Fra Zerohedge/ Morgan Stanley.

Despite ten consecutive weeks of gains in the S&P, investors have continued to largely boycott this rally and as JPM wrote earlier, “most investors have not participated in this V-shaped recovery other than corporates and insiders who were accelerating purchases into the sell-off.”

And, as we have discussed in recent weeks, one main reason for this lingering skepticism is that a majority of investors are confident that contrary to the constant media cheerleading, what we are experiencing is nothing more than a bear market rally prompted by fresh speculation about “green shoots” and “reflation”.

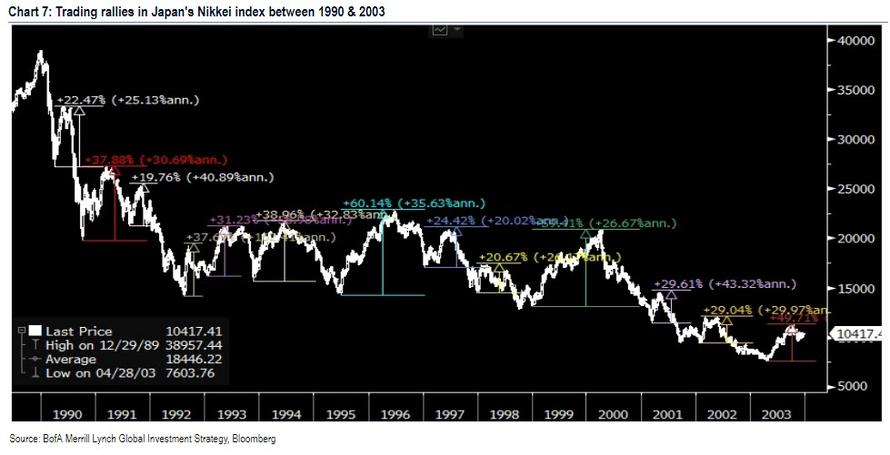

Addressing this point, BofA’s CIO Michael Hartnett last week noted that in Japan between 1990 and 2003 there were no less than 13 equity trading rallies that exceeded 20%, and seven trading rallies that exceeded 33%, all the while Nikkei was caught in a secular bear market.

Yet while the jury is still out on whether this is just a bear market rally for stocks, when it comes to junk bonds, Morgan Stanley has called it, and in a note titled “Selling the Rally”, Morgan Stanley’s credit strategist Adam Richmond writes that after he turned tactically constructive on US credit on January 7, “in our view, the trade is now mostly done and the risk/reward of remaining meaningfully long US credit is no longer attractive. Specifically, we are exiting our tactical buy recommendation, and reverting to our longer-term cautious view on the asset class.”

First, explaining the bank’s tactical short-term bullish view, Richmond writes that it was based on two simple points:

- One, sentiment had shifted too far in the negative direction at the end of 2018, when recession fears were rising fast, many had started to believe the Fed was making a policy mistake, and to some investors, the expectation for spreads to trend wider this year, in fact, didn’t seem bearish enough.

- Two, markets finally moved in the direction of pricing in long-term fundamental concerns, with US credit becoming cheap to Morgan Stanley’s long-term fair value estimate for the first time in 2 ½ years.

Going back to Hartnett’s point, Richmond writes that bear markets don’t move in a straight line, “and we thought credit was due for a bounce. Nearly all bear markets have periodic (usually multi-month) rallies, and they are often sharp and painful (for those who are short), just like episodes of spread widening.”

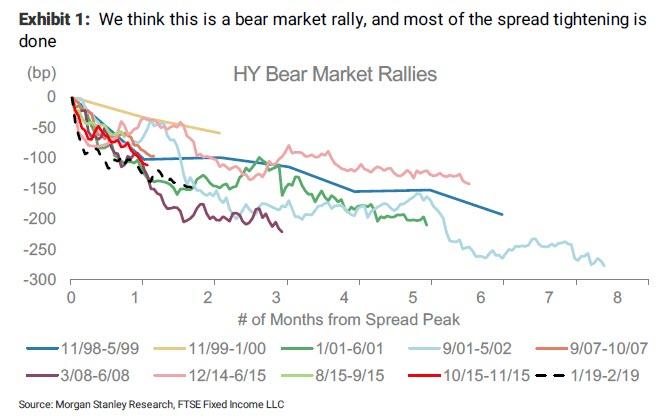

Morgan Stanley shows this in the chart below, which it prefaces by saying that “we think this is a bear market rally, and most of the spread tightening is done.”

So why is Morgan Stanley reverting to its cautious, long-term view?

As Richmond explains, his long-term view hasn’t changed, and “if anything, our conviction is increasing that spreads will trend wider over the medium term, the fundamental challenges built up over the course of a nearly decade-long bull market are gradually rising to the surface, and the credit cycle is ever so slowly starting to turn. And with IG/HY spreads 33bp/151bp tighter since January 3, these risks are now even less in-the-price.”

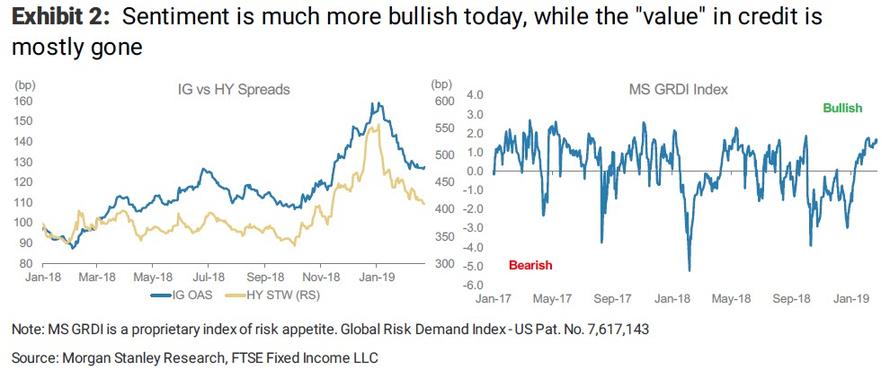

In addition, Morgan Stanley thinks that sentiment has swung back in the bullish direction, noting that while in the first few weeks of January, most investors Morgan Stanley spoke with wanted to sell the rally, however, this mentality started to change after the January Fed meeting, when many began to believe a “Goldilocks” environment was back – modest growth, low rates, low vol, and a dovish Fed.

To Morgan Stanley’s credit team, this was a cue to start de-risking:

We think it’s important to remember this is not 2017, when spreads slowly and steadily tightened with virtually no volatility. This is a credit bear market, in our view, where sentiment swings much more sharply in both directions. And as a result, you have to fight the urge to chase the market when everything starts to feel much better, as it does today, unless the fundamental story has truly changed. We think it has not.

Next, touching on a point we discussed over the weekend, when Goldman joined the bearish brigade saying the “goldilocks” rally is over, Richmond asks, rhetorically, why have markets bounced so aggressively? The answer according to the MS strategist, is that the dovish Fed shift combined with the expectation for a China trade deal would be high on the list.

And without a doubt, both of these factors were short-term positives, especially coming on the back of such an oversold market late last year. But neither change our view on the broader credit cycle.

Finally, with respect to a more dovish Fed, Richmond urges clients not to forget that the bulk of spread widening in a cycle actually happens AFTER the hiking cycle is done, because that is when growth weakens most. The sequence Fed policy follows as the cycle turns is that monetary policy first becomes tight and the Treasury curve flattens, then usually inverts. Eventually, the Fed stops tightening. As growth keeps slowing (and/or financial conditions keep tightening), the Fed cuts and the Treasury curve bull steepens into a recession.

Hence, somewhat counterintuitively, “if the Fed has finished hiking for the cycle, as rates markets could be suggesting, that may make it MORE likely that a bigger turn in the credit cycle is near, given this typical sequence, and what it implies about the trajectory of the US economy.”

So what trades is MS recommending? There are four:

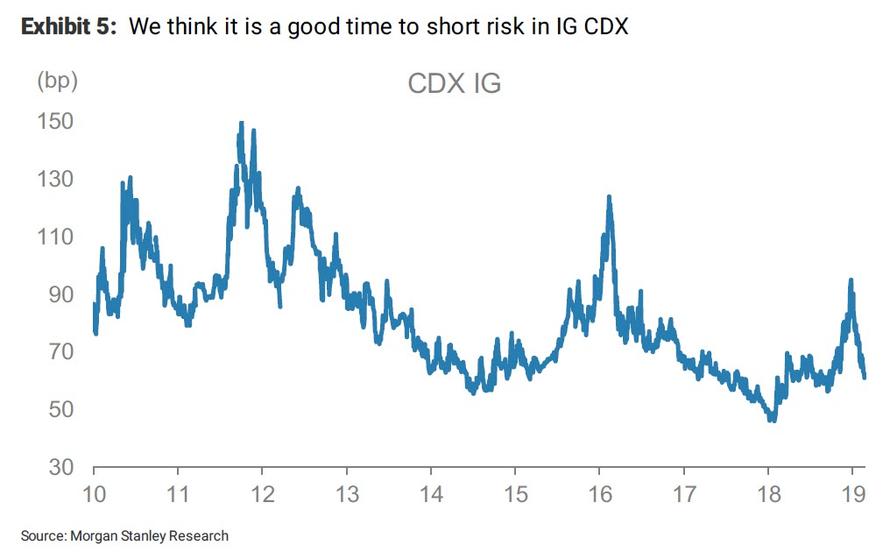

- First, MS says that now “is a good time to short the liquid derivatives indices”, on the belief that cash will underperform CDX longer term, in past selloffs, the liquid indices have tended to underperform initially, until outflows persisted for a few weeks/months and investors were eventually forced to sell their less liquid cash bonds. Specifically, Richmond thinks IG CDX, which has outperformed cash and outperformed HY CDX, is one of the best (and simplest) shorts at ~60bp.

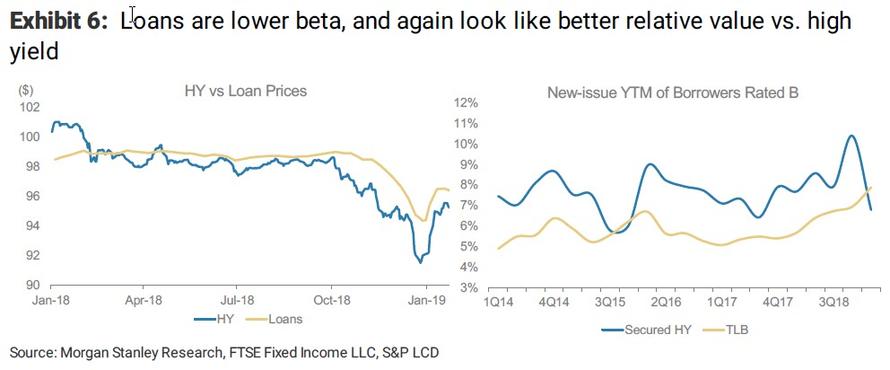

- Second, the bank recommends to shift back into loans relative to high yield. Earlier this year, the bank made the opposite switch, from loans into HY as it “thought the HY market looked cheaper than loans after the 4Q selloff, and we expected technicals to remain relatively weaker in the loan market, on top of a more challenging long-term fundamental story for loans.” And while Morgan Stanley remains more concerned about some of the technical and fundamental challenges specific to the loan market, the 4Q18 selloff should have reminded investors that HY is still the higher-beta market, with HY falling by over seven points, while loans declined by less than five.

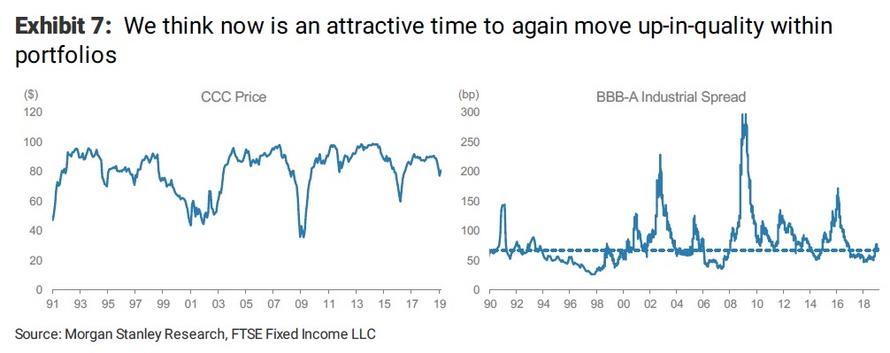

- Third, move up-in-quality: “We did not advocate adding too much beta to portfolios in our note early this year, because we only saw our bullish recommendation as tactical in nature. However, we did make the point that there would be a better opportunity to de-risk portfolios later in the year. We think that opportunity has come, and would once again move more aggressively up-inquality within credit (i.e., BBs over CCCs) and within fixed income (i.e., mortgages over corporates).”

- Fourth and last, the bank maintains its short-duration OW. Even though supportive technicals over the past month have made short-duration IG look relatively richer, Richmond continues to believe front-end credit is a decent source of defensive carry. (The risk is that if Treasury curves begin steepening, the credit curve may flatten.)

And judging by the market’s abrupt selloff to start the week, Morgan Stanley may have once again timed its call perfectly.