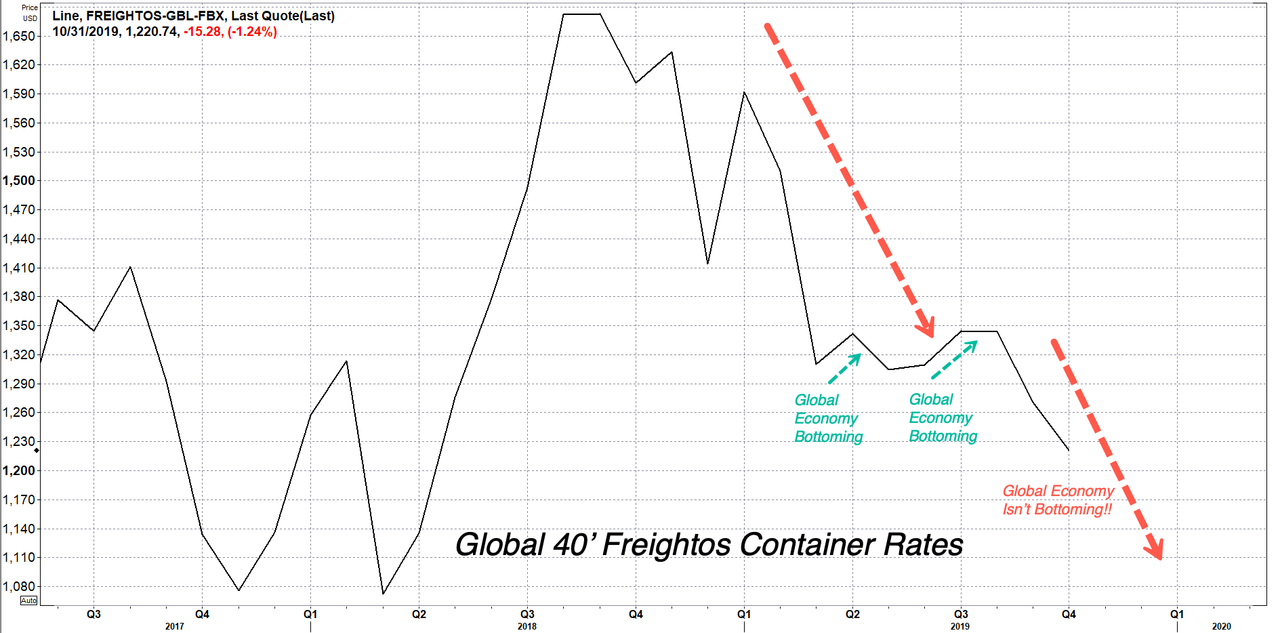

Teddy Vallee, CIO of Pervalle Global, has spotted an alarming downtrend in the Freightos 40 ft. Global Shipping Container Rate.

Vallee has likely found an accurate barometer of global economic activity, now plunging in the last two months.

“The move in container shipping rates is consistent with the continued deterioration in raw industrial commodities, China’s official PMI, China’s steel PMI, as well as market internals such as industrials relative to the S&P500,” Vallee said.

Freightos 40 ft. Global Shipping Container Rate started to trough in 1H19. The narrative back then was the global/US economy would rebound in 4Q19 and soar in 2020. But with 61 days left in 4Q, macroeconomic headwinds continue to mount across the world as global container rates plunge to new lows on the year, suggesting a global/US economic revival is nowhere to be found.

With no signs of a global recovery, market participants will once again be jawboned back to reality, or as some have called it: a ‘macro matters’ event — the only question is finding the trigger that brings everybody out of the fake trade news daze spurred by the Trump administration.