Fra Zerohedge/ Goldman

And speaking of Goldman, the bank’s equity strategist David Kostin writes that – as one would expect – all its clients care about is the coronavirus correction. To allay their fears, the perpetually cheerful Kostin writes that his baseline assumption “is the COVID-19 virus becomes widespread but is relatively short-lived. We forecast flat earnings in 2020 followed by 6% growth in 2021.

We estimate the yield gap will narrow to 395 bp by year-end as economic activity and confidence rebound, leading S&P 500 P/E to recover to 19.4x and the index to reach 3400, 14% above the current level.”

That’s the optimistic case.

In the not so optimistic one, Kostin admits that “the US economy could slip into a recession if the coronavirus contagion lasts for an extended period of time”; as a reminder, just yesterday we noted that a global recession is now Bank of America’s baseline assumption. In such a situation, Goldman estimates S&P 500 EPS would fall by 13% to $143 in 2020 and the index would decline to 2450 by year-end.

Extending Kostin’s observations, he notes that under the surface of the S&P 500 volatile decline, “sector performance has been well-ordered” and since the S&P 500 peak, “realized sector performance has generally been in line with the return implied by each sector’s beta to S&P 500 (Exhibit 2).”

Sectors with the most notable deviation from this trend have been Energy (-15% vs. -9% implied), which has been driven by the 23% decline in Brent crude oil prices to $46/bbl, and Financials (-11% vs. -8% implied), which has underperformed sharply given the large decline in interest rates.

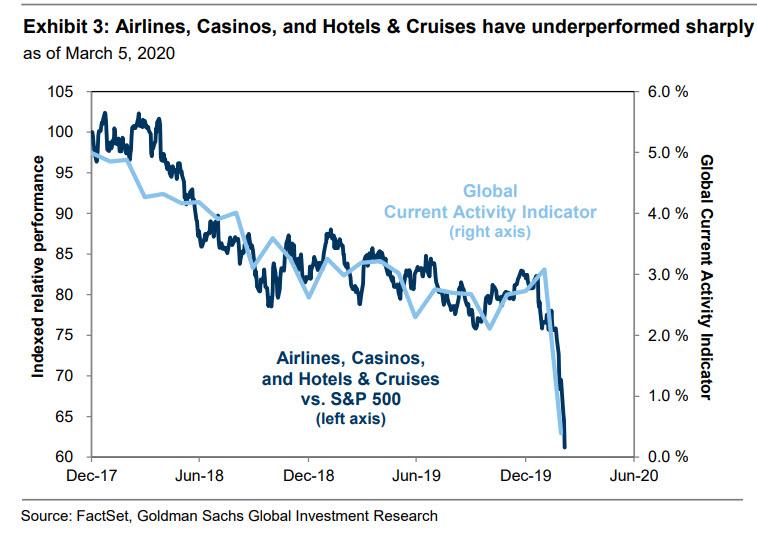

Looking at distinct industries, travel stocks have been among the most heavily monkeyhammered as virus concerns have intensified. Airlines, Casinos, Hotels, and Cruises have underperformed S&P 500 by 19 pp since February 19 (Exhibit 3). United Airlines announced that it would be cutting flights in April due to weaker demand amid coronavirus concerns. News broke on Thursday that authorities are holding another Princess cruise ship off the coast of California after a passenger died from the coronavirus and hotels have warned that occupancy rates are likely to dip amidst increasing travel restrictions

Meanwhile, as we warned almost a month ago, semiconductor stocks have also come under pressure due to the industry’s outsized exposure to China. Semiconductors derives 85% of revenues from international sources, the highest of any S&P 500 industry group. 47% of sales come explicitly from Greater China.

Despite a recent spate of negative guidance, the median semiconductors firm has experienced a 1-month 2020E EPS revision of just -0.2%. Goldman also cautions that while most companies have slashed 1Q guidance, they have not yet addressed the longer-term or full-year outlook.