Uddrag fra Nordea analyse:

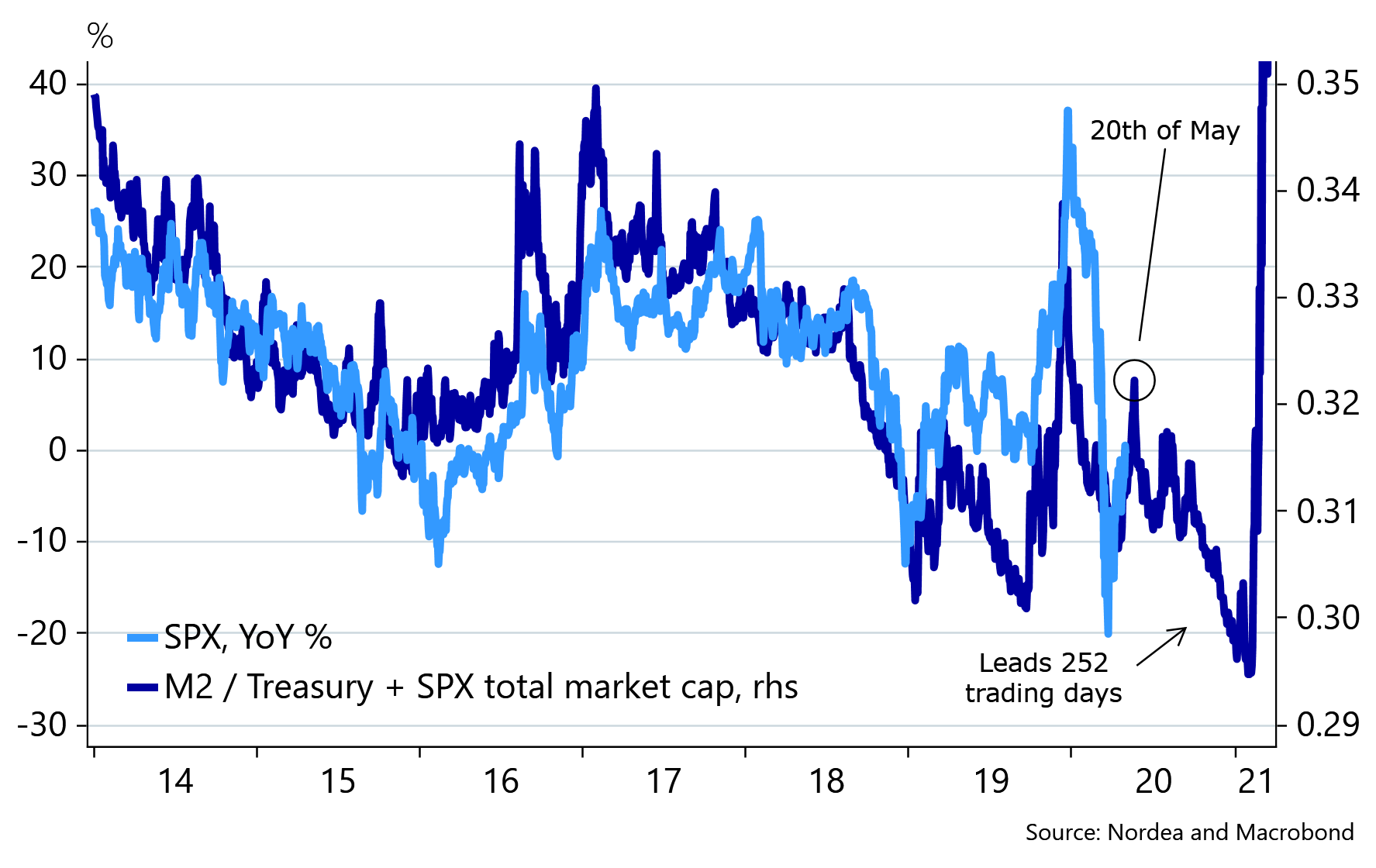

“Sell in May and go away” is maybe one of the most annoying investment clichés but it could prove to work again this year, if lead/lag patterns from the M2 development to risk asset performance persist. As M2 improves in the US, it is i) a result of much easier Fed policies and ii) a demand for credit that is suddenly revived due to the Corona lock-downs, but it usually also comes with important bearing for risk assets after a while.

Judging from usual lead/lag patterns, lackluster M2 developments from 2019 should still act as a drag on risk assets from May and into the second half of the year, while 2021 looks to be the most “ketchupped” market ever, as the bonanza of policy measures will leave too much money chasing too few assets.

Chart 4: Too much money chasing too few assets in 2021?

So, what should you buy in FX space, if we are right that an exorbitant ketchup effect arrives in late 2020 or early 2021? NZD is likely THE bet in G10, while JPY could prove to be the loser (we reached profit levels in short CHF/JPY over the week). The below is a heatmap of FX beta to rising spot core real rates (Fed funds minus Core CPI) as we will likely be faced with once Core CPI drops as a lagged result of rising unemployment.

Why is “risk on” the name of the game when core real rates increase? Likely as the central banks (and in particular the Fed) have printed and eased their way out the mess by then, which leaves a weaker USD outlook and a stronger commodity outlook likely, once the dust settles. That is a story for later. Q2 and Q3 are likely to be driven by other, less positive, factors.