The key event on the calendar today will be the Fed’s October minutes, which while dated, are expected to validate the December rate hike message. Expectations for a U.S. rate hike have shot up from 35 percent on Oct.27 to 66 percent, according to Bloomberg data. Elsewhere, the Bank of Japan starts a two-day meeting just days after it was revealed the economy sank into a recession. Don’t expect any change in stimulus. That’s the view of all 41 economists surveyed by Bloomberg News.

As Bloomberg notes, the widening spread – or difference – between the yield of U.S. two-year notes and their G-7 peers is now 76 basis points, the widest since July 2007. That reflects the view the Federal Reserve is ready to raise interest rates for the first time since 2006. It also highlights a divergence in monetary policy between the world’s biggest economies. While the Fed contemplates tighter policy, the European Central Bank has signaled it’s ready to boost stimulus next month, while the Bank of Japan has pushed back its deadline to achieve stable 2 percent inflation, raising the possibility of more bond-buying.

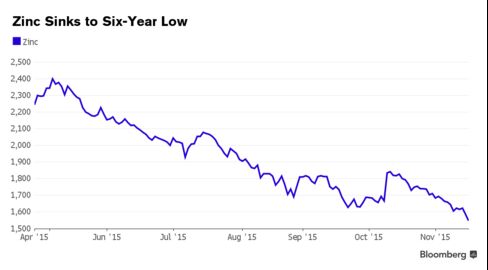

Elsewhere the commodity carnage continues, and the sell-off in industrial metals continues unabated. Zinc has fallen to its lowest since July 2009 as concerns persist about slowing demand from China. The dollar’s strength is also weighing on the metal used to galvanize steel. The Bloomberg Dollar Spot Index has risen to its highest in a decade ahead of next month’s Fed meeting, making dollar-denominated commodities more expensive for buyers in other currencies. Output cuts from miners including Glencore have failed to halt the rout in industrial metals, which have plunged 25 percent in 2015, according to a London Metal Exchange index.

Looking at markets, Asian equities rose, albeit mildly so following the lacklustre lead from Wall Street as gains in US bourses reversed late in the session due to geopolitical concerns. Nikkei 225 (+0.1%) traded in positive territory with Japanese exporters benefitting from a weaker JPY, while the ASX 200 (+0.5%) pared initial losses as gains in financials offset the weakness in mining large caps. Shanghai Comp (-1.0%) swung between gains and losses amid reports for the first time that the Shanghai-Shenzhen stock link will not go ahead this year. JGBs traded sideways overnight with a lack of news flow to instigate significant price action.

With the week so far seeing substantial gains in European equities, today has so far seen weakness go through Euro Stoxx (+0.9% ), in line with their Asian counterparts to pare some of the recent strength. In terms of stock specific news, Air Liquide (-6.7%) are the notable laggard in Europe after the announcement of the USD 13.4bIn purchase of Airgas. In line with weakness in equities, Bunds have traded in positive territory today, with the German benchmark also benefitting from the geopolitical situation, with concerns over France remaining ongoing and as such, today has seen the FR/GE spread marginally wider in early trade.

in FX, ECB’s Mersch downplayed the financial consequences of the attacks in Paris while also failing to mention anything regarding further ECB easing and as such contributed to the bid seen in EUR as European participants arrived at their desk this morning to see EUR/USD retake the 1.0650 level, however failed to reach the psychological 1.0700 handle. Separately, GBP has also seen a bout of strength today in the wake of comments by BoE’s Broadbent, who avoided any dovish rhetoric and suggested that focus USD-index trades in negative territory as participants keenly await the FOMC minutes to gain clarification on the viability of a December lift-off . The USD has been firm for the last few days and came off highs overnight.

The energy complex has continued the volatile price action seen in recent weeks, with yesterday’s API crude oil inventories showing a drawdown of 482k, the first drawdown since the first week of October and as such seeing a bid in both WTI and Brent. In terms of the metals complex, gold has come off its lows, whereby earlier in the day the yellow metal touched its lowest level since Feb’10 having fallen for a 7th consecutive session, while elsewhere zinc has fallen to 6 year lows and iron ore has slumped to a 7 year low, both suffering from continued weakened Chinese demand. Of note, today sees the release of DoE crude oil inventories.

Bulletin Headline Summary From Bloomberg and RanSquawk

- Today has seen some paring of this week’s gains for European equities, with Eurostoxx (-0.9%) trading in negative territory

- GBP has witnessed a bout of strength today in the wake of comments by BoE’s Broadbent, with EUR bid on the back of comments from ECB’s Mersch and a broadly softer USD

- Looking ahead today: US Housing Starts and Building Permits, DOE Inventories, FOMC Minutes, ECB’S Lautenschlager, Fed’s Dudley and Kaplan

- Treasuries steady amid global equity market declines, further drop in metals before FOMC releases minutes of its October meeting.

- Heavily armed police and military descended on a Paris suburb before dawn, targeting what they believed was the hideout of the architect of last week’s terrorist violence in a raid that led to at least two deaths and seven arrests

- China’s economy faces “considerable downward pressure,” President Xi Jinping said, while assuring fellow Asian leaders that the economy is resilient and will remain on path of reform

- Germany sold EU4.07b 2Y notes at all-time yield of -0.38%, suggesting investors are confident ECB will boost stimulus at next month’s

- The families of Islamic State leaders were fleeing Raqqa, the group’s stronghold in Syria, as France and Russia intensified airstrikes after attacks in Paris, a group that monitors the war said

- For the second time this week, Obama lashed out at lawmakers and U.S. governors, most of them Republicans, who are pushing to block the administration from allowing 10,000 Syrian refugees to resettle in the country

$14.8b IG priced yesterday, $1b HY. BofAML Corporate Master Index OAS narrows 1bp to +162, YTD range 180/129. High Yield Master II OAS narrows 9bp to +619, YTD range 683/438 - Sovereign 10Y bond yields mostly lower. Asian and European stocks mostly lower, U.S. equity-index futures decline. Crude oil rises, copper falls, gold little changed

US Event Calendar

- 7:00am: MBA Mortgage Applications, Nov. 13 (prior -1.3%)

- 8:30am: Housing Starts, Oct., est. 1.160m (prior 1.206m)

- Housing Starts m/m, Oct., est. -3.8% (prior 6.5%)

- Building Permits, Oct., est. 1.147m (prior 1.103m, revised 1.105m)

- Building Permits m/m, Oct., est. 3.8% (prior -5%, revised -4.8%)

Top News:

- Paris Raids Target Terrorist Ringleader, Leaving at Least 2 Dead: Abdelhamid Abaaoud believed holed up in Saint Denis flat?Russia, France Put Aside Syria Disputes to Hit Islamic State: Putin ordered Russian navy to work with French vessels

- German-Dutch Soccer Game Canceled Over Stadium Bomb Threat: game in Hanover called off ~90 mins before start after police get tip that bomb attack planned

- The Imam Who Wants to Purge France’s Mosques: Marc Champion says Abdelali Mamoun agrees with France’s plan to shut down radical mosques in response to Paris terror attacks

- Obama Says Debate on Syrian Refugees Feeds Anti-U.S. Propaganda: criticizes those seeking to block Syrians from U.S.; speaks at news conference in the Philippines

- Nigeria Orders Criminal Probe of $5.5b in Defense Outlays: probe into weapons deals found total “extra-budgetary interventions” of 644b naira in local currency and $2.2b in foreign funds

- Jonah Lomu, Rampaging Wing Who Transformed Rugby, Dies at 40: Lomu died unexpectedly in Auckland Wednesday, New Zealand Rugby said in statement

- India to Sell 10% Stake in Coal India Valued at $3.2b: Govt stake in Coal India to drop to about 69% post sale

- BOE’s Broadbent Sees Argument for Looking Through Price Shocks: says yield curve is very flat; officials shouldn’t rush to return inflation to target

- Fairchild Semi to Be Bought by ON Semi for $20-Shr

- Lowe’s Reaffirms Yr Forecast; 3Q EPS, Rev., Comps Top Estimates

- Air Liquide to Buy Airgas for $10.3 Billion in U.S. Expansion: French co. makes cash offer of $143/shr; plans capital increase of up to $4.3b?Airgas Founder McCausland to Receive $958 Million in Takeover

- Monsanto Says It’s Evaluating Another Syngenta Takeover Bid: is discussing internally merits of a new offer, other potential acquisitions, COO Brett Begemann told reporters in St. Louis

- Citrix to Cut About 1,000 Jobs, Plans Spin-Off of GoTo Business: sees 2016 adj. EPS $4.40-$4.50, est. $4.22

- Barclays Said to Pay $100 Million to End Currency-Rigging Probe: accord over currency-trading platform with NY bank regulator

DB’s Jim Reid completes the overnight wrap

It’s hard to pinpoint the overall tone of markets now after some contrasting moves over the past 24 hours. On the back of a strong session in Asia and some dovish ECB commentary the previous night, risk assets in Europe rallied through the day with equity markets up 2-3% and European credit sharply tighter (Crossover -15bps), while the positive news that Greece had reached an agreement with creditors which should release a €2bn aid tranche (more later) also helped boost sentiment. US markets started in a similar positive fashion, before a reversal in Oil markets (WTI closing -2.56%) along with Copper touching a six-year low and concerning headlines emerging of a bomb threat in Germany saw US equities stumble into the close with the S&P 500 (-0.13%), Dow (+0.04%) and Nasdaq (+0.03%) all finishing close to unchanged in the end.

US 10y Treasury yields finished little moved at the close too at 2.267%, although that also masked what was a fairly roundabout session which saw yields hit as high at 2.312% intraday before then tumbling into the close. Some of the blame for the change in tone midway through the afternoon is also being attributed to the postponement by the underwriters of a $5.5bn LBO by Carlyle Group of data-storage business Symantec, raising concerns of investor appetite for larger leveraged deals into year-end.

The focus of today will be on the FOMC minutes from the October 27th and 28th meeting, due out at 7pm GMT. Remember that the hawkishness of the statement that followed that meeting was the start of a big swing in December liftoff expectations. In fact, prior to that meeting December hike expectations were sitting at around 35%, before rising to 50% or so immediately after the statement. Currently we’re sitting at 66% which is just shy of the 69% high point earlier this month. It’s worth keeping in mind that while the minutes refer to the October meeting, asset prices have certainly moved fairly materially since that meeting. The S&P 500 is down -1.91% from the close of the 28th October and has declined on 10 of the 14 trading days in that time. The VIX is up over 30% in the same time frame, the US Dollar is nearly 2% stronger, 10y and 2y Treasury yields are up +9.4bps and +12.7bps respectively, while WTI has fallen over -11%. Clearly the moves in the US Dollar and Oil the most significant here.

Our colleagues in the US expect the minutes to be more balanced and much less committed to a December hike than what was inferred from the October communiqué. Clearly there is a lot of data left between now and the December 15th/16th meeting (including the November payrolls number) and while the latest employment report was encouraging, our colleagues note that growth and inflation numbers could be slipping given the latest retail sales and import price figures. They expect the probability of a December rate hike to fall closer to 50/50 over the next couple of weeks.

Yesterday’s US CPI data didn’t offer a whole lot of surprises after coming in pretty much in-line with expectations. Headline inflation rose +0.2% mom last month as expected, while the YoY rate nudged back up to +0.2% (vs. +0.1% expected) and back to where it was in the summer having briefly dipped to 0.0% in September. The core also came in at +0.2% mom (vs. +0.2% expected) last month with the YoY rate staying unchanged at +1.9%. The details revealed that core goods inflation in particular came out soft in October, but that a big rise in medical costs helped the print meet expectations.

Meanwhile, there was some disappointment to be had in the October US industrial production data, with the reading down -0.2% mom last month (vs. +0.1% expected) to mark the second consecutive monthly decline. There was better news to be had in the manufacturing production read however, which was up +0.4% mom (vs. +0.2% expected) last month. Capacity utilization edged down two-tenths as expected to 77.5%, while finally the NAHB housing market index dropped 3pts in November to 62 (vs. 64 expected) and off the recent highs.

Price action has been fairly subdued in the Asia session this morning. The Nikkei (+0.28%), Kospi (+0.13%) and ASX (+0.29%) while the Hang Seng (-0.11%) is a touch lower and Chinese equities broadly unchanged. Oil markets are around half a percent better off this morning, while Asia credit is generally unchanged. The only data of note this morning has come from China where the October home price data is out. The data showed that, relative to September, prices for new residential apartments rose in just 27 cities last month (compared to 39 and 35 in September and August respectively). At the same time fewer cities also reported a rise in existing residential apartment prices last month relative to September.

Moving on, the HouseView team has published their November edition overnight called “Policy divergence ahead”. They highlight that macro data over the last month have helped reduce global growth concerns. A rate cut in Europe soon followed by a rate hike in the US would at last crystallise the Fed-ECB policy divergence theme. Markets have welcomed the additional clarity about global growth and monetary policy. Going forward positive data would reinforce Fed hike expectations and support risk assets.

Greece was back in the headlines yesterday with the positive news of a successful negotiation with creditors after agreeing on a set of prior actions which will unlock the disbursement of the €2bn sub-tranche of aid (subject to parliament ratification tomorrow). Importantly, the agreement will allow the bank recap to move ahead with the aim of completion by year end.

Rounding up the remaining news yesterday, data wise in Europe yesterday the November German ZEW survey revealed a 0.8pt fall in the current situations index to 54.4 (vs. 55.2 expected). However the expectations survey was up a robust 8.5pts to 10.4 (vs. 6.0 expected). In the UK we saw the October headline CPI print come in as expected at +0.1% mom which kept the YoY at -0.1%. The core rate did however edge up a tenth to +1.1% yoy (vs. +1.0% expected). Core PPI output was down -0.1% mom (vs. 0.0% expected) last month in the UK, while RPI (0.0% mom vs. +0.1% expected) also came in a tad below market.

Looking at the day ahead now. It’s a quiet start to the day this morning in Europe with no notable releases expected. This afternoon in the US session the October housing starts and building permits readings will be out shortly after lunch before we then get the aforementioned FOMC minutes at 7pm GMT. In terms of Fedspeak, Dudley, Mester and Lockhart are due to speak on a panel at around 1pm GMT on the financial payments system, while the more interesting comments may come from the Fed’s Kaplan who is due to speak before the FOMC minutes on economic conditions.