Fra Zerohedge:

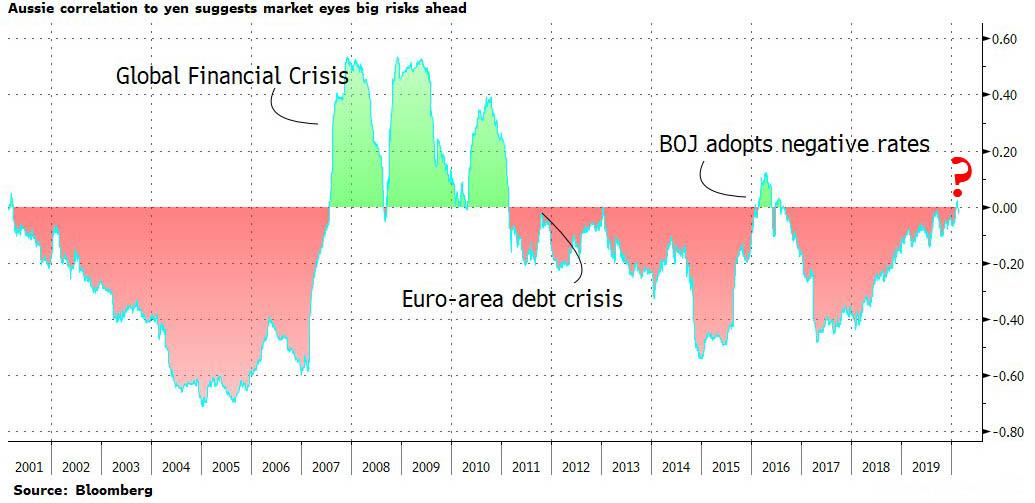

This is notable, because as the Greek FX strategist explains, referring to the chart below, “whenever this correlation breaks down, it is down to tail risks materializing such as the global financial crisis and the euro-area debt turmoil.”

It also tends to spark an immediate central bank “crisis” response: “The last time the correlation turned positive, the Bank of Japan surprised markets by adopting negative interest rates.”

Will this time be different, or will the breakdown of this historic correlation be the harbinger to another global crisis (arguably the result of the coronavirus pandemic) and another major emergency response by central banks?

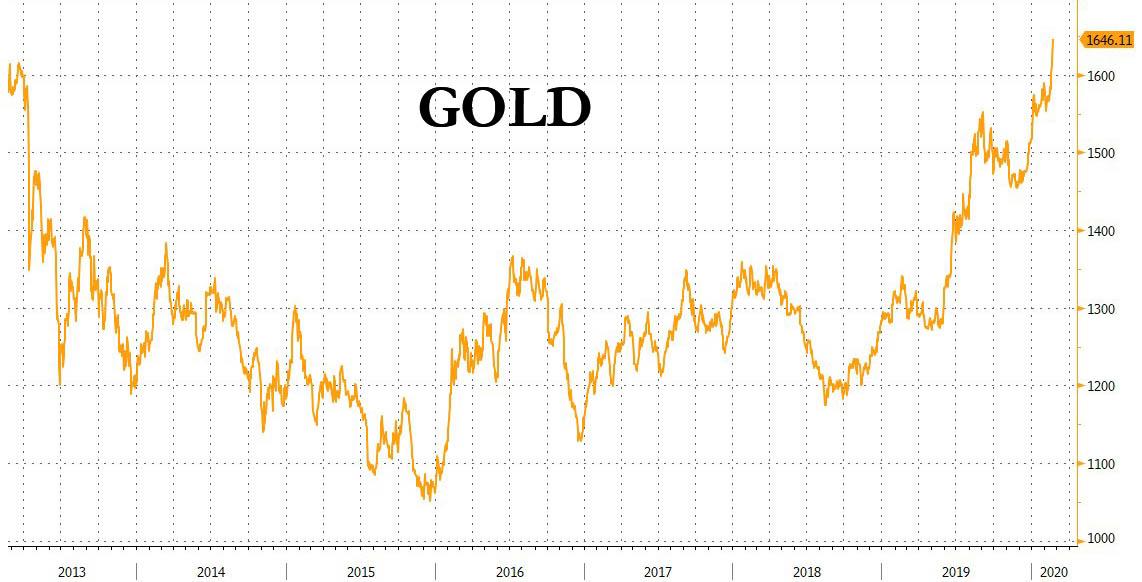

One look at the relentless explosion in the price of gold suggesting “someone knows something” about the imminent hammering of the CTRL+P combination, and the answer is a resounding yes…