Uddrag fra Nordea – læs hele analysen her

Everybody seems to believe that the Fed is essentially running QE4, while no one dares to be short risk in to the potential signing of a Phase-1 deal. The next monthly purchase pace update is out on Thursday, which could prove to be an eye-opener.

If you want to receive a copy of FX weekly directly in your inbox, you can sign up via this link.

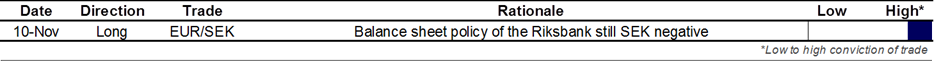

Table 1: Our current convictions

Almost everybody seems to believe that what the Fed is currently doing is identical to a large and substantial QE program, with many market participants extrapolating the initial purchase pace of 60bn/month to last at least until April, possibly even until the end of June 2020. This – ceteris paribus – implies a cumulative growth of bank reserves (or excess liquidity, if you will) of 390bn-510bn (this is wrong in our view, since things can’t be held equal…). Anyhow, everybody probably knows by now that when the Fed does QE, everything just turns perfect – which is indeed reflective in price-action across global markets over the past month or so.

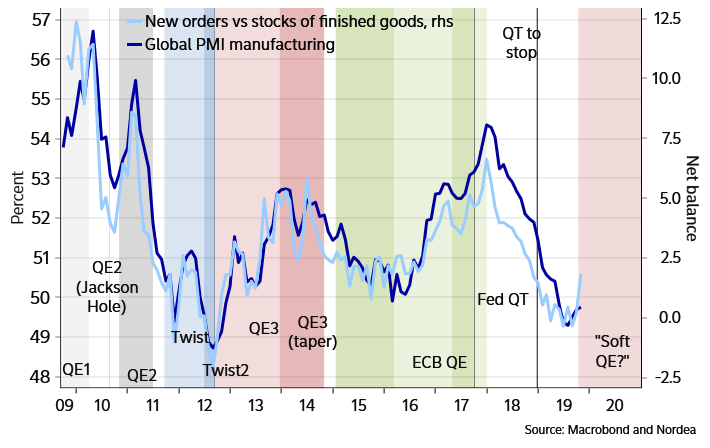

Chart 1: Fed QE usually makes everything alright

However, when the Fed announced its intention to buy bills T-back in October, it started with “with the period from mid-October to mid-November”. Now, a month has almost passed, and a new schedule for the Fed’s POMOs will be released on Thursday November 14: “the Desk [NY Fed] will announce the planned purchase amount and release a tentative schedule of operations for the monthly period”.

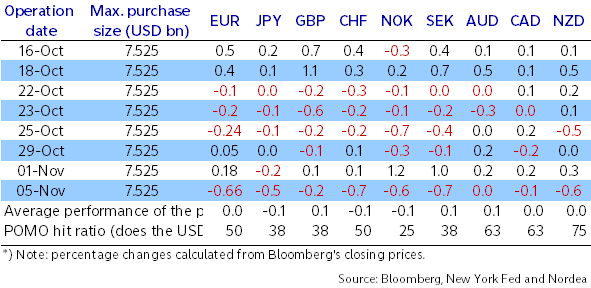

Table 2: New POMO schedule due next week – so far there is no pattern for the dollar

It may be too early to expect it already for the 14th, but it’s not completely unthinkable that the Fed will cut its planned purchase pace at some point. For instance, the US Treasury will add plenty of liquidity to the system over the next month, the Effective Fed Funds Rate has dropped towards the IOER rate (meaning easing money market strains), while interest in the Fed’s TOMOs has been range-bound. If the Fed does cut its bill purchase pace, then the extrapolators will need to reassess their calculations, threatening the QE narrative.