Fra Zerohedge:

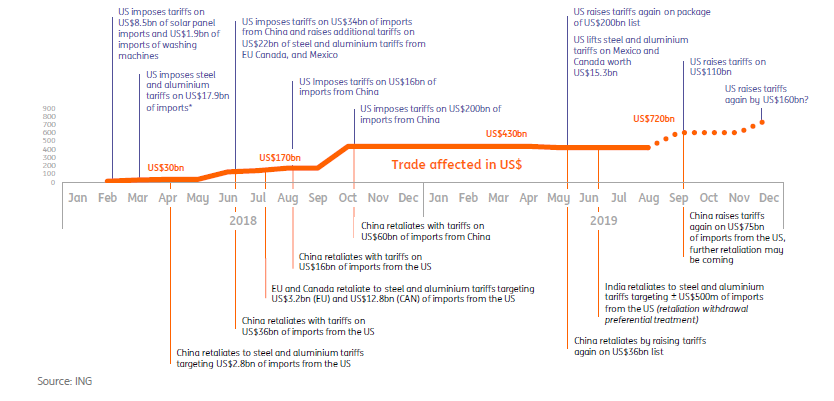

For those confused about what the US and China actually agreed on after months of negotiations and all that confusion in the past few hours, here is the bottom line,from the USTR: “The United States will be maintaining 25 percent tariffs on approximately $250 billion of Chinese imports, along with 7.5 percent tariffs on approximately $120 billion of Chinese imports.”

Furthermore, while not expressly stated in the USTR recap of the “deal”, Trump tweeted earlier that no new tariffs will be imposed on Dec 15, while negotiations over the next, Phase Two, deal begin immediately. As a reminder, since this “deal” includes enforcement over actually complicated issues such as intellectual property theft, it will never be concluded.

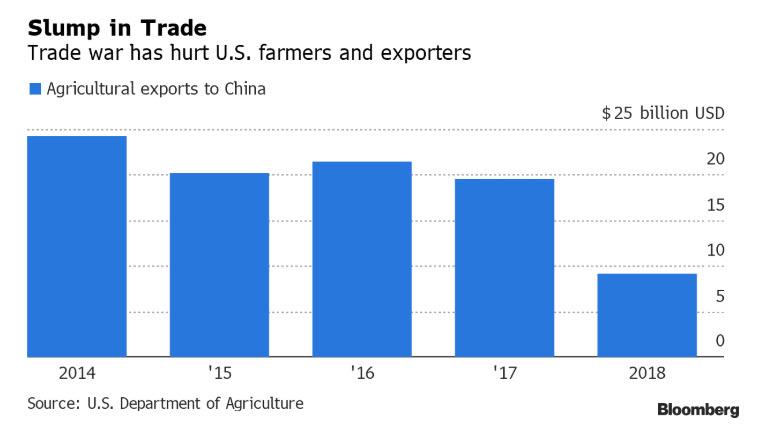

So what does the US get in exchange? It remains unclear – China has promised to buy “more” agri products, but without providing actual details, while saying it plans to import US wheat, rice, and corn within quotas.

- CHINA VICE STATE PLANNER HEAD, ASKED ABOUT COMMITMENT ON U.S. FARM GOODS PURCHASES, SAYS VALUE OF U.S. FARM PURCHASES WILL BE DISCLOSED AT LATER DATE

The USTR also said that The Phase One agreement “includes a commitment by China that it will make substantial additional purchases of U.S. goods and services in the coming years.” However according to some that merely means that it will merely seek to raise its US agri imports back to $20bn, where they were in 2017 and before.

In any case, China did not give any indication of just what it had promised to purchase volume or dollar wise, suggesting there was no explicit agreement on this issue.

Separately, the USTR notes that the Phase One deal “requires structural reforms and other changes to China’s economic and trade regime in the areas of intellectual property, technology transfer, agriculture, financial services, and currency and foreign exchange”, however since there is no actual enforcement mechanism besides merely pushing tariffs back to where they were, none of this will be implemented.

Meanwhile, as Fox Business reporter Edward Lawrence notes, “Chinese say the deal is in 9 chapters.. it deals with protections for intellectual property, but also the forced transfer of technology. The US Trade Representative says there is a dispute mechanism in the Phase One deal.” Of course, those 9 chapters will never be made public.

In short: Trump folded without getting any tangible concessions from China merely to avoid new tariffs, and potentially a market crash. Meanwhile, there are virtually no details what China has agreed to do, and despite the USTR’s insistence to the contrary, there apepars to be no actual enforcement mechanism to make sure China does not reneg on the agreement.

Full USTR statement below:

The United States and China have reached an historic and enforceable agreement on a Phase One trade deal that requires structural reforms and other changes to China’s economic and trade regime in the areas of intellectual property, technology transfer, agriculture, financial services, and currency and foreign exchange. The Phase One agreement also includes a commitment by China that it will make substantial additional purchases of U.S. goods and services in the coming years. Importantly, the agreement establishes a strong dispute resolution system that ensures prompt and effective implementation and enforcement. The United States has agreed to modify its Section 301 tariff actions in a significant way.

“President Trump has focused on concluding a Phase One agreement that achieves meaningful, fully-enforceable structural changes and begins rebalancing the U.S.-China trade relationship. This unprecedented agreement accomplishes those very significant goals and would not have been possible without the President’s strong leadership,” said United States Trade Representative Robert Lighthizer.

“Today’s announcement of a Phase One agreement with China is another significant step forward in advancing President Trump’s economic agenda. Thanks to the President’s leadership, this landmark agreement marks critical progress toward a more balanced trade relationship and a more level playing field for American workers and companies,” said Secretary of the Treasury Steven Mnuchin.

The United States first imposed tariffs on imports from China based on the findings of the Section 301 investigation on China’s acts, policies, and practices related to technology transfer, intellectual property, and innovation. The United States will be maintaining 25 percent tariffs on approximately $250 billion of Chinese imports, along with 7.5 percent tariffs on approximately $120 billion of Chinese imports.

Still confused? Here is the simplest summary from CNBC’s Eunice Yoon:

- there is a phase one deal

- US has agreed to keep promise to cancel tariffs “step by step” (end part of existing tariffs, cancel tariffs to be imposed, expand exemptions)

- China to buy more US goods “without doubt” but on market need (i.e., no target)