Fra ECRI:

A Nasty, Short and Bitter Recession

With the coronavirus pandemic slamming the economy into a severe recession, it’s natural to try to see the light at the end of the tunnel – and imagine the shape of the recovery. Yet, that revival will depend critically on the nature and intensity of this recession.

A recession’s severity is measured by its depth, diffusion and duration, or what we call the 3Ds. In terms of depth, this recession looks extreme, and will likely be the deepest in living memory. It’s also exceptionally widespread in terms of industries affected, so in terms of diffusion, as well, it’s a severe recession.

Regarding duration, though, this recession still could end up on the short side. In fact, there’s reason to believe it’ll be much shorter than the 2007-09 Great Recession, which dragged on for 18 months.

Here’s why we believe that this recession will be extremely deep, very broad, but relatively brief. By mid-year, we’ll have seen a huge plunge in economic activity forced by medically mandated shutdowns and widespread job losses cascading through the economy.

But if those shutdowns start ebbing by summertime, the economy will then begin reviving, albeit slowly and partially. As a result, the level of economic activity – in terms of output, employment, income and sales – will necessarily rise above the lows seen during the worst of the closures. By definition, when such economic activity starts to increase on a sustained basis – even slowly from a low base – the recession will have ended. So it’s plausible that this recession could last about a half-year, rather than the one and a half years we endured during the Great Recession.

Let’s be clear. When this recession ends, the jobless rate will still be very high, and it certainly won’t feel like a recovery. Millions of formerly employed people will still be without jobs and incomes, so sales would still be pretty weak, meaning there wouldn’t be enough demand for production to really ramp up.

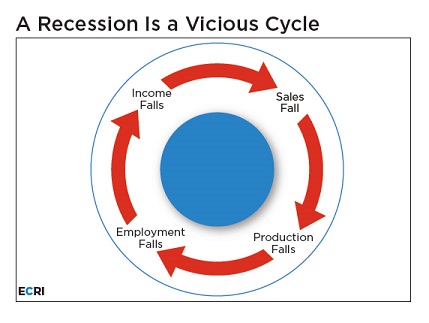

A recession is really a specific sort of vicious cycle, in which falling output triggers job losses, declining incomes, and sliding sales, which, in turn, feeds back into further declines in output. It’s when this vicious cycle ends, and switches to a virtuous cycle of self-feeding increases in output, employment, income and sales, that a recession is officially over. We believe that the end of the compulsory closures can jump-start this virtuous cycle in relatively short order.

That isn’t to say that this eventual upturn is already in sight. Some might assume that this is a normal – though deep – economic valley, with steep mountains going up on the other side. However, this isn’t a recession where we can simply look across that valley, because we’re trying to look through the fog of pandemic.

We will start to see that recovery in due course, and it could be relatively soon. But this revival may be very different from the historical norm.

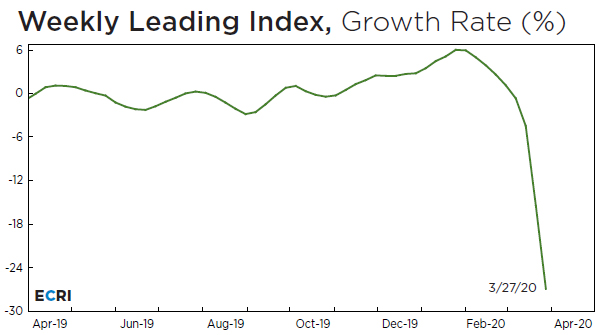

Some answers will come from ECRI’s publicly available Weekly Leading Index (WLI), already available through March. But right now, the WLI is in free fall.

ECRI U.S. Weekly Leading Index dropped to 106.0. Meanwhile its growth rate plummeted to -26.9%. Read more and freely download WLI data here: https://bit.ly/2xOnqDi

With the WLI plunging for nine weeks – since the week ending January 24th – a recessionary window of vulnerability was violently thrown open. So, given the shock of the pandemic, there’s no question that a recession is underway.

The nine-week drop in the WLI is more pronounced than anything we’ve ever seen at this stage of a recession. It’s literally off the charts. It’s more pervasive than average, and about as persistent as it’s been at this stage of past WLI downturns.

For perspective, it’s helpful to look at a chart of WLI growth going back half a century. It looks like WLI growth has just fallen off a cliff, not having been this low since the immediate aftermath of the Lehman Brothers collapse.

Historically, the vigor of a recovery – at least in its first year – has been proportional to the depth of the preceding recession. But this time around, a sustained “V” shaped recovery is improbable.

Sure, it might start with a little bit of a “V” as existing businesses get employees back to work. But so many small and medium size firms are going out of business that it might actually require rebuilding rather than restarting business relationships to really get things going. In any case, people may not be so eager to get out there to restaurants and entertainment venues and mingle – not until they feel safe. That could take a while, and will hamper the services side of the economy.

In order to feel safe after such a deeply traumatic experience, people have to feel confident about their safety. They’ll venture out only when health officials can credibly assure them that the pandemic has been contained, and that a vaccine or, at least, a therapeutic drug – whether a prophylactic or a treatment – is available. Indeed, while we all appreciate the urgency of reopening the economy, saving lives is a precondition for saving livelihoods.

After we restart the economy’s engines, it will pull out of its nosedive. But without all engines firing, it won’t be a steep climb back up.

The key takeaway from our cyclical research is that this could very well be a slow, halting recovery from a severe economic contraction, but it shouldn’t take as long to arrive as the end of the Great Recession. Meanwhile, we’ll keep our eyes peeled for its advent with the aid of high-frequency leading indicators, like the Weekly Leading Index.