Den finansielle hjælp, som flere regeringer har bebudet til erhvervslivet for at kompensere for corona-krisen, svarer slet ikke til tabet.

Uddrag fra ABN Amro:

Fiscal response to coronavirus still lacking scale

Global Macro: Fiscal response still has a way to go for it to be meaningful – Governments in the US and Europe are following their counterparts in Asia in putting in place fiscal measures to cushion the economic blow from the coronavirus. We set out some measures from selected economies below. The UK will announce measures in the Budget tomorrow, while the French government has been calling for a large scale co-ordinated fiscal response.

EU leaders will hold a videoconference at 17:00 CET today. Overall, although we are seeing the beginning of a response, it still has a way to go in terms of the number of countries and the scale in each country to be a meaningful counter-weight to the economic shock the global economy is facing.

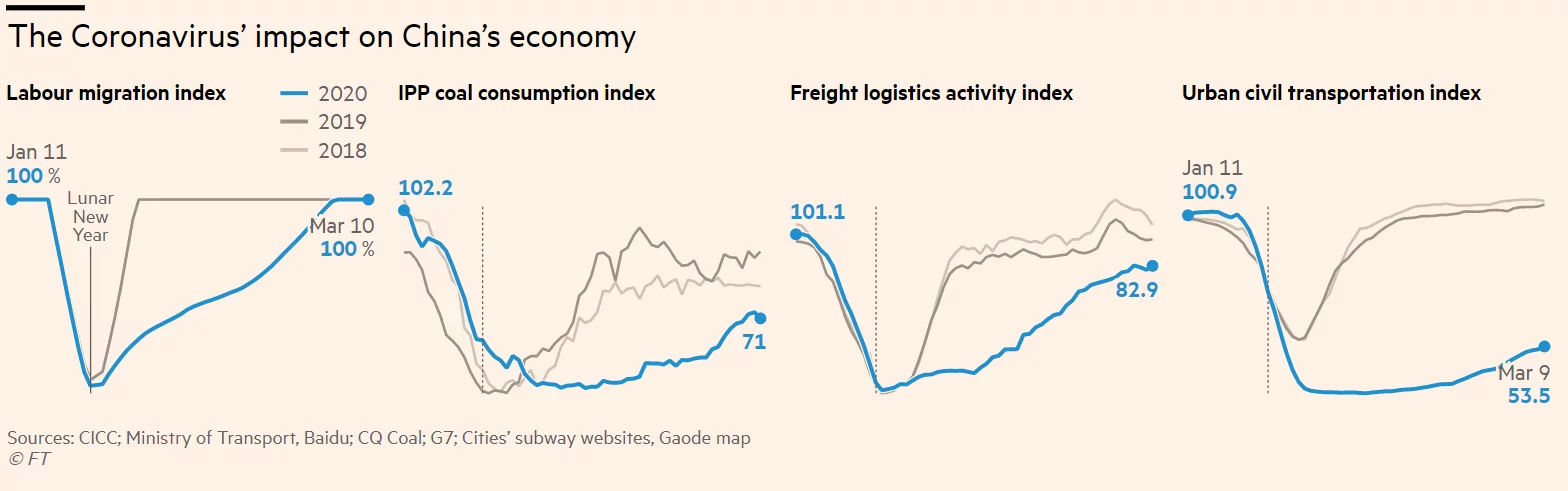

Mens corona-krisen bider mere og mere i landene uden for Kina, så er den kinesiske økonomi ved at komme i omdrejninger. Det viser følgende graf fra Financial Times:

ABN Amro:

US Macro: Fiscal measures likely to come in waves – Following the passage of the USD 8.3bn package (0.04% of GDP) of practical measures to deal with the coronavirus spread, the focus for Congress has quickly shifted to economic rescue measures to help cushion the blow to incomes from reduced activity.

The White House’s opening gambit here is a payroll tax cut and an expansion of paid sick leave to help ‘gig economy’ and other hourly wage earners who may have to self-quarantine. Despite the crisis, political considerations will surely play a role in shaping the final package, with president Trump likely to focus on growth stimulus measures (tax cuts), and Democrats focused on relief measures for those who will be hardest hit.

The size of the White House’s proposal is not yet known, but should become clear in the coming days after the Congressional Budget Office publishes estimates. It is possible that some more targeted measures might be implemented through executive orders (for instance on paid sick leave), bypassing Congress, although such measures would not be on a sufficient scale to be stimulatory.

Following the passage of these measures, the next step for a fiscal response will be on support for sectors that are hardest hit by the drop in activity resulting from the coronavirus outbreak. For instance, in the tourism and travel industry, with perhaps some kind of scheme to help SMEs weather the storm – as has been touted in other countries. More classical stimulus measures (such as boosts to infrastructure spending) are likely to be left for a future fiscal package, when activity begins recovering again.

Eurozone Macro: Extra fiscal stimulus in eurozone – Few eurozone countries have announced significant extra fiscal spending to compensate for some of the economic impact of the coronavirus. The German government has announced that it will spend EUR 12.4bn (equal to 0.4% of GDP) extra on government investment during the years 2021-2024, which is limited considering the potential short-term economic damage from the spreading of the coronavirus.

Still, the government has also announced some measures that will support the economy in the shorter-term. For instance, it will re-introduce the government-subsidised scheme that allows companies to keep existing employees on the payroll while reducing their number of working hours (“Kurzarbeit”).

Besides that, the minister of economic affairs has said that the government stands ready to provide companies with bridge loans and credit guarantees, if necessary. In any case, the German government has ample room for fiscal stimulus. It registered a 1.5% surplus on the total budget balance in 2019 and an estimated surplus of 1.1% on the structural budget balance, while its debt ratio has declined to 59% of GDP. Before the spreading of the coronavirus, the government had already planned to ease fiscal policy, with the structural budget surplus projected to decline to 0.5% GDP by 2021. Reducing the structural balance to zero would free some EUR 18bn and reducing it to the maximum allowed deficit of -0.5% would double this amount.

Meanwhile, Italy’s government has announced fiscal measures worth EUR 7.5bn (0.4% GDP) and plans to boost this amount to EUR10bn (0.6% GDP). The measures include extra spending on health and emergency services. In addition, financial assistance is planned for the worst affected households, firms and sectors. It emerged today that the government was negotiating with banks to provide breaks from debt payments including mortgages across the country. Details of the measures will be announced soon. Although a positive that the fiscal stimulus is targeted and being stepped up, it is still modest compared to the economic hit that the economy is currently experiencing. The nationwide lockdown as well as collapse in tourism is likely to see sharp falls in economic activity and a fairly deep recession.