Fra Zerohedge:

Alternative title: “FOMC Minutes show market is now in charge”

* * *

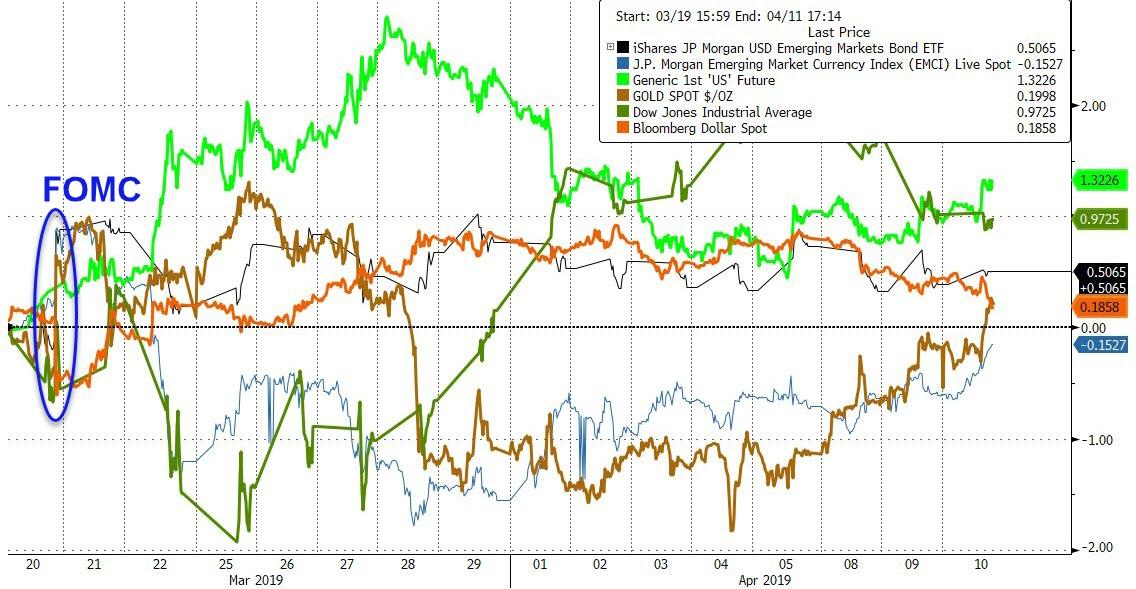

Since the uber-dovish flip-flop of The Fed on March 20th, the long-end of the US Treasury curve has outperformed all other asset classes…

The dollar and gold are also higher along with The Dow as we note that the yield curve flattened dramatically before rebounding back to almost unchanged…

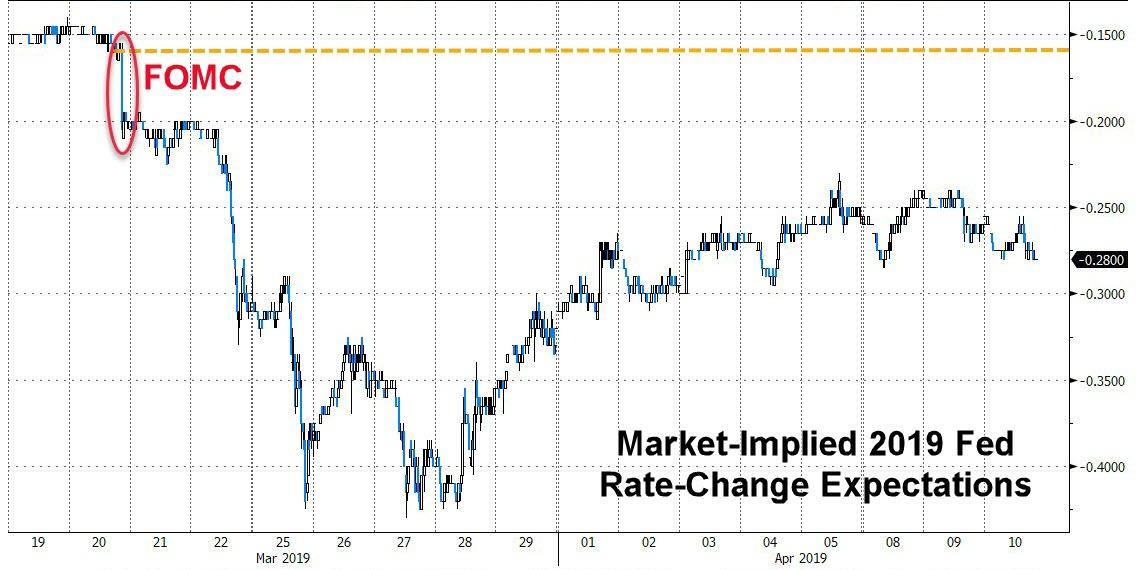

And mirroring the yield curve, the market’s expectations for Fed rate-changes in 2019 plunged (dovishly right after the March FOMC) only to rebound hawkishly in recent weeks…

Recall the FOMC held rates steady, forecast no additional hikes this year and announced plans to end balance sheet shrinkage in September, and as Bloomberg reports, that led markets to price in interest rate cuts by next January. The minutes could push back against those expectations for actual cuts as the committee lays out conditions needed for a cut — or a hike.

Bloomberg Chief U.S. Economist Carl Riccadonna warned that “an important focal point of the minutes will be to determine the extent to which Fed officials expect the sources of recent economic weakness to be transitory. This, in turn, will signal how they might respond to signs of firming hiring, consumption and output ahead of the Fed’s next rate decision on May 1.”

All eyes will be on any signal of rate-change direction (after Powell said in the last press conference, he didn’t know whether the central bank’s next move would be to raise or lower its short-term benchmark rate), as well as what to expect when the balance sheet run-off ends.

The Minutes highlighted a sheepishly dovish FOMC…

- *FED MAJORITY SAW RISKS WARRANTING RATES ON HOLD THROUGH 2019

- *SOME FED OFFICIALS SAW FURTHER MODEST INCREASE LATER THIS YEAR

- *FED OFFICIALS SAW `SIGNIFICANT UNCERTAINTIES’ AROUND OUTLOOK

- *SEVERAL FED OFFICIALS CONCERNED YIELD CURVE WAS QUITE FLAT

- *SEVERAL FED OFFICIALS POINTED TO INCREASED DEBT, LEVERAGE

Key highlights include:

On the outlook:

“With regard to the outlook for monetary policy beyond this meeting, a majority of participants expected that the evolution of the economic outlook and risks to the outlook would likely warrant leaving the target range unchanged for the remainder of the year.”

On the direction of rates rate, which sounds unexpectedly hawkish, and certainly not indicative of a Fed that is about to cut rates:

“Several participants noted that their views of the appropriate target range for the federal funds rate could shift in either direction based on incoming data and other developments. Some participants indicated that if the economy evolved as they currently expected, with economic growth above its longer-run trend rate, they would likely judge it appropriate to raise the target range for the federal funds rate modestly later this year”

On concerns about the flat yield curve:

“Several participants expressed concern that the yield curve for Treasury securities was now quite flat and noted that historical evidence suggested that an inverted yield curve could portend economic weakness”

“Several participants expressed concern that the yield curve for Treasury securities was now quite flat and noted that historical evidence suggested that an inverted yield curve could portend economic weakness…”

Yet others were unconcerned:

… however, their discussion also noted that the unusually low level of term premiums in longer-term interest rates made historical relationships a less reliable basis for assessing the implications of the recent behavior of the yield curve.

On what “patient” means:

“Several participants observed that the characterization of the Committee’s approach to monetary policy as ‘patient’ would need to be reviewed regularly as the economic outlook and uncertainties surrounding the outlook evolve.”

“A couple of participants noted that the ‘patient’ characterization should not be seen as limiting the Committee’s options for making policy adjustments when they are deemed appropriate.”

On the lack of inflation:

“Participants also discussed alternative interpretations of subdued inflation pressures in current economic circumstances and the associated policy implications.”

On the risks to the US economy:

“Participants commented on a number of risks associated with their outlook for economic activity.”

On the risks to the international economy:

“A few participants noted that there remained a high level of uncertainty associated with international developments, including ongoing trade talks and Brexit deliberations, although a couple of participants remarked that the risks of adverse outcomes were somewhat lower than in anuary.”

On implementing a Reverse Repo Ceiling facility

“Some participants suggested that, at future meetings, the Committee should discuss the potential benefits and costs of tools that might reduce reserve demand or support interest rate control.”

On concerns about rising leverage:

“Several participants pointed to the increased debt issuance and higher leverage of nonfinancial corporations as a development that warranted continued monitoring.”

And how this could get worse:

“A few participants observed that an economic deterioration in the United States, if it occurred, might be amplified by significant debt service burdens for many firms.”

“Several participants pointed to the increased debt issuance and higher leverage of nonfinancial corporations as a development that warranted continued monitoring.”

On asset prices:

“Participants noted that asset valuations had recovered strongly and also discussed the decline that had occurred in recent months in yields on longer-term Treasury securities.”

Finally, on the fact that the Fed’s forecasts and dot plot have become a joke:

“The Chair noted that he had asked the subcommittee on communications to consider ways to improve the information contained in the SEP and to improve communications regarding the role of the federal funds rate projections in the SEP as part of the policy process.”

And the punchline: the Fed is angry that the investing public thinks it has a clue what is going on:

Several participants expressed concerns that the public had, at times, misinterpreted the medians of participants’ assessments of the appropriate level for the federal funds rate presented in the SEP as representing the consensus view of the Committee or as suggesting that policy was on a preset course. Such misinterpretations could complicate the Committee’s communications regarding its view of appropriate monetary policy, particularly in circumstances when the future course of policy is unusually uncertain

Finally, on the bright side, Treasury Secretary Steven Mnuchin said he was right to recommend Jerome Powell as Federal Reserve chairman despite President Donald Trump’s frequent criticism of the central bank leader.

“I don’t feel like I picked the wrong person,” Mnuchin said Wednesday in an interview on CNBC.

“But I respect the president’s views and his views of the economy, where he’s had tremendous insight.”

* * *

Full Minutes below:

https://www.scribd.com/document/405783959/Fomc-Minutes-20190320#from_embed