Fra Zerohedge:

While the week starts off slowly, traders will look forward to a “Super Wednesday” with the EU emergency Brexit summit, ECB meeting, US CPI report and FOMC minutes all slated for that day. According to DB’s Craig Nicol, “that should be the highlight of the week ahead however we’ve also got a busy week for data out of China, as well as a number of scheduled Fed speakers, the annual IMF and World Bank Spring Meetings and China-EU Summit. If that wasn’t enough, US banks also kick off earnings season next week.”

Starting with Brexit, the latest in the neverending divorce saga is the UK seeking an extension of the Brexit deadline until June 30, with a further headline suggesting that PM May is aiming to ratify the divorce deal before May 23. The PM’s letter also announced that the UK will hold European Parliamentary elections on May 23 if a deal hasn’t been ratified by then.

So markets will now await the EU response with an emergency Summit scheduled for next Wednesday. PM May will reportedly not bring any Brexit plan to a vote before the Summit which means the EU will need to come to a unanimous agreement that a clear plan on a way forward is being proposed, to allow the EU to come to a common position and offer the extension.

For the ECB, after markets were left puzzled by the messaging from the previous meeting and with the subsequent moves in bond markets which has seen Bunds turn negative again, expect there to be plenty of questions directed at Draghi both on the TLTRO details and also the impact of negative rates.

Newsflow on tiering has picked up in recent days including an acknowledgement in the latest meeting minutes, with the latest report suggesting that the tiering trial balloon was not quite as successful and the ECB may hold off on announcing details. So markets will particularly be looking for clues as to where the internal debate on persistent low rates on bank margins and profitability now lies.

Shortly after the ECB on Wednesday we’ll get the March CPI report in the US. The consensus is for a +0.2% mom core reading which would be enough to hold the annual rate at a relatively solid +2.1% yoy. In the evening we then get the FOMC minutes from the March meeting. A reminder that the message from this meeting was undeniably dovish.

The median dot moved to no rate hikes this year with seven officials also seeing the Fed on hold at least through the end of 2020. Deutsche Bank economists made the point that it is clear that the Committee no longer has a strong tightening bias and patience remains the order of the day for some time. With that in mind, expect the minutes to reiterate this more dovish tone, with readers also likely to look out for hints on the composition and duration of the balance sheet.

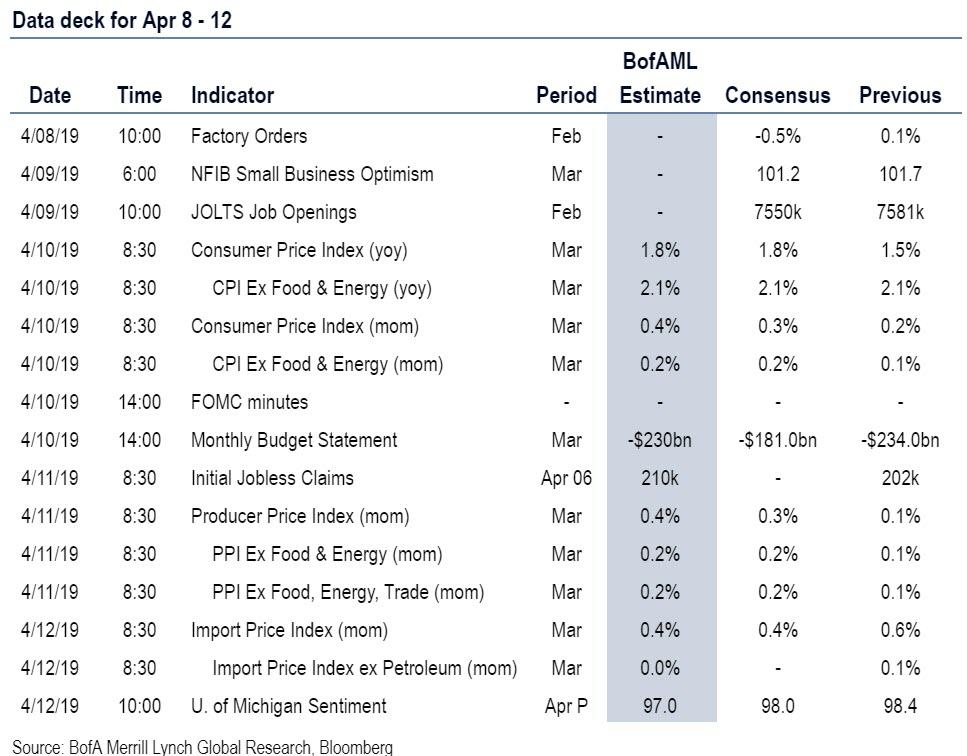

Elsewhere, as well as the CPI report in the US next week we’ll also get the March PPI report on Thursday. Outside of that it’s fairly light for data in the US though with only final February factory, durable and capital goods orders due on Monday, the March monthly budget statement on Wednesday, claims on Thursday and the preliminary April University of Michigan consumer sentiment survey on Friday worth flagging.

In Europe expect there to be some focus on the February industrial production reports next week with data due for the UK and France on Wednesday and the Euro Area on Friday. We’ll also get the February GDP reading for the UK on Wednesday while Thursday will see final March CPI revisions made in Germany and France. Meanwhile in Asia it’s a busy week for data out of China with March foreign reserves due on Sunday, March CPI and PPI due on Thursday and March trade data due on Friday. We’re also expecting to get the latest money and credit aggregates data covering March at some stage next week.

As for the Fedspeak, we got confirmation that Chair Powell is to address the House Democratic Retreat which takes place over three days from Wednesday to Friday next week. Other speakers include Clarida late on Tuesday, and Clarida again on Thursday along with Bullard, Quarles, Kashkari and Bowman – all at separate events.

At a more micro level next week will also see an early drip feed of Q1 earnings in the US including the banks with both JP Morgan and Wells Fargo due to report on Friday. The quarter is expected to be a dud, with consensus now expecting a sharp drop in EPS growth, the first decline since 2016.

Finally, other things to potentially watch out for next week include China Premier Li Keqiang travelling to Brussels for the five day China-EU Summit on Monday, the annual week long Spring Meetings of the World Bank/IMF also kicking off Monday, Israel’s general election on Tuesday, the IMF’s latest World Economic Outlook update on Tuesday, the US Congressional Committee holding a hearing on Wednesday with the chiefs of the biggest US banks on “Holding Megabanks Accountable”, the OPEC monthly oil market report on Wednesday, South Korea President Moon Jae-in meeting President Trump on Thursday, and India heading to the polls on Thursday (albeit voting in phases with results in late May).

Summary of key events by day, courtesy of Deutsche Bank

- Monday: A fairly light day for data, with March consumer confidence due in Japan overnight followed by February trade data in Germany, March industry sentiment data in France and the Sentix investor confidence reading for the Euro Area. In the US we’ll get February factory orders and final durable and capital goods orders revisions. Elsewhere, the BoJ’s Kuroda and ECB’s Villeroy are due to speak, while China Premier Li Keqiang is due to travel to Brussels for the China-EU Summit. The annual IMF/World Bank Spring Meetings also kick off.

- Tuesday: A very quiet day for data releases with the UK’s March BRC sales data, and March NFIB small business optimism print and February JOLTS report in the US the only releases of note. The Fed’s Clarida speaks in the evening while the IMF’s latest World Economic Outlook update is due.

- Wednesday: The big highlight is the ECB meeting in the early afternoon followed by Draghi’s press conference. Not long after that we’ll also get the March CPI report in the US. Also high on the agenda will be the emergency EU Brexit Summit. Other data releases of note include February industrial production prints in France and the UK, as well as the February GDP reading in the latter. The March monthly budget statement is also due in the US along with the latest FOMC meeting minutes. The OPEC monthly oil report is due while the US Congressional Committee is due to hold a hearing with chiefs of the biggest US banks on “Holding Megabanks Accountable”.

- Thursday: Inflation releases should be the main focus with March CPI/PPI in China, final March CPI revisions in Germany and France and the March PPI report in the US all due. The latest initial jobless claims reading in the US will also be out. It’s also a busy day for Fedspeak with Clarida, Bullard, Quarles, Kashkari and Bowman all due to speak. Meanwhile, South Korea President Moon Jae-in will meet with President Trump. India will also go to the polls.

- Friday: Another quiet day for data with the February industrial production report for the Euro Area, and March import price index and preliminary University of Michigan consumer sentiment readings in the US due. March trade data in China is also likely to be out at some stage. Away from that the BoE’s Carney is due to speak at the IMF/World Bank Spring Meetings.

Looking at just the US, Goldman writes that the key economic data releases this week are the CPI report on Wednesday and the PPI report on Thursday. In addition, minutes from the March FOMC meeting will be released on Wednesday. There are several scheduled speaking engagements by Fed officials this week, including two by Vice Chairman Richard Clarida on Tuesday and Thursday.

Monday, April 8

- 10:00 AM Factory Orders, February (GS -0.5%, consensus -0.5%, last +0.1%); Durable goods orders, February final (last -1.6%); Durable goods orders ex-transportation, February final (last +0.1%); Core capital goods orders, February final (last -0.1%); Core capital goods shipments, February final (last flat): We estimate factory orders decreased 0.5% in February following a 0.1% increase in January. Durable goods orders declined in the February advance report, driven primarily by a decline in aircraft orders.

Tuesday, April 9

- 06:00 AM NFIB small business optimism, March (consensus 101.2, last 101.7)

- 10:00 AM JOLTS Job Openings, February (consensus 7,550 last 7,581k)

- 6:45 PM Fed Vice Chairman Clarida (FOMC voter) speaks: Fed Vice Chairman Richard Clarida will speak at a Fed Listens event to discuss the review of the monetary policy framework at the Minneapolis Fed.

Wednesday, April 10

- 08:30 AM CPI (mom), March (GS +0.35%, consensus +0.3%, last +0.2%); Core CPI (mom), March (GS +0.13%, consensus +0.2%, last +0.1%); CPI (yoy), March (GS +1.82%, consensus +1.8%, last +1.5%); Core CPI (yoy), March (GS +2.03%, consensus +2.1%, last +2.1%): We estimate a 0.13% increase in March core CPI (mom sa), which would lower the year-over-year rate by a tenth to +2.0%. Our forecast reflects an expected drag from residual seasonality in the apparel category from methodological changes. We also expect softness in the used cars and lodging away from home categories. On the positive side, we expect a relatively stable pace of monthly shelter inflation, as alternative rent measures have picked back up, apartment completions have peaked, and aggregate vacancy rates remain low. Rebounding oil prices could also boost airfares in the upcoming report. We look for a 0.35% increase in headline CPI (mom sa), reflecting a boost from higher gasoline prices.

- 2:00 PM Minutes from the March 19-20 FOMC meeting: At its March meeting, the FOMC left the target range for the policy rate unchanged at 2.25-2.50%, as widely expected. The median dot in the Summary of Economic Projections showed a 0-1 baseline for rate hikes in 2019-2020, compared to 2-1 in December, and the average dots declined significantly. The FOMC also announced that portfolio runoff will stop at the end of September and that the pace of Treasury runoff will be tapered in the interim. In the minutes, we will look for further discussion of inflation, the path of the policy rate, the review of the monetary policy framework, and balance sheet normalization.

Thursday, April 11

- 08:30 AM PPI final demand, March (GS +0.4%, consensus +0.3%, last +0.1%); PPI ex-food and energy, March (GS +0.2%, consensus +0.2%, last +0.1%); PPI ex-food, energy, and trade, March (GS +0.2%, consensus + 0.2%, last +0.1%): We estimate a 0.4% increase in headline PPI in February, reflecting relatively firm core prices and energy prices. We expect a 0.2% increase in the core measure excluding food and energy, and also a 0.2% increase in the core measure excluding food, energy, and trade.

- 08:30 AM Initial jobless claims, week ended April 6 (GS 210k, consensus 210k, last 202k); Continuing jobless claims, week ended March 30 (last 1,717k): We estimate jobless claims increased by 8k to 210k in the week ended April 6, following a 10k decline in the prior week.

- 09:30 AM Fed Vice Chairman Clarida (FOMC voter) speaks: Fed Vice Chairman Richard Clarida will speak with Institute of International Finance President Tim Adams at a policy summit in Washington.

- 09:40 AM St. Louis Fed President James Bullard (FOMC voter) speaks: St. Louis Fed President James Bullard will discuss the US economy and monetary policy in Tupelo, Mississippi. Prepared text and audience and media Q&A are expected.

Friday, April 12

- 08:30 AM Import price index, March (consensus +0.4%, last +0.6%)

- 10:00 AM University of Michigan consumer sentiment, April preliminary (GS 97.0, consensus 98.0, last 98.4): We expect the University of Michigan consumer sentiment index to decrease by 1.4pt to 97.0. The measure appears elevated compared to similar measures such as the Conference Board consumer confidence index.

Source: Deutsche Bank, Goldman, BofA