Kommentar: Teva oppræciserer i Q3 regnskabet de tidligere udmeldte forventningsintervaller fra ledelsens side.

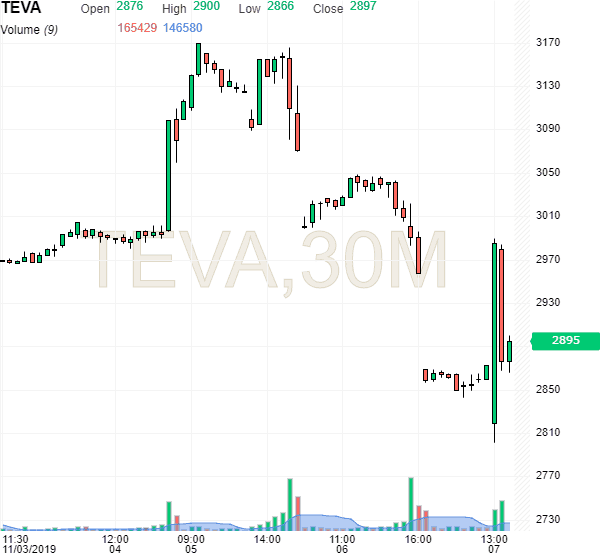

Kursgraf:

fra Teva:

TEVA REPORTS THIRD QUARTER 2019 FINANCIAL RESULTS

Revenues of $4.3 billion

GAAP diluted loss per share of $0.29

Non-GAAP diluted EPS of $0.58

Free cash flow of $551 million

Spend base reduction of $2.9 billion since initiation of the restructuring plan in 2018; ontrack to achieve $3.0 billion by the end of 2019

Full year 2019 business outlook revised to:

o Net revenues of $17.2 – $ 17.4 billion (prior $17.0 – $ 17.4 billion)

o Operating income of $4.0 – $ 4.2 billion (prior $3.8 – $ 4.2 billion)

o EBITDA of $4.5 – $ 4.8 billion (prior $4.4 – $ 4.8 billion)

o EPS of $2.30 – $2.50 (prior $2.20 – $2.50)

o Free cash flow of $1.7 – $2.0 billion (prior $1.6 – $2.0 billion)

Jerusalem, November 7, 2019 – Teva Pharmaceutical Industries Ltd. (NYSE: TEVA, TASE:

TEVA) today reported results for the quarter ended September 30, 2019. Mr. Kåre Schultz, Teva’s President and CEO, said, “During the third quarter, we continued to make significant progress in achieving our 2019 goals. Free cash flow was especially strong in the quarter, totaling $550 million. Our North American generics business continued its steady trend, achieving sales of $914 million, supported by 39 new product launches in the first nine

months of 2019, including generic EpiPen® Jr. Among our branded products, AUSTEDO®

continues to demonstrate consistent growth, and AJOVY® maintained its U.S. market share and is being introduced in the EU.”

Mr. Schultz added: “We remain on track to achieve our two-year restructuring target of a $3 billion spend base reduction. Looking ahead, we are committed to driving long-term shareholder value by maximizing profits from existing core businesses, increasing sales of new brands and products, executing our biosimilar/biologics strategy, delivering manufacturing efficiencies, and generating strong free cash flow for debt repayment.”