Fra Zerohedge/ Socgen

Over the weekend, One River CIO Eric Peters observed that “in each downturn, central bankers must step in more and more aggressively…. the process is reflexive and ultimately leads to a Minsky extreme,” an observation that was picked up by Morgan Stanley’s Mike Wilson the next day,when in discussing the potential impact on the market as a result of the coronavirus pandemic and other builtup imbalances, Wilson said that while a correction has likely begun, it will be contained to 5 percent or less as the Fed won’t let stocks drop too much as “liquidity remains flush.”

Today, in its attempt to assess the possible damage to global markets from coronavirus risk, SocGen doubles down on Morgan Stanley’s forecast, and cautions that “a further escalation of the coronavirus could result in an overall 10% equity market correction”, however like Wilson, it stops there because “to argue for more, we would need to see the emergence of more significant fears on global growth” even as the French bank concedes the precarious gamma positioning on the derivatives side could be pointing to the possibility of a further rise in equity volatility.

In making its case for a potential correction, SocGen focuses on fundamental, technical and thematic catalysts:

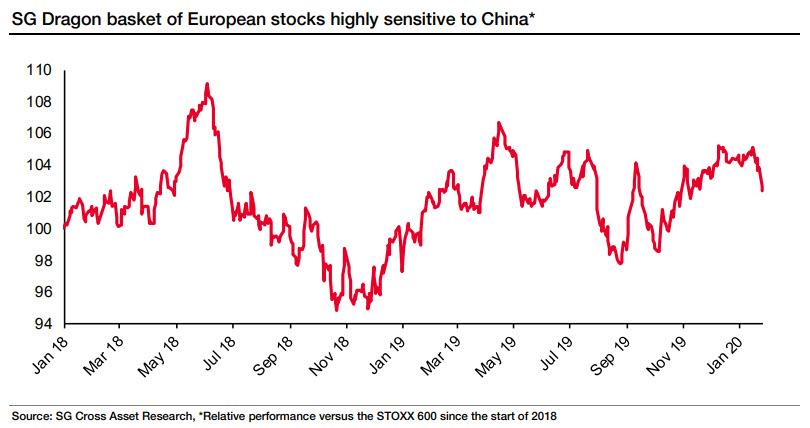

Starting with the first, SocGen’s Alai Bokobza writes that “fundamentally, we see converging uncertainty signals that call into question the acceleration of the global economy.” Specifically, he targets China, saying that if it were to be hit again, “its 18% weight in the global economy would have an overwhelmingly negative effect on the rest of the global economy.”

That said, and just like Morgan Stanley, Bokobza still thinks the Federal Reserve would respond immediately to the risk of a slowdown as times are turbulent in Washington, preventing quick activation of fiscal policy, noting that “this is possibly what the USD has been telling us in recent days, having failed to rise.”

As a result, SocGen continues to push “for a high content of US Treasuries; 50% of our sovereign bond exposure in fact” while Gold and the Yen are often singled out as two other assets potentially worth holding to stabilize portfolios in the coming turbulent times.

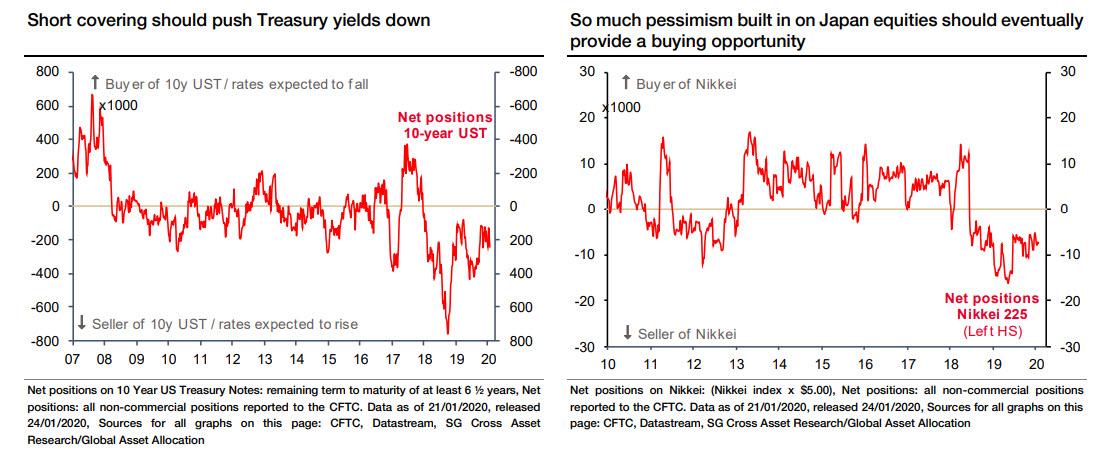

While SocGen is clearly bearish on the economy and expects a recession later this year, there is another reason why it is recommending duration exposure: not long ago, the market was significantly net short Treasuries in the belief that the US economy was on track for acceleration. However, after brainstorming with its top US economist Stephen Gallagher, the SocGen derivatives team sees “little or no reason to rethink protecting against a recession we anticipate will arrive later this year.”

And while SocGen clearly agrees with Morgan Stanley in broad terms, it disagrees with JPM, which as we noted on Monday is urging clients to buy the dip, and says that “in our view, it is too early to call a generalized “buy the dips”, given the newsflow on the virus is currently anything but reassuring.” That said, the French bank would view material weakness “as a potential opportunity to raise exposure to Japan equities – after all, they are no longer burdened by the risk of potentially fast Yen appreciation, which investors had been fearing previously.”

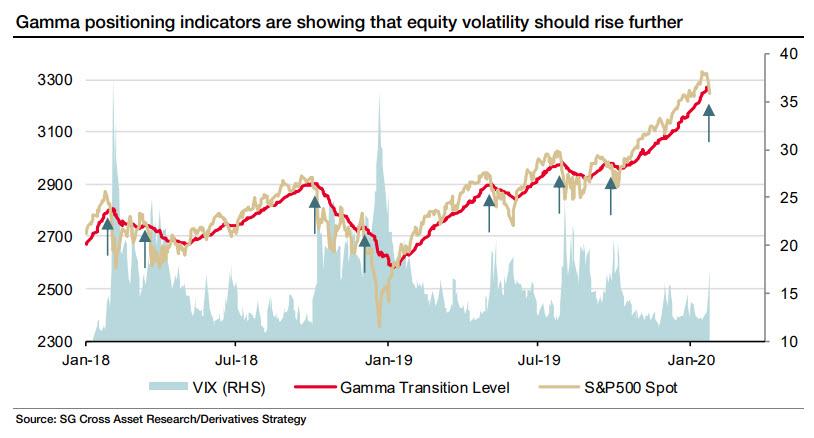

Moving to technicals, SocGen sees another potential trigger for short-term turbulence in the from the listed derivative markets. As we noted as recently on Monday, gamma positioning had recently shifted into negative territory (although the rebound from the past two days appears to have lifted the SPX above the selling threshold).

As a reminder, gamma-linked indicators are designed to estimate whether hedging by market makers is currently suppressing or elevating volatility. Positive gamma leads to dampening of index moves because the hedgers need to sell when the market moves up and vice versa.

Negative gamma leads to hedgers exacerbating volatility as they sell when the market moves down and buy when it goes up. The chart below shows that the S&P500 spot moving into negative gamma territory (below the red line) is consistent with higher levels of VIX:

In conclusion, while SocGen would stay away from stocks at least until a bigger market flush takes place, it likes US Treasuries as “portfolio stabilizers”, as the Fed continues to be seen (and act) as proactive in turbulent times, “but prefer Gold to the Yen or USD.” Additionally, the bank sees an opportunity to invest in Japan equities (deep value) “while baskets of stocks with high valuation linkage to China may remain vulnerable at least until the clouds clear.” For now, however, SocGen’s clearest reco is simple: “do not add more risk only after the coronavirus situation stabilizes.”