Fra Zerohedge:

Uddrag fra traders kommentar:

“Today is one of the most bizarre days in the stock market I can remember and that’s saying a lot…”

—————————-

The S&P 500’s P/E multiple just broke above the all-time highs from the dotcom bubble…

Source: Bloomberg

As the S&P 500 reaches a critical resistance level…

Source: Bloomberg

And the record surge higher in stocks is occurring as liquidity crashes to record lows…

Source: Bloomberg

Nasdaq from +1.3% to -1% to +1.0% – Composite broke above 12,000 today. The Dow and S&P massively outperformed today with a massive panic-bid all afternoon…

AAPL was down $170BN today, more than an ‘Exxon’…

TSLA tanked for the second day in a row…

After the carmaker became more valuable than 18 other automakers in the U.S., western Europe and Japan combined…

Source: Bloomberg

Bonds were mixed today with the long-end bid and shorter-end (out to 5Y) flat, but this has erased the entire post-Powell “inflation is coming, inflation is coming” speech spike in yields…

Source: Bloomberg

So much for the end of the bond bull market…

Source: Bloomberg

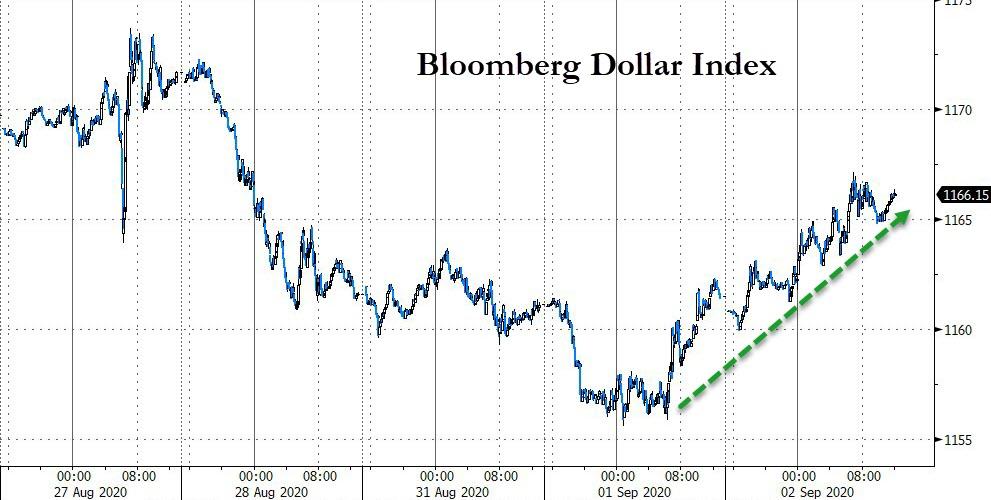

The dollar rallied today, extending yesterday afternoon’s surge…

Source: Bloomberg

The Ruble tumbled after German claims that “worst military grade nerve agent ever” was used to poison Navalny…

Source: Bloomberg

Bitcoin was rejected at $12k again…

Source: Bloomberg

And Ethereum could not quite make it to $500…

Source: Bloomberg

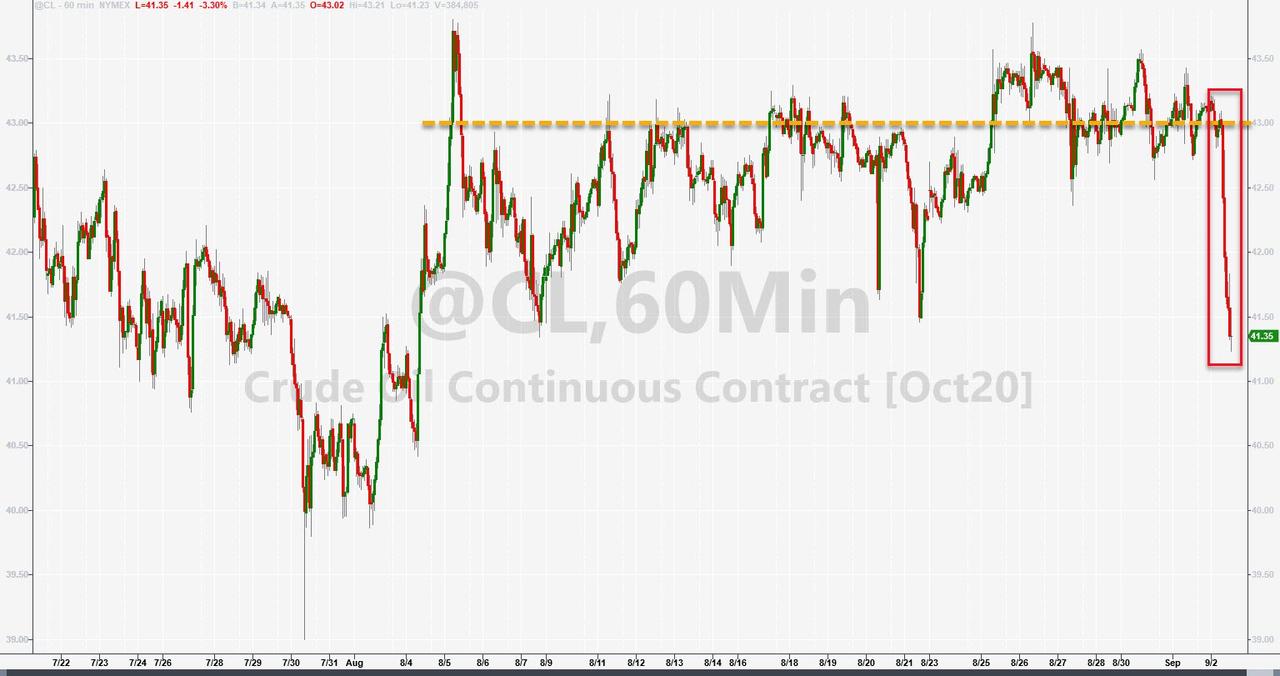

Oil plunged today rejected at $43 once again (on Russia production and Nalvany headlines)…

Dollar’s gains took the shine off gold today…

Real yields continue to suggest gold goes higher…

Source: Bloomberg

Silver futures too, having tagged $29…

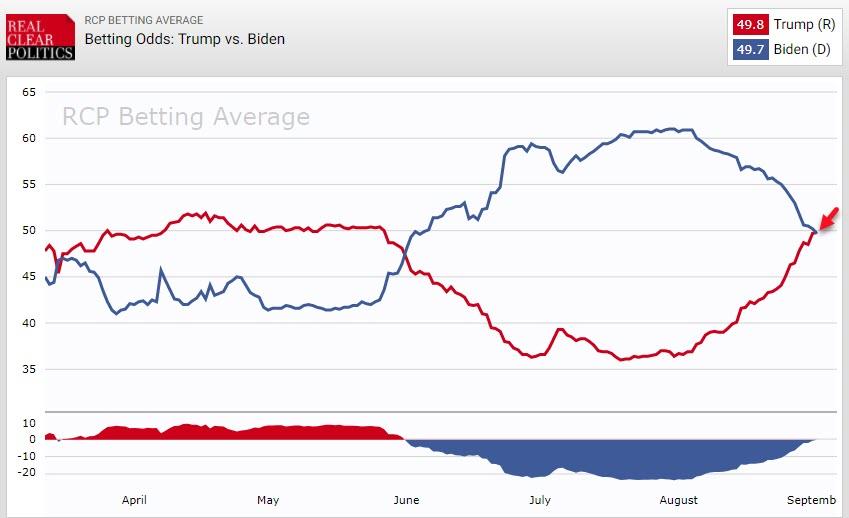

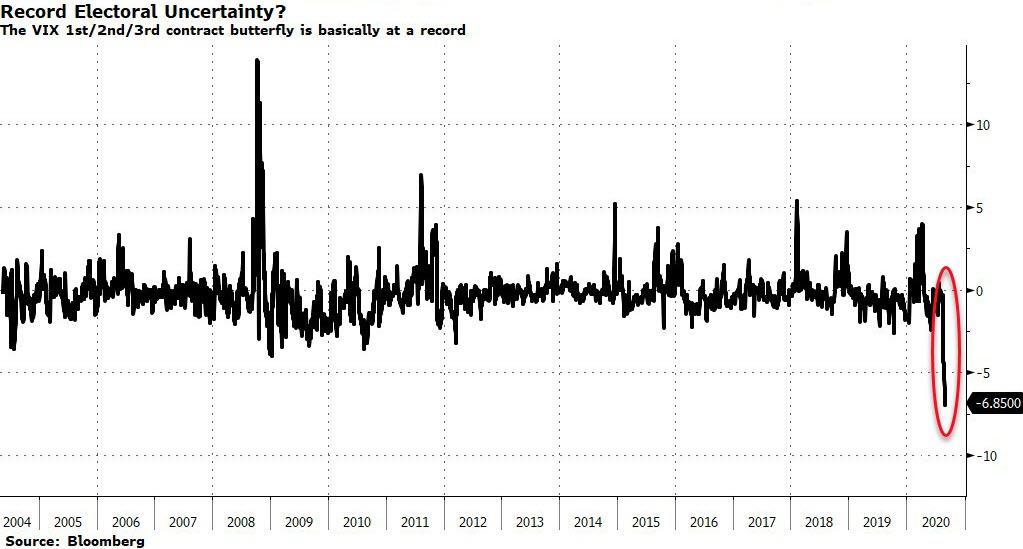

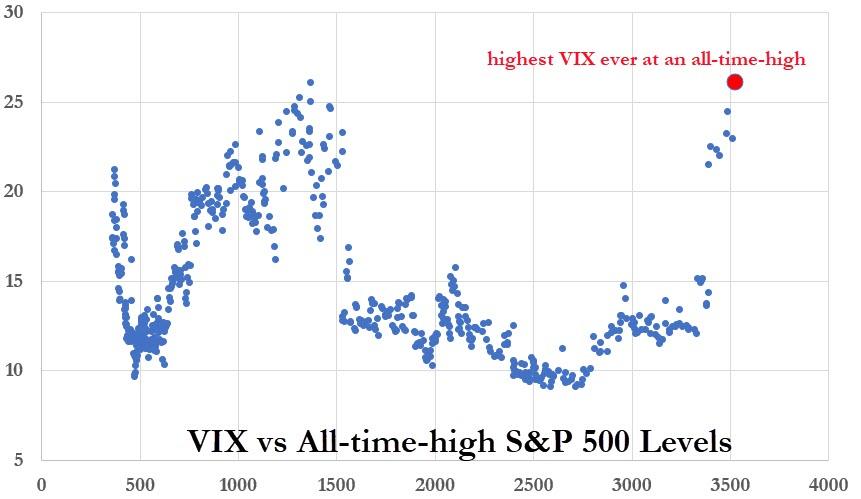

Finally, uncertainty around the forthcoming election has never been so extremely priced into vol markets. With betting markets now seeing Trump back in the lead over Biden…

The volatility curve is pricing is massive relative and sudden risk around the election period…

Source: Bloomberg

As Bloomberg macro strategist Cameron Crise notes, “in the history of the VIX futures contracts, we’ve never had an event risk command this sort of premium into forward-dated vol at a specific tenor.”

“That obviously suggests that markets anticipate some pretty incredible fireworks.”

The spread between October and November VIX futures is also wide at about -1.7 instead of about 0.2, which history suggests it should be based on the level of the spot VIX, according to Crise. Of course, none of this vol disturbance has held back stocks.

Source: Bloomberg

Today’s all-time-high in the S&P 500 was accompanied by the highest level ever for VIX at an all-time high stock print…

Source: Bloomberg

But we give the last words to Liberty Blitzkrieg’s Mike Krieger:

“Today is one of the most bizarre days in the stock market I can remember and that’s saying a lot…”

We’d say that about sums things up in general everyday!