Uddrag fra Zerohedge:

The impact of automation on the labor market has become more of a political issue now than it ever has, with its impact on the labor force being cited as one of the main causes for the election of leaders like U.S. President Donald Trump and Italy’s Matteo Salvini, according to a new Bloomberg op-ed by Ferdinando Giugliano.

In the U.S., the main factor as to whether or not a worker can beat out a robot for a job seems to be his or her education. Overseas, in the EU, a lot of it is determined by how strong a workers’ employment contract is.

He calls the American model of favoring the educated “brutal”, but at least having some semblance of being meritocratic. The European model of protecting workers with contracts, he says, is unfair on younger workers that don’t have contracts. This, in turn, won’t help with the problem of inter-generational injustice that drives voters toward populist politicians, the op-ed argues.

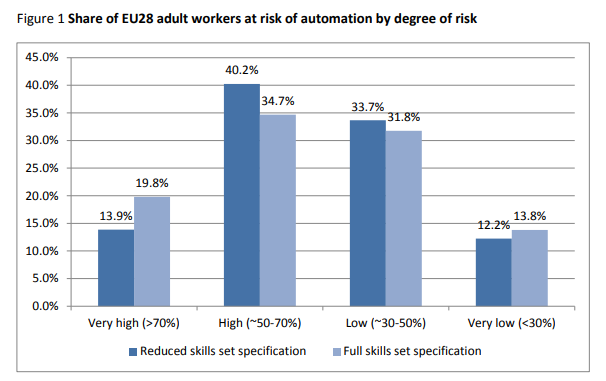

He also points out a study by Konstantinos Pouliakas for the European Centre for the Development of Vocational Training that shows the extent of how automation is a challenge in Europe. The study found that 14% of adult workers may face a “very high risk of automation” and that the occupations most in danger are routine jobs with little demand for transferable skills or social interaction.

Economists Maarten Goos, Alan Manning and Anna Salomons also conducted a study, looking at 16 European countries between 1993 and 2006, and finding an increase in the employment share for high-paid professional managers, as well as low-paid services workers, and a decrease in the share of manufacturing and routine office workers.

This is a result of computers easily replacing routine tasks, the study concludes, echoing the sentiment that workers doing these jobs are the most vulnerable.

There is little evidence that automation is polarizing wages in Europe the way that it is in the US. Economists Paolo Naticchioni, Giuseppe Ragusa and Riccardo Massari researched salaries on the continent between 1995 and 2007 and found that technology only had a “weak effect” on their distribution. They also found that education plays no role in determining wage inequality in the EU, which is not the case in the US.

The clear losers from automation in Europe can be highlighted by study of Germany by Wolfgang Dauth, an economist at the University of Wuerzburg. He found that the burden falls primarily on young workers just entering the manufacturing sectors. Newer workers are penalized because Europe’s labor market means companies have to give more stable and better paid jobs to older incumbent workers.

Giugliano concludes that governments shouldn’t dissuade innovation:

The example of Italy shows that not having enough automation has a pernicious effect on the labor market. Gaetano Basso, a researcher at the Bank of Italy, found that since the mid-2000s, Italians haven’t suffered wage polarization, but rather an outright degradation of the jobs market. Only the share of low-wage manual occupations has increased markedly, while high-wage jobs have dropped along with middle-income employment. The lack of automation is one cause. Italy’s economy has been marred by stagnant productivity for three decades, so it’s unsurprising that wages and job quality haven’t improved.

Instead, he concludes that governments must get better at handling the unwanted consequences of automation by promoting the right skills and education for prospective workers.