Uddrag fra Bank og America/harnett:

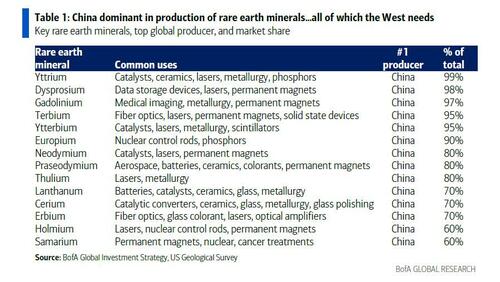

for all the jawboning, the US is unlikely to go full-bore China trade war, which “would be a big political misstep for Trump” as it would “allow 2nd wave of inflation, and meanwhile China is less reliant on exports to the US, which are down to just 2.8% of China GDP today vs. 7.2% in ’07” and furthermore “neither side is likely to pursue “MAD” tech war because while US and allies control >90% of global semiconductor manufacturing, China extracts 60% and processes 85% of world’s rare earth minerals”

So fast forward to today when in his latest weekly Flow Show (also available to pro subs) in which Hartnett doubles and says that the “hot 3% US CPI in January was a “blessing-in-disguise” for bonds & stocks” as the rising inflation means “Trump must go “small” not “big” on tariffs & immigration in coming months to avoid fanning 2nd wave of inflation.” Which means that according to Hartnett, Trump is playing 4D chess, which may be a stretch but who knows.

So assuming Trump is thinking 5 steps ahead, Hartnett – who last week explained why he is long BIG (Bonds, International, Gold) – doubled down saying that 5% was “a multi-year top for 30-year Treasury yield” as the impact of inflation, tariffs, immigration (big or small) will be more negative than positive for US consumers & labor market H1’25 (a point he first made last June). That said, he notes that catalysts for a dramatic H1 move lower in bond yields below 4% are scarce, due to…

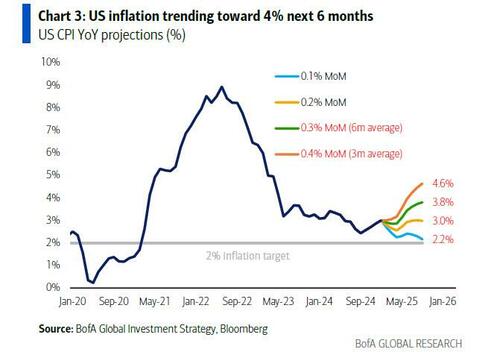

- Fed: CPI has averaged 0.3-0.4% monthly gains past 3-6 months…US CPI YoY trending toward 4% next 6 months. Wall Street knows Fed’s monetary policy asymmetric (they cut faster than they hike), and Fed lacks inflation-credibility (since Fed introduced it’s 2% FAIT flexible average inflation target in Aug’20 the US CPI has averaged 4.3%);

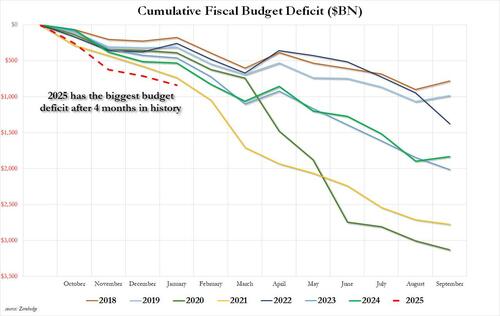

- US government: in the past 4 months US budget deficit jumped 25% YoY to record $840bn as government spending rose 15% YoY to $7.1tn…

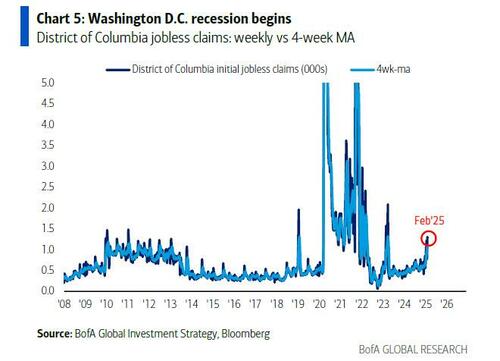

- …almost certain Congress will pursue two reconciliation bills rather than one to pass budget, which lowers probability of big spending cuts in defense (and potentially waters down tax cuts); Washington D.C. recession beginning (see spike in D.C. initial jobless claims), but sub-4% US Treasury yield requires bigger evidence US government getting smaller.

Going down the list, the last BIG letter, G for gold, needs no explanation as it simply keeps rising every single day, and hit a record high well above $2,900 on Friday only to ease back modestly on rumors of an imminent Ukraine ceasefire (spoiler alert: not happening), meanwhile the delivery requests at Comex gold vaults are now literally off the charts.

Which brings us to International.

Here, Hartnett argues that like bonds, international stocks have been shunned by asset allocators in 2020s (past 5 years fund flows to US equities…$1.3tn vs. $0.2tn to Rest-of-World); meanwhile the BofA CIO is long international in ’25 because…

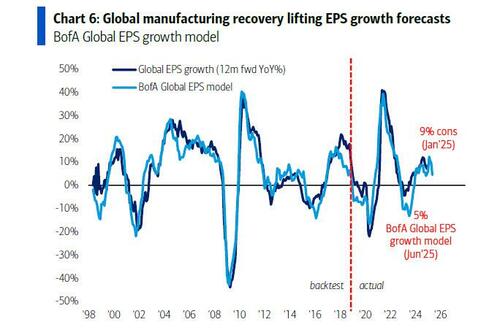

Long international stocks is at heart a long global manufacturing cycle play; leading indicator of orders-to-inventories indicates global PMI & US ISM to move from 45-50 to 50-55 range in H1’25, and this indicates 5-10% EPS growth according to BofA Global EPS Growth Model (note further H2 acceleration requires faster Asian export growth & steeper US yield curve).

One place where International is certainly working is China: since Jan 20th, China big tech “BATX” (Baidu, Alibaba, Tencent, Xiaomi) up 22% vs. 0% for US Magnificent 7.

DeepSeek confirms that China is not losing the AI race; meanwhile there is big market catch-up potential (BATX market cap = $1tn vs $17tn for Mag7). Looking ahead, China outperformance can continue (Hang Seng China Enterprise Index up 34% from Sep’24 lows, and 20% in US$-terms) for these reasons:

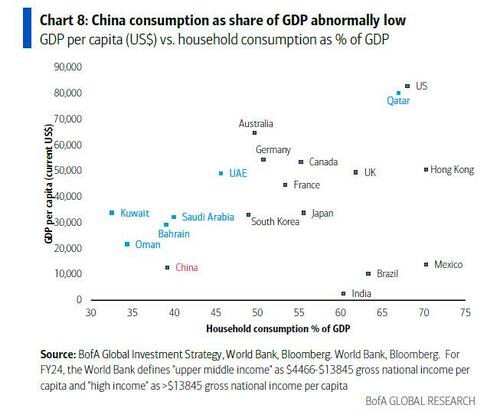

- a. China policy is easing fiscal/monetary/regulatory to boost demand and lift abnormally low share of consumption in China GDP (39% vs 64% average for Mexico/Brazil/India – Chart 8)

- b. DeepSeek shows China not losing ground in AI race, will produce cheap AI to support domestic economy, and challenges “US exceptionalism” consensus that AI race won solely by US big tech monopolies.

Going back to the beginning, and to last week’s note, Hartnett reiterates that investor fears on US-China trade/tech wars are overdone: there is too much for US & China to lose with big escalation of US-China trade war, neither side likely to pursue “MAD*” tech war given US/allies control >90% of global semiconductor manufacturing (which China needs) while China has dominant share in production of electric vehicles (80%), batteries (75%), clean energy (80% solar, 60% wind), rare earth minerals (70% of global production, 85% of global processing capacity)…all of which the West needs.

And then there is Europe: the old continent’s next catalyst is 23rd Feb Germany federal election; Hartnett believes that fiscal stimulus is coming under 2 of 3 of likely election outcome scenarios:

- most bullish scenario = 2-party coalition of CDU/SPD winning over 50% of vote (they currently polling 47% per Politico Poll of Polls) leading to “fiscal ‘bazooka”/constitutional change of German “debt break” (can’t run structural budget deficit),

- mild bullish scenario = multi-party coalition (BofA base case – see Euro Area Viewpoint: Germany: fiscal hope springs eternal 04 February 2025) and one-off fiscal stimulus in ’25,

- bearish scenario = far-right/left AfD/BSW parties win >33% of vote (currently polling 23% per Politico Poll of Polls) resulting in no stimulus/policy stalemate (as mainstream parties unlikely to vote for AfD/BSW immigration demands in exchange for fiscal stimulus).

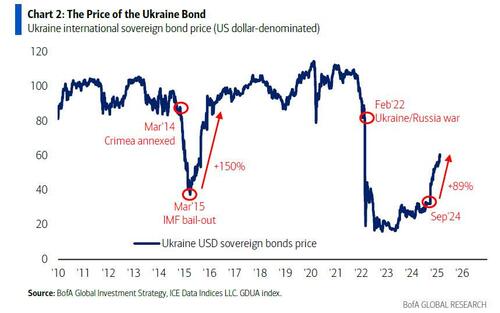

Meanwhile, Ukraine bonds are soaring…

… the Russian ruble is +20% YTD, German DAX is the best market YTD; and while geopolitical conflict is positive for US stocks, geopolitical peace is positive for International (esp manufacturing oil importers China & Europe).

In summary, Hartnett is “long International in ‘25; as no one positioned for RoW equity outperformance (if they were China/EU bond yields/FX would be lot higher); short-term think squeezy rally in “peace trades” to be tested by German election, end once peace deal imminent.”

To this, all we would add is that global peace breaking out would mean the US deep state – which makes its money from global turmoil and death – is dead. And anyone who believes that, we have quite a few nice bridges in Brooklyn for sale…

We conclude with the two Zeitgeist quotes used by Hartnett in this week’s note:

- Zeitgeist: “US where all the political action is, but price action is all outside the US”.

- Zeitgeist: “Only in Europe could the end of a war cause a huge rally in defense stocks”.