By Chetan Ahya, Morgan Stanley’s Chief Economist and Global Head of Economics

Most market participants and policy-makers have been surprised by the speed of the recovery. On our estimates, the US economy will reach pre-COVID-19 output levels by the current quarter.

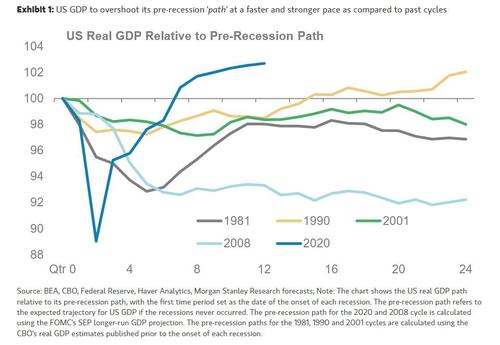

From 3Q21 onwards, we expect US GDP to overshoot the path it was projected to follow before the recession. The last time GDP rose above its pre-recession path was in the 1990s. Back then, it took 15 quarters compared to seven quarters this time around. Moreover, we expect the US economy to reach 103% of its pre-recession path in 12 quarters (i.e., by December 2022) versus 27 quarters in the 1990s.

Our chief US economist Ellen Zentner is forecasting growth of 7.3%Y in 2021 and 4.7%Y in 2022, almost 2 percentage points above consensus this year and 1 percentage point next year. This gap between our estimates and consensus is, as far as I can remember, the widest ever.

How did we come to the conclusion that GDP can surpass its pre-COVID-19 path? We have focused on the regime shifts in monetary and fiscal policies, with policy-makers aiming for a high-pressure economy in response to a profound exogenous shock.

In particular, fiscal policy is doing much more than fill the output hole. Transfers to households have already exceeded the income lost in the recession. As reopening gathers pace, the labor market is poised for a sharp rebound. This implies that consumption growth in 2021 will be supported by wage income and transfers, with little reliance on excess savings. The excess saving stock (savings accumulated by households over and above the pre-COVID-19 run rate) will still rise to a peak of US$2.3 trillion in 3Q21. Even for 2022, we are building in only a modest drawdown of the excess saving to US$2.14 trillion (8.7% of GDP) by year-end. A faster-than-expected drawdown will pose upside risk to growth.

If we are right, the surge in demand will quickly stretch resources, inevitably leading to higher inflation. Following a near-term surge in the spring, we see inflation remaining elevated above 2%Y this year and next.

Such a forecast may not concern the Fed, which is now explicitly targeting an inflation overshoot. But what happens when inflation stays above 2%Y sustainably, accompanied by low unemployment? I, for one, am concerned that by 2H22 inflation could take a sharper turn into what I would term the acceleration phase. I see a risk that inflation will not just moderately overshoot 2%Y but could threaten to breach 2.5%Y – the Fed’s implicit tolerance threshold.

My concerns are two-fold:

- First, the speed of the labour market recovery: While there is still considerable slack in the labour market today, the rebound under way may turn out to be faster than expected. In just 10 months, even with restrictions not fully lifted, headline unemployment has dropped from a peak of 14.8% in April to 6.2% currently. The underlying unemployment rate has fallen faster, from 23% to 10% over the same period. For context, in the previous cycle unemployment took 72 months to move from 10% to 5%. In the last two cycles, the decline in unemployment averaged just 5bp per month. As reopening enters full swing, accompanied by a surge in demand, the labour market will clearly improve at a markedly quicker pace than recent history suggests.

- Second, uncertainty around the natural rate of unemployment: Restructuring comes with every recession. This time around, behavioural changes resulting from the pandemic have accelerated the process. Hence, it is conceivable that the natural rate of unemployment has risen, and perhaps by more than normal. Against the backdrop of a rapid labour market recovery, inflationary pressures from higher wage growth could also surprise to the upside.

As things stand today, with the Fed still far away from its goals, policy-makers can maintain their forward guidance that monetary tightening is still some time off. However, rapid progress towards those goals could easily overtake this guidance. Should inflation threaten to overshoot 2.5%Y, most likely around mid-2022, it may bring a disruptive shift in expectations for Fed tightening – and with it the specter of volatility in financial markets.

Enjoy your Sunday