Fra Zerohedge:

UBS strategist Francois Trahan’s latest note titled If History Were A Perfect Guide…Stocks Would Be In A World of trouble Here suggests that S&P500 earnings deterioration will accelerate through 4Q19 and might not trough until 2Q20.

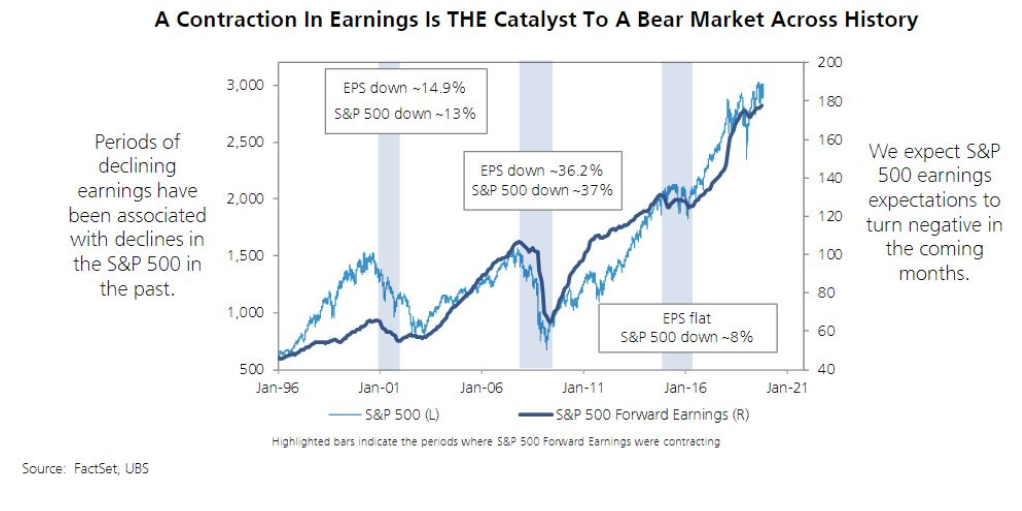

Trahan predicted the rate of 12-month earnings growth would likely plunge into negative territory in the coming months. He said, “There are many ways to assess the health of S&P 500 earnings, but at this stage, no matter how you slice it, the trend is slowing.”

“The earnings landscape has already deteriorated and will likely get worse: The consensus year-over-year growth rate in S&P500 forward earnings is down to a mere 1% from a peak of 23% in September of 2018. Forward earnings are already contracting in the Midcap and Smallcap indices…If history were a perfect guide, the S&P500 would trough in Q2 of 2020 and rebound after that. Should the economy bottom in Q4 of 2020, as interest rates suggest, then history argues, the S&P500 would begin to price in a sustainable recovery sometime between April and August of 2020…PMIs Argue That Forward EPS Growth Will Trend Lower For Another 6 Months,” Trahan wrote.

Trahan’s note has a bearish macro tilt: S&P500 earnings growth might not bottom until 2Q20. It might not be until November 2020 when the overall economy bottoms.

His bearish forecast could be disastrous for stocks, considering many equity indexes are at all-time highs. “Ultimately, the most vulnerable macro backdrop for equities occurs when forward earnings growth turns negative as LEIs are trending downward (pushing [price-to-earnings] lower),” Trahan warned, who offers this ominous chart:

Bloomberg data shows 3Q19 S&P 500 company profits will likely expand by 1% to zero, which is significantly below the 3.3% forecast from last month. Estimates for 4Q19 are moving lower, could be below zero by year-end.

Trahan also suggests the Fed might be less inclined to prop up the stock market as it slams interest rates lower to act as a countercyclical buffer against a faltering economy. He warned that interest rates moving lower would also mean more depressed equity prices. He ended the piece by saying the upcoming earnings contraction is likely to kick off the next bear market.