Fra T. Row Price:

U.S.

POSITIVE VACCINE SENTIMENT DRIVES STOCKS HIGHER

Stocks continued to grind higher on largely positive news flow about potential vaccines and treatments for COVID-19, the disease caused by the coronavirus, generating solid returns for the week. Companies that would benefit most from a full reopening of the economy, such as airlines and aircraft part manufacturers, enjoyed strong support at times.

However, higher-valuation growth stocks outperformed lower-priced value companies, extending the 2020 trend. Large-cap companies easily outpaced small-caps, as large information technology firms continued to drive the market’s upward momentum.

SHIFTING MARKET LEADERSHIP

On Monday, news about the Food and Drug Administration’s approval of plasma treatment for COVID-19 patients and the Trump administration’s discussion of fast-tracking a potential vaccine from AstraZeneca and Oxford University led to a jump in stock prices for airlines. Some U.S. airlines saw daily gains of about 10% as investors anticipated a possible recovery in air travel. Boeing and its suppliers also experienced strong gains.

By midweek, the technology and communication services stocks driving the market’s rapid recovery from late-March lows took over leadership as value stocks lagged somewhat. T. Rowe Price traders noted that volume was particularly weak as the peak of summer vacation season had many market participants away from their desks.

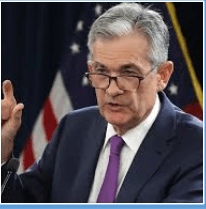

FED TO ADJUST INFLATION TARGETING FRAMEWORK

On Thursday, Federal Reserve Chair Jerome Powell delivered (virtually) a long-anticipated speech at the Kansas City Fed’s Economic Policy Symposium, which is typically held in Jackson Hole, Wyoming, announcing the results of the central bank’s review of its monetary policy framework. Powell said that the Fed will adjust its inflation targeting to allow overshoots of its 2% inflation goal to offset undershoots of the target. This will effectively allow the Fed to keep rates at the current near-zero level for a longer period without raising them to preempt inflation.

The Powell speech did not appear to have a major impact on equities, but it seemed to support stocks that the market sees as riskier, including value companies. Stocks that would benefit the most from a faster economic recovery outperformed on Thursday, when our traders said that volumes were slightly better than earlier in the week.

TREASURY YIELDS CLIMB

U.S. Treasury yields increased, with much of the move coming after Powell’s statements on Thursday. The dovish speech boosted riskier assets at the expense of Treasuries, which investors widely view as a safe haven. (Bond prices and yields move in opposite directions.)

T. Rowe Price’s investment-grade corporate bond traders reported that investor sentiment appeared broadly positive, partly due to the encouraging developments in the race to create a COVID-19 vaccine. However, they noted that trading volumes were low amid modest new issuance. Our high yield traders said that this month has been the busiest August on record in terms of high yield bond issuance. This week’s new deals were met with strong demand, and high yield funds industrywide reported positive flows.

NEGATIVE RETURNS FOR MUNIS

The broad municipal bond market posted negative returns, weakened in part by the increase in Treasury yields and a heavier new issuance calendar. However, munis held up better than Treasuries. Demand was strongest for shorter-maturity municipals, according to the firm’s traders.

| Index | Friday’s Close | Week’s Change | % Change YTD |

| DJIA | 28,653.87 | 723.54 | 0.40% |

| S&P 500 | 3,508.01 | 110.85 | 8.58% |

| Nasdaq Composite | 11,695.63 | 383.83 | 30.35% |

| S&P MidCap 400 | 1,946.51 | 36.22 | -5.65% |

| Russell 2000 | 1,578.34 | 26.57 | -5.40% |

This chart is for illustrative purposes only and does not represent the performance of any specific security. Past performance cannot guarantee future results.

Source of data: Reuters, obtained through Yahoo! Finance and Bloomberg. Closing data as of 4 p.m. ET. The Dow Jones Industrial Average, the Standard & Poor’s 500 Stock Index of blue chip stocks, the Standard & Poor’s MidCap 400 Index, and the Russell 2000 Index are unmanaged indexes representing various segments of the U.S. equity markets by market capitalization. The Nasdaq Composite is an unmanaged index representing the companies traded on the Nasdaq stock exchange and the National Market System. Frank Russell Company (Russell) is the source and owner of the Russell index data contained or reflected in these materials and all trademarks and copyrights related thereto. Russell® is a registered trademark of Russell. Russell is not responsible for the formatting or configuration of these materials or for any inaccuracy in T. Rowe Price Associates’ presentation thereof.

Europe

European shares rose on further economic stimulus in France and Germany, a recommitment by the U.S. and China to their partial trade deal, and signs of progress in the development of treatments for COVID-19. In local currency terms, the pan-European STOXX Europe 600 Index ended the week 1.02% higher, while Germany’s Xetra DAX Index climbed 2.10%, France’s CAC 40 added 2.18%, and Italy’s FTSE MIB rose 0.74%. The UK’s FTSE 100 Index slipped 0.6%.

EUROPEANS REJECT THE RENEWAL OF NATIONAL LOCKDOWNS

Despite renewed surges in coronavirus infections, France, Spain, and Italy appeared to reject the need for nationwide lockdowns to curb what could be a second wave of the pandemic. French Prime Minister Jean Castex said the government would do everything to prevent a nationwide lockdown but warned that some regions might need to be isolated after cases quadrupled over the past month. In Italy, Health Minister Roberto Speranza asserted that the government was optimistic about keeping the situation under control, noting that there were fewer hospitalizations and fatalities. In Spain, Prime Minister Pedro Sanchez appeared to rule out a countrywide lockdown, saying the current outbreak was far from the situation in March and that officials were better prepared and had a better understanding of the virus.

GERMANY EXTENDS JOBS SCHEME, ADDING EUR 10 BILLION

Germany’s ruling coalition extended a program to help keep workers on companies’ books and increased its funding by EUR 10 billion. Additional measures would allow struggling companies to delay insolvency filings until year-end. The German economy contracted at a record rate in the second quarter, although the initial estimate of a quarterly decline of 10.1% in gross domestic product was revised up to a 9.7% contraction.

German business sentiment strengthened for a fourth consecutive month in August, pointing to a strong economic recovery in the third quarter. The Ifo Institute’s business climate index rose to 92.6 from a revised 90.4 in July, beating a consensus estimate of 92.2. Ifo President Clemens Fuest said the German economy was on the “road to recovery.”

FRANCE RECOVERY PLAN COMBINES BUSINESS AID, TAX CUTS

Castex said the planned EUR 100 billion recovery plan to be unveiled on September 3 would support small and medium-sized businesses and include cuts to commercial and industrial property taxes, local value-added taxes, and corporation taxes.

Finance Minister Bruno Le Maire extended the emergency program providing EUR 300 billion in state-guaranteed bank loans to businesses and added EUR 3 billion of guarantees for quasi-equity financing that will provide between EUR 10 billion and EUR 15 billion for small companies.

Japan

Japanese stocks were largely flat for the week as news of Prime Minister Shinzo Abe’s resignation on Friday helped offset earlier gains. The Nikkei 225 Stock Average declined 37 points (-0.16%) and closed at 22,882.65. The benchmark has stalled over the past two weeks after posting gains in the first half of August. The large-cap TOPIX Index finished with slightly positive returns, while the TOPIX Small Index was modestly lower.

ABE’S RESIGNATION UNLIKELY TO RESULT IN CHANGE IN POLICY

Abe, who has been prime minister since December 2012, said he is resigning because of declining health caused by ulcerative colitis, a bowel disease. Abe, who has served longer than any other prime minister in Japanese history, instituted a series of economic reforms during his time in office that were collectively known as Abenomics and were aimed at reinvigorating the Japanese economy.

Aadish Kumar, a T. Rowe Price international economist, does not believe that Abe’s resignation will result in significant changes for Japanese fiscal and monetary policy. “The views of Abe’s potential successors indicate that expansionary fiscal policy is likely to continue given the economic damage from the pandemic,” he said.

Abe’s successor will be chosen by the ruling Liberal Democratic Party (LDP). According to Kumar, the leading candidates include Yoshihide Suga, the chief cabinet secretary; Fumio Kishida, chair of the LDP’s policy research council; and Shigeru Ishiba, a former LDP secretary-general. Although Ishiba has questioned the sustainability of the Bank of Japan’s ultra-loose monetary policy in the past, Kumar believes he would be unlikely to push for change given the potential harm tighter monetary policy could inflict on the economy.

CABINET REPORT NOTES IMPROVEMENT IN EXPORTS

The Cabinet Office left its assessment of the economy unchanged in its latest monthly report, noting that the economy was in “a severe situation” but “showing movements of picking up recently.” In a change from the previous month, the report noted that exports have shown signs of improvement. A separate report showed that core consumer prices in Tokyo declined 0.3% in August compared with the same period last year.

The yield on the 10-year Japanese government bond rose to 0.059%, the highest level since the market disruptions caused by the onset of the coronavirus pandemic in March. The yen was little changed for the week and traded at 105.7 per U.S. dollar on Friday morning.

China

Mainland Chinese stock markets rose for the week. The blue chip CSI 300 Index gained 2.7% and the benchmark Shanghai Composite Index, which gives a significantly larger weighting to state-owned enterprises, added 0.7%. For the year to date, Chinese yuan-denominated A shares have gained about 10% compared with a roughly 8.5% gain for the S&P 500 Index, making them among the best performers in global stock markets.

JULY INDUSTRIAL PROFITS JUMP

The yield on China’s sovereign 10-year bond increased for the week amid further evidence of the strengthening economy. Industrial profits in July surged 19.6% over a year earlier in their fastest year-over-year growth since June 2018. However, cumulative profits for the year to date remain in negative territory. Profits at state-owned enterprises significantly lagged those at private and foreign-owned companies.

In a sign of China’s growing focus on home-grown technology, Beijing reported that basic research and development (R&D) spending climbed 52% in 2019, more than triple the rate for the previous two years. Basic or “pure” research—which is viewed as essential for a country to successfully innovate and to develop more advanced technologies—represented more than 6% of total R&D, which accounted for a record 2.23% of China’s economy last year. In developed countries, basic or pure research averages 15%, suggesting that R&D investment has a long growth runway in China.

In the week starting August 31, investors will focus on evidence that China’s economy is picking up from the coronavirus-induced downturn. Purchasing managers’ indexes for August are expected to remain in expansionary territory as new export orders will likely temper the impact of devastating rain and floods across large parts of the country over the summer. Analysts expect that an improvement in corporate profits may bolster demand and help manufacturers replace depleted inventories and resume capital expenditure plans that were sidelined by the virus. Investors will also look for signs of a recovery in China’s services sector now that COVID-19 has largely been contained.