Fra Rabobank/ Zerohedge:

With rates traders still amazed at the shocking bond market response to Thursday’s blockbuster economic data, Rabobank strategist Richard McGuire chimes in and writes that the Treasuries market has undergone a “notable” change in the way it reacts to U.S. data since last year, with Thursday’s stellar economic reports seen as reducing the odds of aggressive fiscal stimulus.

The “quite remarkable” rally in Treasuries on Thursday following upbeat data is just the latest sign of that reflexive reaction change, according to the latest note by McGuire (attached below). In an interview with Bloomberg he said that yields are not simply being impacted by the outlook for growth and inflation, “but uncertainty and, as demonstrated yesterday, a reassessment of future policy mix”; in other words, lower odds of fiscal stimulus strengthening expectations that monetary policy remains at extraordinarily easy settings.

While according to McGuire, the “economy’s apparent buoyancy is likely to make it that much harder to co- opt the centrists within the Democratic party”, we disagree with this assessment as the Democrats will do everything they can to ram as many more trillions in stimulus as they can, and is why we expect another round of shutdowns in the mid-summer, one which will be blamed entirely on “Trump supporters” refusing to get vaccinated.

Where we do agree with McGuire is that the change in the reaction function can be traced back to September’s presidential debate between Joe Biden and Donald Trump, when the odds of Biden winning the election started to rise. From that point on, softer-than-expected U.S. payroll data paradoxically weighed on Treasuries, sending yields higher, he said.

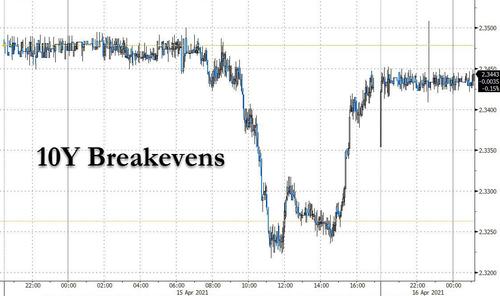

Meanwhile, the steady nature of U.S. breakevens suggests that the UST rally was the result of shifting expectations in terms of future policy mix, or in other words, we have crossed a point where even stronger economic data may depress yields further as the bond market prices in not only the end of the current stimulus cycle but the lack of the next one.

* * *

Below we republish the full note from Rabobank strategist Richard McGuire

As has become a somewhat familiar occurrence, Thursday’s dramatic market developments leave us having to take a somewhat forensic approach as we attempt to piece together exactly what happened. This specifically relates to the quite remarkable rally in long-dated USTs in the wake of a brace of much more upbeat than expected data.

These data included notable upside surprises on the part of the Empire and Philly Fed, a 193K drop in initial claims vs expectations of a 44K decline and a strong beat in terms of headline retail sales which jumped 9.8% m/m in Mar vs. 5.8% anticipated.

While one would think these numbers would be greeted with a resounding cheer from the reflationistas, USTs began to rally in the immediate wake of this release with 10y yields falling some 9bp to hit an intra-day low of a shade under 1.53% while 30y yields also dropped by c. 9bp to briefly touch 2.20%.

As one would expect, the wires are replete with commentary from m0arket watchers such as ourselves attempting to explain away this development. Geopolitical concern was one factor that your author has seen being touted. Meanwhile, a more popular explanation appears to be higher demand from Japanese investors. This, though, does not stand up to scrutiny when one consider the fact that OIS outperformed USTs by no small margin during yesterday’s rally with 10y UST yields ending the session some 5bp higher than OIS (the spread standing at 24.3bp).

One might argue, however, that chunky US bank bond issuance (a 5-part $13bn JP Morgan deal and a $6bn 2-part Goldman issue) had an impact here in so far as this supply was swapped. We cannot substantiate this but, even then, would still discount these explanations not simply due to the market’s clear earlier insouciance as regards geopolitical concerns such as are brewing in the Ukraine and Taiwan but, more importantly, the timing. Did these concerns suddenly spike at 14:30CET yesterday as the above mentioned data were released or did Japanese demand suddenly jump at this same moment?

Instead, the explanation that we would offer refers to a theme that we detailed at the beginning of this year which is the notable change in reaction function in the wake of last year’s presidential debate on Sep 29. From this point on, we observed the fact that weak data paradoxically weighed upon USTs with softer-than-expected payrolls reports in the ensuing months seeing US yields push higher into the close.

We surmised that this was due to the fact that with the odds of Biden winning the election rising markedly after this debate, the market begin to toy with the fact that under a Democrat administration fiscal policy may become the default policy response to weak growth rather than monetary policy as had been the case through the post GFC period.

This, then, meant that bad news was no longer good news for USTs as rather than heighten speculation of lower policy rates/more QE, weak data were seen increasing the odds of fiscal stimulus which is a negative both from the perspective of higher supply and the notion that that government spending is more likely to have a positive inflationary impact than monetary policy which has clearly been pushing on a string for a great many years.

Employing this same logic, Thursday’s upbeat data could be construed as reducing the odds of further aggressive fiscal stimulus as the economy’s apparent buoyancy is likely to make it that much harder to co-opt the centrists within the Democratic Party. We believe this assessment is supported by the response of the Eurodollar futures strip which rallied hard in the wake of these numbers – the Dec 2023 contract dropping 9bp in yield to fall sub-1.0% for the first time since Mar 2 while contracts from 2025 onward rallied by 14-15bp. This also appears to stand very much at odds with yesterday’s data unless one takes the view that the reduced odds of fiscal support these numbers portend also sees it less likely that the Fed will respond to a state-sponsored boost to aggregate demand by normalising policy.

As a final point, we also note that US breakevens did not budge Thursday afternoon with 10y BEIRs ending pretty much exactly where they started at 2.34%. This highlights that yesterday’s UST rally was in no way the product of a gloomy reassessment of the outlook for growth (which would have been odd to say the least given yesterday’s data).

Instead, one could argue that the steady nature of US breakevens reflects the fact that the upbeat demand implicit in yesterday’s numbers was offset by the reduced expectations of fiscal stimulus that they also triggered. This, then, suggests that the rally in USTs was the result of a shifting expectations in terms of the future policy mix with lower odds of fiscal support and higher odds of monetary policy remaining accommodative a bullish cocktail for bonds.

Technical factors appear to have also informed the size of yesterday’s move with the rally in 30y yields gathering pace one they breached 2.29% – a level they had previously tested and failed to breach on four occasions since Mar 16. 10y yields, meanwhile, saw their rally further fuelled by a break sub-1.59% – a level that had been tested 3 times since Mar 16.

* * *

We would argue the implications of this analysis are as follows. First, if we are correct and firm data is seen as reducing the odds of aggressive fiscal support then the likelihood of US medium-term inflation expectations pushing higher from their already historically elevated levels appears limited (at least over the near term). This owing to the fact that the impact of a brightening outlook for demand on expectations as regard inflation could potentially tempered by a reassessment of future government support.

What this analysis also implies though is that the uncertainty that currently besets the market is likely to remain very high if not increase from here. This is due to the fact that not only does the market have to contend with gauging how we emerge from what is an unprecedented crisis (and so will be followed by an unprecedented recovery) and having to weigh how the Fed will respond given its new and untested policy framework but there is also the difficulty in predicting the reaction function of other investors themselves.

The fact we have devoted this entire note to attempting to rationalize yesterday’s market moves is a clear reflection of this elevated level of uncertainty and that, in turn, argues that investors are likely to require some compensation for locking their money away in a long-dated UST when predicting even the near future is a decidedly fraught exercise. That argues then that term premia are likely to remain elevated if not increasingly so which continues to see the odds tilted toward a renewed push higher in US yields. Our mid-yr forecast sees 10y US yields returning to 1.75%.