Resume på dansk

Velkommen til et nyt bull market. Ikke et bull market i jubel og champagne – men i usikkerhed, uro og brutal omfordeling.

Ifølge analysen fra Goldman-topstrateg Mike Wilson står vi midt i en historisk “great rotation”, drevet af AI’s voldsomme fremmarch

. Og hvis han får ret, kan det blive smertefuldt for de investorer, der stadig sidder tungt i gårsdagens vindere.

Markedet ser roligt ud – men under overfladen raser krigen

de store aktieindekse har holdt skindet på næsen. Men det er et fatamorgana.

Under overfladen har vi set en “violent rolling rotation” – en brutal sektor-rotation, hvor risikoaktiver torsdag faldt på ekstremt høje handelsvolumener

Ifølge Wilson nærmer vi os muligvis slutningen på denne AI-drevne “seek-and-destroy”-fase – men han advarer: Forvent ingen hurtig genopretning i multiplerne

Signalet er ifølge analysen klart:

Vi er midt i en fundamental og meget handelbar rotation, katalyseret af AI

AI æder software – og måske hele profitpuljen

I 00’erne og 10’erne var mantraet: “Software is eating the world”.

Nu er frygten, at AI spiser software. Og services. Og alle andre kapitallette forretningsmodeller med høje marginer

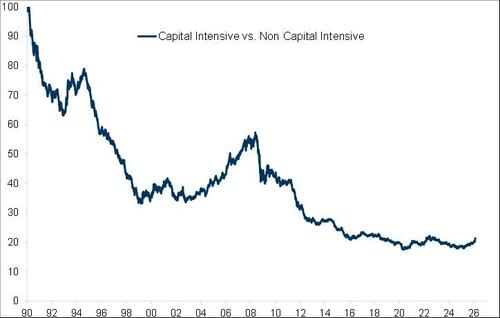

I 15 år har kapitallette selskaber slået kapitaltunge. Den trend kan være ved at vende

Og det stopper ikke dér.

Deglobalisering, økonomisk nationalisme, omlagte forsyningskæder og en gigantisk investeringsbølge i infrastruktur, energi og datacentre giver pludselig medvind til de udskældte kapitaltunge virksomheder

Kort sagt: Det gamle paradigme er under pres.

Tech-gælden er den oversete bombe

I sidste uge blev software igen de-ratet massivt. Og her gemmer sig en risiko, som mange investorer ignorerer: kreditmarkedet.

I det seneste årti har private equity opkøbt 1.900 softwareselskaber for 440 mia. dollar

Men:

2/3 af lånene handlede over pari ved årets start – nu kun 20%

22% af lånene handler under 90 cent – mere end fordoblet i år

Software/tech udgør 16% af låneindekset, men 21% af restruktureringer i 2025

Hvis AI presser marginer og forretningsmodeller, kan det hurtigt blive en kreditbegivenhed – ikke bare en aktiehistorie.

Deflation, AI og Wall Streets største misforståelse

Mange investorer frygter stadig inflationscomeback.

Men analysen peger på det modsatte: AI-risikoen for arbejdsmarkedet og klare deflationstendenser i prisdata

Et konkret eksempel: KPMG forhandlede ifølge FT en 14% honorar-reduktion fra deres egen revisor, fordi AI sænkede omkostningsbasen

Fra revisorer til advokater og ejendomsmæglere: Markedet diskonterer nu kortere levetid og lavere terminalværdi på immaterielle aktiver

Selv bitcoin og “Software At Risk”-kurven har bevæget sig ned i takt

AI er ikke bare hype. Det er marginpres.

Momentum er flyttet – og det er ikke til tech

Momentum-porteføljerne er allerede vendt.

I USA er man nu mest lang biotech, mining og kommunikationsudstyr – og kort software og retail

I Europa er man lang banker, forsvar og metal – og kort kemi og professionelle services

Det ligner ikke 2021.

Det ligner regimeskifte.

Elefanten og musehullet

Tallene er ekstreme:

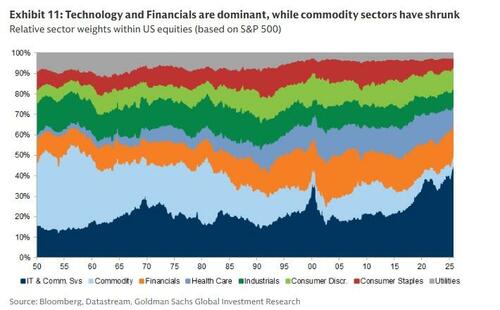

Tech udgør 44% af S&P 500

Materialer 2%

Utilities 2%

Energi 3%

Industrials 9%

Nvidia, Apple og Microsoft har tilsammen større markedsværdi end alle amerikanske industri-, forsynings-, energi- og materialselskaber tilsammen

Hvis kapitalen for alvor begynder at rotere væk fra mega-cap tech, er det – som Wilson skriver – en elefant, der skal igennem et musehul

Og passive investorer flytter sig sidst

Hvad betyder det for danske investorer?

Indeksinvestering er ikke risikofri diversifikation.

Kreditrisiko i tech bør tages alvorligt.

Kapitaltunge sektorer kan være strukturelle vindere.

Aktiv forvaltning kan igen få sin renæssance.

Bull marketet lever.

Men festen har skiftet adresse.

—————–

Welcome to the new bull market…

A bull market in uncertainty, as the pace of disruption accelerates & AI-progress lurches forward again

There’s been no let-up in market pressure.

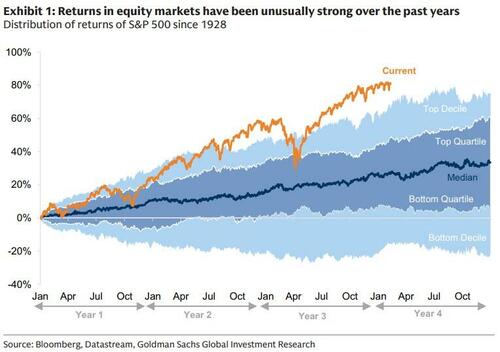

Headline indices held-in for most the week, despite a violent rolling rotation amid ongoing fears & the threat of AI-led disruption across ever-widening pockets of the market; but that was until Thursday when risk assets broadly legged lower on notably high turnover (S&P500 and gold futures volumes running 3x & 6x average volumes).

With that in mind, top Goldman Sachs trader, Mike Wilson, explained in his latest ‘weekly mash’ that he suspects we’re approaching the end of this innings of AI-risk seek-and-destroy, but don’t expect a fast multiple re-rate, nor much change to the broad themes that are becoming increasingly clear.

So, while remaining acutely aware of prioritizing signal over noise in such a busy market, here’s a reiteration of the signal:

we’re in the midst of a fundamental and very tradeable ‘great rotation’ catalysed by the evolving & accelerating story of AI.

As laid out previously, this ‘great rotation’ has 3 elements at play:

- The changing capital intensity of the largest stocks in the market; for the time being, the ‘Mag7’ EPS upgrades, cash returns, & top-line growth have stalled, all while their returns profile’s deteriorating;

- 15 years ago Andreessen prophetically declared “software is eating the world”; but now there’s a real risk AI eats software… and services… and countless other IP-led profit pools across the market. The extraordinary trend of capital-light companies outperforming asset heavy companies is reversing.

- And point 2 is being exacerbated by well identified trends of de-globalisation, economic nationalism, supply chain re-orgs, & a new investment mega cycle in infrastructure, power, data centres and physical compute capacity – all of which is a real tailwind for those much maligned “capital intensive” businesses.

Here’s 5 points illustrating ‘the great rotation’ in action (somewhat intentionally framed to illustrate how far this could run still, assuming the underlying drivers have been accurately diagnosed)…

1/ the ‘90s and then the post-GFC period saw Equity performance dominated by the theme of asset-light business outperforming capital intensive; there’s a long way to go if this is a substantive shift (tks for the chart Guillaume) :

2/ same is true for S&P500 outperformance over Europe’s Stoxx600 :

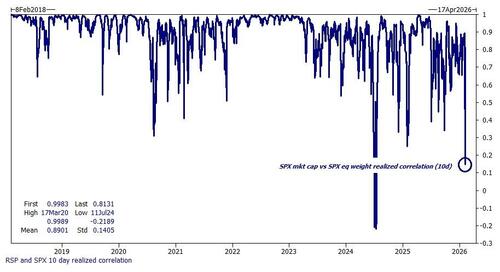

3/ the S&P index outperformed S&P equal-weight in the tech bull market of the late 90s, and then again for the decade 2015-2025; but from 2000-2015 the largest stocks in the index did not drive the majority of returns.

Its possible another shifts afoot today, especially when you consider correlation of S&P market-cap vs equal weight now stands in the ‘teens (thanks Brian Garrett) :

Source: Goldman Sachs

4/ given what a headline grabber US tech has been for 15 years, its pretty staggering to consider the Dow Transport index has handily outstripped Nasdaq over the last 25 years (yes I know, starting points really do matter – on both sides of the balance sheet, which makes this current period all the more interesting given extreme valuation disparities across regions & sectors) :

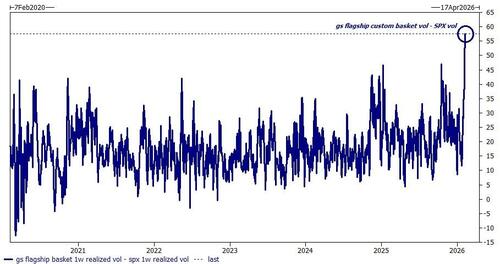

5/ and with full credit to Brian Garrett again: the stability at index level is truly masking the ferocity of the action under the surface – in fact, the volatility of our flagship custom baskets realised at 80 last week, 60 vol points over the index, far eclipsing anything we’ve seen before :

Source: Goldman Sachs

…and then 4 points worth making given the market’s current focus:

1. Tech Debt

Last April investors were highly dubious of Google/Alphabet’s relevance or moat in an AI-world.

From April the stock nearly tripled, adding almost $2.5 trillion of market cap before year-end … and this week they’re issuing 100yr bonds which investors eagerly lined-up for ! Markets are fickle, but in a week where markets continued to de-rate software in all formats, its worth considering the credit & loan market element to this tech transition :

- In the last decade, private equity have taken private 1900 software companies for a total consideration of $440bln;

- Over the same period, the tech & software sector saw the greatest concentration of > 6x levered deals;

- Across the loan market, 2/3s of loans traded above par on Jan 1st; now its only 20% … 22% of loans trade sub-90c, which has more than doubled YTD;

- Software/tech loans make-up about 16% of the index, roughly 21% of BDC portfolios, but also 21% of 2025 restructurings & distressed exchanges were software;

Thanks to KC O’Connor for the data; more available at Bloomberg and CreditSights here & here.

2. Warsh Is Not A Hawk

I’d contend that Warsh’s appointment has been a crucial input to, and cause of, the current ongoing bout of volatility.

I suspect entirely incorrectly, but the market has extrapolated his appointment to mean a truncation of the dovish right tail that was presumed to exist with all of Trump’s favored candidates – but least of all with Warsh.

I’d argue this is wrong for 2 reasons:

1/ Warsh is not a hawk per se, his prior comments – often cited – make it clear his situational hawkishness should not be confused for a fallback position; and,

2/ in contrast to most global central banks who have a price stability mandate, the Fed has a dual mandate, and now may be one of the most crucial periods for that dual objective given what’s going on with the labour market. In fact, Navarro and Hasset have been at pains to stress this labour market consideration this week; also, China CPI’s plummeting again (0.2% vs 0.4% expected), and I’m amazed in client conversations how many people still fear an goods driven inflation upside impulse through this year, despite the AI-labour risk, the clear AI-deflation risk, and the implosion lower in nowcast readings of US price pressures (which broke below the stable 2-3% range in December, but then really broke low in early Feb):

3. AI Disruption & Deflation

Of course, in prior periods of deflationary fears and falling rates, long duration equity assets responded well and most rallies were usually led by tech.

On Wednesday the FT reported that KPMG (the largest auditor in world) negotiated a 14% fee reduction from their own auditor (Grant Thornton UK) as they argued successfully for a cost save pass through as AI lowered the cost load of the job.

From auditors, to ratings agencies, to real estate brokers, to insurance brokers & legal firms – the markets repriced higher the uncertainty of each of these businesses, discounting intangible assets & shortening the duration & terminal value of each.

On reflection, perhaps crypto was the best tell on all of this: open source software, programmable money was the first to crack back in October, and despite underperforming our “Software At Risk” basket (white line; bitcoin = blue), they’ve both traded in lockstep most the way down:

4. Momentum Regime Change

The changing nature of momentum : given this rotation isn’t new (its speed may be, but the trend is not a recent 2026 phenomenon, as per prior chart), its important to note that the composition of equity “momentum” has shifted already.

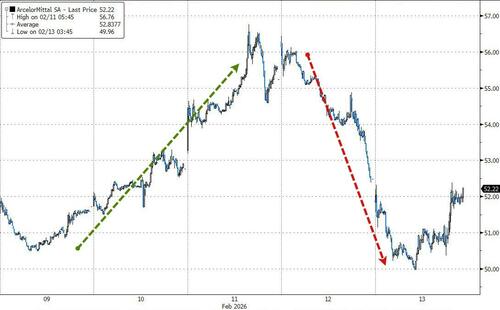

Have a look at how European chemicals responded to our multiple stock upgrades this week , or look at the stock chart of Arcelor Mittal – which looks more like the latest meme stock.

US momentum’s now most long biotech, mining, comm eqmt – while most short software, specialty retail & healthcare eqmt; while European momentum’s most long banks, aerospace & defense, metals & mining, and short chemicals, healthcare eqmt, professional services.

The global economic environment, fuelled by robust growth (especially in the US), policy support, lower US interest rates, and a weakening dollar, continues to bolster equity markets. The post-pandemic bull market has been exceptionally strong, recovering from a bear market trough, and we appear to be in a late-cycle “optimism” phase where fundamental growth, combined with rising valuations, will drive equity returns higher…

Finally, Wilson concludes that in a world where indexification already dominates assets, the US equity market’s > 70% of global total, mega-cap tech’s > 40% of US equity market cap, where credit investors aren’t quite as concentrated but they’re very long nonetheless, and ‘passive’ holders will definitionally move last (if at all) – active managers have to be genuinely differentiated.

Have a look at the below: tech’s now 44% of the index, while materials are just 2% … Utilities make-up another 2%, energy another 3%; industrials make-up 9%.

Put another way, Nvidia Apple & Microsoft market cap’s larger than all industrials, utilities, energy & materials stocks in the US.

If this rotation does persist, it’s a proverbial elephant squeezing through a mouse hole.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her