Fra JP Morgan/ Zerohedge

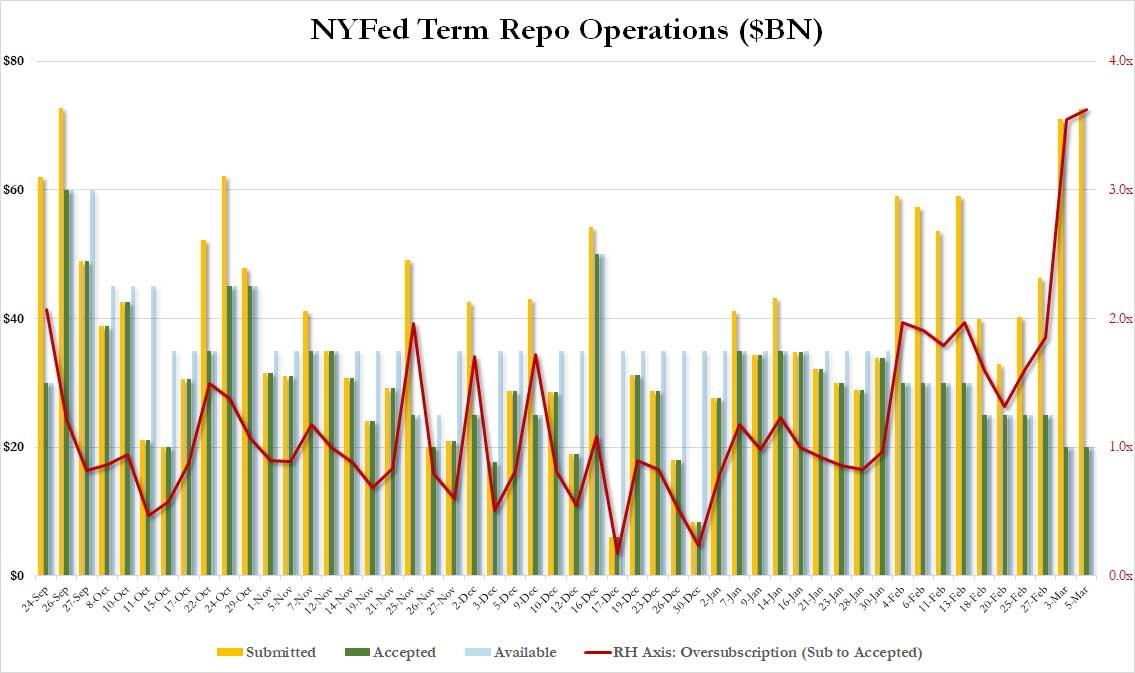

Following three consecutive days of oversubscription in both the Fed’s overnight repo…

… and term repo operations…

We then asked if that will be enough to stabilize the market, responding that for now, we don’t know, but in light of the imminent corona-recession, on Tuesday Credit Suisse’s Zoltan Pozsar repo guru published a lengthy – and especially ominous – research report whose conclusion – at least on the liquidity front – is that the Fed should “combine rate cuts with open liquidity lines that include a pledge to use the swap lines, an uncapped repo facility and QE if necessary.”

To which, our conclusion was that “a liquidity avalanche is coming to prevent a market crash. It’s only a matter of time.“

A few days later, JPMorgan agreed with us that some very substantial cracks have appeared in the credit and funding markets, with the bank’s strategist Nikolaos Panigirtzoglou writing in his latest “Flows and Liquidity” report that “we see initial signs of emerging credit and funding stress” and cautions that “if these shifts in credit and funding markets are sustained over the coming weeks and months, especially in the issuance space, credit channels might start amplifying the economic fallout from the COVID-19 crisis.“

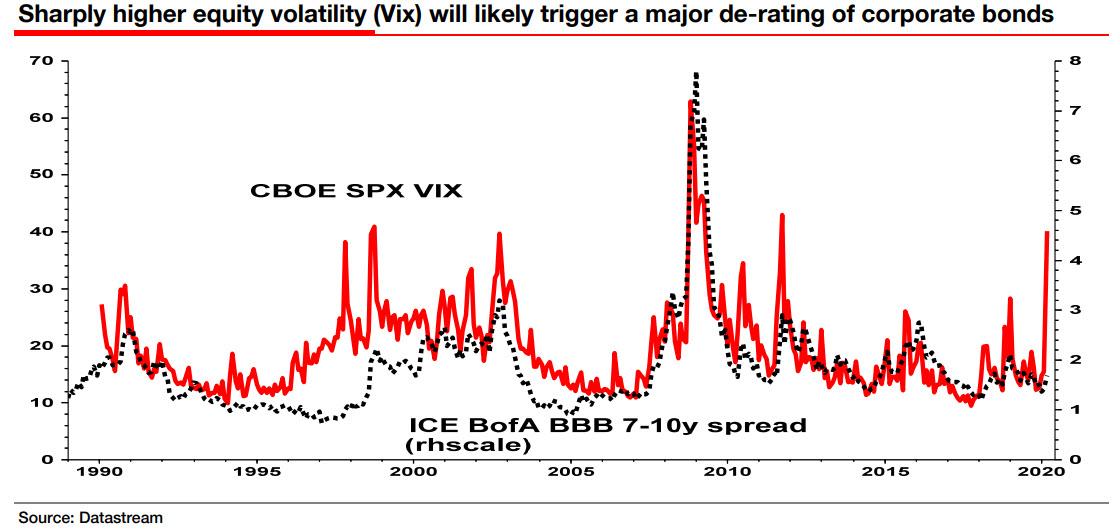

This, incidentally, is precisely why on Friday we said that the Fed now must step in to prevent a “catastrophic” credit crash as the surging VIX, which briefly hit the highest level since the financial crisis on Friday, will have dire consequences on bond spreads, potentially resulting in a collapse in not just the junk bond market, but triggering a wave of downgrades in the BBB-space, launching the long awaited “fallen angel” crisis as trillions in investment grade bonds are suddenly downgraded to junk.

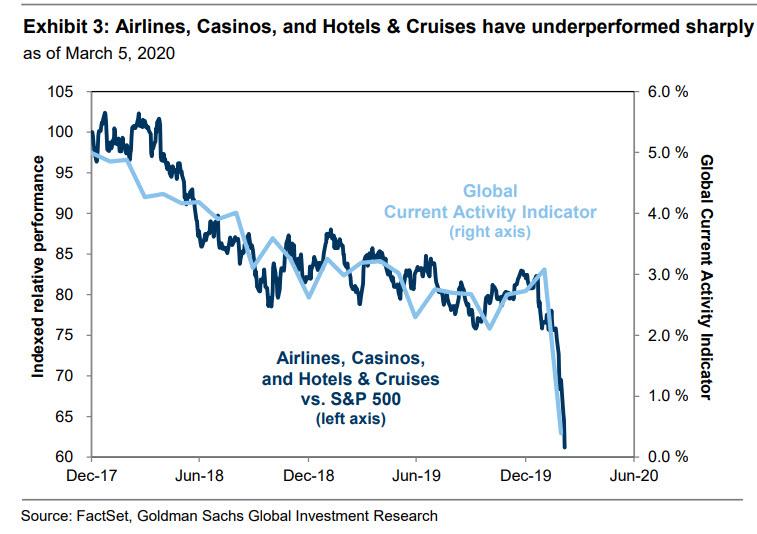

While not nearly as “doom and gloomy” as Credit Suisse’s Zoltan Pozsar who now expects nothing less than a liquidity tsunami from central banks to reverse the ongoing funding squeeze, Panigirtzoglou starts off by pointing out that the “supply chain disruptions and the demand shock caused by the COVID-19 crisis are likely already creating cash flow problems for certain businesses in particular smaller companies and those belonging to sectors most affected by the crisis, e.g. travel, transportation, leisure, lodging”, something we showed yesterday with the following chart.

In response, central banks or governments are already hinting to providing credit support. For example, the JPM strategist notes that “Boston Fed’s Rosengren on Friday suggested that the Fed could consider a facility that could buy a broader set of assets.” Separately, the Bank of England’s next Governor hinted that the BoE could get involved in providing supply chain finance.

But unless that credit support by central banks and/or governments is “broad, fast and direct, we note credit markets are facing an increased risk of the cycle turning with a lot more downgrades or even defaults over the coming months”, according to JPMorgan.

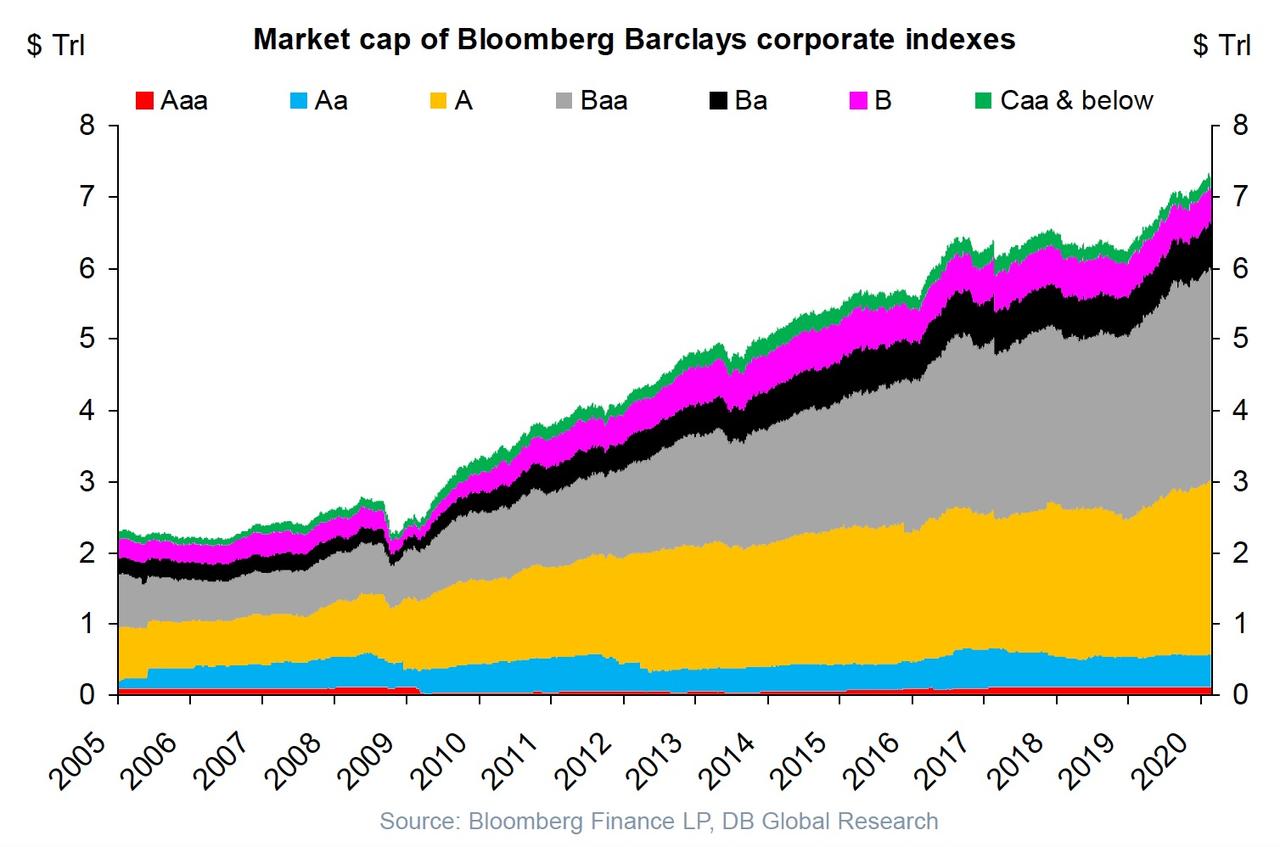

Panigirtzoglou then first looks at a debate that has been raging for the past three years, namely whether trillions in BBB-rated (i.e., the lowest investment grade bond rating) are about to be downgraded to junk, unleashing a crash in the high yield space, one which could then quickly migrate to the IG space, and the entire credit market.

Considering that defaults are subtracting from HY investors’ returns, the JPM quant writes that “rating downgrades or fallen angels are important for HG investors because they drive a wedge between spread returns and total returns as the managers who are only allowed to hold investment grade bonds are forced to offload their downgraded bonds.”

Which leads to the next obvious question: how much of that downgrade or fallen angels, i.e. corporate bonds downgraded from investment-grade status to high-yield, is materializing already, and how will the covid pandemic impact it in the future?

According to JPM’s HY team the number of fallen angels has risen sharply by 5 in February bring the Jan/Feb total to 6. Annualizing that number brings the 2020 fallen angels to 36 not far from the previous highs of 40 in the 2015 cycle. In other words, if the YTD pace is sustained the downgrade force would exert similar pressure on credit markets to that seen during 2015.

Of course, if Brent indeed plunges to the low-$30s (or lower) now that Saudi Arabia has unleashed a scorched earth price war and effectively destroyed OPEC, expect the downgrades to explode as countless E&P companies face an immediate funding and operational crisis as nobody is prepared for oil below $35.

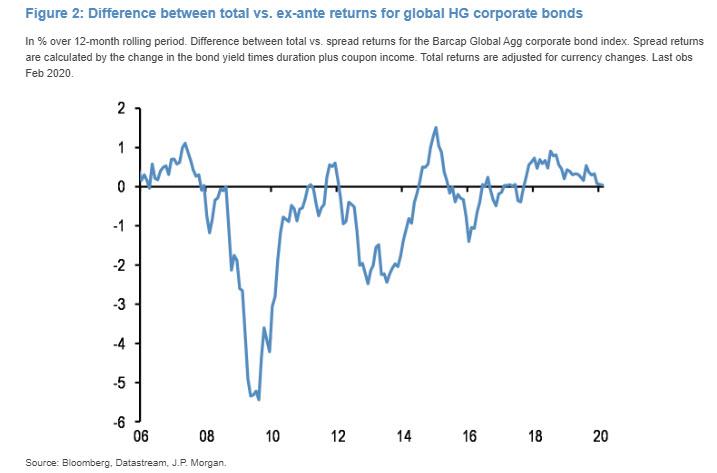

What is especially worrisome is that the negative impact that downgrades and fallen angels typically exert on credit returns has started to show up in credit returns, and that’s even before the crash that will result from the plunge in oil prices. Pointing to the next chart, Panigirtzoglou notes that the wedge between total vs. ex-ante returns for the Global Agg corporate bond index shrank over the past two months as downgrades outweighed upgrades.

That said, “this pressure appears to be still at an early stage as the wedge between total and ex-ante returns remains far from the negative territory seen in previous credit cycles. In other words, downgrades and fallen angels have yet to exert a strong negative impact on credit returns, and the YTD downgrade/fallen angel impulse would have to be sustained for the remainder of the year for 2020 to look like 2015.” Of course, with the oil now the key catalyst for both the viability of countless junk bond-funded companies, and inflation breakevens…

… the fallen angel impulse is about to explode.

This brings us to the next question posed by Panigirtzoglou, arguably the one at the heart of the credit bubble debate, namely “are current concerns by market participants about rating downgrades/fallen angels justified?”

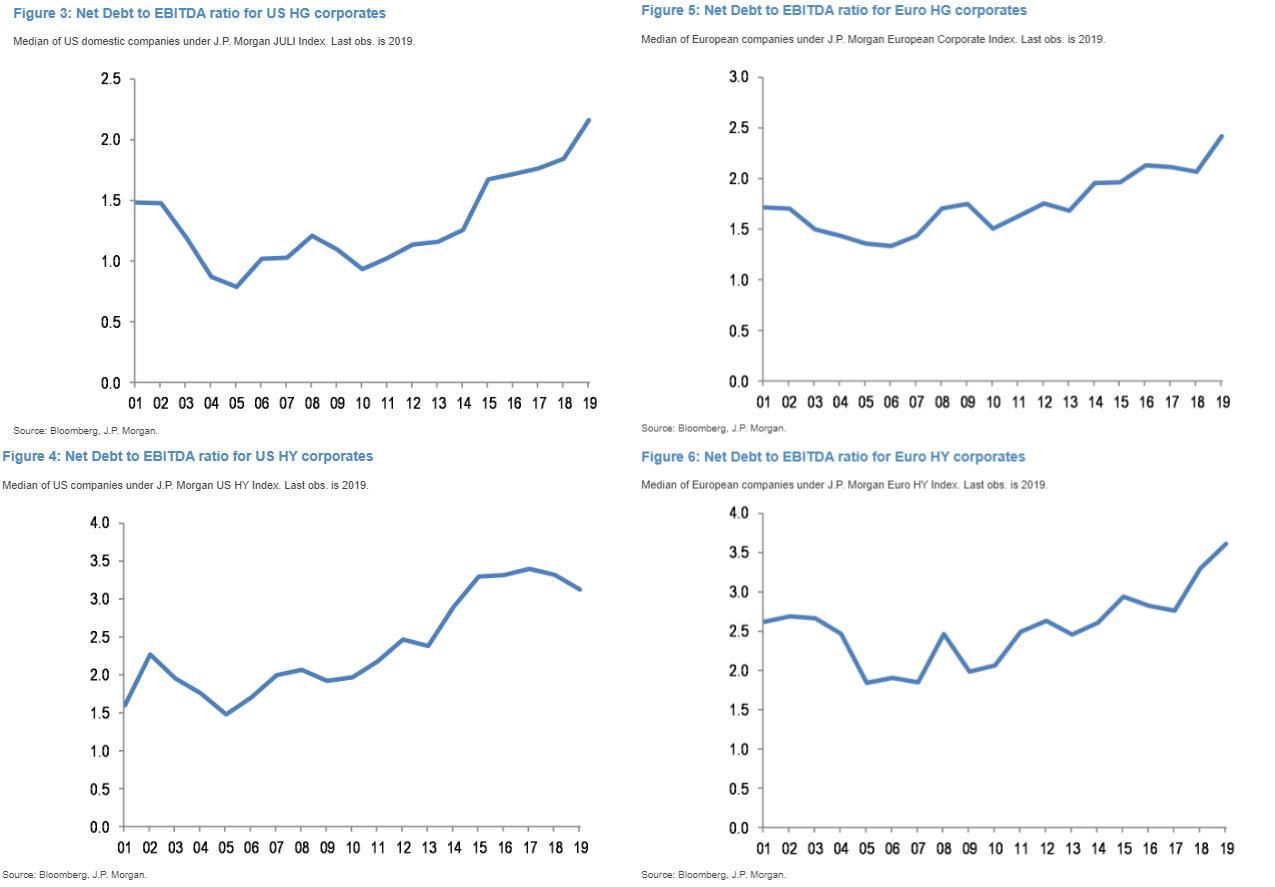

To which his answer is “yes… if one looks at simple credit fundamentals such as median debt-to-income ratios”, thereby validating all those – like this website – who have for years warned that the real credit crisis will come once the fallen angel avalanche kicks in.

To justify his answer, the JPM quant writes that “a visual inspection of median debt-to-income ratios across the universe of companies behind corporate bond indices reveals a highly problematic picture ahead of the COVID-19 crisis. Figure 3 to Figure 6 show the median net-debt-to-EBITDA ratio for companies behind J.P. Morgan’s HG and HY indices in both the US and Europe up until 2019. This leverage metric has been rising steeply over the past decade to levels that are higher than those seen at the peaks of the previous two cycles in 2007/2008 and 2001/2002.

In other words, companies are currently much more vulnerable to a decline in incomes and/or a rise in corporate bond spreads and yields than in the previous two recessions. This is especially true for US credit and for Euro HY given the absence there of the backstop from the ECB’s corporate bond program that solely benefits Euro HG.”

With fundamentals flashing a red alert due to the “highly problematic picture” the massive debt loads reveal, the next question is perhaps even more important: what about issuance and funding market?

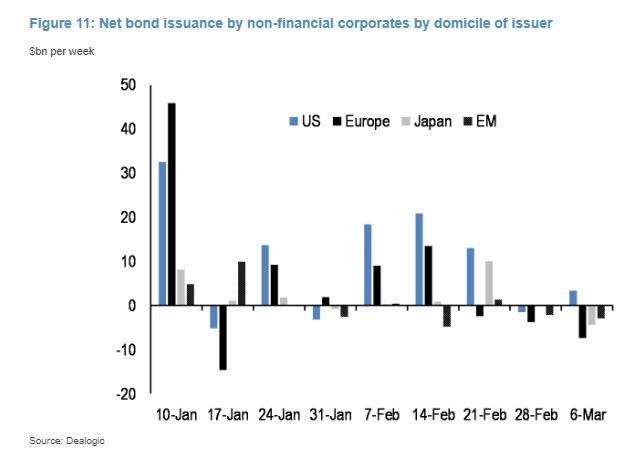

As the JPM quant responds, on the issuance front there are signs of an overall decline in net issuance by non-financial corporates, i.e. gross issuance minus maturities. This is shown in the next chart which depicts weekly net issuance by non-financial corporates across the US, Europe, Japan and EM. As we pointed out previously discussing the paralysis in the primary market, “net bond issuance has been predominantly negative for two consecutive weeks pointing to emerging signs of funding stress.”

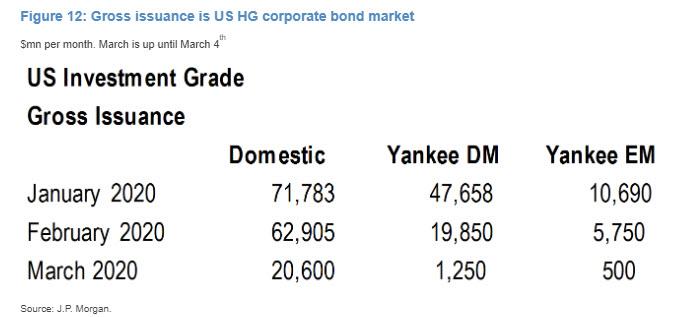

Furthermore, there are signs of stress in Yankee issuance as well, the report said, noting that it tends to be more sensitive to funding concerns because non-U.S. companies can find it harder to raise dollar funding relative to domestic U.S. companies in periods of stress. The chart below shows that slowing Yankee issuance in the US HG corporate bond market during February and March relative to Domestic issuance which has been a lot more resilient: “This implies that some non–US companies might start finding it more difficult to issue in US dollar funding markets.”

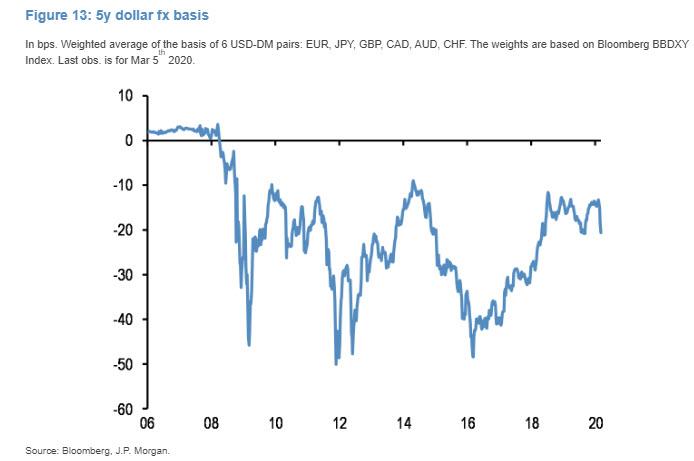

It is therefore not surprising that the dollar cross currency basis has jumped sharply into more negative territory, a traditional indicator of funding stress. Reduced Yankee issuance is likely associated with more negative dollar basis to the extent that Yankee issuance is substituted by synthetic dollar funding, and vice-versa.

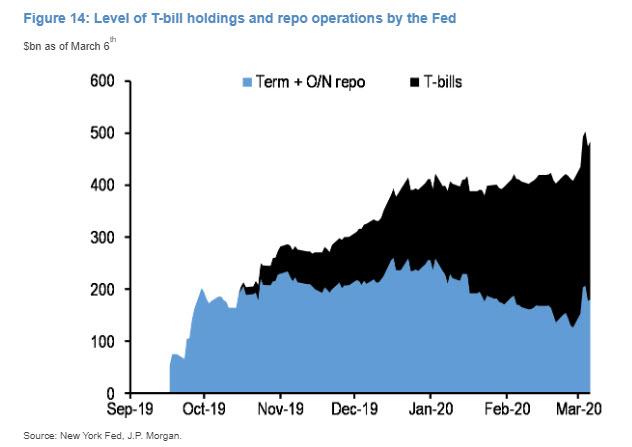

Next, the JPMorgan strategist looks at the clearest indication of funding market stress, the one we highlighted at the very top, namely the recent surge in demand for Fed liquidity via repo, and writes that “the shift in the dollar cross currency basis is also consistent with signs that the previous dollar shortage seen in the US banking system during 2019, is re-emerging following the market stress of the past two weeks.” He then adds that “the recent spike in Fed’s repo operations take suggest that the market stress of the past two weeks is raising banks’ overall need for reserves (Figure 14). One potential channel could emanate from the payments businesses of banks which might come under stress as companies face cash flow problems from the coronavirus crisis.” It is this particular aspect of “supply chains being funding chains in reverse” that has spooked Pozsar the most, and why he believes central banks will need to step in with their entire artillery to avoid a systemic crash.

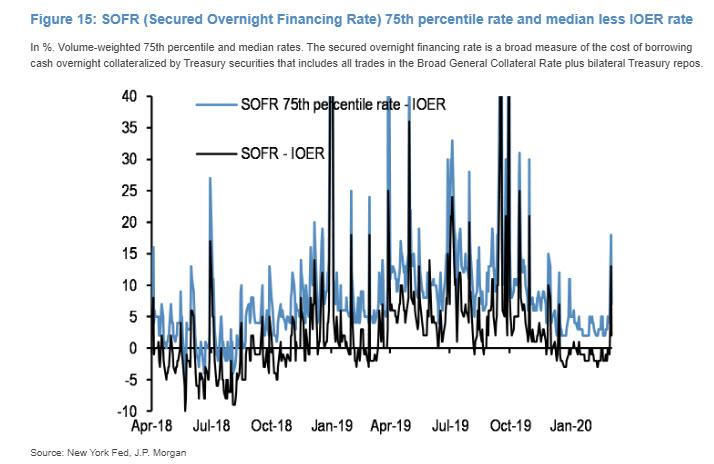

Finally, this week’s spike in both SOFR rates…

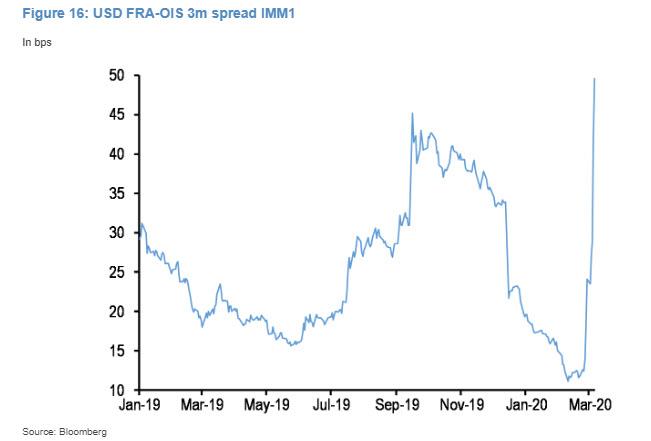

…. and the all important FRA-OIS spreads…

… is consistent with the idea of dollar reserve shortage and/or funding and credit stress emerging in US money market space, Panigirtzoglou warns, and follows up with precisely what we said earlier this week, namely that “these signs suggest that the Fed could again become aggressive in injecting reserves into the US banking system in a similar fashion to last September.”

Alternatively, woe to markets if the Fed does nothing in the next 24hours.

And while JPMorgan’s conclusion is somewhat more balanced, the implication is the same: “in all, we see initial signs of emerging credit and funding stress. If these shifts in credit and funding markets are sustained over the coming weeks and months, especially in the issuance space, credit channels might start amplifying the economic fallout from the COVID-19 crisis.“