Fra Zerohedge / MUST READ:

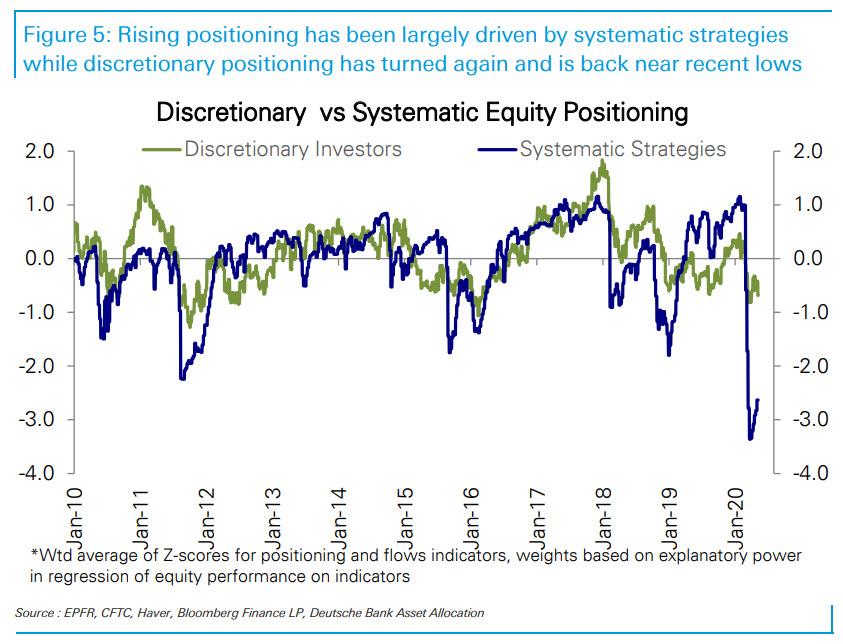

Yesterday, we showed how as a result of the boycott of capital markets by institutional and systematic investors, who have refused to ride the bear market rally higher by keeping their net bullish exposure near decade lows…

… resulting in markets that remain extremely illiquid, with futures liquidity only recovering to its 22nd percentile, while single-stock liquidity remains below Dec-2018 levels according to Goldman…

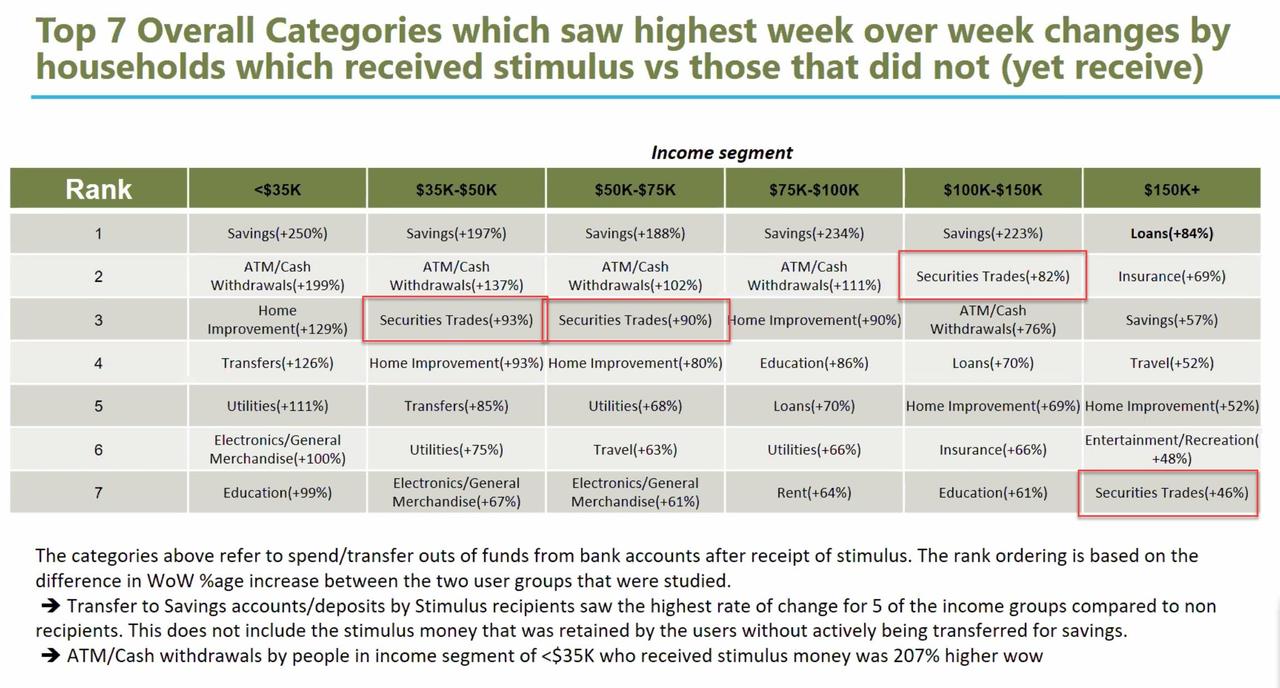

… retail investors have effectively “taken over the market.” This took place as armchair daytraders plowed their government stimulus checks into “securities trading”…

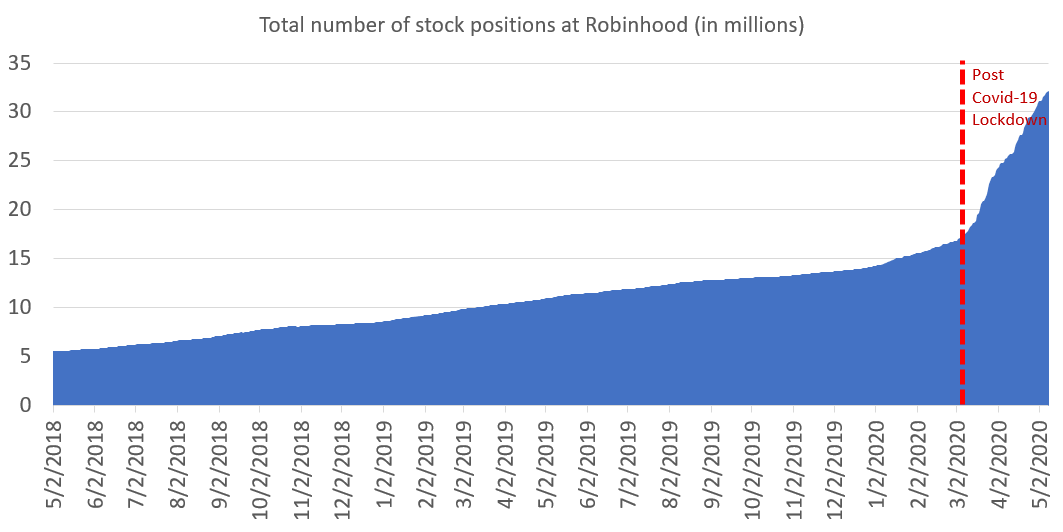

… which resulted in an explosion of daytrading on “zero cost” platforms like Robin Hood, and more recently, all other online brokerages.

Picking up on this, Bloomberg today laid out all the other ways that retail traders have taken over the market, including jumping “in and out of stock options, dabbling in complicated exchange-traded funds” and devouring trading how-to books by the dozen as “locked down and socially distant with lots of time and (apparently) money to spare, they’re leveraging zero-percent brokerage fees in new and surprising ways.”

Needless to say, with retail investors flooding the market as the so-called “smart money” steps back, “Wall Streetsays it will end badly.”

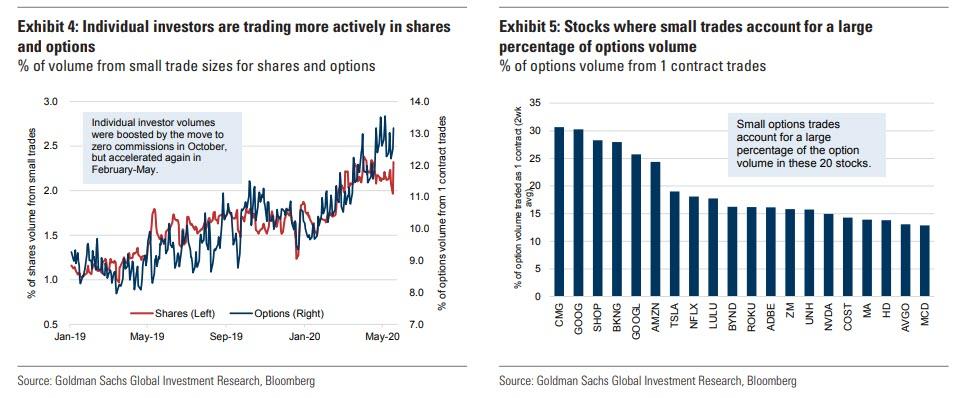

Bloomberg also picked up on a chart that we showed from Goldman yesterday, demonstrating that the “fingerprints of tiny investors are all over the options market” where as we noted yesterday, trades consisting of just one contract now account for 13% of total volume.

That supports a view that “individual investor active trading is playing an increased role in market volatility.” In some popular stocks, like Chipotle Mexican Grill Inc. and Alphabet Inc., small options trades account for nearly a third of total volume.

In an amusing twist, what retail investors are trying to do, is replicate the strategy popularized by HFTs: Chris Murphy, Susquehanna International Group’s co-head of derivatives strategy, told Bloomberg the phenomenon is “message board trading,” one-day round trips where an investor both opens and closes the position in the same session. Such activity is exploding, especially in stocks like Apple Inc., Stitch Fix Inc. and TripAdvisor Inc.

Japan has a name for such momentum-chasing daytraders: Mrs. Watanabe. What will it be in the US?

Of course, retail investors are nothing like HFTs, and if anything routinely have their pockets picked by the real HFTs who use various exchanges, like Robinhood, that has historically routed its retail orders to HFT powerhouses like Citadel.

That, however, does not stop them from trying especially in a market that has been flooded by the Fed with trillions in liquidity, sparking the schizophrenic response by professional traders which we discussed earlier when none other than Bank of America’s CIO called it a “fake market” adding that “government and corporate bond prices have been fixed by central banks…why would anyone expect stocks to price rationally?”

Well, retail investors aren’t expecting rationality. They are only expecting a greater fool, which in a market dominated by other retail investors there appears to be plenty of.

TD Ameritrade Holding Corp. has seen client engagement soar, with requests flooding in for new investing strategies. Visits to the brokerage’s “Education Center” hit an all-time high in April, up 280% from the year prior, with clients downloading explanatory videos and online courses. The most popular classes included stock fundamentals and options trading. Clients gravitated to content showing how to buy and sell stocks using mobile apps, and also on covered calls — a type of options strategy.

“People are still trying to learn to do this better,” said JJ Kinahan, the chief market strategist at TD Ameritrade. “People are just saying, ‘OK, retail is going in and being crazy.’ Well, I think the fact is retail is trading more because they have more time. People actually have time to do so, and that’s why they are more interested.”

So easy a five year old can do it? Maybe not, but easy enough for Ameer Umarov, a cab driver in Arizona with an interest in math and a passion for video games.

As Bloomberg recalls, when he realized the coronavirus was growing into a global health crisis several months ago, Ameer reactivated his Amazon.com account to make some purchases. Not for masks or hand sanitizer — for books on stock trading. Two a week, at one point.

When equities started surging in late March, Umarov stayed away, scared by the volatility. He was ready to act by the first week of April. He bought shares of Boeing Co., a bad decision that set him back more than $4,000. But a stake in Halliburton Co. brought him $9,800, after he sold shares on the day of a 16% rally late last month. A few other purchases — Goldman Sachs and Micron Technology Inc., among them — yielded mixed results.

All told, Umarov is down some $400 since he began.

“It’s a gamble, but a highly intellectual gamble,” he said by phone. “It’s about knowledge and risk, but especially for guys like me, it’s all about sheer luck.”

He’s right: trading has become a gamble where the only thing that matters is luck. If knowledge mattered, then the professional investors would be all over it. Instead, they are sitting it out as nothing makes sense any more.

And speaking of gambling, it’s also an addiction and once you start you can’t stop and neither can Ameer.

This month, he stopped buying books and instead signed up for a virtual trading boot-camp. He paid $4,100 for two days of 8 a.m. to 4 p.m. classes, where he learned about concepts like support, resistance, and trading on gaps. To Umarov, the course is a long-term investment, and he’s decided eventually he wants to make trading his full-time job.

“I have no idea how it’s going to go,” he said. “But it will be stupid not to try.”

Well, since he won’t have a job for months, he may as well use all that government stimulus money to aid the wealth as they sell to him and countless other retail investors in a pattern as old as the market itself. It’s called “distribution”, and we hope all these newly hatched retail traders look it up.

Alas, that won’t happen since most “traders” will instead be transfixed on the next momentum chasing opportunity:

Chris Camillo isn’t your typical retail trader. He starting investing when he was 13 years old. Now 45 in Dallas, he’s turned the original hobby into a full-time job, he says, and created quite the community — aided by claims of mammoth gains in his TD Ameritrade portfolio. All the while, he was hosting live shows on YouTube, each episode drawing as many as 6,000 viewers, where he explains his method — what he calls “social arb” trading.

On Tuesday he created a chatroom through the site Discord to develop a hub for conversation. It already has over 500 members — many of them younger.

“And, hey, it took a pandemic, but it was already happening before this with Wall Street Bets and cryptocurrency,” Camillo said by phone. “Now they’re wanting to go one layer deeper. OK I did that, I did crypto, OK now I own Tesla, I get it. But there has to be more to investing than just Tesla.”

Some Wall Street hacks, such as Benn Eifert, chief “investment” officer of QVR Advisors, whose own positions just happen to be aligned with those of the retail horde, go so far as trying to justify what is nothing more than a gambling mania gripping the wider

“It’s good to get people involved in investing earlier in an efficient way that meets their asset scale,” Eifert said, apparently confusing “their” asset scale with his own.

“From my perspective, the difference is, are you channeling them into the gameification of day trading, into over-confidence, into getting involved in things you don’t understand, or are you channeling that into long-term planning and asset allocation?”

The fact that Eifert asked this “question” when he very well knows the answer to it, explains all one needs to know about his particular narrative bias on the topic.

And speaking of narrative, Bloomberg is guilty of imposing it own saying that “contrary to old-school theories that mom and pop bail at times of market crisis.”

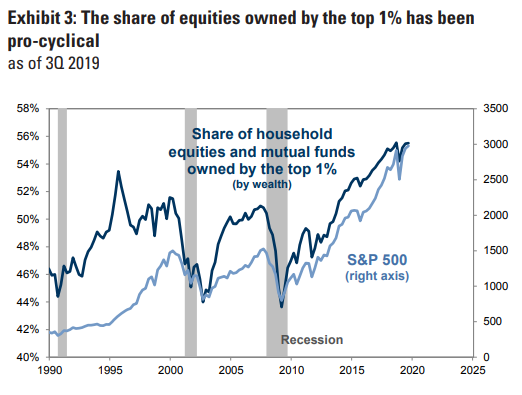

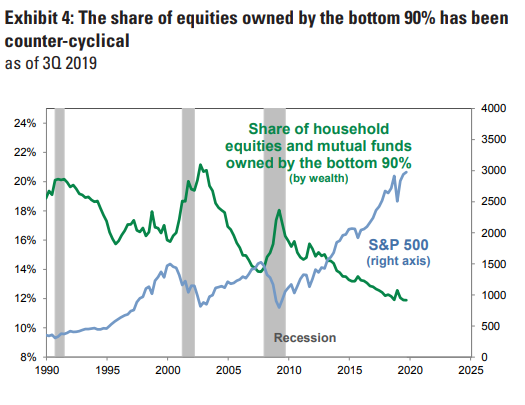

Well… no. As we showed back in February in “The Rich Dump To The Poor”, recently released data from the Federal Reserve show us a couple of trends that refute that simplistic take. The two following charts indicate that as recessions begin, the top 1% begins to sell their holdings, while the bottom 90% continues to try and “buy the dip”.

The first chart shows the top 1% dumping as the market falls entering recession. Of late, we can see that selling has happened in spurts by the top 1%. It’s precisely this selling by the 1% that is also happening right now, with BofA pointing out that “smart money” have been dumping stocks for 6 consecutive weeks.

Meanwhile, for the bottom 90% it’s just the opposite: the vast majority of unsophisticated retail investors start to chase momentum at the worst possible time, as they buy stocks en masse just as a recession begins, which in turn craters the market. In the Goldman chart below, we can see that the share of equities owned by the 90% jumps just as recession begin.

This is precisely what is going on right now: in laymen’s terms, the rich are dumping their stock to the poor. The technical term is “distribution.”

And when it comes to other signs of both recession and “dumping to the bottom 90%” as of late, there’s plenty.

“There is a long, documented history of retail investors chasing a handful of story stocks and then getting burned,” said James Pillow, managing director at Moors & Cabot Inc. “We humans love a good narrative. I cannot imagine this time around ending any different.”