Fra Zerohedge/ The Hill.com

Update (2040ET): 12 hours after the Senate was supposed to originally release the full text – all 889 pages of it – of the $2 trillion stimulus bill, it finally did just that, detailing in a whopping 889 pages, detailing its plans to stimulate spending, push tax breaks and generally boost the U.S. economy during and after the coronavirus outbreak.

Here is the part most relevant to capital markets, discussing the limitations on dividends and buyback:

The Secretary may enter into agreements to make loans or loan guarantees to 1 or more eligible businesses… if the Secretary determines that, in the Secretary’s discretion—(A) the applicant is an eligible business for which credit is not reasonably available at the time of the transaction; (B) the intended obligation by the applicant is prudently incurred; (C) the loan or loan guarantee is sufficiently secured or is made at a rate that— (i) reflects the risk of the loan or loan guarantee; and (ii) is to the extent practicable, not less than an interest rate based on market conditions for comparable obligations prevalent prior to the outbreak of the coronavirus disease 2019 (COVID–19); (D) the duration of the loan or loan guarantee is as short as practicable and in any case not longer than 5 years…

… and the punchline:

In other words, as noted earlier, no dividends or buybacks for any company that uses the bailout loan. By implication, it means that all other companies can continue to repurchase their stock.

And here, courtesy of Bloomberg, are some additional observations on the winners and losers:

- The plan includes $500 billion in loans and assistance for larger companies, as well as states and cities, according to the latest drafts being circulated.

- But the aid comes with strings attached after pressure from Democrats: Companies receiving a government loan would be subject to a ban on stock buybacks through the term of the loan plus one additional year. They also would have to limit executive bonuses and take steps to protect workers. The Treasury Department would have to disclose the terms of loans or other aid, and a new Treasury inspector general would oversee the lending program.

- The bill is largely a win for the retail, hotel and restaurant industries that initially viewed lawmakers as favoring the airline industry. Trade groups representing those sectors lobbied Congress hard for loans, grants and unemployment assistance because their businesses have also suffered coronavirus-related revenue losses. “We see it as an important win,” said Austen Jensen of the Retail Industry Leaders Association. “Yes airlines are in a tough spot, but the retail industry is equally in a difficult position.”

The winners:

Cash for citizens, gig workers

- The package provides direct payments to lower- and middle-income Americans of $1,200 for each adult, as well as $500 for each child. Democrats were able to secure a change from a previous version that allows low-income taxpayers to get the full $1,200 payment.

- Unemployment insurance payments were boosted and recipients would be eligible to receive those funds for an average of four months, up from three in the prior GOP plan. It also would extend eligibility to the self-employed and workers in the gig economy such as drivers for Uber Technologies Inc.

Airlines to get loans, cash-for-equity bailouts

- Struggling U.S. airlines would be eligible to receive federal loans and direct cash assistance if they are willing to give an option for an ownership stake to the government. The program allocates $25 billion to passenger carriers and $3 billion to airline contractors providing ground staff such as caterers, while cargo haulers would see $4 billion.

- The addition of direct cash relief, earmarked for payrolls, was sought by airline and industry unions, which feared massive job losses if loans were the only option. The legislation does not include emissions limits for airplanes that were sought by House Democrats, Senator Pat Toomey, a Pennsylvania Republican, said on a press call.

- Other transportation winners include rail and transit operators. Amtrak would get $1.02 billion to cover coronavirus-related revenue losses and support state-funded routes.

- Here is the controversial section on “air carrier or contractor” bailouts:

To be eligible for financial assistance under this subtitle, an air carrier or contractor shall enter into an agreement with the Secretary, or otherwise certify in such form and manner as the Secretary shall prescribe, that the air carrier or contractor shall— (1) refrain from conducting involuntary furloughs or reducing pay rates and benefits until September 30, 2020; (2) through September 30, 2021, ensure that neither the air carrier or contractor nor any affiliate of the air carrier or contractor may, in any transaction, purchase an equity security of the air carrier or contractor or the parent company of the air carrier or contractor that is listed on a national securities exchange; (3) through September 30, 2021, ensure that the air carrier or contractor shall not pay dividends, or make other capital distributions, with respect to the common stock (or equivalent interest) of the air carrier or contractor.

- No surprises here either: an aircraft company getting bailout funds will not be allowed to fire workers or cut wages, nor pursue M&A or engage in buybacks and dividends.

Small businesses get cash injections

- The bill carves out more than $350 billion in aid for small businesses, much of which would be in loans through the Small Business Administration and banks, guaranteed by the federal government. The loans would be forgiven provided the businesses meet certain requirements, including limiting reductions in pay and layoffs, though with more flexibility for employers than the original Senate bill. Industry advocates previously said loans weren’t enough, especially for the smallest outfits, although some expressed more optimism on Wednesday.

Money for hospitals in healthcare ‘Marshall Plan’

- The legislation calls for $117 billion for hospitals and veterans’ health care, as well as $16 billion for personal protective equipment, ventilators and other medical supplies for federal and state response efforts. It also includes $11 billion for vaccines, therapeutics, diagnostics and other medical needs, and at least $250 million to improve the capacity of health-care facilities to respond to medical events, according to a summary by the Senate Appropriations Committee.

- The bill would require insurers to cover tests for Covid-19. Labs would be required to post cash prices for the tests on public websites, and insurers would have to pay those prices or another privately negotiated rate. Any vaccines or other preventive services would have to be covered with no cost-sharing.

- The measure temporarily lifts Medicare payment cuts and includes a 20% increase in Medicare payments to hospitals for treating Covid-19 patients. The hospital industry supported the measure for providing emergency funds, boosting payments and suspending some funding cuts. But “more will need to be done to deal with the unprecedented challenge of this virus,” Rick Pollack, head of the American Hospital Association, said in a statement.

Mortgage relief for wide swath of borrowers

- Many U.S. homeowners and businesses could get relief from making their monthly mortgage payments through the bill. Borrowers with loans insured by government agencies such as the Federal Housing Administration and the Department of Veterans Affairs would be eligible for forbearance. Consumers whose mortgages are backed by Fannie Mae and Freddie Mac would also be eligible to skip payments.

- U.S. regulators have already mandated forbearance to borrowers facing financial hardships due to coronavirus, in addition to suspending foreclosures and evictions through the end of April and in some cases longer. Under the bill, borrowers would be eligible for 60 days of forbearance if they can demonstrate virus-related financial stress. The relief can be extended for 30 days up to four times.

- Mortgage servicers, who collect homeowners’ monthly payments, couldn’t demand documentation proving economic hardship. Instead, borrowers would just have to attest that they’re struggling, according to the text of the legislation.

- Commercial borrowers with federally backed loans could skip payments for at least 30 days with a possible extension of up to 60 additional days. Unlike individual consumers, businesses would have to document financial hardship and they would be barred from evicting tenants as long as they are missing mortgage payments.

Emergency aid for farmers:

- The stimulus package includes up to $23.5 billion in farm aid. It would provide $9.5 billion in emergency funds for agriculture, including livestock producers and growers of specialty crops such as fruits and vegetables. And it would authorize $14 billion in new borrowing authority for the U.S. Agriculture Department’s Commodity Credit Corp., a Depression-era entity the Trump administration has used for its farm-bailout programs the past two years.

State and local governments get relief

- A coronavirus relief fund with $150 billion would be created for states, cities and other local governments. Additional funds will be set aside for territories, tribal governments and other entitites. The package includes $400 million for the Election Assistance Commission to provide grants in response to the coronavirus outbreak. The funds could be used to expand voting by mail, early voting and online registration and bolster in-person voting, according to a Senate aide. The bill doesn’t create a national requirement for voting by mail, which Republicans objected to.

The losers:

- No aid for Trump properties: Democrats won language that bars any business owned by President Donald Trump or his family from getting loans from Treasury. Businesses owned by members of Congress, heads of executive departments and Vice President Mike Pence also would be blocked from receiving aid under the stimulus program.

- Oil Industry: A $3 billion provision in the original GOP bill to buy oil for the nation’s Strategic Petroleum Reserve was cut by negotiators. The funding for the emergency stockpiles had been requested by the Trump administration for the purchase of up to 77 million barrels of crude oil to support the domestic industry and boost reserves at cheap prices. Democrats sought to add billions in funding for clean energy in exchange and in the end both were scuttled. But the issue could arise as Congress takes up additional coronavirus-related legislation in coming weeks. Anne Bradbury, head of the American Exploration and Production Council that represents independent oil producers, said the group is “confident that DOE will be able to meet the president’s directive to purchase up to $3 billion in U.S.-produced crude.”

- Renewables: The omission of expanded tax incentives for renewable energy and spending on green infrastructure is a blow to advocates of solar, wind and electric vehicles who worry that a buildup of new federal debt from stimulus spending will discourage green investment and lending in the future.

Full text below:

Here are the seven things that The Hill thinks are key to know.

Cash assistance

The Senate bill will provide a one-time $1,200 check for an individual making up to $75,000 per year or $2,400 for couples earning less than $150,000. After that, it will be scaled down until it reaches a $99,000 income threshold for an individual or $198,000 for a couple and then phased out altogether. It also provides an additional $500 per child.

The idea quickly gained steam with both the administration and senators as they tried to figure out a way to provide direct financial assistance to Americans. Supporters say the funding could help cover short-term costs such as rent, groceries and utilities, while opponents argue it does little to stimulate the broader economy.

Some Republicans, such as Sen. Lindsey Graham (R-S.C.) were vocal critics of the idea, instead pushing for expanded unemployment. Others, such as Sens. Josh Hawley (R-Mo.) and Mitt Romney (R-Utah), took issue with a provision in the initial GOP draft that would have given those with little or no tax liability small checks — a minimum of $600. That restriction was ultimately dropped.

President Trump

Democrats got a provision tucked into the massive legislation that prevents businesses controlled by President Trump from receiving loans or investments from Treasury programs included in the bill.

Senate Minority Leader Charles Schumer (D-N.Y.) told CNN that it applies to not just Trump but also Vice President Pence, heads of executive departments and members of Congress, where four lawmakers have recently faced accusations of insider trading.

“We wrote a provision, not just the president, but any major figure in government, Cabinet, Senate, congressmen — if they have majority, they have majority control, they can’t get grants or loans, and that makes sense. Those of us who write the law shouldn’t benefit from the law,” Schumer told CNN during an interview on Wednesday.

The provision would also apply to children, spouses and in-laws of the individuals affected.

Unemployment

The bill provides four months of bolstered unemployment benefits as Congress braces for a spike in jobless claims, with the spread of the coronavirus curtailing businesses or closing them altogether.

As part of the bipartisan package, the maximum unemployment benefit would be increased by $600. A GOP Finance Committee aide said the across-the-board increase was more practical because “each state has a different [unemployment insurance] program.”

But the unemployment insurance provision is sparking an eleventh-hour fight, with four GOP senators pushing for an amendment vote that would cap unemployment insurance at 100 percent of wages.

They argue that, as currently written, the bill could incentivize individuals not to work. The aide rebutted that, saying, “Nothing in this bill incentivizes businesses to lay off employees. In fact it’s just the opposite.”

Sens. Graham, Tim Scott (R-S.C.) and Ben Sasse (R-Neb.) warned in a statement that they would oppose fast-tracking the bill over the provision unless they could get an amendment vote.

Corporate fund

The bill includes a $500 billion corporate liquidity fund to help companies impacted by the coronavirus access credit.

That includes $46 billion in direct financial assistance, with $25 billion for U.S. airlines, $4 billion for air cargo carriers and $17 billion for other distressed companies related to critical national security.

The debate over what form of aid to give to airlines was one of the stickiest negotiations in the days-long fight over the stimulus package. Sen. Pat Toomey (R-Pa.), who was at the center of the negotiations, said that he favored giving airlines low-interest loans, but companies warned that the application process was not quick enough to prevent bankruptcy.

“My preference would have been that like the other industries across America that will access credit through the 13(3) program — I would have preferred the direct funding from the Treasury to the airlines to be in the form of a loan, to be in the form of an extension of credit,” Toomey said.

Schumer, in a letter to his colleagues, outlined a list of restrictions on the aid, including appointing an inspector general to provide oversight, similar to TARP, and “real-time public reporting of Treasury transactions under the Act.”

It would also, according to Schumer, ban stock buybacks for the length of government assistance plus one year for companies receiving loans and specifically prohibit airlines from stock buybacks or executive bonuses.

Health care

In addition to economic assistance, the bill includes $100 billion for hospitals, which have warned they could soon be overwhelmed by the steady increase in coronavirus cases.

The bill requires boosting medical supplies in the Strategic National Stockpile amid reports that the country is facing a shortfall of key items such as ventilators, masks and swabs used for coronavirus testing.

It would also require health insurance companies to pay for coronavirus testing and increase funding for community health centers.

Border wall

The Senate bill prevents the Pentagon from shifting $10.5 billion in coronavirus funding to a counterdrug account it has been using to fund the U.S.-Mexico border wall.

The bill would allow the Pentagon to transfer the coronavirus funds to other accounts “except for ‘Drug Interdiction and Counter-Drug Activities, Defense,’” according to a summary from the Senate Appropriations Committee.

A Democratic summary of the bill described the language as intended to “prevent funds in this title from being diverted to build a wall on the southern border.”

Student loans

The bill would defer payments for federally owned student loans for six months, through Sept. 30.

Democrats had wanted to go a step further by having the Education Department make federal student loan payments for the duration of the coronavirus health crisis. The department, under the Democratic plan, would then make an additional payment at the end to make sure every borrower had received $10,000 toward their student loan debt over the duration of the health emergency.

* * *

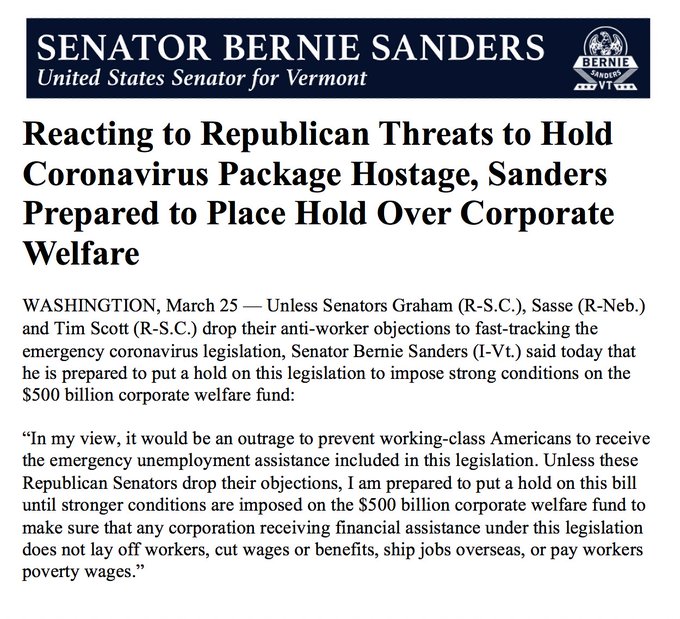

Update (1600ET): Stocks tumbled into the bell after Sen. Bernie Sanders (I-VT) became the latest lawmaker to threaten to hold up the coronavirus stimulus package “until stronger conditions are imposed on the $500 billion corporate welfare fund.”

“Unless Senators Graham (R-SC), Sasse (R-NE) and Time Scott (R-SC) drop their anti-worker objections to fast-tracking the emergency coronavirus legislation, I am prepared to put a hold on this bill until stronger conditions are imposed on the $500 billion corporate welfare fund,” Sanders said over Twitter.

Unless Republican Senators drop their objections to the coronavirus legislation, I am prepared to put a hold on this bill until stronger conditions are imposed on the $500 billion corporate welfare fund.

Looks like AOC wants to get in on the holdup as well.

AOC warns she may force House members to return for stimulus vote, potentially delaying final passage, via @mkraju http://www.cnn.com/2020/03/25/politics/alexandria-ocasio-cortez-coronavirus-package-vote/index.html …

AOC warns she may force House members to return for stimulus vote, potentially delaying final…

Rep. Alexandria Ocasio-Cortez, the high-profile freshman from New York, is leaving open the option of forcing House members to return to Washington to cast a vote on the $2 trillion stimulus package…

cnn.com

* * *

Update (1415ET): GOP Senators have cautioned against fast-tracking the bull as it stands, which would “create a perverse incentive to sever the employer/employee relationship,” according to a spokesman for Sen. Sasse (R-NE).

The Senators are working on an amendment which would ensure that the maximum unemployment benefit is 100% of someone’s salary.

* * *

First it was Nancy Pelosi ‘rode into town from her extended vacation’ to kill the GOP coronavirus bill.

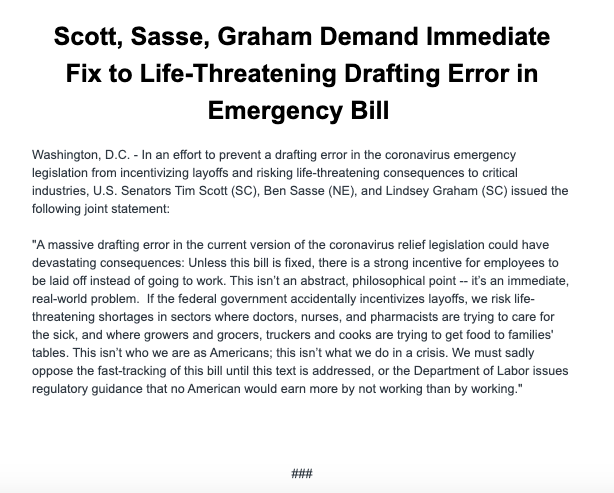

Now, despite what we were told was a done dea, three Republican Senators have demanded an “immediate fix” to a drafting error in the bill which may delay its passage.

Sens. Scott (SC), Sasse(NE) and Graham (SC) wrote in a Wednesday letter:

“A massive drafting error in the current version of the coronavirus relief legislation could have devastating consequences: Unless this bill is fixed, there is a strong incentive for employees to be laid off instead of going to work. This isn’t an abstract, philosophical point — it’s an immediate, real-world problem.”

According to the Senators, “If the federal government accidentally incentivizes layoffs, we risk life-threatening shortages in sectors were doctors, nurses and cooks are trying to get food to families’ tables.”

Sens. Scott, Sasse and Graham “demand” a fix to the current version of the stimulus bill.

“Unless this bill is fixed, there is a strong incentive for employees to be laid off instead of going to work.”