Fra Zerohedge/ WSJ

Following chatter earlier this morning, a WSJ report claiming that the White House and China had agreed to delay a planned tariff hike scheduled for Sunday sent equity futures soaring.

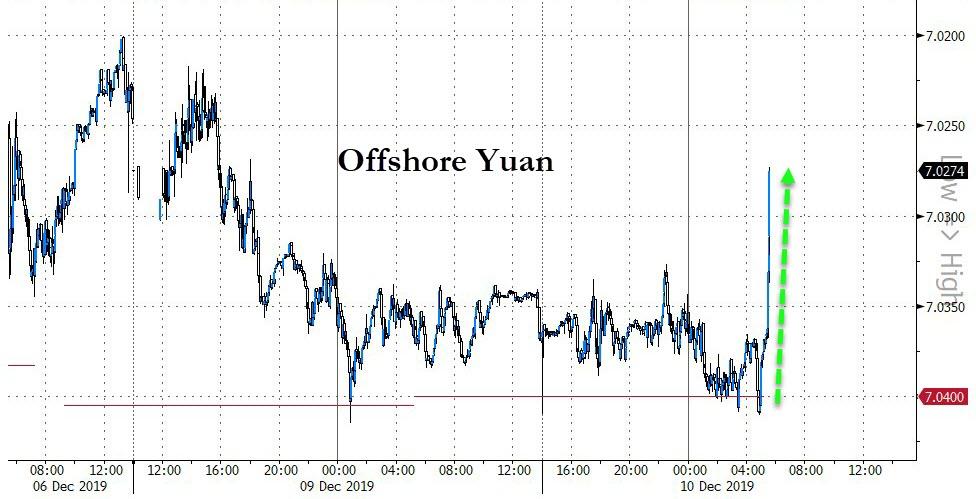

The yuan, a popular gauge of trade-deal sentiment, also rallied on the report.

As 2019 comes to a close, the Trump Administration is shifting its focus to working with Mexico, Canada and Nancy Pelosi (despite all the furor around impeachment) to pass USMCA (Nafta 2.0). But although negotiations with China will be put on hold temporarily, a mini-deal to delay the next round of US tariffs from taking effect on Dec. 15 is still possible, according to a report by SCMP.

Meanwhile, on Monday, Secretary of Agriculture Sonny Perdue said the US likely won’t move ahead with imposing new tariffs on a $160 billion swath of Chinese goods, including toys and smartphones, on Sunday, and that talks are progressing on the subject of IP.

Additionally, Commerce Secretary Wilbur Ross told Fox Business that American and Chinese negotiators are working “around the clock” on a deal, but added that it’s more important to win a good deal for the US than to put off the tariffs set to take effect on Sunday. Ross added that the Phase One deal would focus on agriculture and trade. On the other hand, Ross said the US is “within millimeters” of winning a deal on USMCA.