Fra Zerohedge / Goldman:

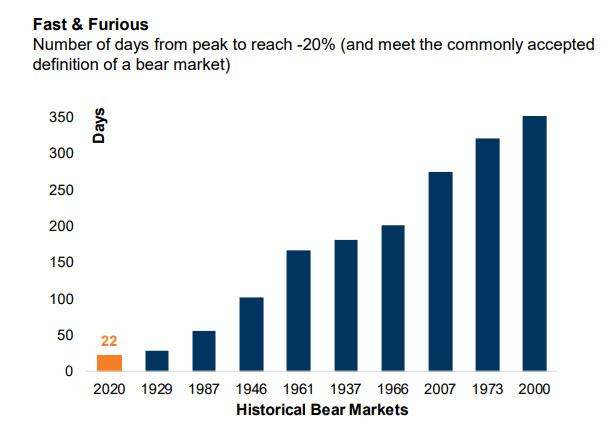

One week ago, following the fastest bear market on record…

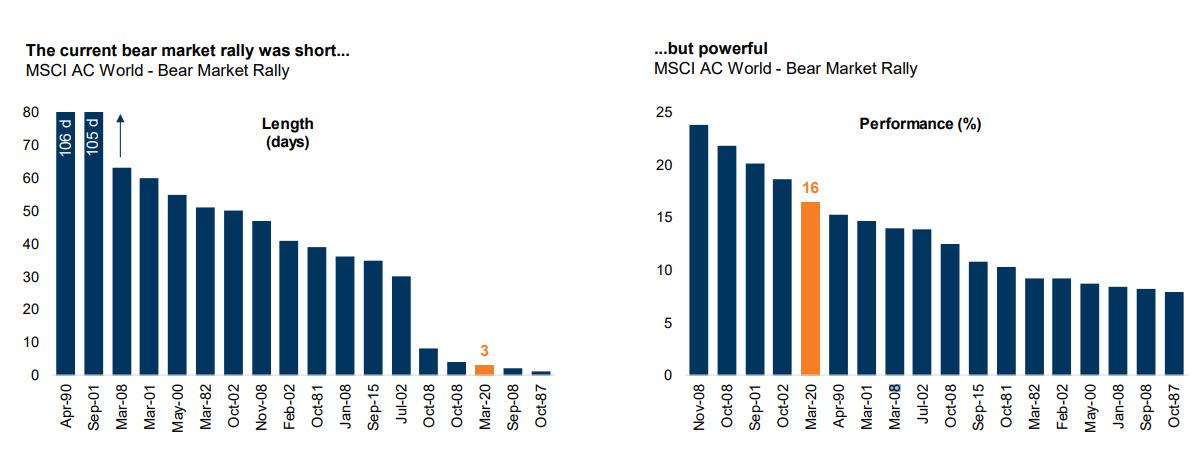

… which was followed by one of the fastest bear market rallies in history (which briefly became a bull market from the March 20 lows), Goldman’s clients – together with everyone else – had just one question: was this the bottom?

One week later, with the market below last Friday’s lows, it appears that nobody knows what the correct answer is. So, to narrow down the confusion, Goldman’s clients have shifted their attention to a just a more easily answerable question: will the buybacks that helped push the market to all time highs on increasingly less volume, still be there in the coming months?

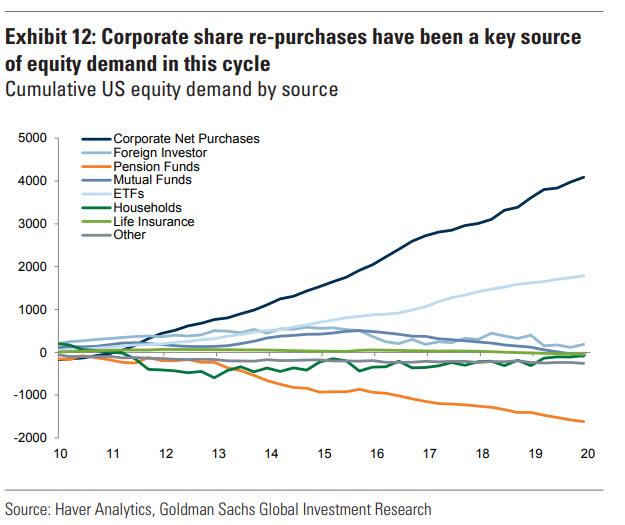

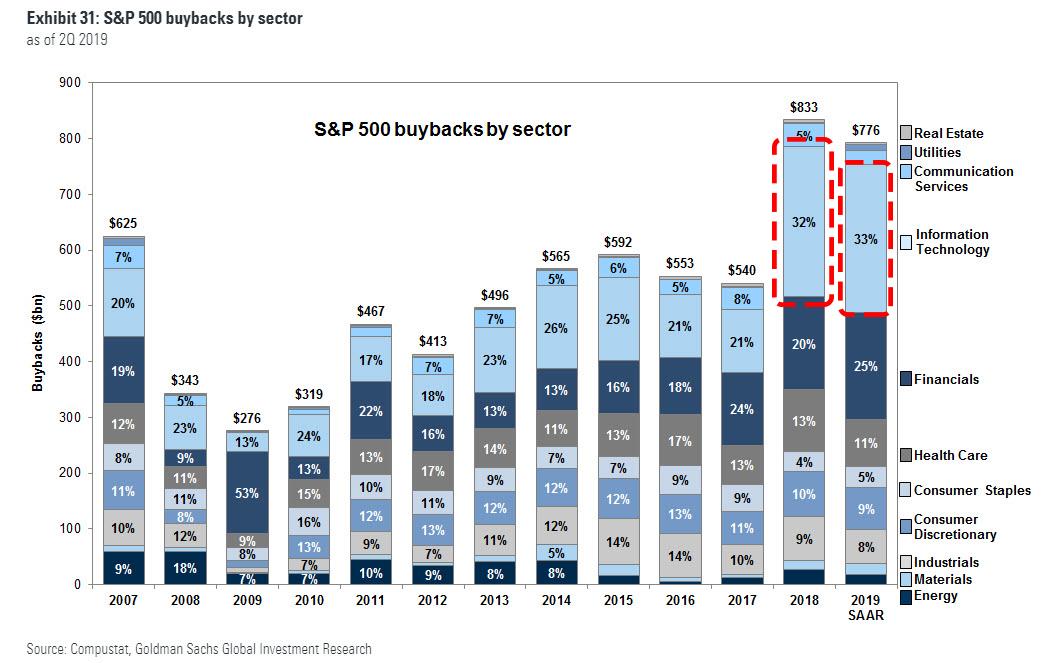

The reason for the angst is the fact that, as we wrote last Sunday, Goldman’s buyback desk warned that nearly 50 US companies have suspended existing share repurchase authorizations in the past two weeks, representing $190 billion of buybacks or nearly 25% of the 2019 total.There’s more: as Goldman’s chief equity strategist David Kostin wrote, reduced cash flows and select restrictions mandated as part of the Phase 3 fiscal legislation “suggest more suspensions are likely.” And since buybacks have represented the single largest source of US equity demand in each of the last several years…

… the strategist concludes that “higher volatility and lower equity valuations are among the likely consequences of reduced buybacks.”

Which brings us to the latest weekly note from the Goldman strategist, in which he writes that in the latest week, “many of our investor discussions gravitated towards the topic of dividends and share repurchases. The intensifying economic crisis, collapse in company revenues, flurry of suspension announcements, and restrictions in the recently-passed $2 trillion fiscal package have raised questions regarding future corporate cash spending priorities.”

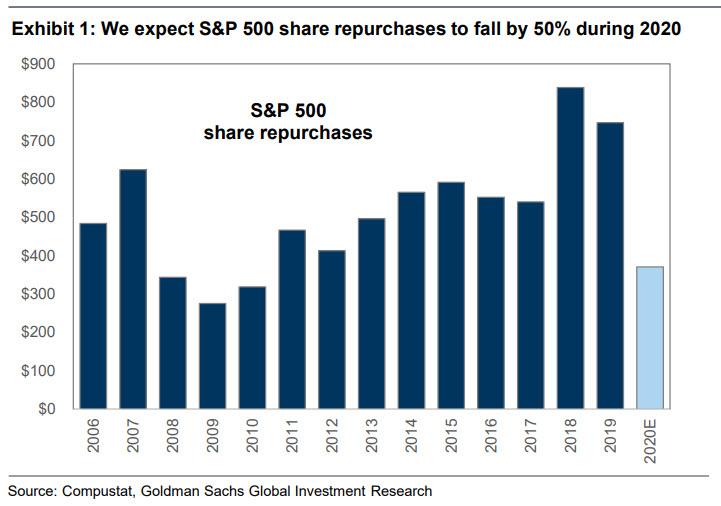

His answer will hardly appeal to Goldman’s client base, or anyone else for that matter, so used to corporation repurchasing their stocks when times get rough: in 2020, Goldman forecasts that S&P 500 dividends will fall by 25% and buybacks will plummet by 50% compared with 2019 levels.

Here are the details behind Goldman’s dour assessment, first dividends:

We estimate S&P 500 dividends will decline by 25% in 2020. Dividends actually rose by 9% during 1Q. However, dividend suspensions, cuts, and eliminations will result in DPS falling by 38% during the next nine months so on a full-year basis dividends will be 25% below the level of last year.

And then buybacks:

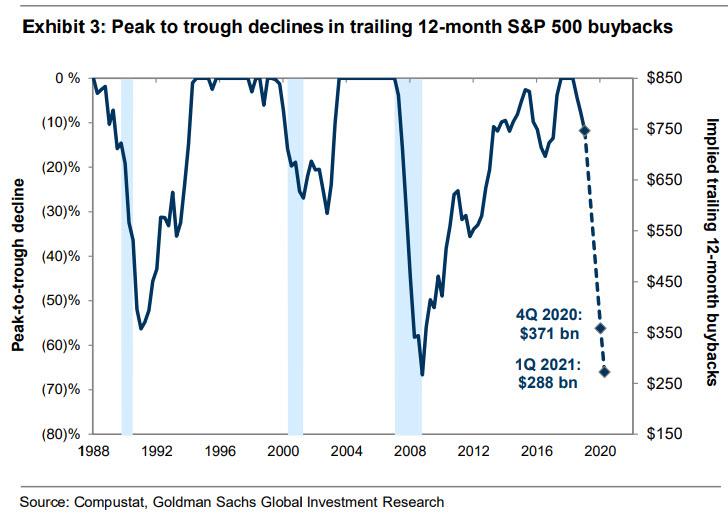

In total, we expect S&P 500 share repurchases will decline by 50% to $371 billion during 2020. Despite elevated market volatility, a review of sell-side analyst estimates published since the market’s peak suggests buybacks likely fell by 21% during the first quarter. However, Goldman Sachs buyback desk executions actually rose by 25% year/year. Averaging these two approaches, we assume buybacks were flat year/year during 1Q. We forecast buybacks will fall by 75% year/year in 2Q, by 70% in 3Q, and by 65% in 4Q. An additional 40% year/year slide during 1Q 2021 will result in 12-month repurchase volume that is 65% below the 2018 peak.

The irony, of course, is that company should not have been repurchasing their stock at the all time S&P500 highs, yet that’s precisely what they were doing. In fact, as we explained in late 2019, the main reason why stocks were at all time highs at a time when virtually every investor class was selling, was because of stock buybacks!

To be sure, our insistence ever since 2012 that it was only buybacks behind the market’s relentless grind higher, was met with stern opposition and mockery from some of the more imbecilic financial commentators, most of whom were either tweeting from their parents’ basement or the AQR trading floor, although suddenly their vocal “explanations” how buybacks had nothing to do with the stock market – even though it was painfully obvious why speculators would always frontrun and buy ahead of price indiscriminate CFOs and treasurers who had billions in freshly minted dollar burning a hole in their pockets thanks to a record amount of debt issuance and who were buying up their stock to make sure their equity-linked comp was deep in the money – have gone very mute.

So for the benefit of all those “financial expert” idiots who did not have a grasp of the simplest concept in capital markets, namely supply and demand (and likely still don’t now), here is not some fringe blog but Goldman Sachs setting the record straight once and for all:

“The decline in share repurchases will have a significant impact on the equity market.”

Got that fintwit echo chamber? We doubt it, so here is Kostin’s fuller explanation: “Corporate buybacks have far exceeded demand from all other investor categories combined since 2010.”

As an aside, this is something we have been saying… since 2012! Starting in 2012, among countless other pieces on the topic, we wrote “How The Fed’s Visible Hand Is Forcing Corporate Cash Mismanagement” and “Where The Levered Corporate “Cash On The Sidelines” Is Truly Going”, i.e., buybacks“, then in 2013 with “$500 Billion In 2013 Corporate Buybacks: Half Of QE“, then again in 2014 in “Here Is The Mystery, And Completely Indiscriminate, Buyer Of Stocks In The First Quarter” then in 2015 “It’s Not The Record High Debt That Is The Biggest Risk, It’s [the dropping cash flows]”, and on, and on, and on, we have constantly explained that the primary source of stock buying over the past several years have been corporate management teams repurchasing their own shares using ever greater amounts of debt as a source of funds, in the process boosting not only their stock price but their equity-linked compensation and bonus pools.

It only took nearly a decade for what we said – which was year after year mocked and ridiculed by the so-called “experts” – to become Wall Street gospel. With that we give the floor back to Kostin: “The removal of the principal buyer of shares will widen trading ranges and increase volatility.”

And the punchline: “Reduced buyback spending means less downside support for equity prices since fewer firms will step in to repurchase shares if their stock prices fall. During the past 25 years, the 20th percentile return for stocks within the S&P 500 has averaged -27% annualized during buyback blackout periods compared with -16% when companies can freely repurchase their shares. Fewer buybacks also means slower EPS growth. Since 2008, the gap between EPS growth and earnings growth for the aggregate S&P 500 index averaged 1-2 pp annually. ”

And just like that the debate whether stock buybacks propped up stock prices is over, and anyone who has ever told you otherwise should be ignored.

A few more points before we close the chapter on this formerly controversial topic forever, here is Goldman’s explanation why buybacks are about to fall off a cliff:

The recently passed Coronavirus Aid, Relief, and Economic Security (CARES) Act prohibits buybacks and dividends among companies that accept assistance from the Treasury. The bill stipulates that any company that borrows money from the Treasury may not repurchase stock or pay a dividend until 12 months after the loan is repaid. The bill explicitly provisions assistance for airlines, air cargo, and aerospace companies, but our economists believe any company receiving assistance under the Treasury’s $454 billion credit facility could also be subject to these restrictions. More guidance from the Treasury is expected soon.

Since the start of March, 51 S&P 500 companies accounting for 27% of 2019 aggregate buybacks have suspended their repurchase programs. While United Airlines, Delta Airlines, Southwest Airlines, and Alaska Air have suspended buybacks, not all repurchase suspensions have come from companies expected to receive government assistance. Eight of the largest US banks recently announced that they would suspend buybacks through at least the second quarter and allocate that capital toward supporting the global economy. Prominent retailers, hoteliers, and cruise operators have also suspended their buyback programs.

What about the sectors that have mattered the most in recent years, namely tech?

Yep, them too.

Semiconductor and Pharmaceutical buybacks are also likely to decline. Intel recently announced that it was suspending its buyback program, which totaled $13.5 billion last year (nearly 2% of S&P 500 total). Broadcom reiterated that buybacks are on hold. Our semiconductors analysts expect other chipmakers will follow suit and noted that many investors have indicated they would prefer firms focus on shoring up the balance sheet rather than repurchasing stock. Our biopharma analysts believe that the current political spotlight on repurchases may result in firms reducing repurchase spending in 2020 despite significant outstanding authorizations.

And while we already know that such a plunge in buybacks which was last observed during the financial crisis will have a “significant” and not positive “impact on the equity market”, what does it mean quantitatively?

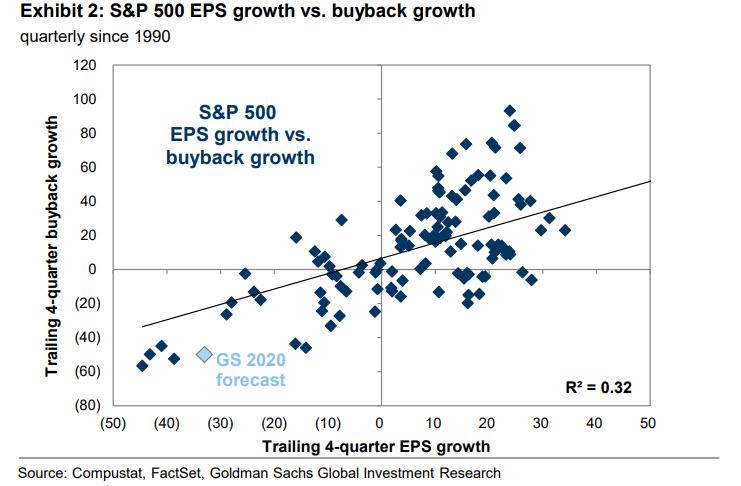

The historical relationship between EPS growth and buyback growth would suggest a roughly 30% decline in buybacks during 2020.

However, we believe the decline in share repurchases will be worse than this relationship implies. Our quarterly review of S&P 500 earnings transcripts consistently reveals that management teams view buybacks as the lowest priority use of cash. A spate of recent suspensions, escalating employee layoffs, and increasing political and social pressure will curtail buyback spending, which remains historically elevated following the passage of corporate tax reform

In historical context, a 50% decline in buybacks would be consistent with the 8-quarter, 67% peak-to-trough decline during the Global Financial Crisis.

Repurchases also declined by 56% peak-to-trough over a period of 11 quarters during the early 1990s. Following each of these sharp declines, equity issuance actually exceeded share repurchases: so are we about to see a flood stock buybacks in reverse as cash-strapped companies flood the market with their shares a la what Carnival did last week? Back in 2008/2009 S&P 500 firms issued $453 billion of equity during the 12-month period ended September 2009, more than double the $208 billion of aggregate share repurchases. Will the number this time be above $1 trillion?

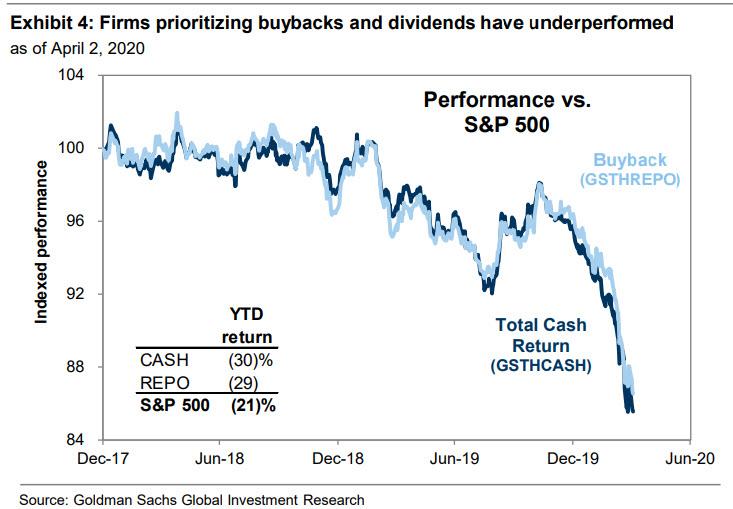

Finally, with everyone fleeing away from companies that have historically returned most capital to investors due to fears such shareholder friendly activity is now over, Goldman is too, and as Kostin concludes, “we rebalance our baskets of stocks with the largest spending on buybacks and dividends.

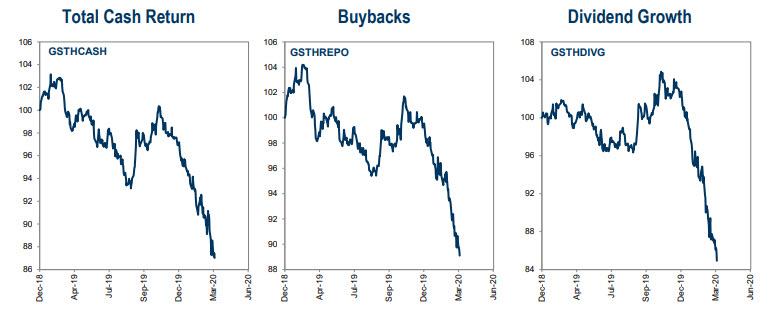

Our sector-neutral Buyback basket (GSTHREPO) consists of the 50 S&P 500 stocks with the largest trailing 12-month buyback spending as a share of market cap. Our Total Cash Return basket (GSTHCASH), also sector-neutral, consists of the stocks with the highest combined buyback and dividend spending over the same period. Both of these baskets have underperformed sharply YTD…

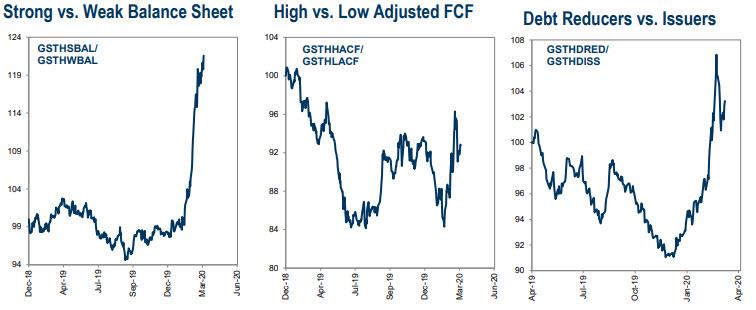

… as investors skeptical of the sustainability of buybacks and dividends have instead rewarded firms with safe balance sheets and those paying down debt” as well as those companies that generate cash flow instead of “pie in the sky” growth narratives that only a Tesla lemming could believe.

Well would you look at that: efficient, rational markets are suddenly back, now that companies can’t fall back to the old trick of issuing ultra cheap credit to boost their stock price.

In other words, the Fed may well be on its way to nationalizing the entire market, but in its last gasps of normalcy, the market is finally exhibiting the kind of lucid efficiency, at least briefly, that was missing for much of the past decade, and for once is actually doing the right thing in rewarding prudent corporate behavior and debt repayment while punishing all those companies that hit all time highs only because their management teams knew nothing more than “wave it in.”

We doubt the Fed will allow this kind of rational behavior to last too long before it goes “full USSR” and completely takes over the stock market as well, at which point capitalism will officially be dead.