Uddrag fra Goldman/ Zerohedge

he global commodities market peaked in early 2022 and stumbled ever since. China’s property sector remains in a multi-year slump, resulting in soft demand for base metals like iron ore and copper. Last week, Baowu Steel Group Chairman Hu Wangming warned that the economic conditions in the world’s second-largest economy felt like a “harsh winter.”

As the world’s largest steel producer, Baowu Steel’s chairman warned that the steel industry’s downturn could be “longer, colder, and more difficult to endure than expected,” potentially mirroring the severe downturns of 2008 and 2015. This should serve as a major wake-up call for macro observers that a recovery in China isn’t imminent; in fact, Beijing might not unleash the monetary and fiscal cannons until after the US presidential elections.

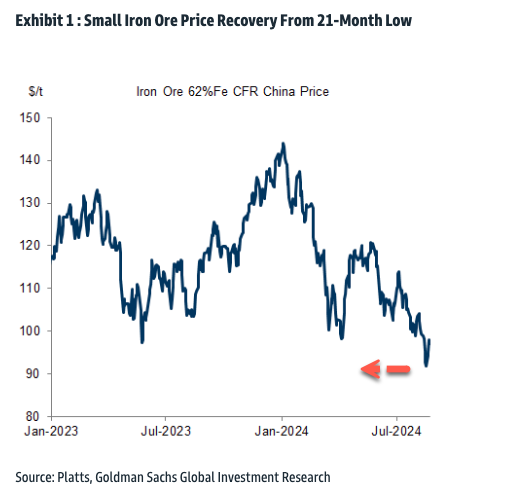

Commenting on Chinese iron ore markets is a team of Goldman analysts led by Aurelia Waltham and Daan Struyven. The analysts provided a very straightforward note to clients on Thursday, pointing out that iron ore’s “fundamental outlook remains bleak” as prices trade below $100/ton level.

Here are the highlights from the note:

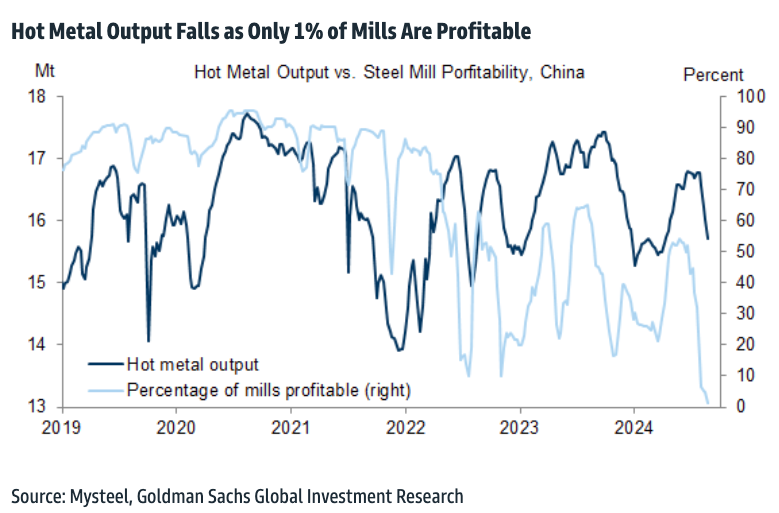

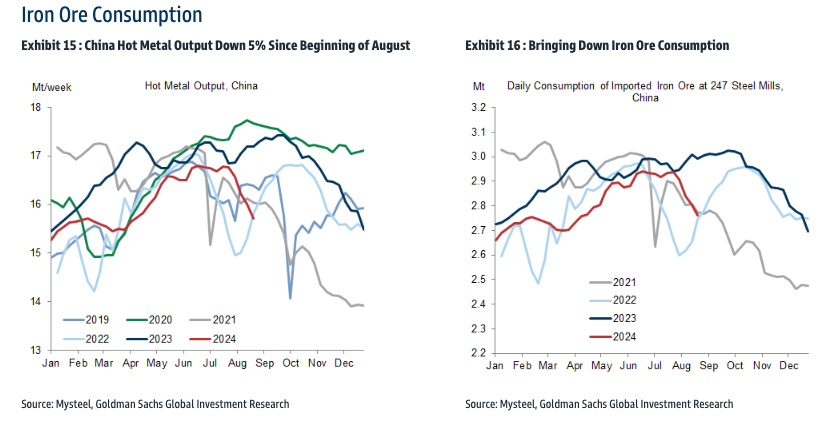

- The fundamental outlook remains bleak, in our view. While both port and in-plant iron ore stocks declined this week, visible stocks remain elevated compared to ‘normal’ August levels and mills’ destocking (despite the drop in iron ore prices) could be an indication of a negative production outlook. This would not be surprising given only 1% of Chinese steel mills are currently profitable, according to a Mysteel survey.

- Meanwhile, our China property team have cut their forecasts for gross floor area starts and completions for 2024, and our China economists have highlighted rising downside risk to Chinese growth, both of which could have negative implications for steel demand, discussed in this week’s Macro Highlight.

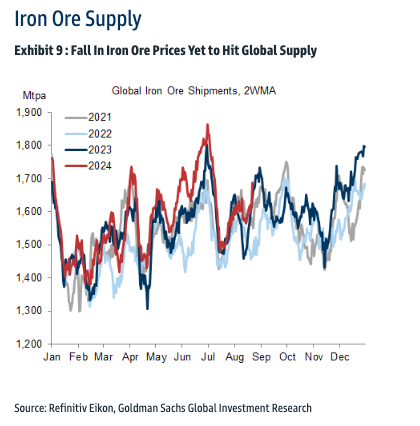

- In the absence of a hot metal output recovery, continued strong iron ore supply means that we maintain the view that iron ore needs to remain below $100/t for long enough to trigger a sufficient supply response to re-balance the market.

The analyst said macro data in China printed on the soft side in July. They were worried about “continued weakness across property sales, new starts and completions.” Also, they pointed out that Goldman’s property team slashed forecasts for the second half of 2024.

Here’s more from the note:

With continued weakness across property sales, new starts and completions, our China Property team have cut their forecasts for H2 2024. The new 2024 full year base case is a YoY contraction in gross floor area (GFA) sales of -20% (prev. -12%), new starts of -22% (prev. -15%) and completions of -13% (prev. +3% YoY). The team’s forecast for property FAI remains unchanged at -12% YoY for 2024. While the new base case does imply some sequential improvement in GFA completions (currently at -22% YoY for Jan-July 2024), the expectation is that new starts (the more steel-intensive stage of property construction) continue to trend substantially below last year’s level (already a low base) over the remainder of the year, diminishing hope for any substantial pick-up in long steel demand, which is down 21% YoY YTD, according to Mysteel data, with output down by the same percentage. Also relating to Chinese long steel demand, our China economists have noted that after years of rapid infrastructure building (which has helped to put a floor under long steel consumption despite very weak property new start data over the past two years), finding new projects with decent return profiles has become increasingly challenging, posing further downside to steel demand in coming years.

However, as we have noted previously, more concerning for iron ore consumption are the growing risks to flat steel demand (used in manufacturing and for exports) due to the strong correlation with hot metal output and iron ore consumption. With export growth expected to moderate, our China economists state that higher domestic demand growth is needed to fill the gap in order to achieve the 2024 growth target of “around 5%”. Likewise, we argue that stronger domestic demand will be necessary in supporting flat steel production, and therefore iron ore consumption, in the scenario that steel exports, either direct or indirect via manufacturing, fall. This is a scenario that looks increasingly likely.

However, we are doubtful of the extent to which domestic demand will be able to pick up any slack. In the near term, our China economists believe that the downside risk to China growth is rising, and private demand appears to be weakening in the data. Urban unemployment rates appear to be increasing, which could have a negative impact on household consumption in H2 (for example, potential further weakness in retail sales following declines in June and July), and corporate demand deposits dropped 18% YoY, suggesting that corporates do not plan to increase investment in the near term. Alongside potentially weaker demand, destocking could also trigger a further reduction in flat steel output in H2. Mysteel-reported flat steel stocks are significantly above August levels of previous years on record (Exhibit 19), concentrated in traders’ holdings (mills’ stocks are within a normal range). Today’s data showed the biggest WoW drop in traders’ flat steel stocks since the post-Lunar New Year destock in March, and we will be keeping an eye on whether this trend continues over the coming weeks.

Beyond this year, our China economists expect GDP growth to slow from a nearly 7% average in the 5 years before the pandemic to 3% by 2034 on weakening demographics, the prolonged property downturn, and global supply-chain de-risking. This will likely have mostly negative effects on global commodity demand growth, including for steel, for which we estimate global demand growth falls by 1.4pp when China growth slows by 1pp.

This is the most stunning chart from the report, showing that only 1% of steel mills are profitable in the world’s second-largest economy. As profitability collapses, hot metal output declines.

Iron ore prices in China have slid to a 21-month low.

Metal stocks are high at ports and steel mills. Reports have surfaced that producers are flooding the world with cheap iron ore.

Global supplies are still elevated.

And consumption is soft.

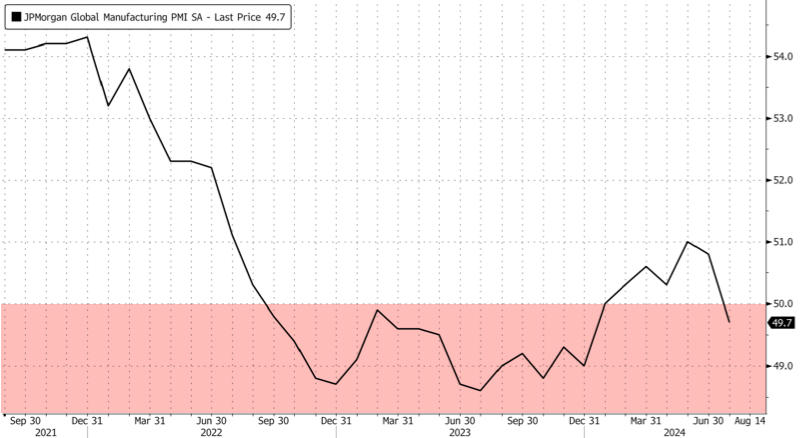

Meanwhile, JPM Global Manufacturing PMI has slid (<50) into a contraction.