Fra Zerohedge/goldman:

While it will probably not come as a surprise to anyone who read our earlier post to “Brace For A Record Decline in GDP“, but moments ago Goldman – which last week called the bear market just hours before it officially materialized, and cut its year-end S&P price target to 2,450 which the S&P almost hit late on Thursday – finally capitulated on its optimistic take for the US economy, and in a note published moments ago by its chief economist Jan Hatzius, Goldman said that it expects US economic activity “to contract sharply in the remainder of March and throughout April as virus fears lead consumers and businesses to continue to cut back on spending such as travel, entertainment, and restaurant meals. Emerging supply chain disruptions and the recent tightening in financial conditions will likely add to the growth hit.”

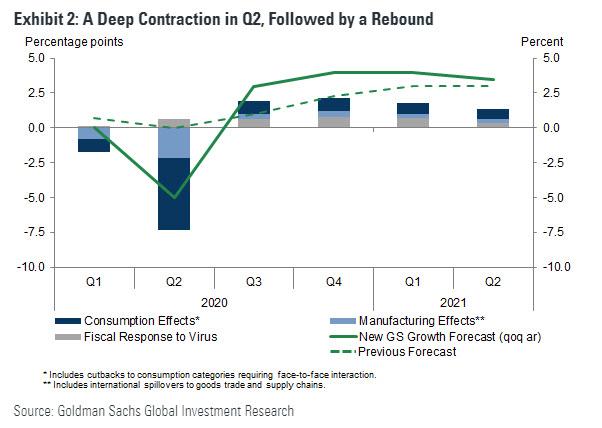

As a result, the bank is now expecting Q2 GDP to crater -5%, down from its prior forecast of 0%, and the biggest quarterly GDP contraction since the peak of the financial crisis when GDP cratered by 8.4%.

Goldman lays out the details of how it gets to this worst GDP print in 12 years below:

Over the last week, the number of coronavirus cases in the US has risen rapidly. In response, business and government leaders have begun much stronger measures to combat the spread of the virus. Even with monetary and fiscal policy turning sharply further toward stimulus—we expect a 100bp rate cut on Wednesday and a fiscal impulse of 1-2% of GDP—these shutdowns and rising public anxiety about the virus are likely to lead to a sharp deterioration in economic activity in the rest of March and throughout April.

Virus fears have already begun to lead US consumers and businesses to reduce spending on activities such as travel, entertainment, and restaurant meals. Airlines have eliminated a significant share of flights, conferences have been called off, major cruise lines have canceled all cruises, theme parks have shut down, and hotel occupancy has fallen sharply in cities with early virus outbreaks. Among sports leagues, the professional and college basketball, hockey, and soccer seasons have been cancelled, as have major golf and tennis events, and the baseball season has been postponed. Data from online restaurant reservations also points to a large drop in restaurant visits, especially in the worst affected cities such as Seattle.

While we are not assuming an Italy-style national shutdown in the US, the experience of countries like Italy, Spain and France offers some indications of the impact that extreme local-level quarantines could have. In Italy, for example, all retail stores except drug stores and grocery stores are closed, all restaurants are closed, hotel occupancy is at a small fraction of capacity, and some factories have closed temporarily while many others are operating below normal levels because workers are resisting going to work out of fear of getting sick.

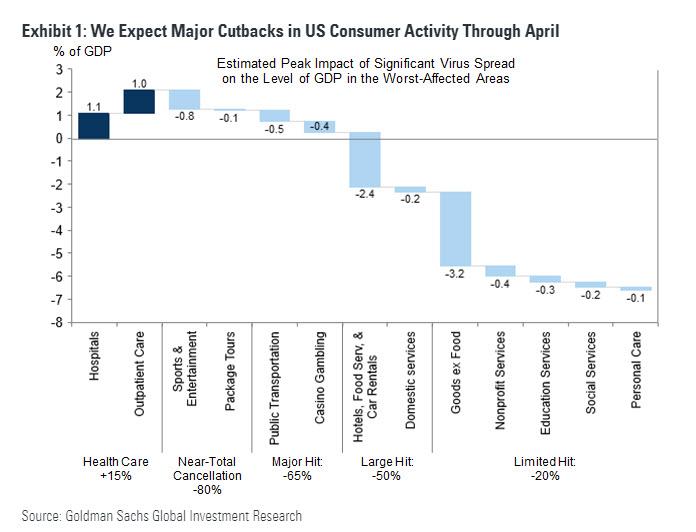

Exhibit 1 provides illustrative estimates of how large the GDP impact of these consumption cutbacks could be at their peak in the worst-affected areas. The bottom of the exhibit shows our assumptions about the peak magnitude of cutbacks—for example, we assume an 80% decline in spending on sports and entertainment and a 50% decline in hotel and restaurant spending. We have scaled up some of our earlier estimates based on preliminary signals from US cutbacks to date and from the experiences of other economies that went through large outbreaks earlier this year. The bars in the exhibit multiply these assumed cutbacks by the GDP share of each category to estimate the impact on the level of GDP.

In total, our assumptions about consumption cutbacks in these categories imply a peak hit to the level of GDP in the worst-affected areas of 6-7%. Reductions in home sales of the sort seen in other virus-hit economies and in business investment would add to the hit to GDP. The impact on US GDP growth depends on what share of the country is affected at a particular time, how close the affected areas come to the peak hit shown in Exhibit 1, and how long the retreat from normal economic life lasts. Our baseline scenario assumes the largest impact in April, with many areas of the US experiencing about two-thirds of the peak effect shown in the chart.

Naturally, this being Goldman, the bank just has to error on the side of optimism, and so it does, noting that its baseline assumption is that “activity will start to recover after April and that H2 will see strong sequential growth, but the specifics depend on a number of important questions. Some are medical, including the extent to which social distancing and seasonally higher temperatures will reduce infections as well as whether good treatments will emerge. Others are behavioral and economic, including how quickly reduced infections will bring back everyday activities and how effective easier monetary and fiscal policy will be in providing support.”

And just to confirm it really has no idea, or visibility about what happens in the period it expects a super surge in GDP, Hatzius caveats that “the uncertainty around all of these numbers is much greater than normal.”

In short, while Goldman has no idea if and how the V-shaped recovery will take place, it is certain it will, and it now sees Q3 GDP surging +3%, up from +1%, and even higher, or +4% in Q4, from +2¼%, with further strong gains in early 2021.

Yet despite the sharply higher second half GDP forecasts, the bank still cuts its 2020 GDP forecast down to +0.4%, from 1.2%, which even in this optimistic, V-shaped recovery scenario, would be the worst annual GDP since the crisis.

What is perhaps most amusing about Goldman’s note is that it manages to incorporate a discussion of whether this catastrophic contraction – which will magically be limited to just one quarter – is classified as a recession.

Would the NBER business cycle dating committee classify our new forecast as a recession, given that it involves only one quarter of strictly negative growth? It is not entirely clear, but we think the answer is probably yes. The committee has noted previously that even a contraction of just a few months can meet its recession definition if it is sufficiently deep.

One shudders to think what the real GDP will be at the end of the year, when Goldman’s V-shaped recovery never materializes, and instead the far more probably L-shaped “recovery”