Uddrag fra Goldman

After a solid week for tech which saw the Nasdaq almost recapture the 200DMA yesterday, tech stocks are getting nuked again and everyone is wondering what sparked the move.

As usual, there are many hypothesis, with Goldman S&T listing four points

- NDX failed the 200dma.

- Continued chop into Apr 2nd.

- Negative stories around Datacenter/AI this week (China NVDA environmental concerns, BABA “bubble” comments yesterday).

- Positioning & trading dynamics in to quarter-end.

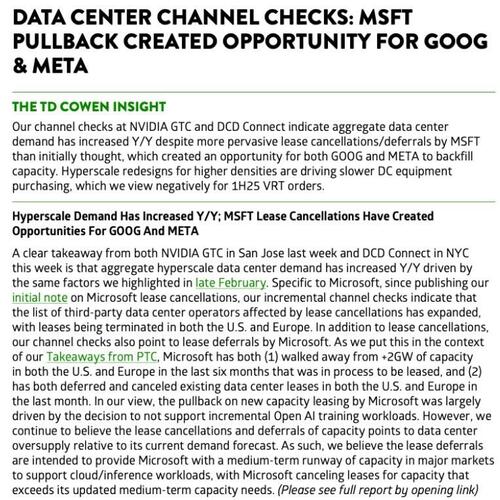

While all of the above is accurate, perhaps the most meaningful driver of today’s bearish sentiment is the same one that sparked a selloff exactly one month ago, that according to channel checks by TD Cowen analyst Michael Elias, Microsoft had 1) canceled leases in the US, totaling ‘a couple of hundred MWs’ with at least two private data center operators, 2) has pulled back on the conversion of SOQs to leases, and 3) has re-allocated a considerable portion of its international spend to the US.

Naturally, Microsoft refuted all the speculation just hours later and banks unleashed a full blown defense of the world’s largest company (with many somehow arguing that while MSFT may indeed be trimming some of its growth CapEx “around the edges” this was merely confirmation of a prudent spending policy, as the company was still actively pursuing growth at the same time or some other ridiculous doublespeak).

However, with the Mag7 still expected to spend a ridiculous amount of capex on datacenter growth (which is directly feeding into US GDP growth) as we noted two months ago…

… it was only a matter of time before we got more indications that the spending cuts are looming, and sure enough Part 2 of the TDavid vs Goliath story hit today when the same TD Cowen analyst said in a report published this morning (and available to pro subscribers), that Microsoft has walked away from more new data center projects in the US and Europe that would have amounted to a capacity of about 2 gigawatts of electricity. Like last month, the pullback was attributed to an oversupply of the clusters of computers that power artificial intelligence.

Author report Michael Elias said the latest move also reflected the company’s choice to forgo some new business from ChatGPT maker OpenAI, which it has backed with some $13 billion. Microsoft and the startup earlier this year said they had altered their multiyear agreement, letting OpenAI use cloud-computing services from other companies, provided Microsoft didn’t want the business itself.

In his latest note, Elias also said that Microsoft’s retrenchment in the last six months included lease cancellations and deferrals, and argued that Google had stepped in to grab some leases Microsoft abandoned in Europe, while Meta Platforms had also scooped up some of the freed capacity in Europe.

“Thanks to the significant investments we have made up to this point, we are well positioned to meet our current and increasing customer demand,” a Microsoft spokesperson said in a statement, adding that the company last year added more capacity than in any other year in its history.

Microsoft also said it remains on track to spend about $80 billion building out AI data centers in its fiscal year that ends in June, although clearly concerns are growing that the real number will be far less, especially if the company wants to save some cash for much needed stock buybacks. Executives have said the pace of growth should slow in the company’s next fiscal year. After a frantic expansion to support OpenAI and other artificial intelligence projects, the company expects spending to shift from new construction to fitting out data centers with servers and other equipment.

“While we may strategically pace or adjust our infrastructure in some areas, we will continue to grow strongly in all regions,” Microsoft’s spokesperson said. “This allows us to invest and allocate resources to growth areas for our future.”

However, judging by the market reaction, investors no longer believe the (former) market generals and instead are putting their bearish chips with the likes of Elias who warned that he continues to believe “the lease cancellations and deferrals of capacity points to data center oversupply relative to its current demand forecast.”

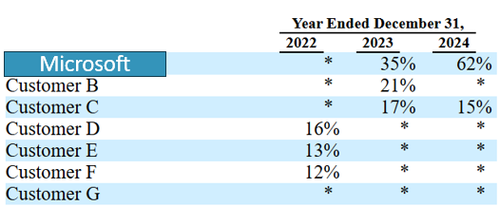

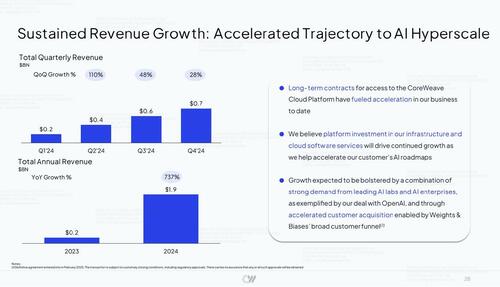

Adding insult to injury, the Cowen report comes just days after speculation emerged that Coreweave is rushing to complete its massive IPO (valuing the company at $32 billion, and which would raise as much as $3 billion in cash), to cover up the the fact that Microsoft, which accounts for a majority of CoreWeave’s revenue, recently passed on a $12 billion option for compute with the company; as Semafor reported, that compute slot was then promptly filled by OpenAI, (which of course is largely funded by Microsoft).

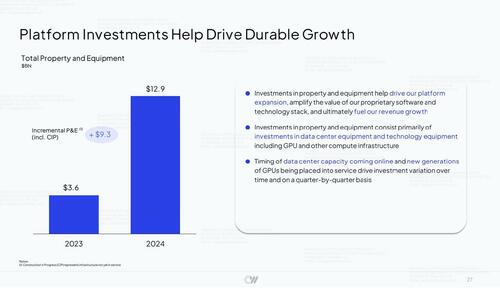

CoreWeave has been compared to WeWork because its tremendous revenue growth…

…. has come at the expense of unsustainable capex and cash burn, which in turn require tremendous constant outsinde investment (or debt): CoreWeave burned nearly $6 billion of cash in 2024 and $1.1 billion the previous year, because of the massive capex to build out its AI infrastructure.

Not surprisingly, CoreWeave – which also counts Microsoft as its largest customer – has been frequently rumored to be a core spoke in revenue roundtripping schemes involving Microsoft, Nvidia and OpenAi.

Microsoft shares fell 1.5% to $389; shares of Nvidia, the top supplier of AI chips globally, dropped 6.4% to $113, amid a broad downturn in the market. Meta declined 2.9% to $607.7 while Alphabet dipped 2.8% to $165.9.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her