Uddrag fra Bank of Americas CIO Harnett:

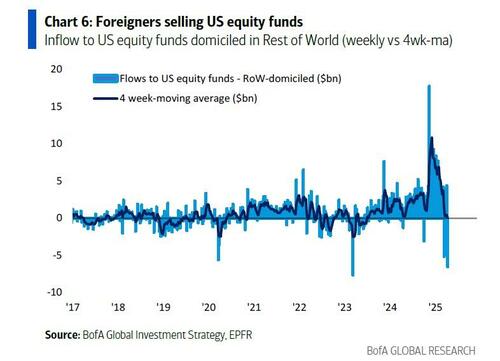

“US exceptionalism” is ending, “US repudiation” starting. To Hartnett this means the end of the era where the “US buys the Rest of the World’s goods – Rest of the World buys US Treasuries” and the start of a “Buyers strike of US assets.”

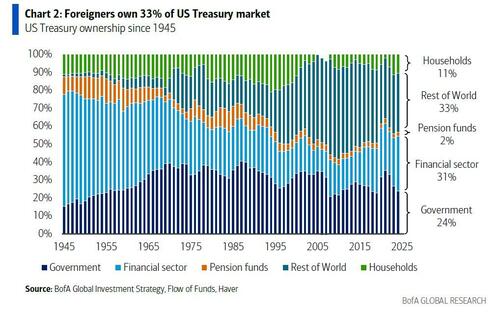

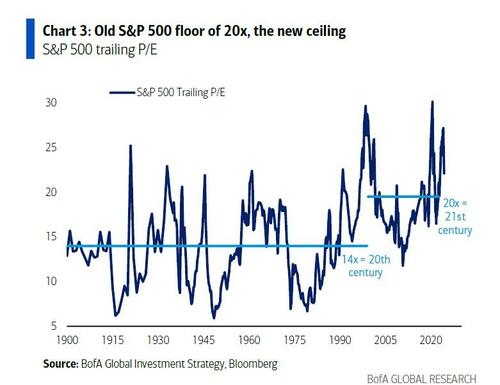

Which is a problem for the US since foreigners own 33% ($8.5tn) of US Treasuries, 27% ($4.4tn) US corp bonds, 18% ($16.5tn) of US stocks. It’s why the US dollar finds itself in secular bear market, why US yield curve set to steepen, old S&P 500 valuation “floor” of 20x is now the new “ceiling”

Turning to a section titled “Long 2s, short Spoos”, a phrase Hartnett coined many years ago (during the 2022 bear market to be precise) the strategist highlights the main dynamic of the past week namely “higher US yields, lower stocks, lower US$” which are driving global asset liquidation, and which will likely force policymakers to act; but until then he suggests to “sell-the-rips”, i.e., long 2-year Treasuries, short S&P until

- Fed cuts hard to break liquidation cycle,

- Trump-Xi pause trade war to reverse global recession momentum;

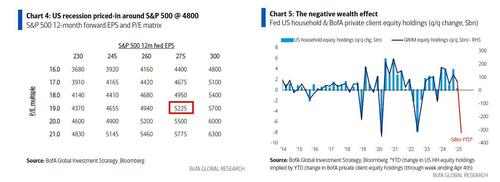

As an aside, and echoing his trade reco from last week, Hartnett still thinks S&P500 at 4,800 is the right level to buy risk assets if policy panic makes recession short/shallow.

A quick aside on the latest fund flows, where we find quite a few notable moves:

- Treasuries: biggest weekly inflow ever ($18.8bn);

- HY bonds: biggest weekly outflow ever ($15.9bn);

- IG bonds: biggest outflow since Oct’22 ($12.0bn);

- Bank loan: biggest weekly outflow ever ($5.4bn);

- TIPS: biggest inflow since Nov’21 ($1.6bn);

- Equities: big $48.9bn inflow, driven by massive $70.3bn inflow to “passive” funds vs $21.3bn redemptions from “active” (liquidation events e.g. Lehman/COVID cause ETF “share creation” to facilitate stock sales/shorting);

- Financials: biggest outflow ever ($3.6bn);

- Foreigners: selling of US equities ($6.5bn) and US corporate bonds ($3.0bn), buying of US Treasuries ($0.6bn).

Which brings us to Hartnett’s latest big picture view, in which he says that – as noted above – he is long 2-year Treasuries, short S&P 500, and suggests to “sell-the-rips in risk assets until a. Fed cuts break liquidation cycle of “higher yields, lower stocks, lower US$”, b. US-China trade war eases to reverse recession momentum, c. US consumer purchasing power rises via real wages, <$3/gallon gas prices, big mortgage refi.“

Hartnett then reminds the readers of the 3Ps rule: max bearish Positioning + max bearish Profit expectations = Policy panic always signal big market lows…

- On Positioning: Hartnett says that investor sentiment insanely bearish (why risk can rip), but data shows investors much more emotionally bearish than physically bearish indeed, the BofA Bull & Bear Indicator is not below 2 (currently 4.8), equity fund outflows nowhere close to 1-1.5% AUM (currently 0), BofA GWIM stocks allocation as % AUM was 54% Mar’20, 39% Mar’08 (currently 60%)…which is why Hartnett thinks investors will reduce allocation to risk assets on rallies;

- On Profits: Hartnett thinks any US recession likely short/shallow and priced-in around S&P 500 4800 ($250 EPS + policy response permits P/E 19-20x); but he is facing tremendous pushback on this…many believe full 10-15% EPS haircut to $230 coming & US capital outflows mean 17-18x mean flush toward SPX 4k; labor market ok, claims not rising as US border shut, but negative wealth effect huge (using BofA private client equity holdings data we estimate US household equity wealth has fallen $8tn thus far in 2025, follows $9tn gain in 2024);

- On Policy: Fed cuts (so long as they stabilize long-end) and China-US trade peace would be bullish risk assets, prevent bear/recession; good news: four opinion polls since Liberation Day show drop in Trump Presidential approval rating from 48-50% to 45%, so both bond market and electoral base now pressing for US trade policy reversal; The big risk here is loss of political capital, which jeopardizes Trump admin ability to cut corporate taxes in H2: that, Hartnett warns, would cause the last bulls to capitulate.

As for positioning Portfolios, Hartnett says:

- own credit, e.g. long-dated high-quality US corporate bonds (many yielding 5-6%),

- own equity income: 71 companies within S&P 500 have dividend yield >4%, 41 have dividend yield >5%; buy stocks that can defend dividend;

- own secular US$ bear plays: EM & commodities;

- once Fed cuts buy “policy pivot” plays: US semiconductors/retail/homebuilders, EU cyclicals, China tech.

Finally, for those seeking market signals, Hartnett points out that on Monday 76% of MSCI ACWI country indices traded below both 50-day & 200-day moving averages, which is close but not quite triggering a buy signal from BofA Global Breadth Rule (triggered at 88%); notably, there have been 10 buy signals since 2011, after which MSCI ACWI rallied 4-5% following 4 weeks.