Fra Zerohedge/ Goldman /

Trading stocks (or even fractions of stocks) is so 2019: 2020 is all about options.

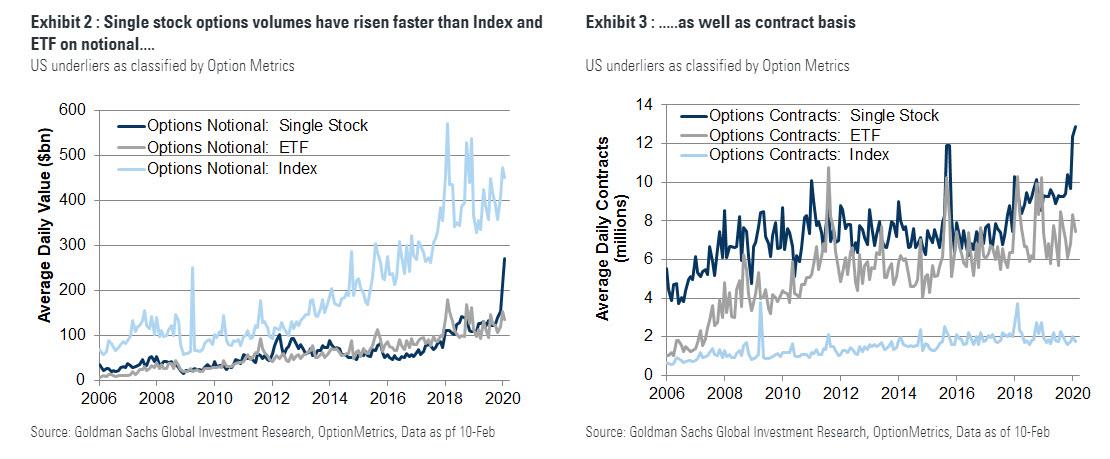

With prices of underlying securities soaring to never before seen levels and market momentum back if only for a handful of megatech stocks, investors have decided that the best way to get rich quick is by splurging on options and hoping the trend (higher) continues. Indeed, as Goldman’s Vihsal Vivek writes this morning, single stock options volumes have risen to record highs in February as the average daily notional traded on options in US stocks surging 27% MoM, up another 77% in the past 6 weeks and 2.0x the trailing 12-month average.

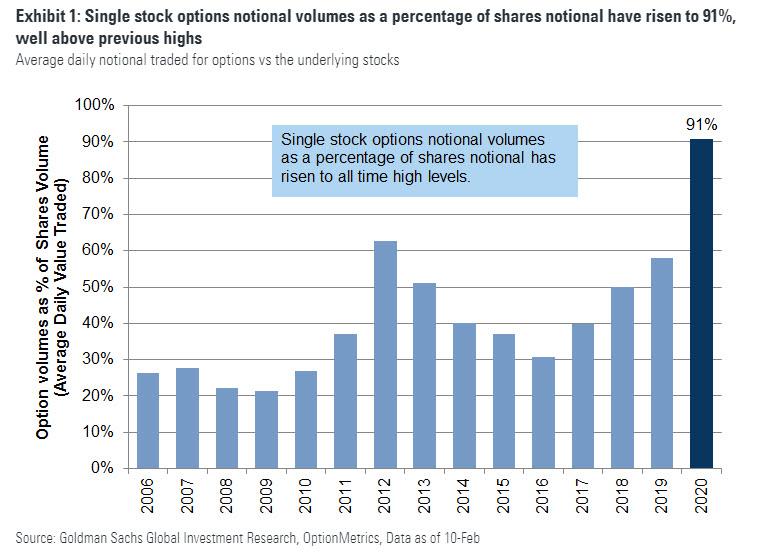

Remarkably, growth in options volumes has exceeded growth in shares notional, which has itself grown 13% MoM and 1.3x relative to the trailing 12-months. Based on average daily value traded YTD, single stock options notional volumes have been so staggering that they have almost caught up with volume in the underlying, rising to as high as 91% of shares notional, the highest level relative to the past 14 years.

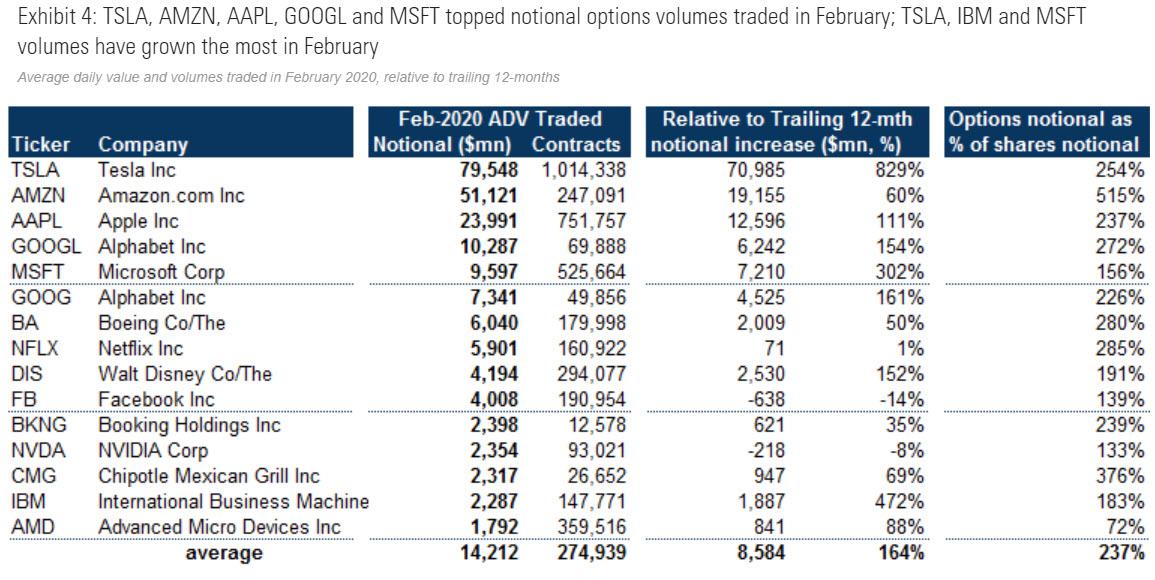

The recent surge in option trading is driven by a handful of underliers including TSLA, AMZN, AAPL, GOOGL, MSFT, DIS and IBM, precisely the stocks that have seen a dramatic increase in prices which suggests that a familiar gamma positive feedback loop has emerged, and as clients buy call options, dealers end up long gamma, resulting in a further lift to the prices, which in turn leads to more call buying, and so on.

As shown below, among the top 15 underliers with high notional volumes, TSLA, IBM and MSFT saw the biggest jump relative to the prior 12-months.

However, as the recent furor over Tesla has died down in recent days, Bloomberg notes that trading in calls on Microsoft has exploded, with the five-day sum of activity jumping to its highest level in years, although judging by the trend reversal in the past two days, the army of call-buying momentum chasers may now move on to yet another megatech name.

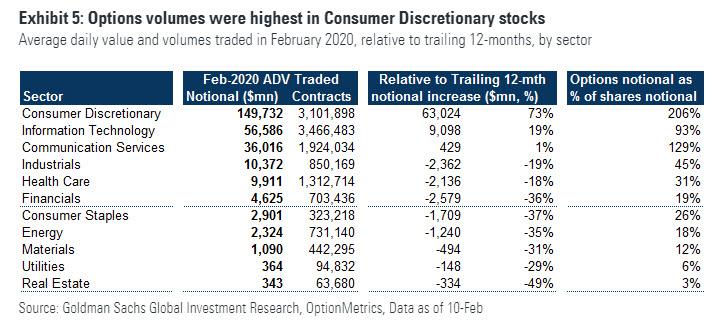

Besides the select tech names, consumer discretionary stocks have been the biggest driver of higher options volumes according to Goldman calculations, with a 73% increase over the trailing 12-months. Options volumes in Information Technology and Communication Services stocks are up 19% and 1%, respectively. Stocks in each of the remaining sectors have broadly traded fewer options in February relative to recent history.

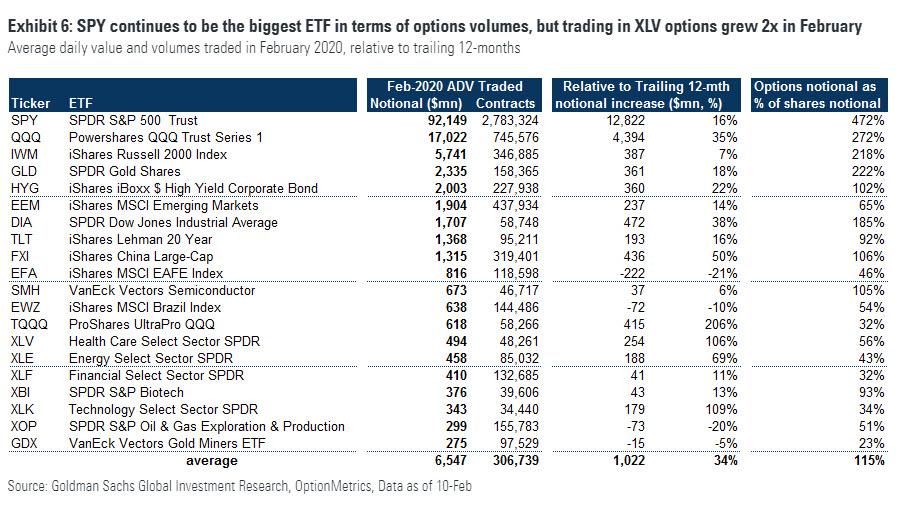

It’s not just single stocks though, as index and ETF options volumes are also near record highs, although unlike the handful of tech stocks these have note seen outsized growth in recent weeks.

And while SPY continues to dominate ETF options volumes, sector ETFs have also increasingly been in focus this past month. Volumes in XLV and XLK options increased 2x in February, relative to history. Investors also increased exposure to Energy and China using the XLE (+69%) and FXI (+50%) options.

The “gamma” kick provided from call trading which as noted above created a positive feedback loop, as more call buying leads to higher prices, lead to even more call buying, etc., has led to a bizarre market outcome, one where just the 4 super-cap names are more than two-thirds of the market’s YTD return: Microsoft accounts for 28% of the S&P’s gains this year, Apple is 15%, Amazon 13%, and Google 11%.

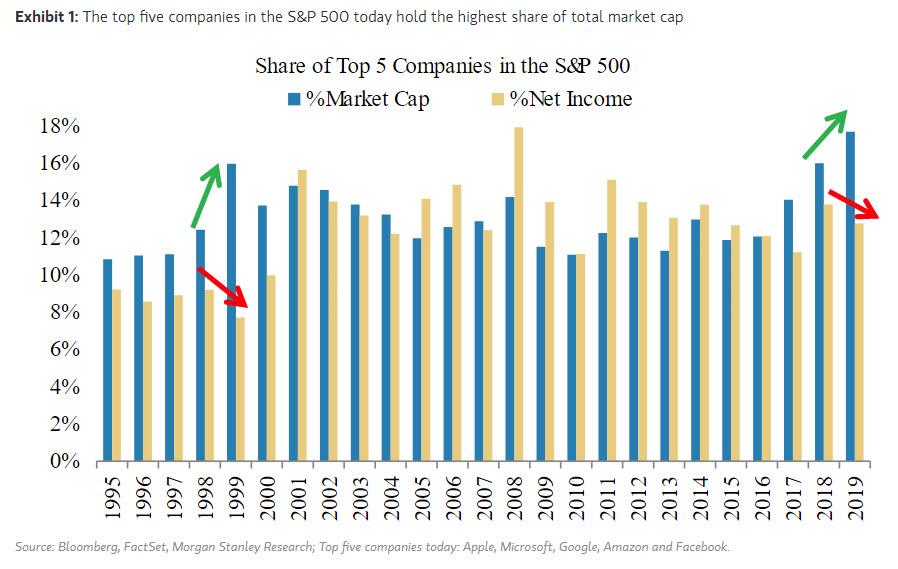

A recent analysis from Morgan Stanley found that as the market bifurcates into the Top 5 megacap companies and “everyone else”, the top five companies in the S&P 500 (the “other 1 percenters”) now make up a record 18% of the total market cap, even as their net income actually shrank in 2019 compared to 2018.

As Bloomberg notes, the top tech giants have rarely dominated the S&P 500 to such an extent. A sector index is up 9.6% just six weeks into the year, despite fears over the impact of the deadly coronavirus on global growth. Tesla has gained a whopping 85%, with Microsoft up 17% and Amazon advancing 16%.