Fra Zerohedge:

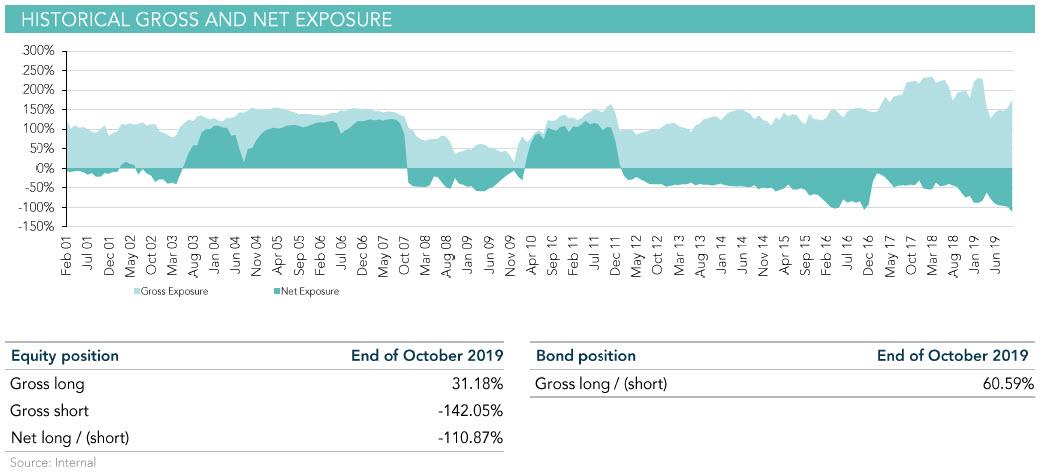

Every trader has heard the age-old saying “don’t fight the Fed”. Everyone, perhaps with one exception: Horseman Global’s CIO, and recently owner, Russell Clark, who has been upping his bearish bets in the face of a relentless liquidity onslaught by the Fed, ECB and PBOC, which now also includes the Fed’s “NOT QE.” In fact, in his ambition to on up the central banks, Clark may have overdone it, because according to his latest investor letter, the fund’s equity net short position is now the highest it has been in history, at a whopping -110.87%, offset by a 60.59% net long in bonds.

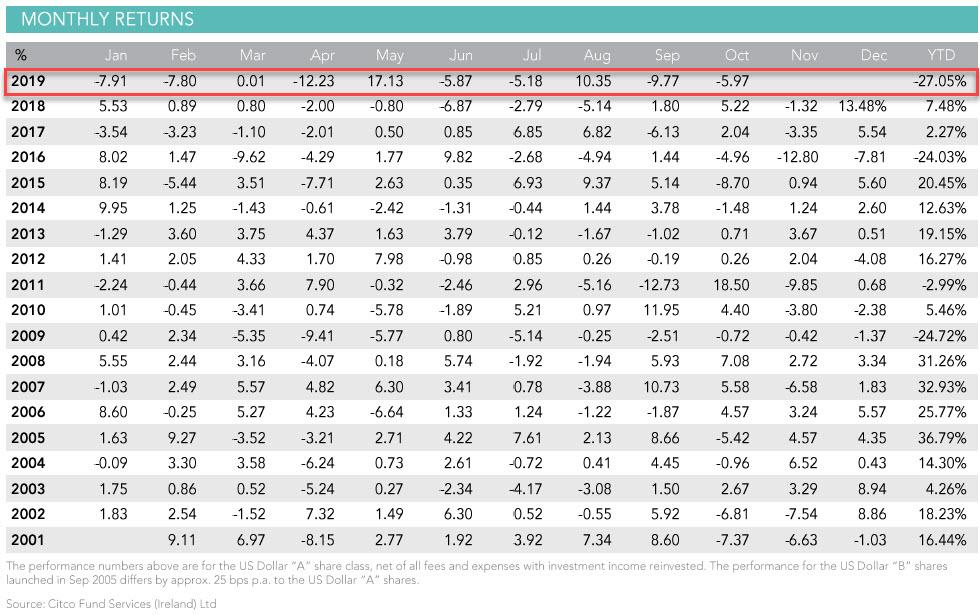

Alas, while we admire Clark’s courage, we have less empathy for the fund’s performance, which has seen better days, and after slumping 6% in October, and losing money on 4 of the past 5 months, is now on pace for its worst year on record, down 27.05% YTD, surpassing the -24.72% return posted in 2009, and reversing all the goodwill the fund created with its 7.5% return last year when most of its peers lost money alongside the S&P500.

… down 75% from the $581 million at the start of the year.

So what is the Hail Mary attempt by the man who this past May told Bloomberg he is “betting it all” on a market crash? While it’s not a new bet, per se, Clark doubles down on his bet against the custodians of market stability, namely clearinghouses, and in his latest letter ties it in to the growing liquidity problems revealed by repo market chaos, to wit: “cash hoarding and repo market problems could be a sign of counterparties beginning to worry about clearinghouses.”

Below we present the main thrust of his October investor letter, for those who wish to if not recreate his trade, then at least follow what may well be Clark’s last ditch attempt at preserving his business… and reputation:

Your fund lost 5.97% in October. I have spent the last month meeting existing investors and prospects explaining why I have such extreme positioning. We have also updated the presentation and provided some more data in recent market views. Most of the presentation is self-explanatory, except for the most important bit about clearinghouses, so I have added more detail below.

Pre-financial crisis, banks and clearinghouses were part of one big and messy system. Banks mainly traded with other banks as it was cheaper, but every now and then they would trade through a clearinghouse. There were two types of trades. Circular trades, which are trades where each bank has a position, but the system has a flat position, and directional trades, where the system would match up buyers who wanted to take a view on future movements of financial markets. Directional trades are more dangerous; risk will be less evenly distributed as it will have no offsetting trades.

When Lehman went bust, LCH, the biggest interest rate derivative clearinghouse, found they only needed one third of the initial margin to cover losses. This encouraged regulators to move clearinghouses to the center of the financial system. However, this has caused two big problems.

Firstly, clearinghouses have no real “skin in the game”. They act like a bookie, that takes bets from punters, and transfers money from winners to losers. But how much risk should they take? What is the correct level of initial margin? Clearinghouses used to piggyback on bank’s risk measures, but without banks to guide them, how should they set risk? Clearing houses and regulators chose to use a backward-looking model, with risks set from market data from between 3 and 10 years in the past. This has caused the markets to have a built-in momentum model which amplifies cycle both ways. Hence, many of the normal trading rules don’t apply. There will be no signs of problems in the market until right at the last moment. Markets are no longer discounting mechanisms and have become more akin to momentum models.

Secondly, banks are now deeply capital constrained, and at the start were very reluctant to move old trades to a centrally cleared model. This problem was resolved through a carrot and stick approach. The stick is uncleared trades carry a capital charge, and the carrot is that the exchanges offer very attractive “netting”. What netting means is that banks can give details of all their trades to a third party, and any circular trades can then be netted off thus requiring less margin. LCH claim to have done a quadrillion of compression trades or netting in the last year, this is more than twice the notional of all outstanding interest rate derivatives.

The problem should be apparent. Clearinghouses were safe because, if there was a problem, the circular trades netted off on settlement. But by aggressively netting off at the margin stage they are no longer as safe. In fact they are very risky. This was highlighted by the near failure of a small clearinghouse in Europe last year. Using BIS data on the penetration of central clearing, and pricing of interest rate derivatives as a proxy of initial margins, I would say that initial margin in the system needs to rise by about 6 times to make the system “safe”. Looking at previous periods of rising initial margins in 2000-2002 and 2007-2009, the pro-cyclicality of claringhouses should be obvious.

The simplest analysis is that if we saw other market participants were getting positioned for problems with clearinghouses, then we should be bearish too. We are seeing that. Long dated volatility, which we proxy as UX8 (8m VIX future) is rising, and is now at a near record high spread to VIX. Secondly, we should begin to see high quality government bonds outperforming all asset classes, something that has been occurring on and off over the last year. Finally, cash hoarding and repo market problems could be a sign of counterparties beginning to worry about clearinghouses.

If initial margins rise significantly, the only assets that will see a bid will be cash, US treasuries, JGBs, Bunds, Yen and Swiss Franc. Everything else will likely face selling pressure. If a major clearinghouse should fail due to two counterparties failing, then many centrally cleared hedges will also fail. If this happens, you will not receive the cash from your bearish hedge, as the counterparty has gone bust, and the clearinghouse needs to pay from its own capital or even get be recapitalised itself. One way to think about it is that the financial crisis only metastasized when MG failed, because at that point, everyone suddenly became un-hedged, and everyone needed to sell.

The big problem is when to put this trade on. I am looking at four different indicators that are mentioned in the presentation: the relative performance of bonds vs equities, the dividend futures derivatives, the returns to put writing strategies, and the 8m VIX futures. If these indicators change then I change, but for the moment we remain short equities long bonds.

We wish the best of luck to Russell, who is not only fighting clearinghouses, but by extension, the very central banks whose continued existence depends on sustaining the viability of market clearing, as without clearinghouses, the market will freeze permanently and nobody will be able to trade in or out of positions.

Sadly, for Clark and his paltry $150 million in remaining AUM, we don’t think he will be there to enjoy it from a professional capacity.