Fra Goldman/Zerohedge:

Back in June we reported that Goldman clients first voiced their concerns over the looming specter of the November election, saying that “the most important equity market implication was the potential for higher corporate tax rates” which would be the result of a Democratic Sweep.

Three months later, in September, JPM chimed in with a counter-narrative that a contested election was the “worst case scenario for the market into year end.” All of this culminated last week when in a rapidly-cobbled together consensus, Wall Street concluded that not only is a contested election unlikely but that a Democratic Sweep – and thus higher corporate taxes – is actually good for stocks.

And then, just to assure investors that no matter what happens – even a massive increase in the top long-term capital gains tax from 20% to 39.6% under the Biden admin – they shouldn’t sell, JPMorgan came out with a late Friday report according to which while a spike in cap gains taxes could be negative for market in late 2021, it would have little to no impact over the long-run.

Putting it all together, was another JPM analyst, this time from the company’s Private Bank, whose conclusion was that no matter what happens, one should not sell:

Since the end of World War II, there’s been this one constant, regardless of the occupant of the White House and the composition of Congress: equity markets have increased in value over time. Some stocks, sectors or styles do better at some times than others, depending on specific, often unpredictable factors—a fact that underlines the importance of diversification. That is why, to ensure the long-term health of one’s portfolio, we think that time in the market, rather than market timing, is key. Consequently, we advise clients to stay invested, regardless of specific events—including election results.

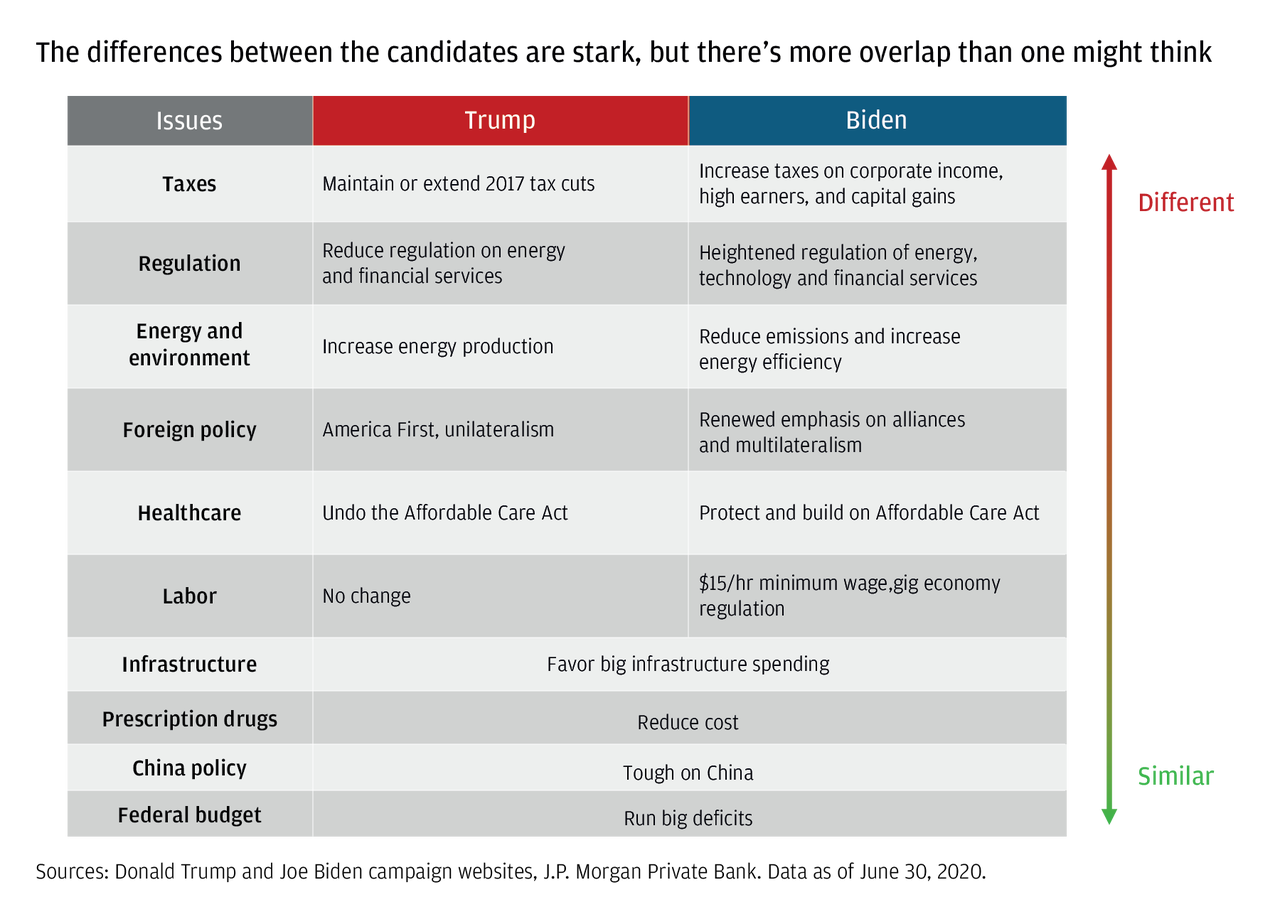

The punchline: despite the clear differences to the tax regime between the Trump and Biden administrations…

… JPMorgan says ignore it all, and in fact, “don’t let the passions of this election lead you to make any key planning or investment decisions.”

And yet, despite an unprecedented effort to minimize the impact of the election, not everyone agrees. In a Saturday note published by Larry McDonald’s Bear Traps report, he echoes what we said on Friday namely that “the race is a lot closer than people think, Trump could still win the electoral college with media polls showing him trailing by 10 points. The mainstream media is making the same mistakes they made in 2016, they are firing up Trump’s base. Polling data looks far too urban -Trump won 2630 counties to Clinton’s 489, so in an electoral college world, polling must be VERY disbursed.”

A lot of Republicans that did not vote for Trump in 2016, will support him now. We know Polls ignore Trump’s silent support and Nixon-like, law, and order support. In our view, he gets 8 to 9% of the African American vote vs. 6% in 2016 -this is a meaningfulneedle mover. However, Biden will definitely bring out more voters than Clinton. Biden could win the popular vote by 5 million and still lose the EC, there is that much dispersionbetween large cities and the country. Trump is loud-mouth with large scale connection to middle-class voters.

This, as McDonalds concludes, “means a contested election risk is now mispriced. November and December volatility has come down a lot.”

Another group of investors who remain concerned about the outcome of the elections are Goldman clients.

As Goldman’s chief equity strategist David Kostin writes in his latest Weekly Kickstart report, “new information on the election, vaccines, and upcoming 3Q earnings represent substantial cross-currents for equities during the next two months.” Of course, in keeping with the Goldman party line according to which a Blue Sweep is now very likely, Kostin seeks to downplay election concerns, and writes that “following the Vice Presidential debate this week, investors remain focused on the likelihood of a “Blue Wave” on November 3rdand the equity market implications of such an outcome. Prediction market probability of a Democratic sweep of the White House and both houses of Congress has climbed to 60% from 47% one month ago.”

And in another attempt to deflect attention from the election which is in less than 4 weeks as a key markets catalyst, Kostin then writes that “the vaccine represents a more important factor than the election result for the recovery in S&P 500 fundamentals.

Good Judgment asks its superforecasters when enough doses of an FDA-approved COVID-19 vaccine to inoculate 25 million people will be distributed in the US. The odds of distribution by 1Q 2021 rose from 39% on Aug. 23rd to 71% on Sep. 8th. However, that probability has dropped to 42% and the odds for 2Q-3Q 2021 are now the greatest (48%).”

Which is ironic, because it was Goldman which in mid-August raised its year-end S&P price target to 3,600 on the assumption that a vaccine would be discovered and delivered by the end of 2000/early 2001. While that is no longer the base case, Goldman forgot to cut its S&P price target.

Still, Goldman is unwilling to throw in the towel on its vaccine optimism, and as Kostin writes, Goldman’s Pharmaceutical and Biotechnology equity analysts Terence Flynn and Salveen Richter hosted a virtual conference “Inoculating the Recovery” with speakers from most of the major companies leading the fight against COVID. “Their assessment of both vaccines and treatments remains optimistic”, of course. Here are the key takeaways:

- Multiple vaccines are advancing in late-stage development based on encouraging initial data and one panelist estimated the vaccines have a 90%+ probability of success;

- FDA guidance as it relates to requirements for emergency use authorization for vaccines was described as a non-binary “continuum” by MRNA;

- amidst investor debate on timelines, HHS Secretary Azar offered upbeat commentary noting that, contingent on success, 100mn vaccine doses could be available in the US by year-end for vulnerable populations, with widespread availability by March/April 2021;

- the biggest challenge to vaccine uptake will not necessarily be cold-storage and distribution but rather convincing the broader population to get vaccinated (something Zero Hedge first warned about back in August ). Aside from the vaccine, therapeutic antibodies from LLY and REGN have demonstrated a benefit on hospitalizations/ER visits in early studies, offering a potential bridge to broader availability of vaccines, a dynamic potentially underappreciated by investors.

So elections and vaccines aside, the third key theme for investors over the next 1-2 months is naturally corporate earnings. This is how Kostin previews 3Q earnings season which kicks off next week and will provide investors with another look at the impact of COVID-19 on fundamentals:

During the quarter, the Goldman Sachs equity analyst US re-opening scale averaged between 4 and 5 on a continuum between 1 (lockdown) and 10 (fully re-opened). The consequences of the semi-frozen economy on an uneven road to recovery will be visible in 3Q results.

Consensus expects 3Q S&P 500 EPS will decline by 21% on a year/year basis, following a 32% drop in 2Q and a 15% fall in 1Q. Including the anticipated 14% fall in 4Q, our full-year 2020 EPS estimate of $130 reflects a 21% year/year decline from the 2019 level. Looking forward, we project a strong 30% earnings rebound to our baseline 2021 EPS forecast of $170, followed by 11% growth to $188 in 2022. In other words, there will be NO EPS GROWTH from the end of 2018 to the end of 2021 even as the stock market has risen nearly 40% since then.

More to the point, Goldman expect three themes will characterize 3Q results across most sectors:

- First, a collapse in margins, with aggregate index-level margins compressing by 220 bps on a year/year basis to 8.7%. For context, although the margin decline in 3Q will represent a slight improvement from the peak pandemic decline in 2Q (-223 bp to 8.6%), it will still register as the lowest level of margins since 2010.

- Second, the modest 3% decline in aggregate sales will mask the bi-modal story beneath the surface. Cyclical sectors will suffer sharp revenue declines led by Energy (-32%). In Industrials, a 15% fall in sales will lead to a 62% plunge in EPS as the sector suffers from elevated operating leverage. Banks earnings are expected to decline by ~25% as pre-provision net revenues continue to deteriorate, despite smaller expected reserve builds. In contrast, Health Care (+5%), Consumer Staples (+4%), and Info Tech (+3%) are expected to post positive sales growth. Large-cap stocks appear better positioned for 3Q than small-cap stocks. Investors have exhibited a preference for size in 2020 with the S&P 500 climbing by 8% YTD vs. -1% for the Russell 2000. The 5 largest S&P 500 stocks –AAPL, MSFT, AMZN, GOOGL, and FB –are expected to grow 3Q sales and EPS by +13% and +1%, respectively, compared with -5% and -24% for the rest of the S&P 500. The disparity is even more apparent across indices. While S&P 500 EPS is expected to fall by 21%, consensus forecasts earnings for the small-cap Russell 2000 index will fall by 40%.

- Third, most managements will still be reluctant to provide forward earnings guidance.The uncertain timeline of a vaccine that is essential for the normalization of the economy, the stalled talks between the Trump administration and Congress on an interim fiscal package, and the contentious election that is only 25 days away are all valid reasons for executives to minimize forward-looking commentary. However, consensus 2021 EPS estimates have recently troughed and started to turn positive. S&P 500 earnings revision sentiment sits at the 95th percentile.

In other words, Kostin insinuates that earnings also don’t matter much in determining the direction of the market.

Going back to the election outcome, Kostin writes that it poses “upside and downside risks to future S&P 500 earnings.

We recently modeled the earnings impact of various election outcomes. Our analysis focused on the proposed and expected policies related to tax reform, fiscal stimulus, and trade. By 2024, we model just a 4% difference between our baseline EPS forecast ($214), which assumes no change in policy, and the potential earnings outlook under policies expected to be enacted in the event of a Democratic sweep ($222). Our analysis suggests that a large increase in fiscal spending, funded in part by increased tax revenue, would boost economic growth and help offset the earnings headwind from high tax rates.”

So… the election could be good and bad. Got it. Of course, such a laughable observation would make the Goldman equity strategist the butt of all jokes which is why he elaborates that “sequencing is a key assumption to our forecast that a “Blue Wave” would have a modestly positive net impact on the trajectory of S&P 500 profits.”

He then notes that Goldman economists “expect that a Biden administration would prioritize fiscal stimulus in the first year of its administration followed by a phasing-in of tax reform in 2022/23. And yetm during Wednesday night’s Vice Presidential debate, Senator Harris stated that a Biden administration would raise taxes “on day one.”

Goldman’s conclusion, “if the Democrats were to implement both fiscal stimulus and tax reform in 2021, we estimate these polices would have largely offsetting effects, leading to S&P 500 EPS being roughly in line with our status quo 2021E estimate but lower thereafter.”

In other words, a Blue Sweep is neither bullish nor bearish. Which again brings us to our parting (rhetorical) question from yesterday: does it even matter who is president as long as we have a Fed?