Fra Zerohedge/BofA /Goldman:

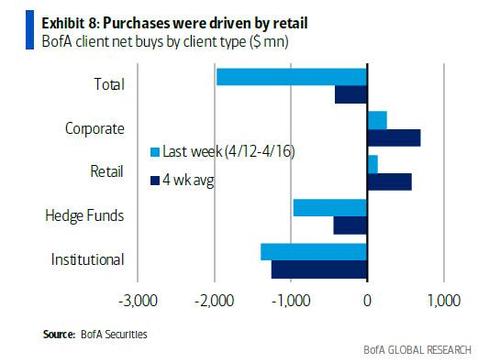

Yesterday we reported that according to the latest institutional and HNW client data published by Bank of America, the bank’s flow desk just had seen the biggest outflows in five months as clients were net sellers of a whopping $5.2BN in US stocks last week – the biggest sales since mid-Nov. and fifth-largest on record – which took place just as the S&P 500 reached new highs.

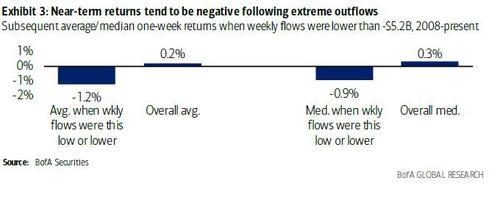

So nothing good coming for stocks in the near-term, at least based on empirical data (which probably means that some HFT will start a short squeeze as quants start piling in on the short side based on the historical record).

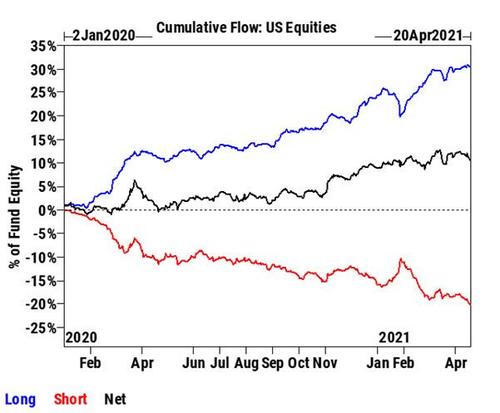

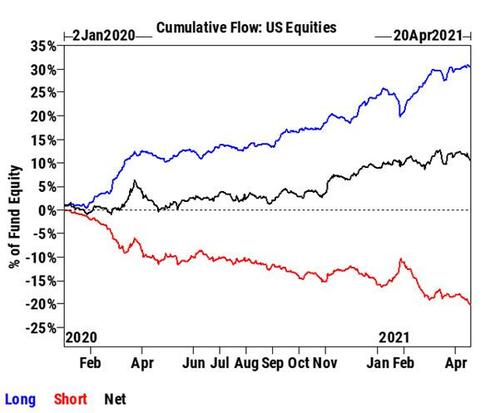

Then, overnight, Goldman’s Prime Brokerage Desk – which recently become famous thanks to its involvement in the Archegos fiasco – poured the latest flow cold water, and in a report from Tuesday night, Goldman wrote that the bank’s Prime book “saw the largest net selling since Mar 18th (-2.4 SDs vs. average daily flow of the past year), driven by short sales and to a lesser extent long sales (2 to 1).”

More remarkably, Goldman Prime notes that “US equities have been net sold for two straight days (7 of the past 8) on the GS Prime book“, and with the exception of Asia which was modestly net bought, all regions were net sold led by North America which made up more than 90% of the $ net selling.

Visually:

And some more details from GS Prime:

- Both Macro Products (Index and ETF combined) and Single Names were net sold yesterday and made up 70% and 30% of the $ net selling, respectively.

- While yesterday’s selling activity was led by Macro Products, most of the recent selling flow had been driven by Single Names which made up more than 80% of the $ net selling from 4/8 to 4/16.

- US ETF shorts on the GS Prime book increased +2.75% – the largest one-day increase in nearly two months – driven by Large Cap and Small Cap ETFs.

- 8 of 11 sectors were net sold led in $ terms by Info Tech (long-and-short sales), Consumer Disc (long-and-short sales), Financials (long-and-short sales), and Real Estate (long sales > short covers), while Energy (short covers + long buys), Utilities (long buys > short sales), and Industrials (long buys > short sales) were the only net bought sectors.

- Most net sold industries – Software, Hotels, Restaurants & Leisure, Automobiles, Specialty Retail, Capital Markets, Internet & Direct Marketing Retail, Tobacco, HC Providers & Svcs

- Most net bought industries – Aerospace & Defense, Electric Utilities, Multiline Retail, LS Tools & Svcs, Tech Hardware, HC Equips & Supplies, Air Freight & Logistics, Household Products

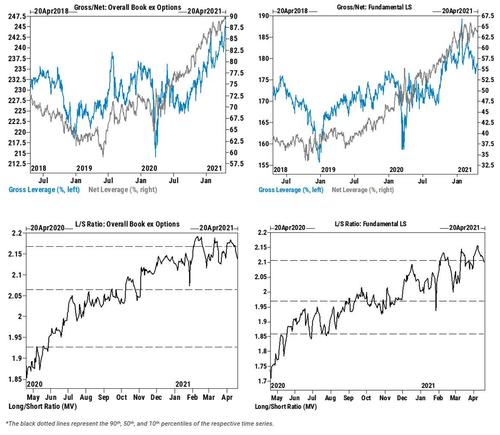

While we have touched upon this in recent weeks, hedge fund leverage remains near all time highs, although the recent reduction in L/S ratio shows managers are turning a bit more cautious.

Finally, for those curious (i.e., anyone working in a hedge fund), here are some recent performance metrics from GS Prime which notes that while fundamental LS alpha improved for three straight weeks, it has been challenged again in the past few days

April MTD

- Fundamental LS +3.1% (alpha +1.2%) vs MSCI TR +4.8%

- Systematic LS +1.5% (alpha +1.4%)

2021 YTD

- Fundamental LS +1.5% (alpha -6.2%) vs MSCI TR +9.9%

- Systematic LS +10.1% (alpha +10.6%)