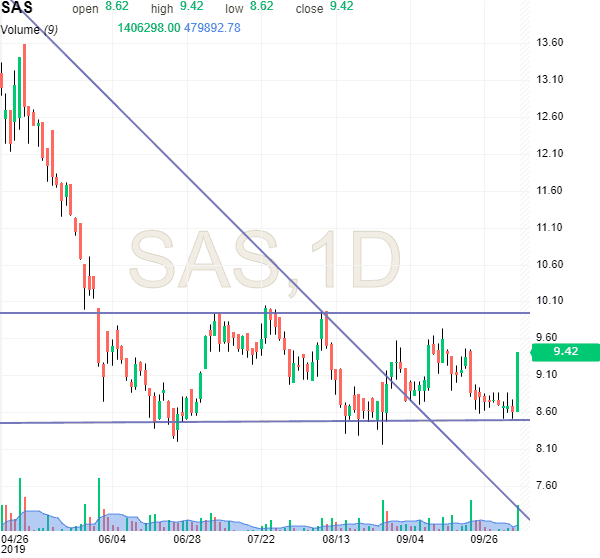

Kursgraf: Efter gode trafiktal fra SAS nettokøber udenlandske finanshuse SAS aktier for næsten 50 mio SEK på Stockholm børs. Vi ser god mulighed for et vigtigt brud op gennem 10 kr. inden for de 1-2 uger.

SAS skriver i den opdaterede trafikmelding:

DURING SEPTEMBER 2.9 MILLION PASSENGERS TRAVELED WITH SAS

SAS reports an increase of 3% in number of passengers compared to same period last year. Unit revenues increased with 4.4% and passenger yield with 5.4% which affirms the positive trend seen during the year.

Total traffic capacity increased with 1.5% and number of passengers increased with 87 000 or 3.0%, compared to September 2018. Regularity and punctuality also showed an improvement compared to last year.

The traffic on SAS’ domestic routes increased in all three Scandinavian countries. The total increase in revenue passenger kilometers was 6.3% on domestic routes, where Norway had the largest growth. European routes also show an increase compared to last year, but the weak Swedish krona and geopolitical uncertainties have dampened the demand for intercontinental travel to and from Scandinavia. Currency adjusted passenger yield and unit revenue increased with 5.4% and 4.4% respectively, reflecting an improved supply/demand balance in Scandinavia.

– It is encouraging that our continuous work to adapt our production to the seasonal demand is reflected in improved passenger numbers. We note an increase in domestic demand, which we believe is a direct effect of our work to improve our customer offering and our efforts to reduce the climate impact of aviation. In addition to our carbon offsetting of all SAS tickets booked by EuroBonus members, travelers can now make their flights more sustainable by choosing to pay for biofuel, which reduces climate affecting carbon emissions by 80 percent compared to fossil fuel. Since launch we’ve seen an increasing interest from customers for this possibility, says Rickard Gustafson, CEO of SAS.

For further information. please contact:

SAS press office. +46 8 797 2944

Michel Fischier. VP Investor Relations. +46 70 997 0673

SAS. Scandinavia’s leading airline. carries more than 30 million passengers annually to. from and within Scandinavia. The airline connects three main hubs – Copenhagen. Oslo and Stockholm – with 125 destinations in Europe. the US and Asia. Spurred by a Scandinavian heritage and sustainable values. SAS will reduce total carbon emissions by 25% and operate with biofuel equivalent to equal the total consumption of fuel used to operate all domestic SAS flights. by 2030. In addition to airline operations. SAS offers ground handling services. technical maintenance and air cargo services. SAS is a founding member of Star Alliance™ and together with partner airlines offers almost 19.000 daily flights to more than 1.300 destinations around the world.

Learn more at https://www.sasgroup.net