Fra Swissquote:

The decision is already made.

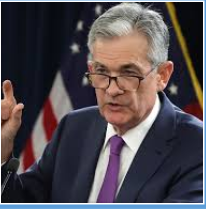

The Federal Reserve (Fed) will announce its latest rate decision today, but most of the wild ride is certainly done by now; the market fully prices in a 75bp hike at today’s decision.

Investors know that the Fed will want to get more aggressive on the back of a difficult-to-ease inflation, and yesterday’s producer data came as another confirmation that inflation has more to inflate in the coming months.

At this point, the decision of a 75bp is almost made, the Fed should only confirm the market verdict.

Could the Fed surprise with 50bo hike?

If the Fed surprises with a 50bp hike, the market will certainly rebound on relief. But the Fed’s primary goal is to tame inflation right now, and not to boost the equity markets. And depressed market conditions seem necessary in achieving that goal.

Now that the 75bp pill has been swallowed by the market, it would be irrational for the Fed not to go ahead with a bigger hike.

Economic projections & dot plot

The aggressive rise in hawkish Fed expectations pushed the US 2-year yield to 3.45% on Tuesday. The 10-year yield flirted with 3.50%. The S&P500 lost another 0.38%, while Nasdaq eked out a small 0.20% gain, but after hitting a fresh low since November 2020.

The US futures are in the positive this morning, but the market will likely remain tense until the Fed breaks the news that it hikes by 75bp. The updated economic projections and the dot plot have an important weight for future expectations.

But the market has already self-punished itself for the rising inflation. Therefore, even in case of a hawkish surprise in economic and dot plot projections, we shall not see a big chunk down in equities.

Hawkish Fed is not a gift for other central banks

Bigger rate hikes from the Fed, and the soaring US dollar are certainly not a gift for other central banks. The US dollar is a base currency, and the rapid appreciation in the greenback increases the cost of the goods that the other countries negotiate in terms of US dollars on international markets, starting from oil and commodities. As a result, a stronger US dollar is a bigger inflation threat for the world.

This is why, the hawkish Fed expectations have a bigger domino effect power on the rest of the world. The German 10-year yield continues pushing higher, and the EURUSD sees a decent support near the 1.04 threshold.

Cable slipped below the 1.20 mark, and a 25bp hike from the Bank of England (BoE) may not suffice to compensate the hawkish Fed, and the renewed Brexit fears.

The softer pound makes the British oil stocks cheaper for foreign investors. Yet, besides the energy and commodity stocks, investors become less comfortable with the British blue-chip index as the renewed Brexit worries and the increased risk of a trade war with EU could take a severe toll on the index.