Fra Zerohedge:

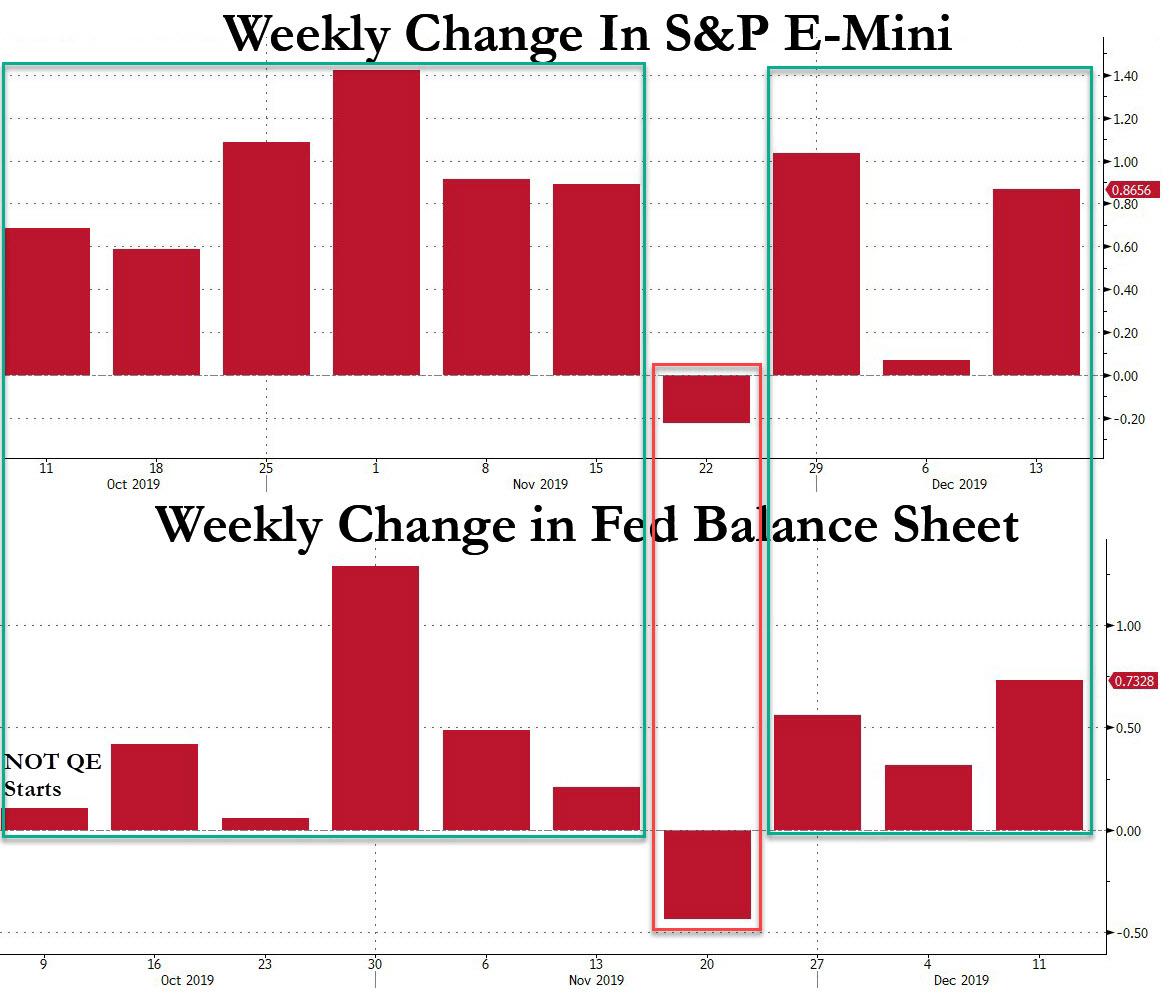

Something remarkable happened when the Fed announced “NOT QE”: starting that week, every time the Fed’s balance sheet rose, so did the S&P. And the one week when the Fed’s balance sheet shrank, the market dropped. Yes, correlation may not be causation, but if a pattern repeats 9 weeks out of 9, then it becomes feedback loop which the math PhDs plug into their various algo/quant models and… voila:

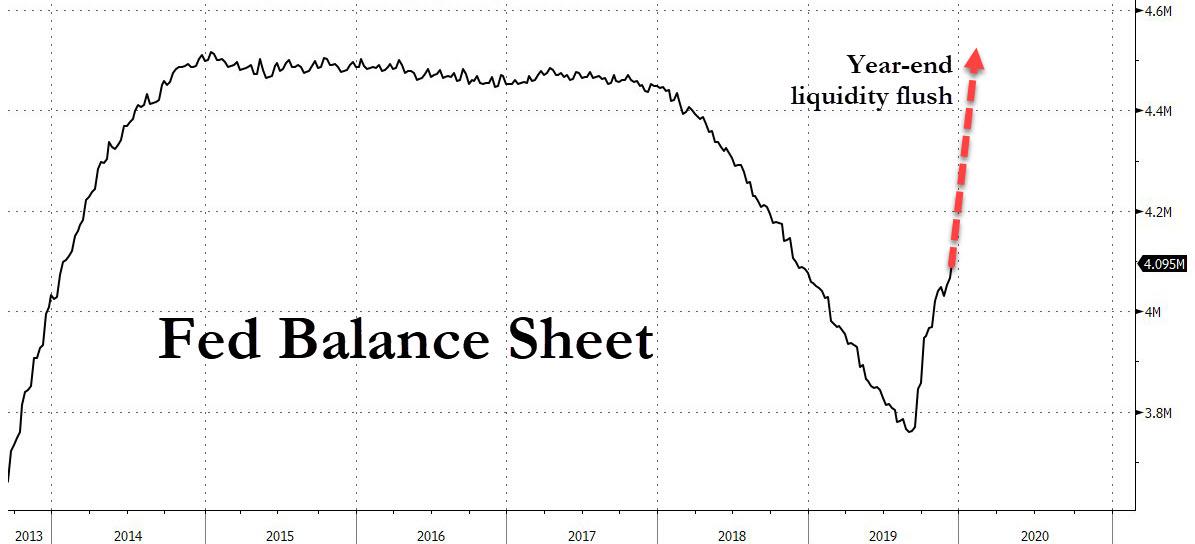

Which begs the question: yesterday we reported that as part of its year-end repo bailout, the Fed plans on injecting over $500 billion of liquidity in the next 4 weeks, a process which will take the Fed’s balance sheet sharply higher by a record $500 billion in one month through mid-January, in the process sending the balance sheet to a new all time high above $4.5 trillion. We wonder: just what will happen to stocks?