Fra Zerohedge:

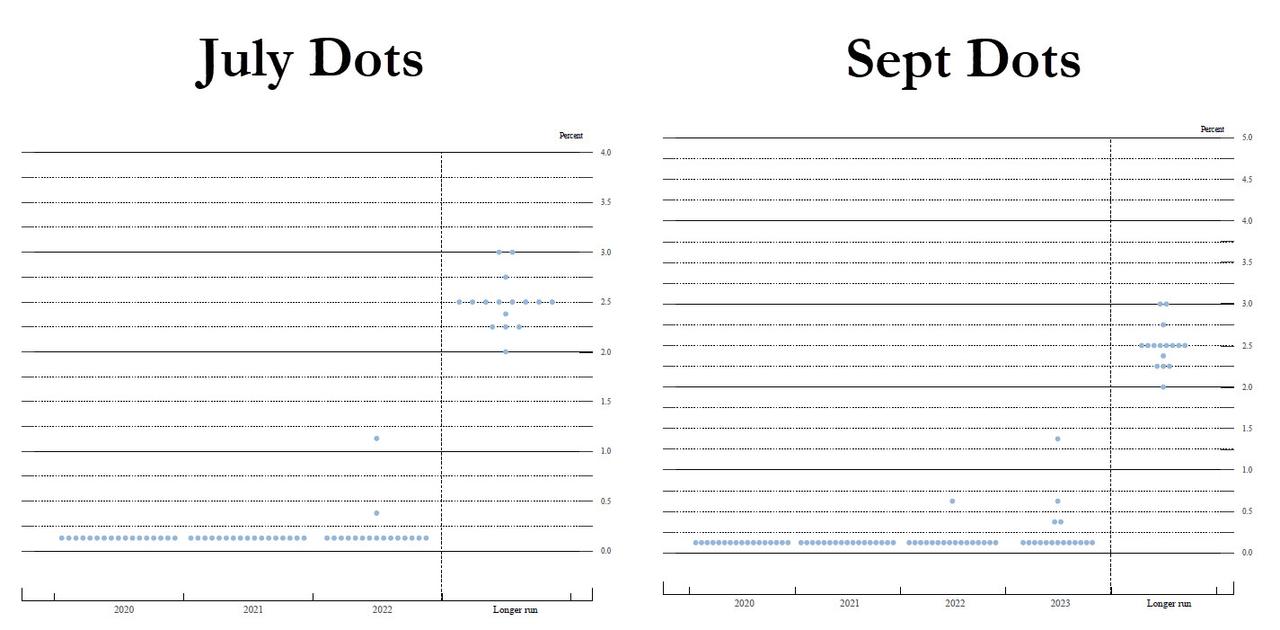

In late August, the Fed unveiled its new flexible Average Inflation Targeting (fAIT) paradigm which while still lacking strict forward guidance and operational parameters (what is the target inflation? what is the lookback period? how long will the overshoot last) means that – according to the latest FOMC projections – the Fed expects rates to be at zero at least until 2023.

There is just one problem (well technically two): for the Fed’s AIT scheme to work, inflation will have to be low enough to where even if it rises above the 2% long-term target, the overshoot will be manageable and won’t take place for a while. However, it now appears that even official readings of both goods and wage inflation, are starting to creep up substantially and could jeopardize the Fed’s inflation overshoot target as soon as 2021.

First, a brief refresher on what the Fed has said regarding AIT – here, as Nordea’s Andreas Steno Larsen writes, there has been a purposeful lack of clarity from Jay Powell although less profiled members of the FOMC committee have been much clearer in their communication: for example Robert Kaplan has saide he could support a hike “if inflation hits 2.275-2.350%”, while uber-dorve Kashkari has suggested that interest rates are kept at current levels until inflation “breaks above 2% in 12 consecutive months.” Most notably, perhaps, Chicago Fed’s Evans – also a dove – hinted last week that a rate hike could potentially come into play before 2% is breached, if the Fed was comfortable enough with the inflation outlook.

The problem emerges that depending on where one looks, one can make the argument that much of what US consumers are spending money on is seeing price increases that are already at – if not above – the Fed’s inflation overshoot targets.

Nobody has made that point better than the WSJ, which over the weekend wrote that “Inflation Is Already Here—For the Stuff You Actually Want to Buy.”

As the WSJ’s James Mackintosh writes, “if it feels like the price of everything you buy has been soaring, that’s because it has—even as central bankers everywhere worry about the danger of deflation.” He then points out to the “massive gap” between everyday experience and the annual inflation rate of 1.3%, and notes that “the price of the stuff we’re buying is rising much faster, while the stuff we’re no longer buying has been falling, but still counts for the figures.”

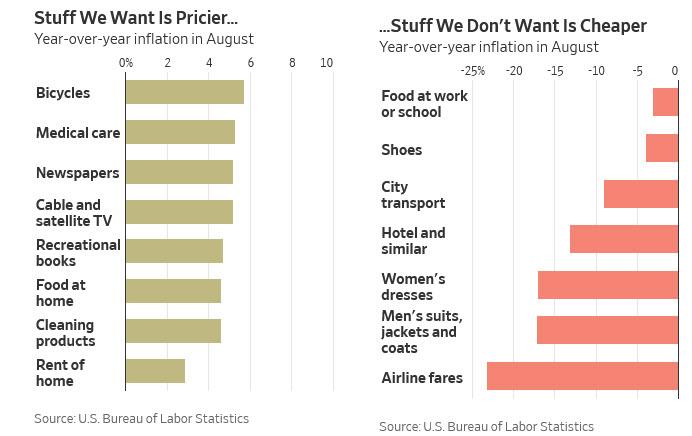

Which makes sense, of course: after all with more demand for a given good or service, the price will jump and vice versa. And as the data reveals, in this post-covid, “work-from-home” age, annual inflation for certain products is now solidly overshooting the Fed’s targets:

Start with the cost of food at home, where so many Americans have been spending their time, and which was up 4.6% in August compared with a year earlier, the biggest rise in almost a decade. In deserted workplace and school cafeterias, food is 3% cheaper.

While food prices are traditionally volatile, the same pattern emerges for many things sensitive to us sitting at home on Zoom. Few home workers need a new suit or dress (down 17%), makeup (down 3%), hotel room (down 13%) or air ticket (down 23%). At the same, the following activities have led to sharp price increases: sitting at home in your pajamas (men’s nightwear is up 4%), cycling (bikes up 6%), reading for pleasure (books up 4%, newspapers up 5%) and making things (sewing machines and fabric up 9%, cameras up 4%). Medical care is in demand (up 5%), while higher education is much less attractive (tuition fees up 1.3%, the lowest since data started in the late 1970s).

The swings in buying habits have also accentuated a core aspect of the current inflation/deflation debate: namely, how inflation is officiallymeasured, with an emphasis on the difference between the consumer-price index (CPI) and the personal-consumption-expenditures price index (PCE). As the WSJ reminds us, CPI captures the headlines and determines the return on inflation-linked Treasurys, or TIPS. The Federal Reserve uses PCE—and the two diverged over the summer.

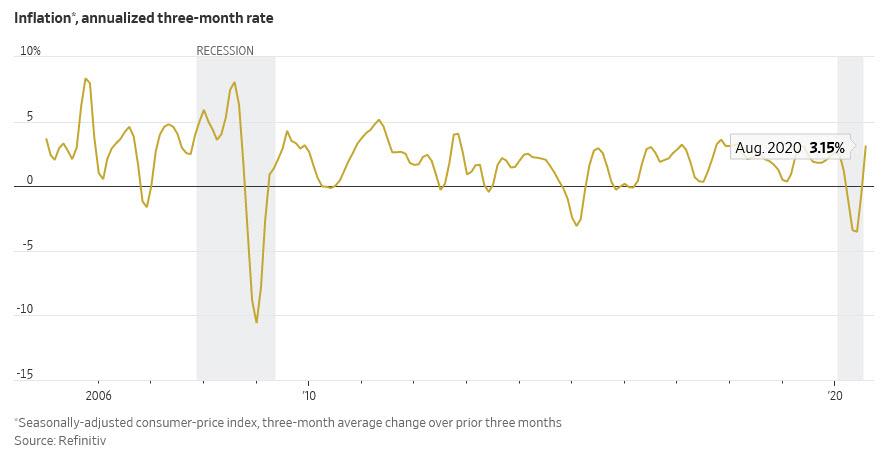

CPI is assessed based on spending patterns from a couple of years ago, while PCE recalculates spending every month. The latest PCE data is only through July, but showed prices rebounded, rising 0.4% over three months compared with the prior three months, on an annualized basis. CPI was still showing prices falling on that basis, although in August the reopening of the economy pushed three-month annualized CPI inflation above 3%.

The PCE will be even higher for August Mackintosh writes, given its calculation method.

Another reason why prices have spiked in recent months is that the pandemic provided inflationary pressure by restricting supply, so when demand rose — for example for eating out as the lockdown eased — prices rose sharply. And because Covid-19 has intensified the U.S.-China trade war and the trend toward deglobalization, supply could be constrained for a long time as existing global supply chains are uprooted.

Still, most economists are confident that the prevailing price forces over the next 1-2 years are mostly deflationary, largely due to the massive layoffs which have crushed wages and continued social distancing.

“In the short term the demand shock prevails, so we will have subdued prices for the next 12 to 18 months,” says Luigi Speranza, chief global economist at BNP Paribas. Lingering effects from the pandemic could mean less need for travel and tourism workers for years, while those who have been unemployed lose skills.

Others are more worried about the deflationary side-effects of upcoming macro transformations, especially how a wave of delinquencies and defaults across commercial property will lead to widespread – and deflationary – debt-destruction as many workers leave to find new roles.

Many of these concerns will be laid to rest if and when Congress agrees on a fifth fiscal stimulus – once Pelosi and McConnell agree on another $1.5-$2 trillion in stimulus and is handed out to US consumers, this summer’s price rises could continue and become a serious worry for investors. Alternatively, if the second wave of Covid-19 is followed by a third, heavy job losses and renewed recession would threaten demand and thus prices again. In Europe, the three-month inflation rate fell back to exactly zero in August as a second wave hit Spain and France.

The bottom line is that while many debate what happens next, the current reality is stark: surging prices for things Americans needs, offset by declining prices for things they don’t. This, according to the Fed, washes out and does not merit tighter financial conditions, even though for the average American on Main Street, the ongoing price spike has proven to be especially painful.

* * *

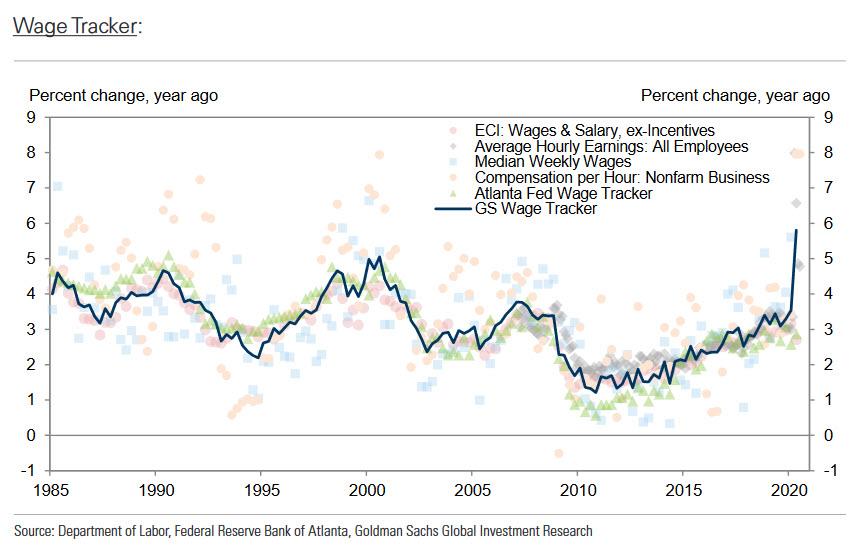

And then there is another problem: whereas the Fed – and most economists – are convinced that due to massive recent layoffs and the growing slack in the labor force, wages will not rise for a long, long time, a real-time measurement of wage growth as reflected in the Goldman Sachs weekly Wage Tracker, which tracks a universe of wage metrics including the ECI wages and salary data, the BLS’s average hourly earnings, hourly compensation and the Atlanta Fed Wage Tracker – reveals the highest print on record!

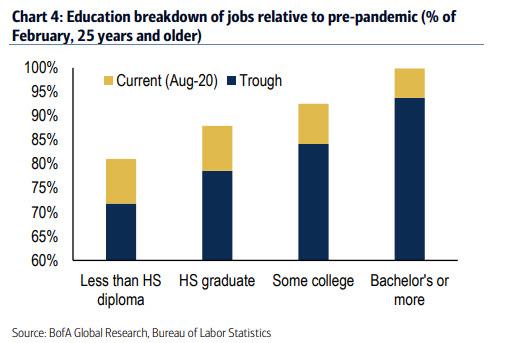

To be sure, much of this is due to the government transfer payments exploding and a creeping experiment in Universal Basic Income, but it is safe to say that one way or another, generous government handouts to America’s poorest will continue into the next administration unless either Trump or Biden want daily riots. But the bottom line is that between the massive government stimulus and organic demand for skilled, highly-employed workers, which has already normalized to pre-covid levels…

… the Fed may soon be shocked at how quickly wages inflation returns, in addition to the runaway inflation for “things Americans need” discussed above.

In short, absent a double-dip recession or a sharp economic contraction, inflation – especially its most benign and welcome form – employee wages, may already be more than double the Fed’s AIT target. If sustained this leaves three options: i) the Fed will hike rates far sooner than 2023, ii) the definition of hourly wages and prices will be revised in a way to make them appear smaller (just ask Japan with its 10 different CPI trackers, how effective that is), or iii) the Fed will merely move the goalposts and change its AIT framework, saying it won’t hike until inflation hits 3%, 4%, 5% or more…

For now, however, both prices (for things US consumers actually need) and wages (for those Americans who have a job) are rising fast and that will create a lot of headaches for the Fed in the coming months.