dansk resume:

Nomuras strateg Charlie McElligott advarede for få dage siden om, at markedet var blevet for roligt og for euforisk (især pga. AI-temaet). Nu er uroen brudt ud efter nye Trump-udmeldinger om hårdere kurs mod Kina, og aktier samt krypto er faldet markant. Det, vi ser, er i høj grad automatiske salg, som forstærker faldet. Trump talte om eksportkontrol på sjældne jordarter og mulige højere toldsatser på varer fra Kina. Efter et langt aktierally var mange investorer meget optimistiske og tungt investeret. Timingen gjorde derfor ekstra ondt.

Hvad betyder “stigende uro” i markedet?

VIX (ofte kaldet “uro-måleren”) steg tydeligt.

Tænk på VIX som et termometer for, hvor store udsving investorer forventer den næste måneds tid: jo højere tal, jo mere nervøsitet.

Hvorfor forstærkes faldet?

Mange fonde og produkter har regler, der tvinger dem til at skære ned i aktier, når udsvingene stiger. Det sker automatisk og kan komme på én gang.

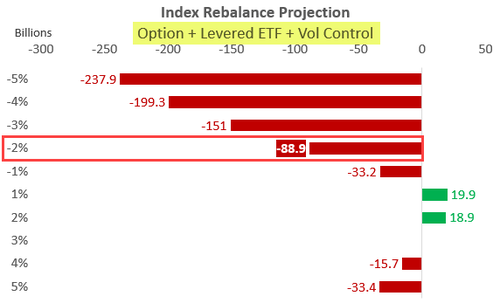

Du kan se det som cruise control: når vejen bliver ujævn, skruer bilen selv ned.Nomura vurderer, at sådanne tvangssalg kan løbe op i omkring 89 mia. dollars, hvis markedet falder ca. 2 %, og op mod 151 mia. dollars ved et fald på 3 %. Det kan presse kurserne yderligere ned.

Hvorfor virker “køb på dippen” ikke som normalt?

I de senere år har mange tjent på at købe, når der var et hurtigt fald, fordi uroen så ofte lagde sig igen.

Denne gang har investorerne i stedet købt mere “forsikring” mod yderligere fald (fx salgsoptioner). Når mange gør det samtidig, forstærker det presset på markedet, fordi modparter må sikre sig ved at sælge mere aktieeksponering.

Tidsfaktor og weekendrisiko

Det hele sker lige før en lang weekend for obligationsmarkedet. Hvis der kommer modsvar fra Kina i weekenden, tør færre tage chancen på at holde aktier hen over pausen. Det taler imod at “købe dippet” her og nu.

Niveaer i markedet (for de nysgerrige)

Der blev nævnt et område, hvor S&P 500-futures forsøgte at finde støtte. Men stemningen var stadig tung, og hvert lille løft blev solgt ned igen.

Bundlinjen

McElligott fik ret: Den “døde ro” vendte på en femøre. En politisk gnist + stor optimisme og høj gearing + automatiske salg = hurtig uro og fald. Hvis uroen (VIX) stiger mere, kan det udløse endnu flere tvangssalg – og presse aktierne yderligere på kort sigt.

Uddrag fra Nomura og Zerohedge

Late on Wednesday, with stocks at all time highs and not a cloud in the market’s careless sky, Nomura’s cross asset guru Chalie McElligott looked at the unprecedented collapse of realized volatility, and said that that “Dead Calm” in realized vol indicated an imminent reversal, especially when coupled with the “peak grabbiness/AI euphoria” In the vol space.

Well, less than 48 hours later, and following the worst selloff in stocks since April (one sparked yet again by a comment from Trump), not to mention the biggest liquidation event in crypto history, we are there, and as the Nomura strategist writes in his follow up note published moments ago, that what we are seeing right now is “a taste of the reason we’ve been pitching VIX Upside (25d10d CS to be exact) as the preferred space for investor hedging”, which McElligott correctly warns was set-up to be a convex move higher”, and indeed, look at the VVIX move go, surging to 110 right now, +13 vols, as “Vol of Vol” is signaling a touch of “pucker” for those Short VIX Optionality.

As McElligott stated in his Wednesday note:

… And as far as my usual focus on“mechanical flows” go,.the extreme Exposures & Leverage off the back of low trailing Realized Vol and crowding into Short Vol / Momentum / Carry’s recently “Smooth Sharpes” (nearly ALL of these dynamics having been supported by “The AI Trade” and the CapEx / Economic Impact) naturally then feeds the mounting discomfort with the pervasive run that markets have been on…as after-all, “STABILITY BREEDS INSTABILITY”…

IF the “AI Singularity” goes wrong…or any number of potential “Vol Catalysts” for that matter (anything that could drive an old-school “Correlation 1 / Risk-Off” –move)… there’s just so much mechanical deleveraging and exposure reduction sitting out there btwn Options and Leveraged ETFs, which you can see below in the asymmetric skew of “$notional to SELL” in a drawdown, versus that of the “$notional to BUY” on further Spot rally

And here we are.

So what flows are markets worried about (and likely front-running ahead of now), after this seemingly left-field Trump “China Bomb” (yes, after all these years, people still fall for the old Trumpian bait-and-switch and sell on a tweet, when the president can and will undo everything with just another tweet) on the rare-earths export controls that risks backsliding into “massive increase of Tariffs on Chinese products coming into the United States” escalation?

Taking a look at Nomura’s estimated “Index Rebalancing Projection” proxy which is an aggregation of SPX Options Dealer positioning / Greeks hedging, Leveraged ETF rebalancing and Vol Control deallocation flows, show something cringeworthy: -$88.9B for Spot ~-2% move (which nearly doubles to -$151.0B in a -3% slide… which is pretty much where the Nasdaq is right now).

And, picking up on something we rhetorically joked about yesterday…

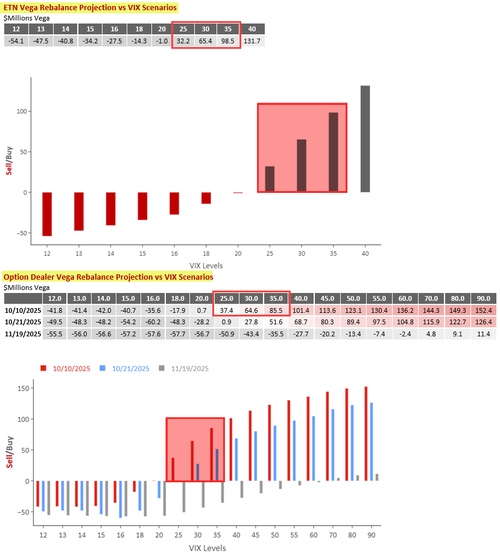

… McElligott writes that the answer was apparently “quite a lot”, to wit: “regarding the pesky “Vega Rebalancing” impact of VIX ETN’s + VIX Option Dealer hedging, where less “nasty” now ~VIX “spot” ~21, but any escalation of the Spot selloff / iVol squeeze further towards that “VIX ~25 and beyond” level into the close will see a nasty chunk of VIX Vega (and-or SPX Downside / Skew) to buy…

So what happens next?

Well, as McElligott correctly points out, the “dicey” thing right now is that conditioning has trained folks for years to fast-monetize hedges into these types of “Vol Squeeze” / “Spot Selloff” -moves… especially when this is the type of negotation we have already seen between the Trump Admin and China previously throughout the prior “price discovery” –phase of Tariff back-and-forth… and we’ve seen fits-and-spurts of this “Hedge Monetization” with some VIX Call and SPX Put -unwind, where those flows can help to arrest the moves.

But the problem is that said “Hedge Monetization” today thus far hasn’t been much more than a speed-bump with regard to being able to stifle this Spot Equities selloff and Vol squeeze… as it seems to McElligott that the aforementioned mechancial flows are overwhelming the “buy the Spot dip / sell the Vol rip” muscle-memory for now.

And, somewhat counterintuitively for a generation that only knows how to buy the dip, amid the Nomura strategist’s recent signaling about the surprising investor focus being more about “Fear Of Right-Tail” than that of “Left-Tail” deleveraging risks, today we’ve seen a bit of a scramble to buy Downside hedges into the Spot Equities selloff, which of course feeds these pockets of “Dealers Short Gamma” into Spot that has continued to melt from from this morning’s 6806 high, then acting as further accelerant feeding prevailing momentum lower.

Meanwhile, as it relates to the market trying to convince itself from prior Trump “Art of the Deal” trial and error in thinking that this is once-again hard-ball “posturing”, the timing of this coming after such a massive stock run with so much overpositioning in positioning having been established, and particularly ahead of a three day weekend for fixed-income, it is a tough thing to risk fading IF we get Chinese tit-for-tat headlines Sunday.

In other words, no buy the dip today.

The little bit of good news at this second is that we see Spooz holding prior lows ~ 6650ish and trying to base around a bit of Dealer legacy “Long Gamma” insulation / shock-absorber btwn 6550-6650; but even so, the move feels “heavy” at this moment, just mintues away from Cash equity close…as every attempted bounce is being sold-into.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her