Fra Zerohedge/ Bank of America:

The last time Bank of America found that complacency and euphoria was so pervasive across the market that a correction was inevitable was back in late 2017 when the VIX was trading in the single digits for a record stretch, stocks were surging and sentiment was one of widespread invincibility which culminated with the great Volmageddon/VIXtermina event of Feb 2018 when all the VIX sellers were crushed and inverse VIX ETFs were wiped out.

And, to describe the market mood, BofA used a trademark phrase that has become a staple of market top conditions: “The Best Reason To Be Bearish Is…There Is No Reason To Be Bearish”

As an aside, and as we first noted last month, once upon a time the Bank of America Fund Manager Survey (FMS) served a useful indicator of what finance professionals did and thought. Then, over the years, it became a survey which only revealed what the prevailing consensus narrative was – if not what respondents actually did – as survey participants merely answered question in line with what they thought was the right answer. Unfortunately, since then it has devolved further to the point where it is mostly noise with very little signal.

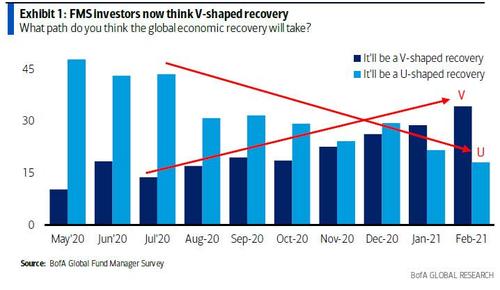

Case in point: last August the survey respondents turned extremely bullish (for no other reason but simply following equity prices) as they cast aside cautious views that it was nothing but a W-shaped recovery, in favor of a U and V-shaped recovery, just as they found all assets to be the most overvalued on record. In short: conflicting signals, nothing makes fundamental sense, and everyone is merely goalseeking their views based on price.

Fast forward a few months when the ongoing euphoria has brought us to where BofA’s chief investment strategist repeated what he said 4 years ago, namely that “the only reason to be bearish is…there is no reason to be bearish.”

The reason for that is according to the February FMS sentiment on global growth at all-time high, V-shaped recovery is finally consensus (with virtually nobody believing in it just a few months ago), cash levels are at 8-year low and equity & commodity allocations highest since ‘11 (which incidentally was the last year both had negative returns).

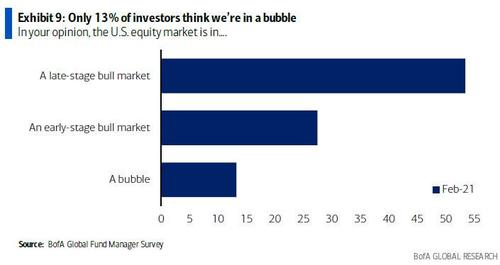

And the punchline: only 13% of finance pros say it’s a bubble, as the BofA Bull & Bear Indicator rising to 7.7, just shy of a screaming signal.

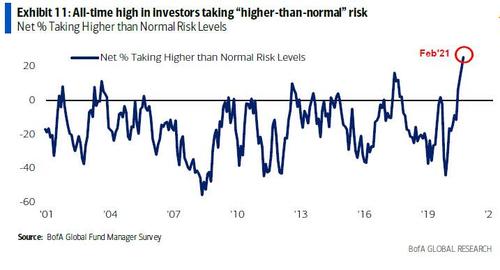

Below we present some of the highlights from the latest FMS, which finds that a record number of investors are taking “higher-than-normal” risk, up to 25% in February the highest on record…

… for the following reasons: Net 91% of investors now see a stronger economy in 2021, with the majority or 34% saying it’s a V-shaped recovery, up from just 10% 9 months ago…

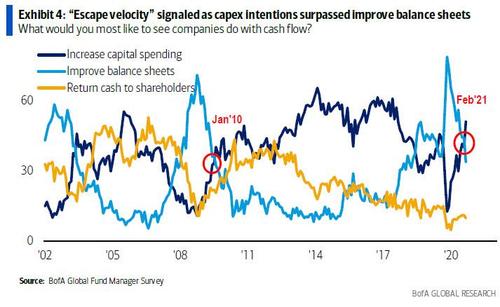

… 1st time since Jan’20 investors want CIO’s to “increase capex” rather than “improve balance sheet.”

And even though millions are still out of work, Powell has assured markets that he won’t hike unless 500,000 jobs are created each month until the end of 2022, resulting in record high inflation expectations…

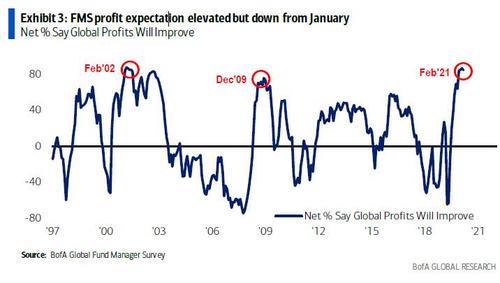

… profit expectations (the net percentage of FMS investors expecting global profits to improve over the next 12 months fell 3ppt MoM to 84%, showing profit expectations peaked in Jan) ….

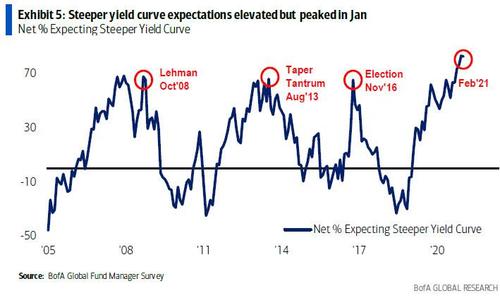

… and yield curve expectations close to record highs.

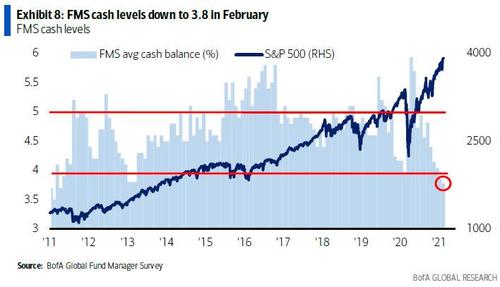

And with a record number of investors flooding into risk assets and expecting surging prices, it is hardly a surprise that FMS cash level timbled to just 3.8%, the lowest since Mar’13 (incidentally, just before Bernanke “taper tantrum” which is ironic since a new taper tantrum is on deck)…

…. also explaining why the allocation to stocks & commodities is highest since Feb’11.

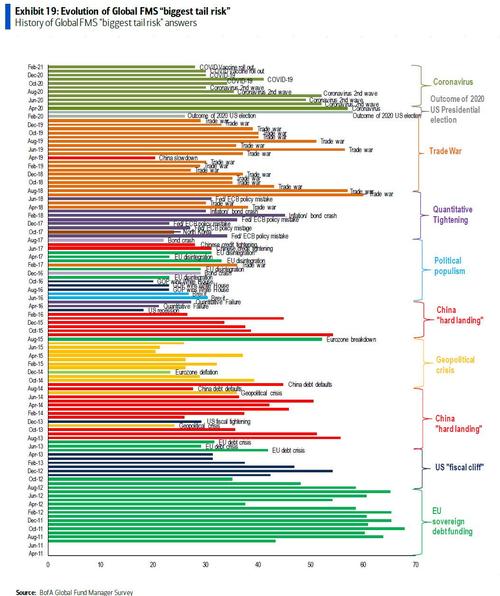

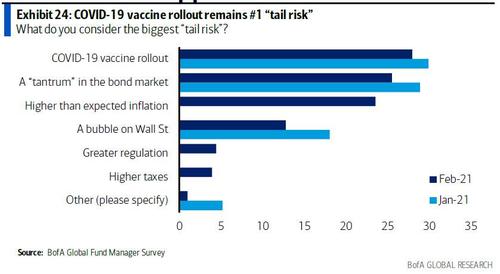

Which is not to say that there are no risks: in February, investors viewed top “tail risks” as vaccine rollout (28%…timing of positive impact has slipped to July)….

…. with taper tantrum (25%) and inflation (24%) second and third. A bubble curiously was just 4th…

… because in one of the most bizarre observations, just 13% of investors think the U.S. equity market is in a bubble – which is hilarious because it is painfully clear that not only the market but the economy are both in a fiscal and monetary stimulus fueled bubble but once again people are happy to lie to themselves if it means goalseeking their thesis. At the same time, 27% think early-stage bull market, 53% late-stage bull market.

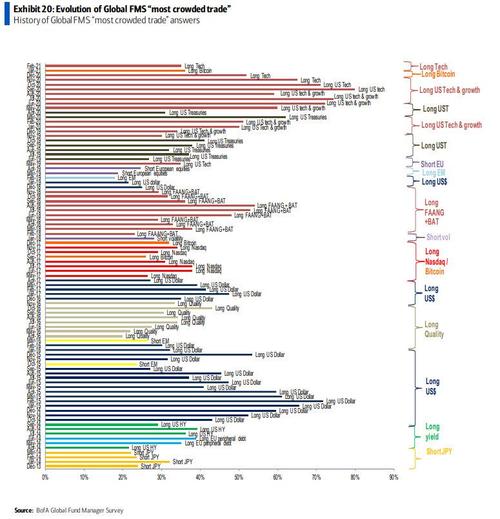

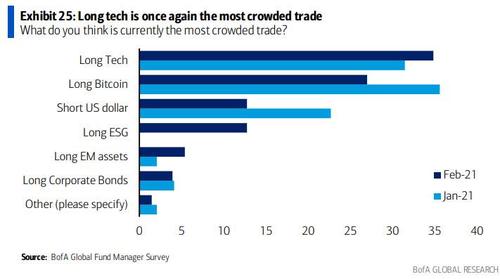

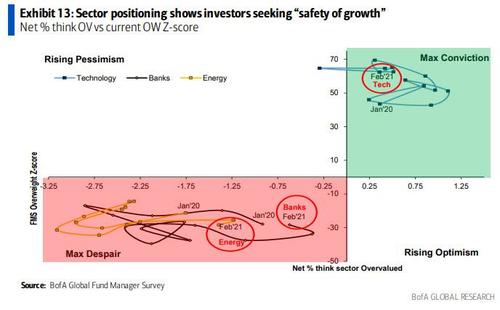

Meanwhile, there has been a reversal in the most “crowded trades” where the top spot is once again “long tech” (35%)…

… taking over from “long Bitcoin” which was the top crowded trade last month with 27% (which as we said at the time is idiotic since most finance professionals can’t even put the bitcoin trade one), and in 3rd spot was short dollar (13%).

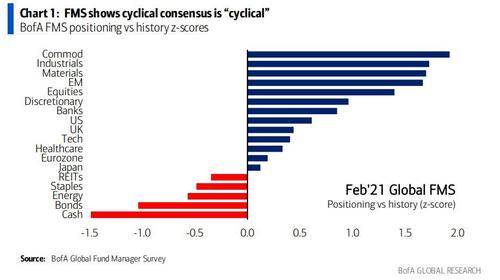

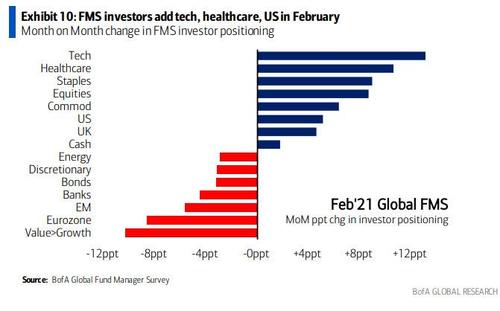

So in terms of investor positioning, the FMS shows that cyclical consensus is “cyclical” with high exposure to commodities, EM, industrials, banks relative to past 10 years…

… but Jan wobble caused investors to top-up “safety of growth” exposure via tech, health care, US stocks.

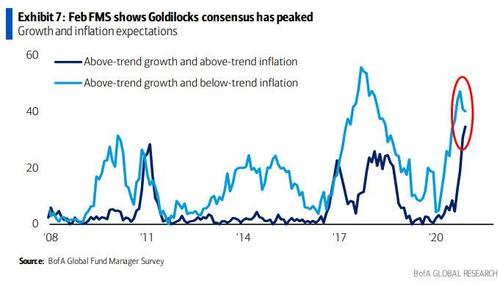

And while there is nothing to fear but fear itself, what should one do if everything goes tits up? According to BofA, the best hedgees are the anti-Goldilocks, contrarian trades, as the Feb FMS indicates “peak Goldilocks” is now behind us as hopes for higher growth-lower inflation peak (down from 47% in Nov’20 to 40% in Feb’21) with higher growth-higher inflation continues to tick up to all-time highs 35%.

As Hartnett explains “bubble move and/or big inflation in 2021 best played via FMS laggards e.g. energy & UK stocks; conversely longs in EM, commodities, industrials most vulnerable to “peak profits” narrative; either way consumer staples a smart contrarian accumulator in H1.”