Fra Zerohedge:

On Wednesday we mused that a race had emerged between Goldman and JPMorgan over who can downgrade the US GDP growth rate the most. Up until that point, Goldman held the lead, with its recently announced -5% cut to Q2 GDP.

But then JPM’s chief economist Michael Feroli, admitting he really has no idea what he is doing but deciding to do it nonetheless, announced that he now expects Q2 GDP to crater by an unprecedented -14%, a drop the kinds of which have never before been seen.

But Goldman, which just three months ago said the US economy is “nearly recession-proof” (but apparently not depression proof), and instantly lost all credibility…

… decided that if it can’t impress its clients with its predictive skills, the least it can do is make them laugh by outshining, or rather outdulling, JPM’s forecast and it did just that moments ago when it slashed its previous GDP estimate published less than two weeks ago, and now sees Q2 GDP crashing at a ridiculous -24% rate, and up from -5% just days ago, which means the US is basically entering a second Great Depression. The trade off, as with JPM, Goldman sees a V-shaped recovery in Q3 but we can likely ignore that: there is no way the country will recover from this kind of “once in a generation” supply and demand shock in 3 months. No way.

While we expect Goldman to take the machete to this analysis as well in the coming days, because if the US economy is indeed paralyzed for at least one quarter, then all of GDP will be lost meaning a -100% annualized print is increasingly likely, here are some of the punchline from the report which will be dramatically revised in just a few days, if not hours.

Over the last few days social distancing measures have shut down normal life in much of the US. News reports point to a sudden surge in layoffs and a collapse in spending, both historic in size and speed, as well as shutdowns of many schools, stores, offices, manufacturing plants, and construction sites. These developments argue for a much sharper drop in GDP in Q1 and Q2.

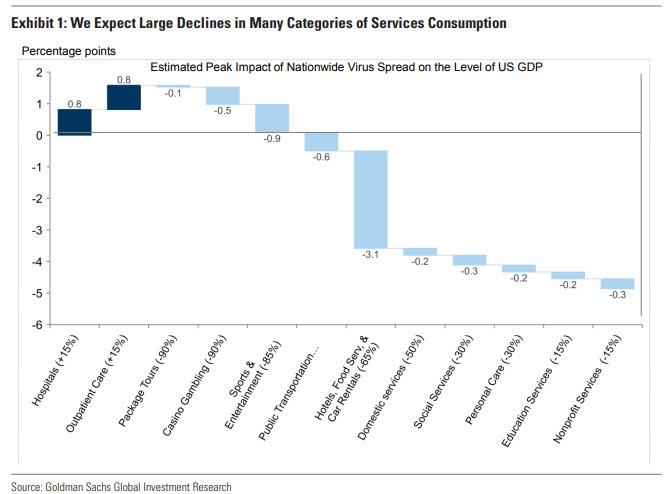

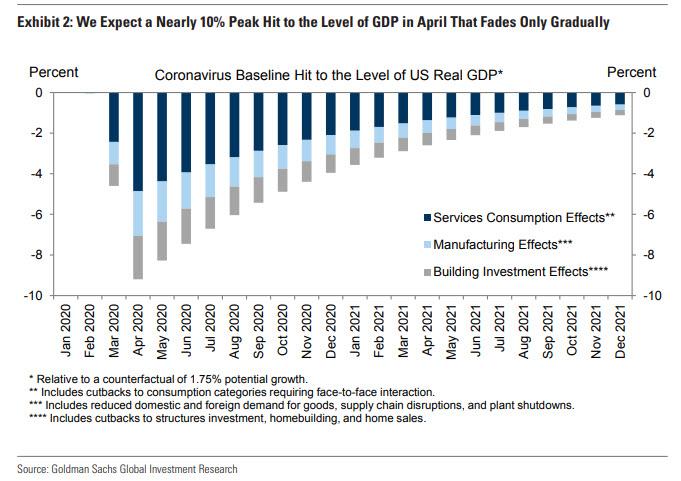

We expect declines in services consumption, manufacturing activity, and building investment to lower the level of GDP in April by nearly 10%, a drag that we expect to fade only gradually in later months. We now forecast quarter-on-quarter annualized growth rates of -6% in Q1, -24% in Q2, +12% in Q3, and +10% in Q4, leaving full-year growth at -3.8% on an annual average basis and -3.1% on a Q4/Q4 basis.

In total, we expect declines in services consumption, manufacturing activity, and building investment to lower the level of GDP in April by nearly 10%. We assume that this drag then fades gradually by 10% each month. While the exact timing is highly uncertain and relapses are plausible, the assumption of a gradual recovery reflects the potential contributions from factors such as effective mitigation and testing actions, weather effects, medical breakthroughs or adaptation by firms and consumers. The slow pace of recovery even in 2021 allows for longer-lasting scarring effects on businesses and workers.

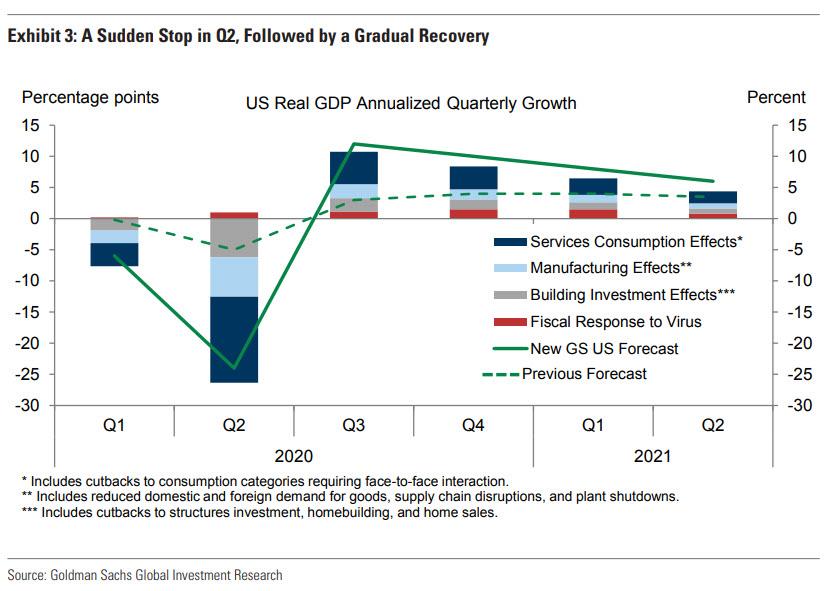

Exhibit 3 translates the monthly path of the level of GDP shown in Exhibit 2 into a quarterly path of GDP growth, adding the impact of the fiscal impulse. We have downgraded our tracking estimate for 2020Q1 to -6% (from -0.2% previously). The largest change to our forecast is in 2020Q2, where we are now forecasting a -24% quarterly annualized growth pace (from -5% previously). A decline of this magnitude would be nearly two-and-a-half times the size of the largest quarterly decline in the history of the modern GDP statistics (-10% quarterly annualized in 1958Q1). It would mean that in only one quarter, the economy would experience an increase in the output gap bigger than that experienced in the entirety of every postwar US recession.

Our assumptions about the gradual fading of the virus drag imply a growth pace of +12% in 2020Q3, +10% in 2020Q4, and +8%/+6%/+4%/+3% in 2021Q1-Q4. Our forecast of full-year growth is now -3.8% on an annual average basis and -3.1% on a Q4/Q4 basis.

Why such an extreme forecast, especially in Q2? The sudden stop in US economic activity in response to the virus is unprecedented, and the early data points over the last week strengthen our confidence that a dramatic slowdown is indeed already underway. In some US states, authorities have now issued statewide shutdown orders to slow the pace of virus spread and avoid overwhelming the health care system, measures that will further reduce the level of economic activity

These unprecedented downgrades to Goldman’s growth forecasts also imply a large upward revision to its unemployment rate forecast as suddenly tens of millions of Americans will be out of a job. Using three approaches—the empirical relationship between GDP and unemployment, the experience of Hurricane Katrina, and a bottom-up analysis of likely job losses by sector and occupation— Goldman estimate a massive 5.5% increase in the U3 unemployment rate to a 9% peak in coming quarters.

What about the $1+ trillion fiscal stimulus, won’t that help?

In the other direction, the Senate Republican proposal for Phase 3 of the fiscal package includes funding for small business loans that would be forgiven if used to finance payroll from March to June, as long as firms pay workers at least 75% of their normal pay.

The odds are increasing that such a provision will be enacted as part of Phase 3, but for now a best guess is that more generous unemployment insurance will be the stronger factor, so that on net these two policies are more likely to nudge the reported unemployment rate higher than lower.

Whatever the final outcome, the bottom line is that if unemployment hits 10% in a few months, it would make a Trump’s reelection very complicated.