Uddrag fra Bank of America:

Hartnett shares some more market indicators in his August zeitgeist recap, where he reminds his clients that “the only thing that matters for risk assets are rates & EPS…everything else is noise.” What follows is his ranking of current client consensus on rates and stocks as follows…

- Goldilocks consensus (60% of clients), i.e. clients expect “rates down = stocks up” (note probability of Sept Fed cut 95%, forward S&P500 EPS forecast +12% to $285),

- Inflation boom/bubble rising tail risk (30% of clients), i.e. “stocks up = yields up” (aka the “US dollar debasement trade”),

- Stagflation falling tail risk (10% of clients), i.e. “yields up = stocks down” (aka the “bond vigilante bust trade”),

- Deflation and client expectation of deflationary “stocks down = rates down” scenario in coming months is 0%… which is also why Hartnett continues recommend some government bonds and note US Treasuries outperforming Dow Jones index YTD.

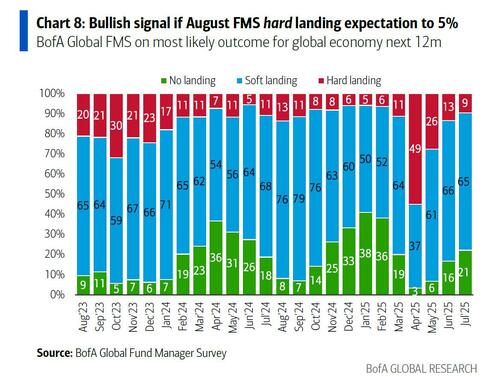

The BofA CIO then looks at the upcoming Fund Manager Survey due on 12th, and – like us – notes that these have become great contrarian indicators, consider: bearish Aug’24 FMS, bullish Dec’24 FMS, bullish Feb’25, bearish Apr’25 FMS… here are the metrics that signal the August 25 FMS is an extreme bullish survey, and thus a sell signal:

- 1. Investor probability of an economic hard landing falls to 5% or below:

- 2. Investor global equity allocation rises from net 4% OW to >25% OW

- 3. Investors cash levels drop further from 3.9% (sell signal level triggered in July FMS – note cash 3.7% or lower has occurred 20 times since 2002, on every occasion stocks down, Treasuries outperform 1-3 months.

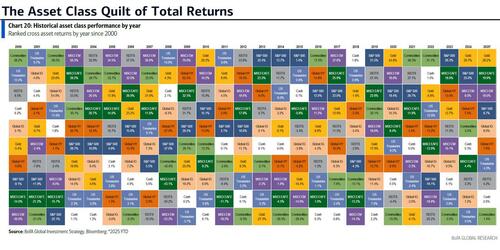

While the above is all fine and great, what many want to know is what is the outlook for the best performing asset not only in 2025 but also 2024, namely gold (and that’s only when excluding bitcoin from the BofA’s returns quilt which continues to blow everything else away).

Sure enough, this is what Hartnett writes in “Gold-binger”, his dedicated blurb on the yellow metal: “peace not war = gold bearish,” but Hartnett remains gold “bingers” because while peace not war may be gold bearish, everything else is very gold & crypto bullish… especially since one needs to hedge Trump need for boom and bubble into mid-term elections (46% Trump job approval close to lows). For Hartnett, gold wins in 2020s decade of inflation (geopolitical isolationism, immigration control, state intervention, less central bank independence), and furthermore, continued US dollar debasement = gold up… and last but not least, Hartnett points to ‘rising market expectations that central banks (only “owners” of gold = 20% global FX reserves) will be forced to revalue gold reserves to reduce domestic debt burden is very positive gold.‘